Blue-chip ETFs are funds that invest in leading stocks and bonds in the industry. These funds have been around for quite a while and earned respect and confidence of investors. Whatever type of investor you may be, you can bank on blue-chip ETFs to deliver returns year after year on average.

What are blue-chip ETFs?

Blue-chip ETFs provide an easy option to gain exposure to a wide array of quality stocks. These funds are great investments, particularly for individuals nearing or in retirement, because of their tendency to fluctuate less than individual stocks. If you are an investor belonging to the younger generation and you want to benefit from automatic diversification, blue-chip ETFs just fit the bill. If you are a busy professional with limited time to research individual stocks, this investment comes in handy.

Blue-chip ETFs to watch and buy

You can find several popular ETFs on the market, but the number of blue-chip ETFs in existence is notably limited. In this section, we cover three blue-chip ETFs with different benchmarks. While the first ETF focuses on blue-chip stocks, the other two that follow focus on bonds. We arrange them in the order of assets under management from highest to lowest as provided by Coinmarketcap.com.

№ 1. SPDR S&P 500 (SPY)

Price: $417.50

Expense ratio: 0.09%

Dividend yield: 1.30%

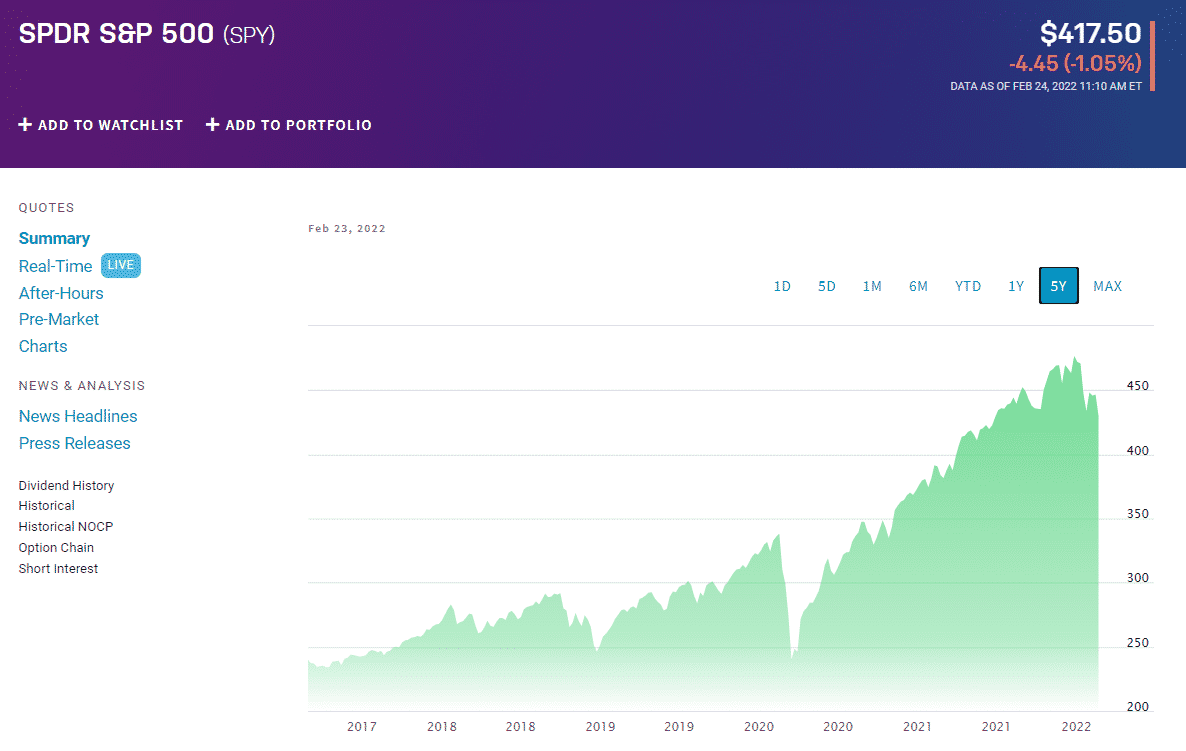

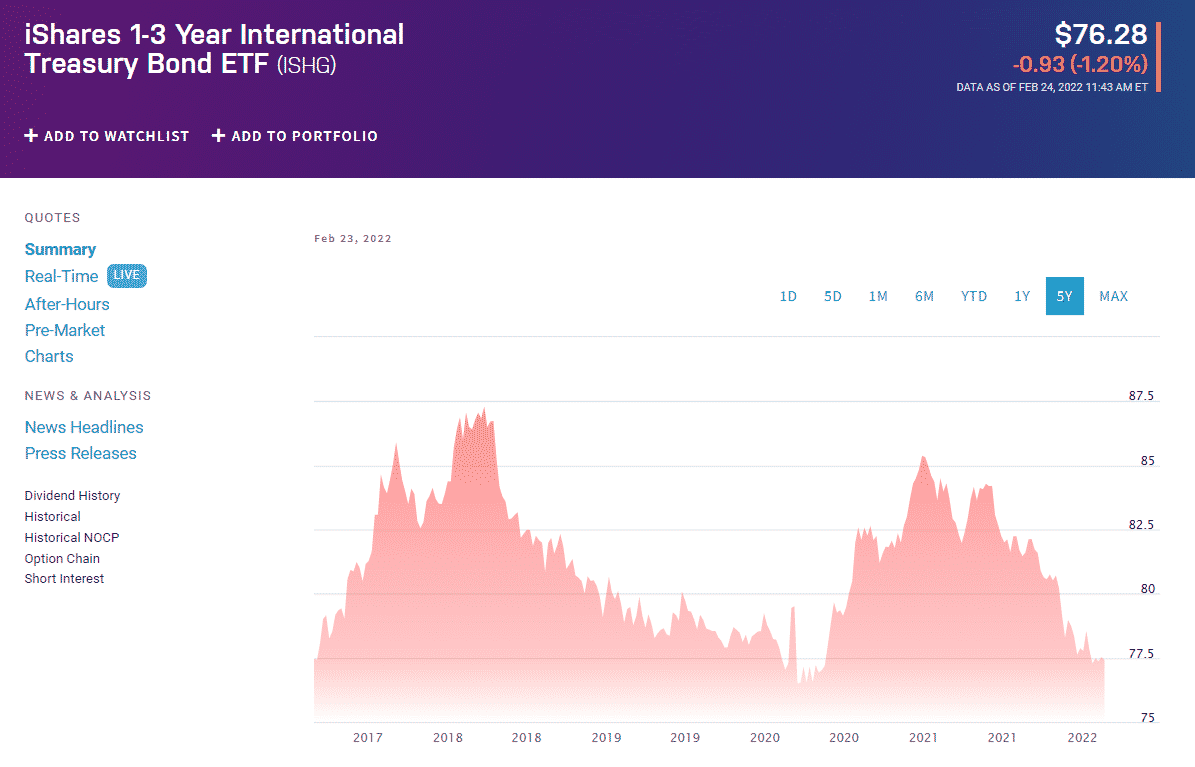

SPY ETF 5Y price chart

The SPY ETF is a household name in the ETF world. It seeks to replicate the performance of the S&P 500 index, which covers 500 of the largest stocks in the US. Selecting which stocks to include in this index is the job of a dedicated committee, which makes the decision based on industry, liquidity, and market cap. Keep in mind that investment managers and investors traditionally use the index to judge the strength and performance of the overall US stock market. Meanwhile, the equity market serves as a benchmark in judging the stability and health of the US economy.

The top three holdings of SPY ETF are:

- Apple Inc. (AAPL) – 5.9%

- Microsoft Corporation (MSFT) – 5.6%

- Amazon.com Inc. (AMZN) – 4.05%

Established on 22 January 1993, SPY is one of the oldest ETFs. At writing, the ETF holds $455.2 billion assets under management. SPY invests virtually all assets (99.71% to be exact) in stocks. Although its YTD return is negative 9.5 percent, its one-year return is 12.53 percent, and its three-year return is 17.38 percent. There were only two years when the fund did not generate profits in the last decade. However, the winning years completely compensated for the two losing years with a huge margin. From 2019 to 2021, the ETF was making huge profits.

№ 2. iShares 1-3 Year International Treasury Bond (ISHG)

Price: $76.28

Expense ratio: 0.35%

Dividend yield: 0.00%

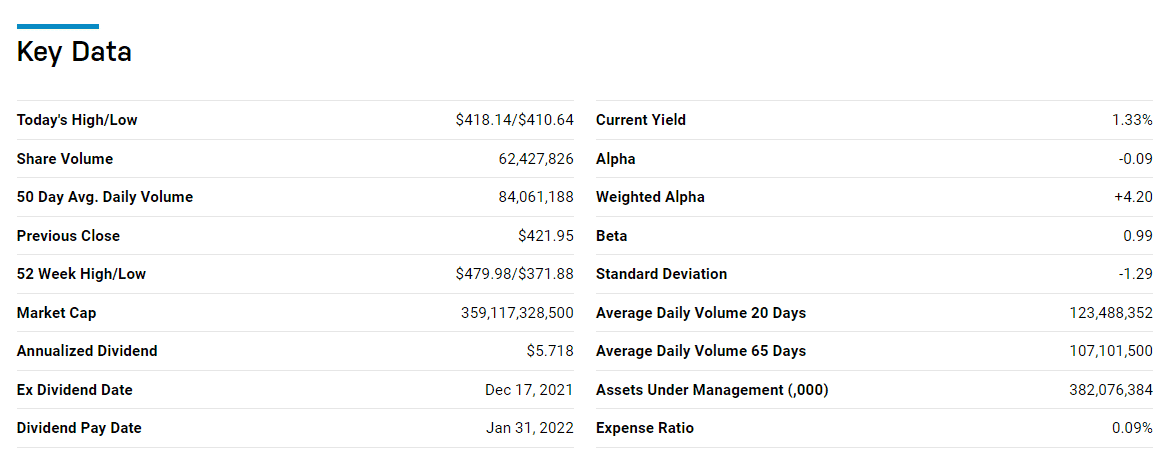

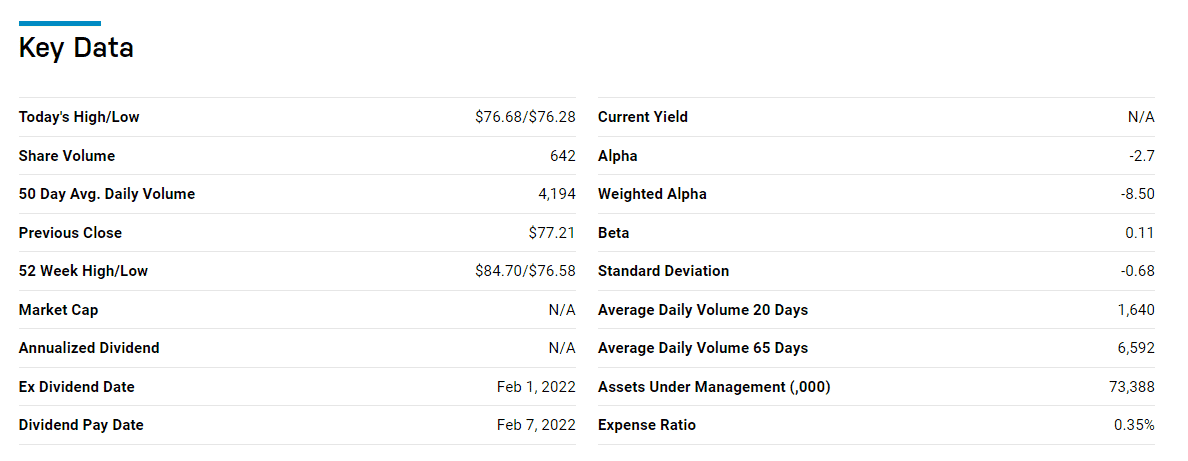

ISHG ETF 5Y price chart

ISHG invests the majority of its investment funds in government bonds issued outside of the United States. Most of these bonds expire from one to three years. The benchmark index sets the limit of exposure in each country to 21 percent and assigns a weighting based on the bond’s market value. Rebalancing of the index is done every month. While the index tries to soften the exposure to countries with large debts using a capping system, the ETF is greatly exposed to European and Japanese economies.

The top three holdings of VGV ETF are:

- Denmark (Kingdom Of) 0.25% – 2.07%

- Japan (Government Of) 0.1% – 2.05%

- Sweden (Kingdom Of) 1.5% – 1.95%

ISHG was established on 21 January 2009. It invests the majority of its funds in bonds (about 95.71%). At present, the ETF has $74.25 million assets being managed. At an expense ratio of 0.35%, investors pay $35 yearly for every $10,000 invested.

In recent times, the ETF has not been so profitable. Its three-year return is -0.63%, one-year return -8.08%, and YTD return -0.87%. However, from 2009 until 2021, there were only three years when the fund was not able to give out dividends to investors.

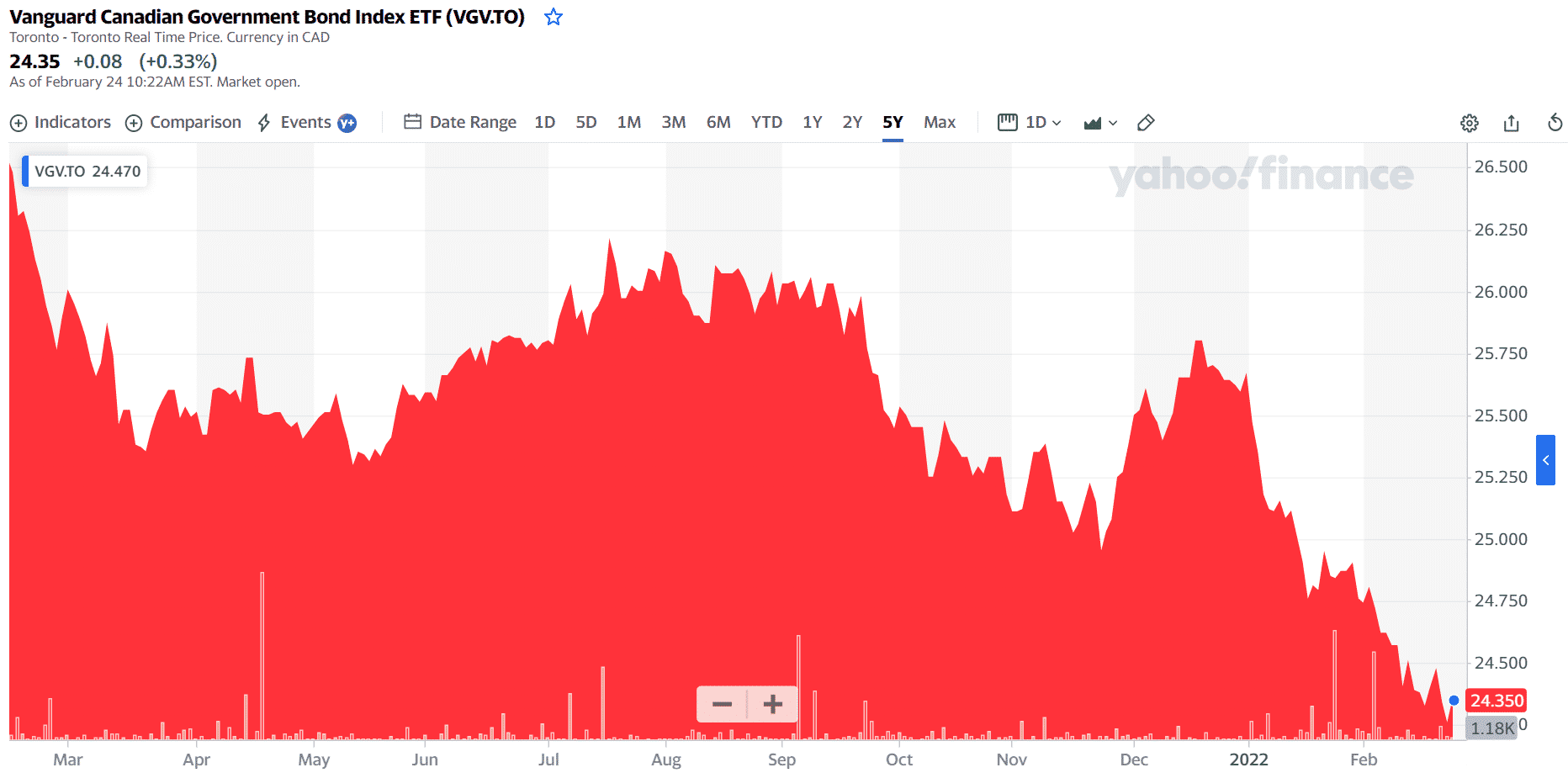

№ 3. Vanguard Canadian Government Bond (VGV.TO)

Price: $24.35

Expense ratio: 0.20%

Dividend yield: 2.45%

VGV.TO ETF 5Y price chart

VGV.TO ETF aims to replicate the investing operations of a Canadian government bond index as closely as possible and prior to deduction of expenses and fees. At present, the fund mimics the performance of the BCFATRUU index. Most of its funds are heavily invested in high-quality public government bonds in Canada. It has experienced minimal earnings in the past two years, probably due to the negative impact of the pandemic. However, the long-term average is still quite good.

The top three holdings of VGV.TO ETF are:

- Canada (Government of) 1.25% – 2.17%

- Canada (Government of) 1.5% – 2.15%

- Canada (Government of) 0.25% – 1.88%

Launched on 31 January 2017, VGV.TO is the youngest ETF on this list. The fund manages $48.95 million assets today and invests all of them in bonds. Its one-year return is -2.85%, and its YTD return is -3.65%. However, its three-year return is positive at 3.82%. Looking deeply into the performance of this fund, you will find out that it has positive returns from 2018 to 2020, but no data was given for 2021.

Final thoughts

Regardless of your length of experience in the world of investing, you will find blue-chip ETFs interesting if you have the mindset of a conservative investor. Because these funds closely follow the performance of reputable stocks and bonds, they are able to weather the storm much more effectively than their lesser counterparts. The peace of mind you will get when you put money in blue-chip funds will not exchange with cheap but risky investments.

That is why investors remain unfazed in the face of economic turmoil that may come along the way. Since they are in for the long haul, they expect the funds to recover and continue to deliver results far into the future. Because they routinely pay their investors with big dividends and their dividend payments grow over time, the ETFs covered in this post are able to make the list of the industry’s dividend kings and aristocrats.

Comments