Since the introduction of the first exchange-traded fund in 1993, these financial instruments have become the darling of the investment world. The popularity of ETFs stems from a straightforward concept, “in the long-run, the economy has to grow.”

ETFs’ conventional construction objective is to track the performance of their underlying index. However, the appetite for ETFs by different investors fuelled the evolution of the traditional ETF to other types to accommodate investment objectives such as inverse and leveraged ETFs.

Here, we take a crack at the world of inverse ETFs.

How do inverse ETFs work?

A conventional ETF is a basket of investment assets seeking to replicate the performance of a particular index. On the other hand, inverse ETFs refer to exchange-traded funds comprising derivatives that gain when the underlying benchmark index declines.

Investing in inverse ETFs is akin to holding multiple short positions, getting a loan on the assets, and selling them at prevailing prices with the hope of future repurchase at a lower cost. This ETF type uses futures contract-contractual obligation to buy/sell an asset in the specified future at a predetermined price to achieve their objective.

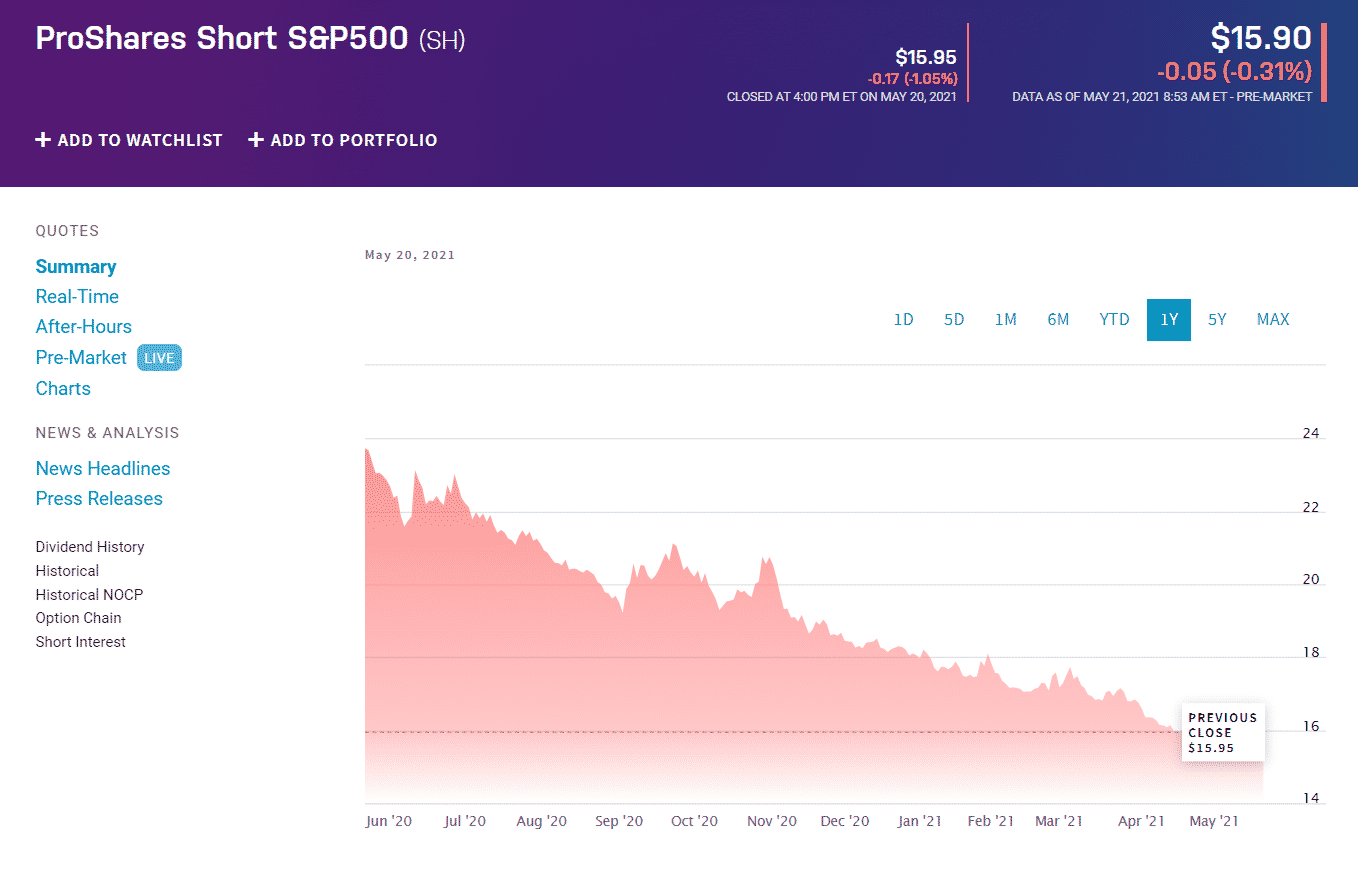

For example, an investor can bet on the decline of the S&P 500 index by investing in the ProShares Short S&P 500, SH. If the S&P 500 index drops by 8%, the ProShares Short S&P 500 ETF gains 8%, and this investor is in the money.

Therefore, these ETFs are excellent hedging assets-short-term assets used to offset losses due to temporal market fluctuations. Derivatives contracts are primarily daily trading instruments making inverse ETFs short-term investments.

As a result, the long-term performance results of inverse ETFs don’t correspond with the underlying index and assets. The daily trading results in higher fees in terms of commissions and fund expenses hence a higher expense ratio than conventional ETFs.

Pros of inverse ETFs

Inverse ETFs may not be a long-term investment like conventional ones. They might attract higher expenses but still attract a large following because:

-

Variety

The inverse market is full of multiple exchange-traded funds for investors to choose an ETF in alignment with investment objectives and risk tolerance. In addition, almost all of the major market indices have an inverse ETF choice.

-

Hedge strategy

Inverse ETFs avail investors an avenue to hedge against fluctuations in the markets. As a result, investors can make money despite a decline in the market and a dip in the underlying index.

Cons of inverse ETFs

As an ETF that trades in the short-term, investors in inverse ETFs have to deal with:

-

Short-term trading

Inverse ETFs are for short-term investments to take advantage of unforeseen market fluctuations. As such, in most cases, the long-term returns don’t correspond to the tracked index performance.

-

Losses

The risk of investing in inverse ETFs is quick-huge losses when the forecasted market moves don’t actualize.

-

Higher fees

These ETFs attract relatively higher costs than traditional due to intra-day trading.

Who should invest in inverse ETFs?

ETF investing is a low-cost way of ensuring long-term returns at very low risks and minimal management efforts due to low volatilities. In addition, they provide investors a chance to protect investments against unprecedented market moves through hedging.

Finally, they also offer intraday traders a chance to get in on the ETF markets without dealing with the higher risks associated with the other short-term ETF offering-leveraged ones.

The inverse ETF structure is relatively more complex, and as such prior ETF market knowledge is a prerequisite for dabbling in this world.

Top 3 inverse ETF worth your while

These ETFs may be a tad more costly than conventional. But, at the same time, they more than makeup for it by being intraday tradable and facilitating hedging strategies. In addition, investors choose between inverse ETFs profiting from a particular industry index or those profiting from the decline of the broader economy.

The following three inverse ETFs represent your best bet for short-term gains and maximum hedge returns.

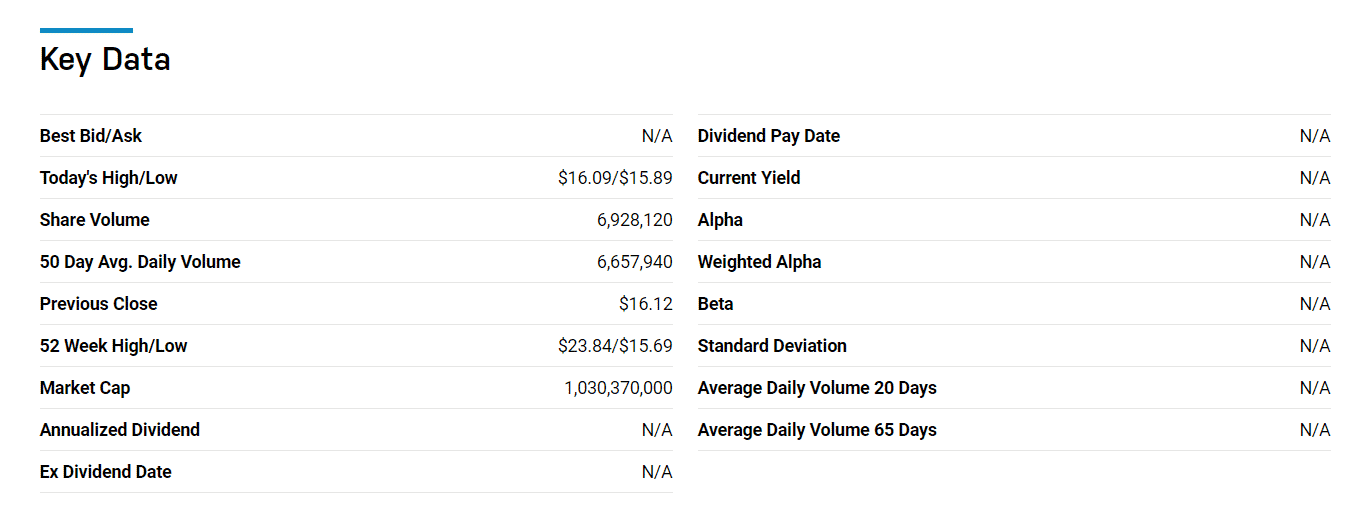

ProShares Short S&P 500 (SH)

ProShares Short S&P 500, SH is the largest inverse ETF in value terms. It seeks returns inversely correlated to those of the S&P 500 index, -1.

SH is a non-diversified fund that cuts across the economic spectrum by tracking an index made up of the top 500 US companies and real estate investment trusts.

The SH has an average distribution yield of 0.16%. In addition, it boasts of $1.43 billion in assets under management, with investors coughing up 0.9% to acquire it.

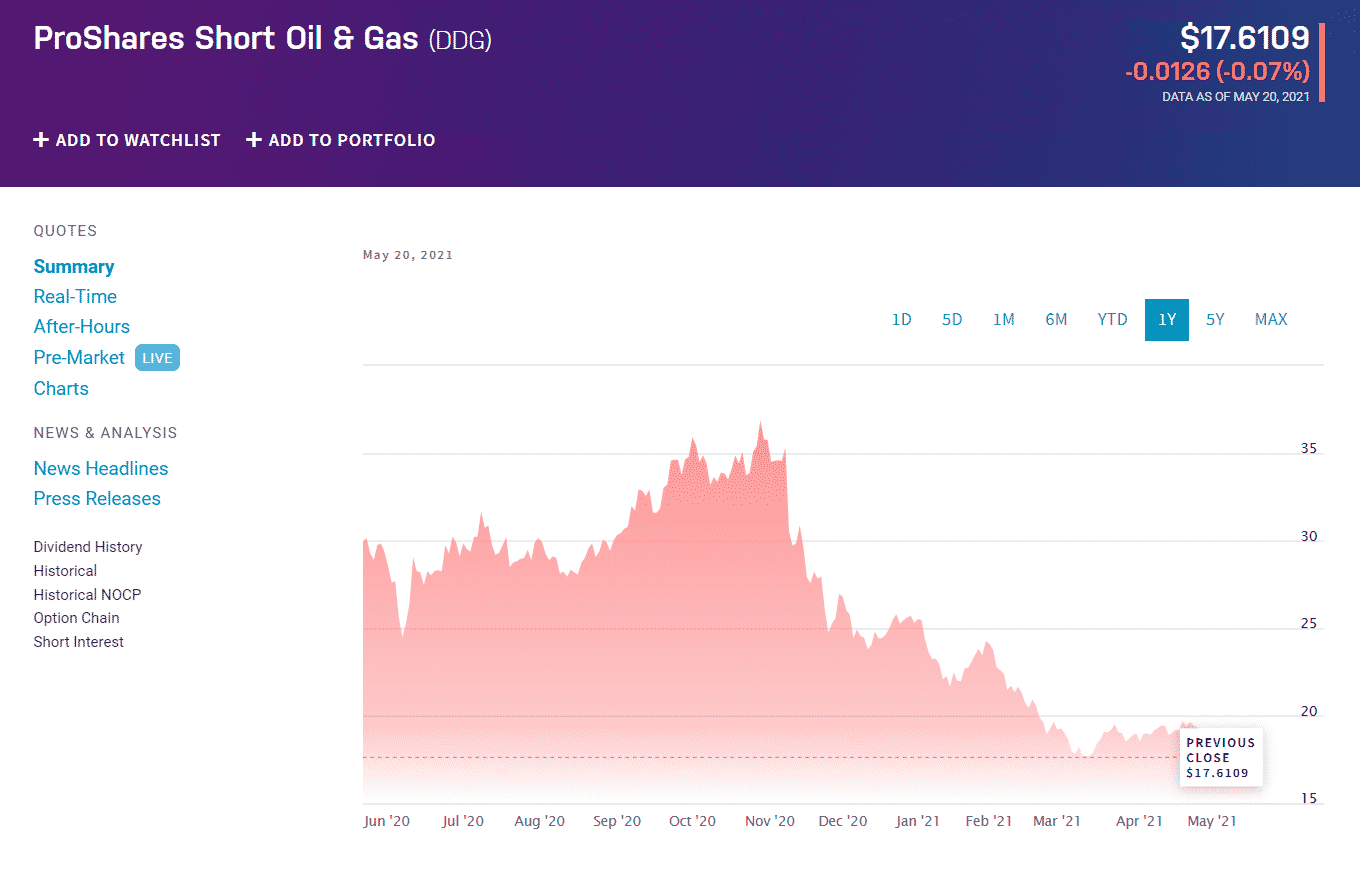

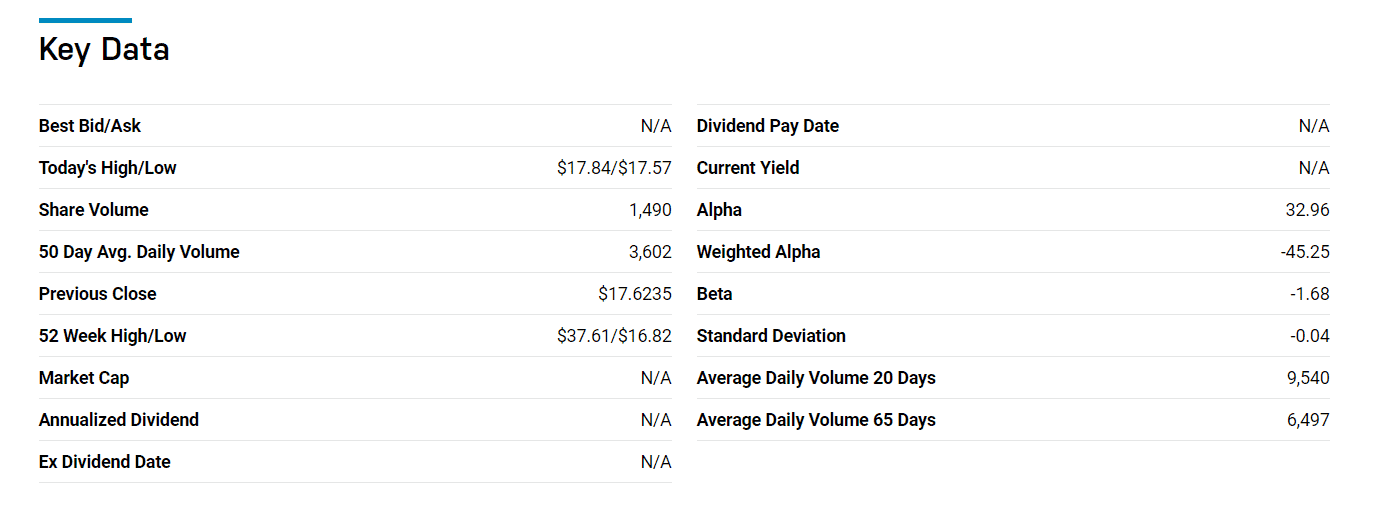

ProShares Short Oil and Gas ETF (DDG)

ProShares Short Oil and Gas ETF, DDG, tracks the performance of the Dow Jones U.S. Oil & Gas Index with a view of an inverse replication of its returns.

The DDG is a non-diversified inverse fund in the oil and energy sector driven by companies in exploration and production, alternative fuels, oil equipment and services, renewable energy, pipelines, and integrated gas and oil.

It is an excellent inverse ETF to have on the radar, given the volatile global market prices. It boasts $3.08 million in assets under management and an expense ratio of 0.95%.

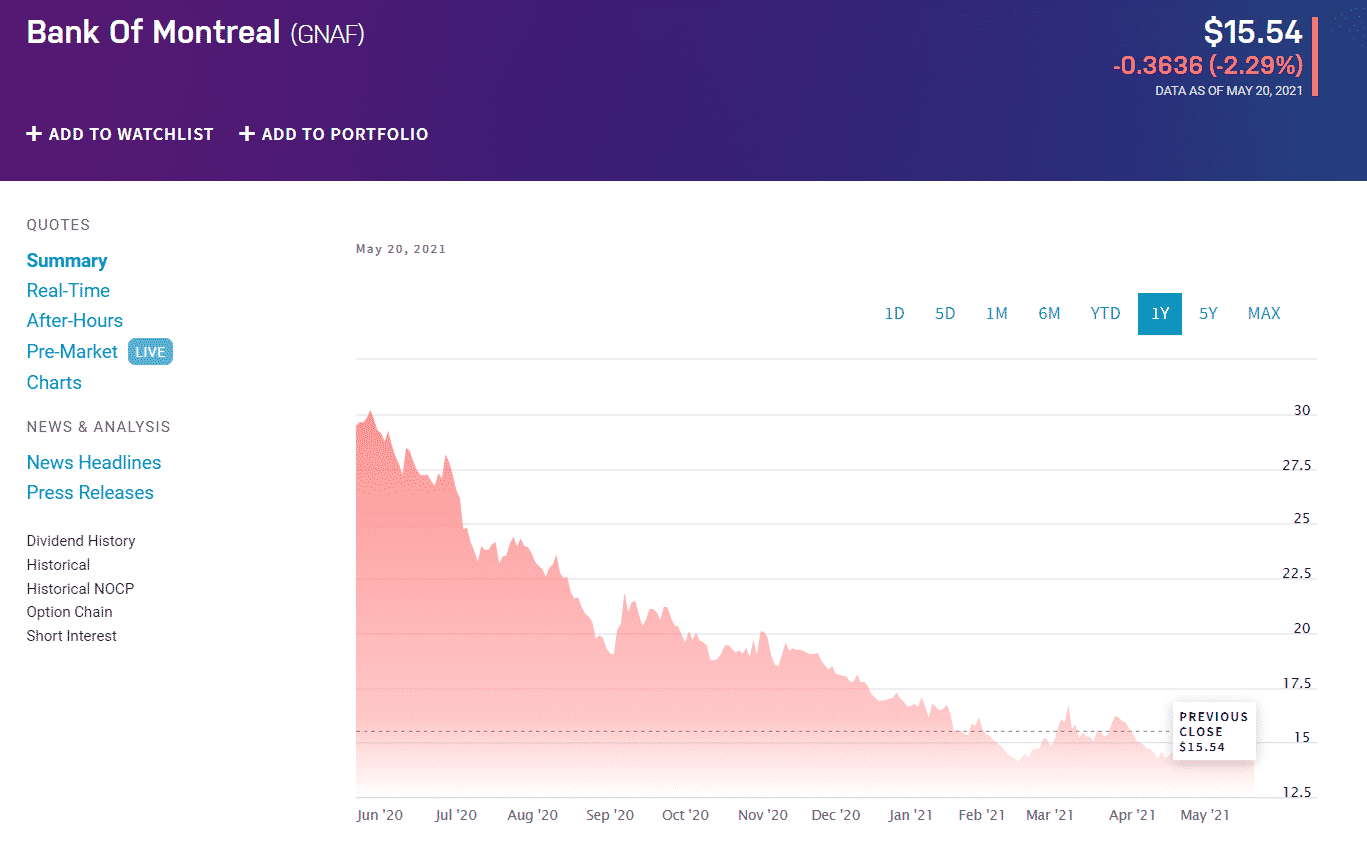

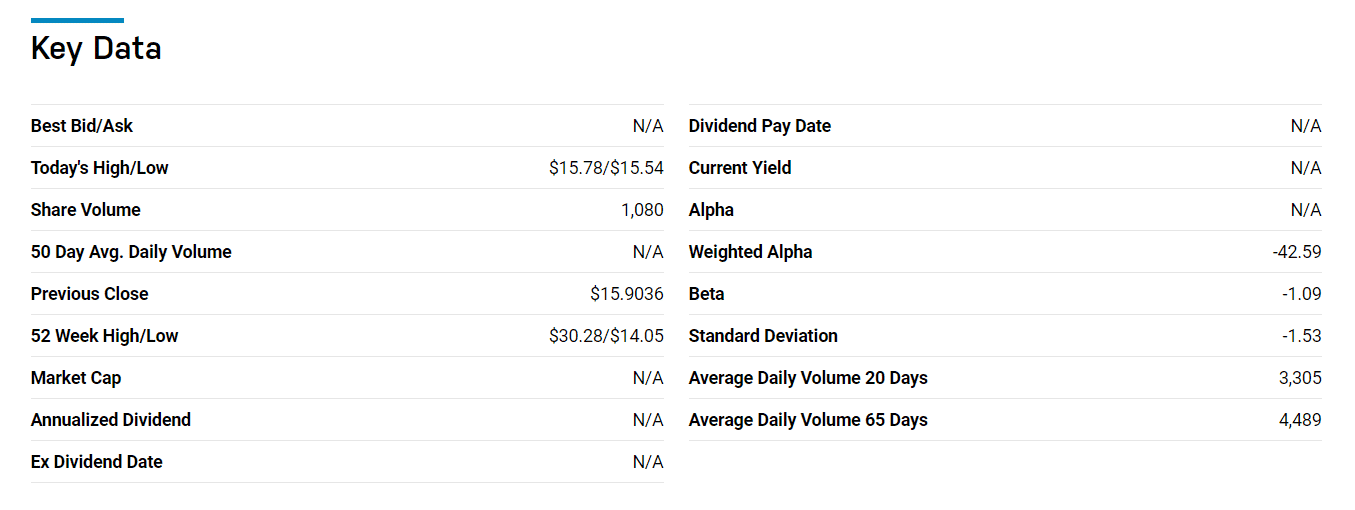

Micro Sectors FANG + Index Inverse ETN (GNAF)

The tech industry is one of the most dynamic sectors of the economy. Recently, the tech market has experienced massive sell-offs, ask Cathy Wood. To hedge against this highly volatile and liquid market, investors can look upon the Micro-Sectors FANG + Index Inverse ETN (GNAF).

This ETF comprises the largest cap technology industries exhibiting the fastest stock movements, including Amazon Inc., Facebook, Alphabet (Google), and Netflix.

Most tech companies weathered the worst of the Coronavirus fairly. However, the broad customer base of these stocks results in high volatility, and the GNAF is the perfect hedge instrument for when unprecedented sell-offs occur. GNAF has $15.05 million in assets under management and an expense ratio of 0.95%.

Comments