After languishing in the sideways market following the Fukushima nuclear disaster, uranium currently is the red-hot metal that is the talk of the town.

In addition to an energy crisis in Europe exposing the limitation of the sources of power currently in use, the lobbying by developed countries for all to be cognizant of fossil fuel detriment to the environment has revealed nuclear energy as the only scalable and bankable green energy option.

France and Japan have intensified their zero-emission efforts and are leading nuclear energy adoption with promises of zero greenhouse gas energy sources by 2030 and 2050, respectively.

With a growth projection from $34.6 billion in 2021 to over $49 billion by 2025, the uranium market is up for grabs for those that dare to believe and make money off that energy niche.

What is the composition of Uranium ETFs?

ETFs are a basket of investment assets with similar economic characteristics. As such, uranium ETFs are made up of equities coupled to organizations in the uranium and nuclear energy value chain:

- uranium exploration

- uranium mining

- uranium processing

- nuclear energy generation

- manufacture of nuclear reactors equipment

- all associated ancillary services

Why invest in uranium exchange-traded funds? Uranium and nuclear energy activities are concentrated in a few countries and organizations globally, making this an actual niche market. It means that picking a single asset as a true winner when this market explodes is quite a headache.

This gap is what uranium ETFs cover. Rather than bet on a single asset, they expose investors to a basket of uranium-related ETFs hence facilitating niche investing.

Top five best uranium ETF to hold in 2022

As economies let inflation run in an effort to spur full economic resurgence, investment inflows automatically shift to hard assets such as commodities and precious metals. Among these, uranium has been making waves as the current demand is way above what uranium firms can supply.

In addition, the continued rise in fossil fuels and natural gas has intensified the race for sustainable, scalable, and cost-efficient energy sources that facilitate decarbonization while preserving the environment. Nuclear energy so far ticks all of these boxes, meaning an increase in demand for uranium and its price as more economies adopt nuclear energy.

The five-uranium exchange-traded funds below represent an opportunity to make a play on these two entwined markets in 2022 and profit.

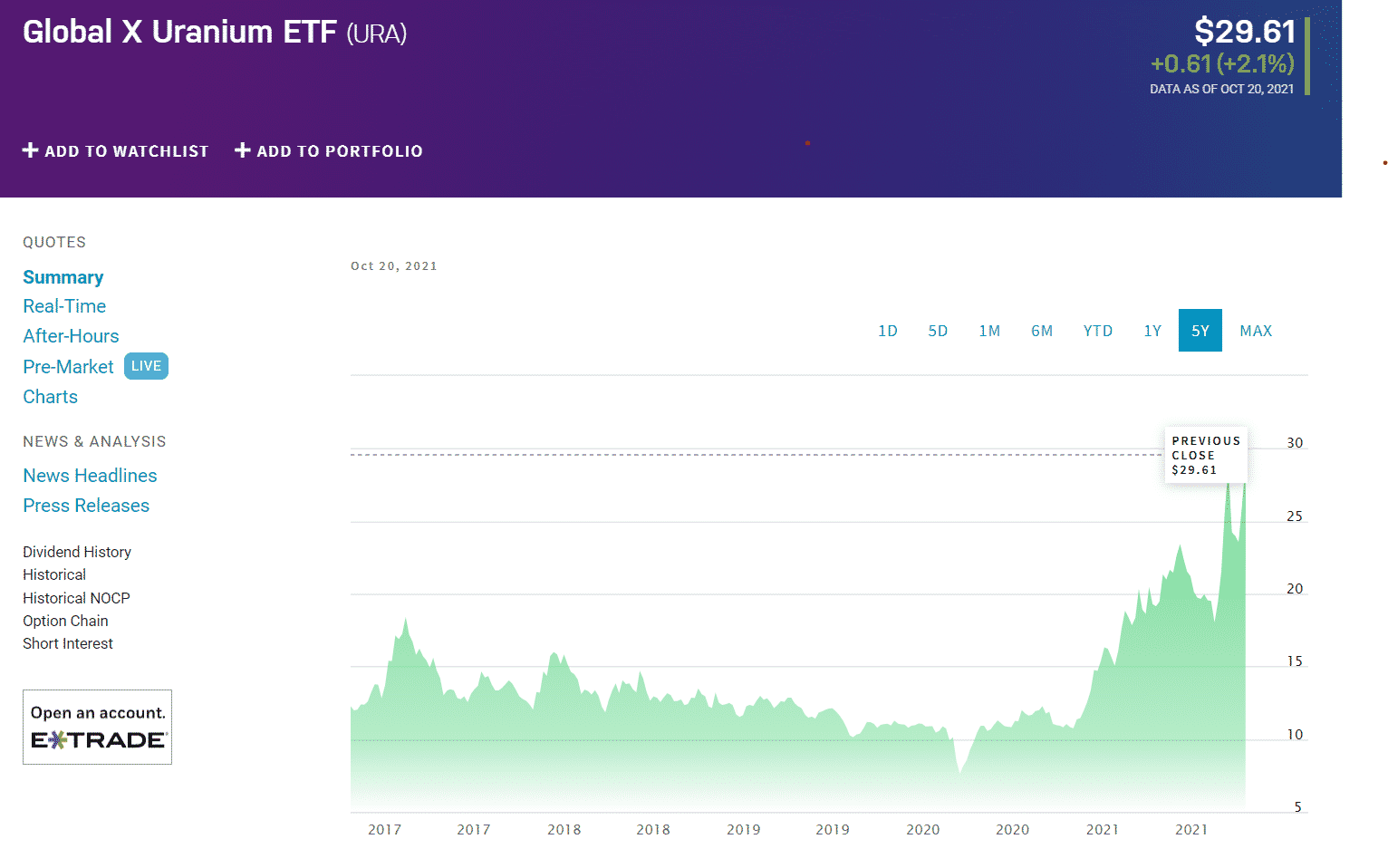

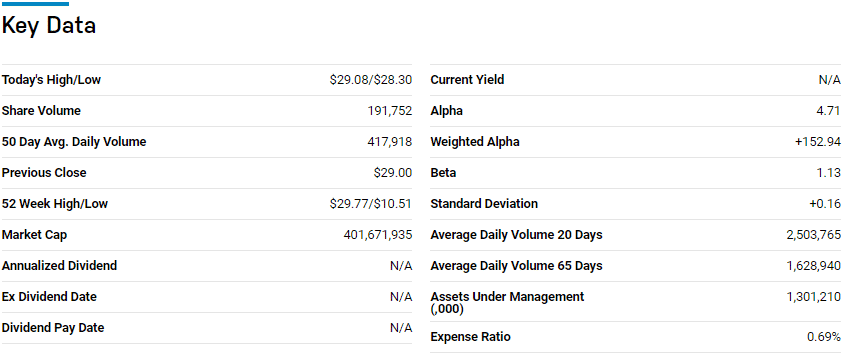

№ 1. Global X Uranium ETF (URA)

Price: $29.61

Expense ratio: 0.69%

Dividend yield: 0.45%

URA ETF chart

URA ETF tracks the Solactive Global Uranium & Nuclear Components Total Return Index, at least 80% of its total assets in the assets making up its benchmark index, in addition to GDRs and ADRs. Its investors get exposure to the global uranium value chain.

In a list of 36 Natural Resource exchange-traded funds for long-term investing by US News, this ETF comes at rank 21.

The top three holdings of this ETF as of now are:

- Cameco Corporation – 23.09%

- National Atomic Company Kazatomprom JSC Sponsored GDR RegS – 10.50%

- NextGen Energy Ltd. – 8.68%

Global X Uranium ETF boasts $1.24 billion in assets under management, investors having to part with $69 for every $10000 investment annually. Historical performance is no guarantee of future returns, but a look at the current year to date returns, 89.36%, and the historical returns beg for URA’s consideration as an asset to hold in 2022; 5-year returns of 161.16%, 3-year returns of 134.64%, and pandemic year returns of 166.61%.

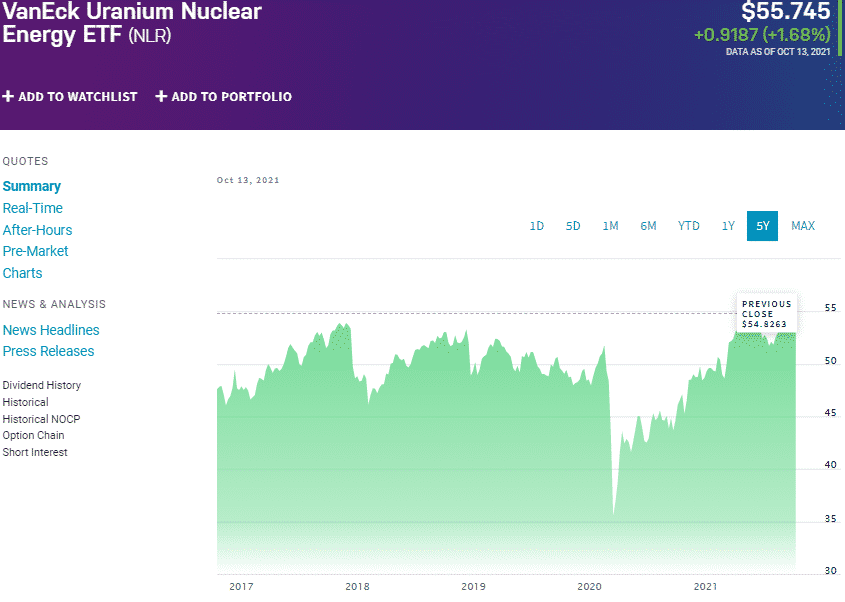

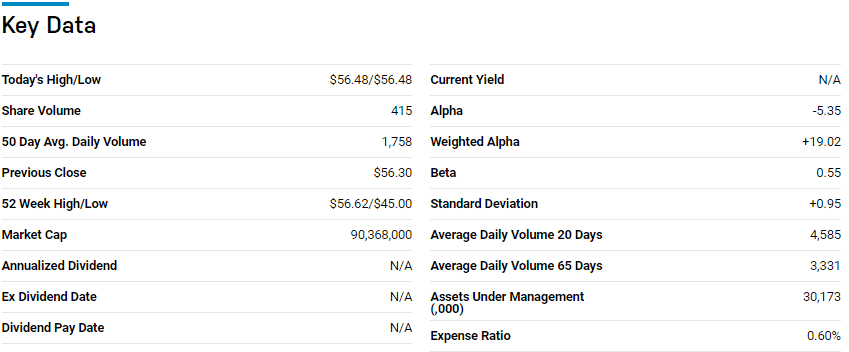

№ 2. VanEck Uranium Nuclear Energy ETF (NLR)

Price: $55.74

Expense ratio: 0.61%

Dividend yield: 1.97%

NLR ETF chart

NLR ETF tracks the MVIS Global Uranium & Nuclear Energy Index, investing at least 80% of its total assets in holdings of its composite index, in addition to equity securities and depository receipts. It exposes investors to the nuclear energy supply chain, and thus by extension the uranium value chain.

The top three holdings of this ETF as of now are:

- Duke Energy Corporation – 7.51%

- Dominion Energy Inc – 7.40%

- Exelon Corporation – 6.82%

VanEck Uranium + Nuclear Energy ETF is among the smallest ETFs in terms of assets under management, $30.02 million. However, investors cough up $61 for every 10000 invested annually.

A look at the historical performance shows that this ETF might not have the same phenomenal returns as the others in this list, but it still can make a tidy profit; 5-year returns of 40.43%, 3-year returns 17.65%, and pandemic year returns of 22.52%.

With a dividend yield of 1.97%, current year-to-date returns of 14.45%, the NLR is worth monitoring for holding in 2022, as calls for green energy intensify.

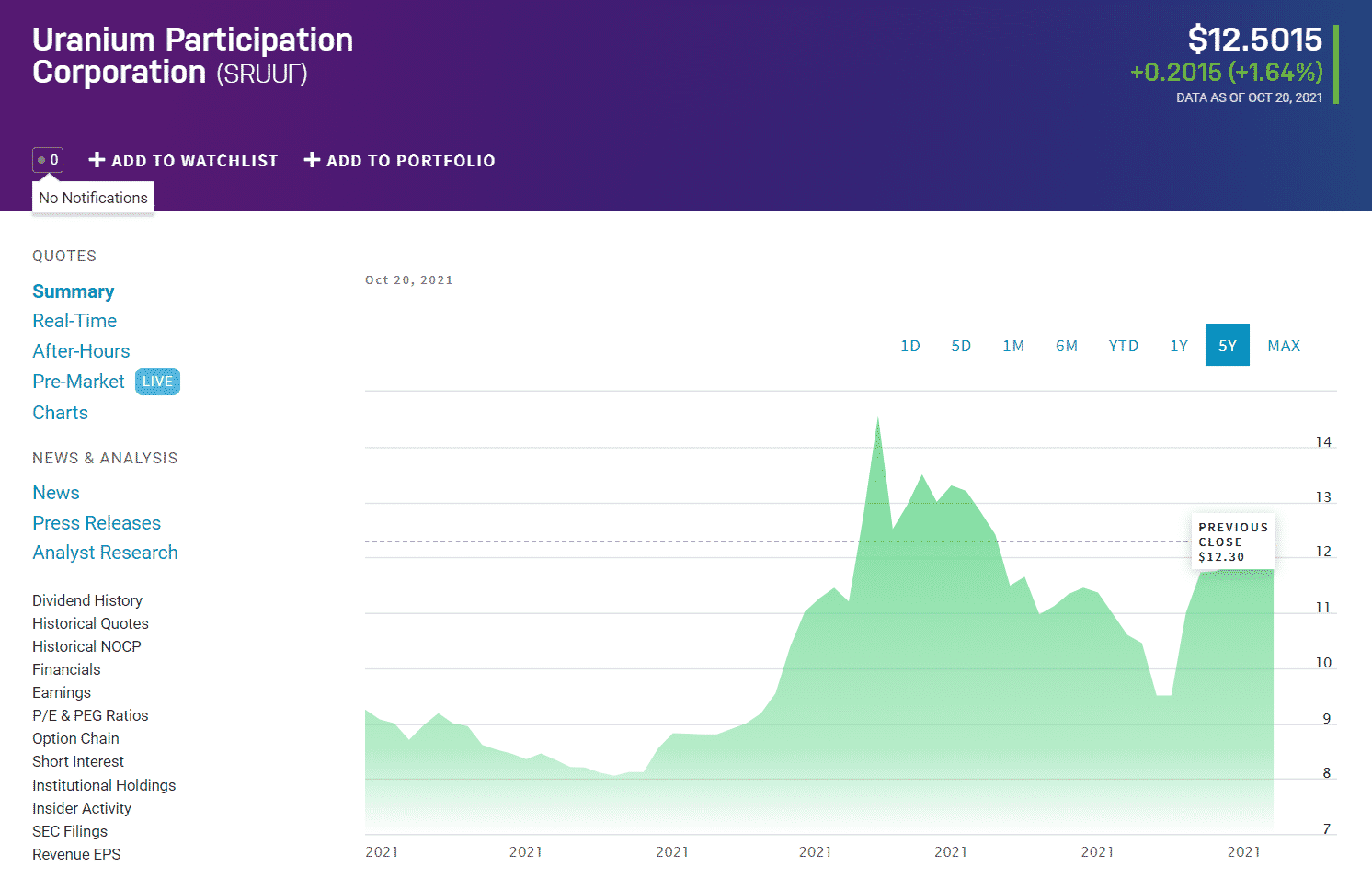

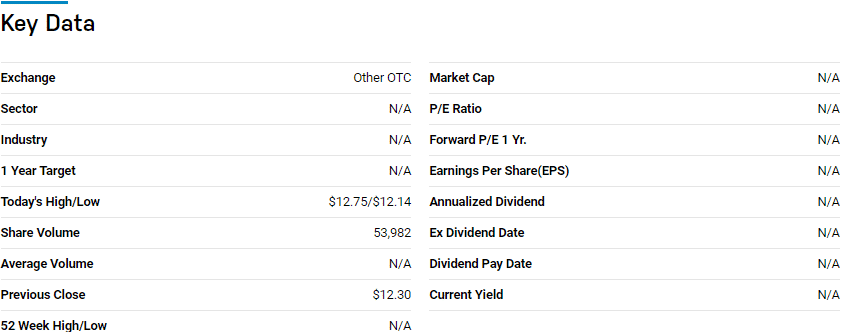

№ 3. Sprott Physical Uranium Trust (SRUUF)

Price: $12.50

Expense ratio: 0.35%

Dividend yield: N/A

SRUUF ETF chart

The SRUUF Fund is a commodity ETF that seeks to reflect the spot price of uranium.

At present, it has these stocks of uranium:

- U3O8 with 30,614,382 kilograms

- UF6 with 300,000 kilograms

Sprott Physical Uranium Fund has $1.6 billion in assets under management, with investors parting with $35 annually as the management fee for a $10000 investment. If the nuclear energy niche is about to explode, SRUUF has been amassing the necessary warfare to take advantage.

Most analysts attribute the meteoric rise of the Uranium ETF to the aggressive purchasing of physical uranium by SRUUF. In addition to this, the change in the price of SRUUF over the last five years calls for holding it if looking into uranium investing; 5-year price change of +92.90%, -year price change of +91.15%, and a current year-to-date price change +51.53%.

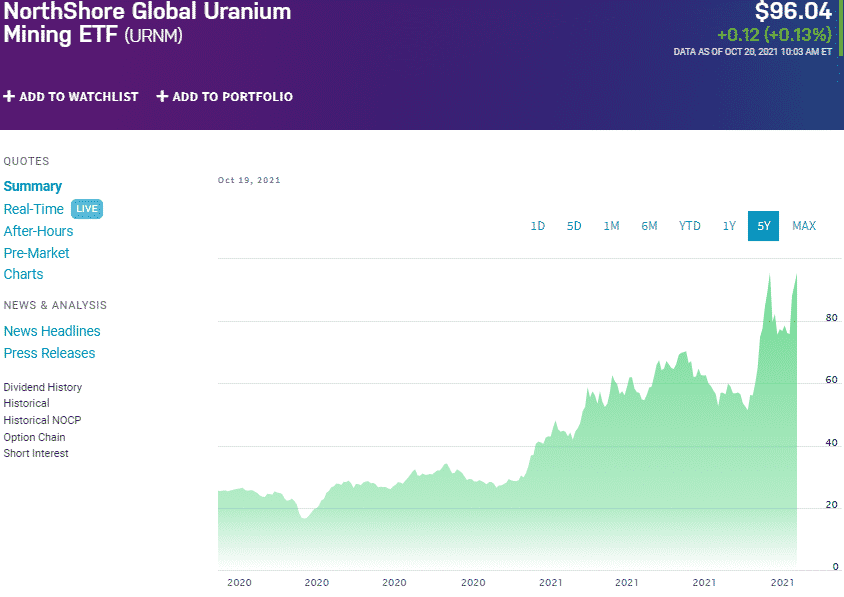

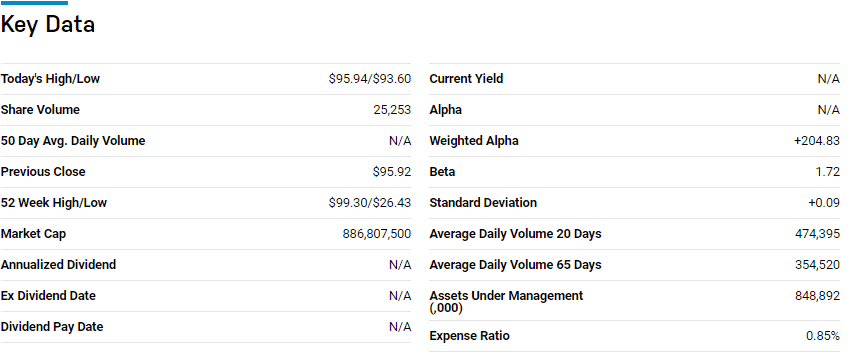

№ 4. North Shore Uranium Mining ETF (URNM)

Price: $96.04

Expense ratio: 0.78%

Dividend yield: 1.15%

URNM ETF chart

The URNM ETF tracks the North Shore Global Uranium Mining Index, investing at least 80% of its total assets in the holdings of its tracked index. Investors get exposure to the entire uranium value chain. Holdings are in two categories:

- Organizations that devote at least 50% of their total assets to uranium exploration, mining, development, and production.

- Firms that derive a minimum of 50% of their total revenue from holding physical uranium, owning uranium royalties, or providing ancillary services to the uranium industry.

The top three holdings of this ETF as of now are:

- National Atomic Company Kazatomprom JSC Sponsored GDR RegS – 16.76%

- Cameco Corporation – 16.29%

- Sprott Physical Silver Trust – 7.84%

Tagged among the best performing ETFs of 2020, this uranium ETF is worth holding since all indicators show that it will continue minting money; current year-to-date returns of 123.59%.

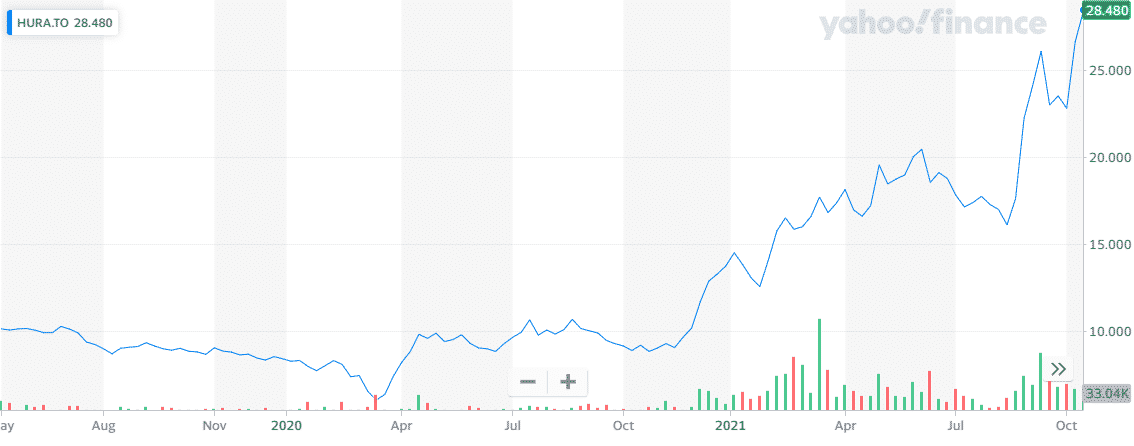

№ 5. Horizons Global Uranium ETF (HURA)

Price: $28.34

Expense ratio: 0.85%

Dividend yield: N/A

HURA ETF chart

HURA ETF is an exchange-traded fund listed with the Toronto Exchange. It tracks the Solactive Global Uranium Pure-Play Index. Holdings of the composite index have to be listed in exchanges of developed economies, exposing investors to their associated uranium markets.

The underlying holdings have to fulfill either of the following parameters to qualify:

- Organizations whose primary activity is uranium exploration and mining.

- Firms are investing and participating in the uranium market directly.

The top three holdings of this ETF as of now are:

- National Atomic Company Kazatomprom JSC Sponsored GDR RegS – 22.44%

- Cameco Corporation – 18.51%

- Yellow Cake PLC Ordinary Shares – 16.63%

Final thoughts

Effects of climate change and detriment to the environment due to fossil fuels are no longer in the scientific halls only but a reality the global populace is grappling with. The cost of fossil fuels and natural gas is also on the rise creating an energy crisis.

These two factors have created an appetite for alternative energy sources with zero emissions, and so far, nuclear energy is the only source that fulfills all these deliverables. With China’s appetite for renewable clean energy leading the way in nuclear adoption, this energy space is reaching critical mass, and the ETFs above are in pole position to benefit come 2022.

Comments