Red Hawk is an expert advisor that was published on MQL5 not so far ago, on October 12, 2020. The designer was Profalgo Limited. It was updated several times to a 2.2 version (15 April 2021). The system was demo downloaded 1948 times.

Red Hawk Review

The presentation doesn’t provide us with every explanation we need:

- It can work fully automatically for us on the charts.

- The robot is available in the MT4 and MT5 versions.

- We have to use it on an ECN account only.

- The developer suggests we use IC Markets or Alpari broker houses.

- The dev recommends us to trade with a VPS service – 4xhosing.

- The EA can close deals in a profit without sitting in long drawdowns.

- The money-management feature covers open deals with SL and TP levels.

- The robot doesn’t execute Grid with Martingale.

- There are filters for avoiding high slippage and high spread periods.

- We may trade with Lots fixed.

- There’s dynamic lot-sizing as well.

- The requirements for balance is $250 or higher.

- The risks can be different for every open order.

Trading Strategies and Currency Pairs

- Red Hawk runs “a mean reversion trading system that trades during the quiet times of the market.” This period is between 11 p.m. and 1 a.m.

- We may work with nine symbols: EUR/AUD, EUR/USD, GBP/USD, EUR/GBP, AUD/CAD, AUD/JPY, USD/CHF, EUR/CHF, and USD/CAD.

- The system works on the M5 time frame.

Red Hawk Trading Statistics

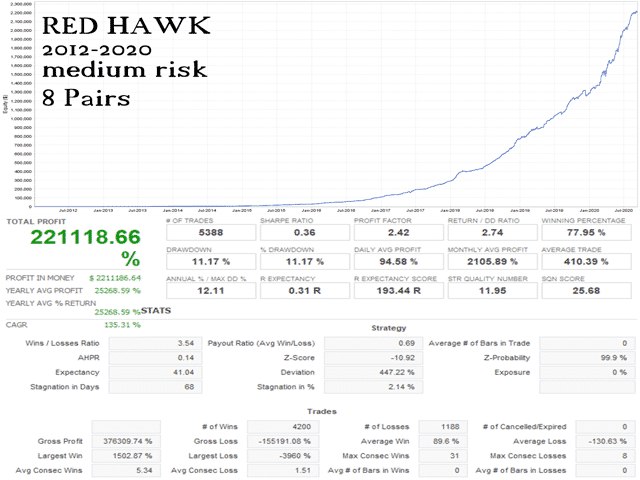

There’s a report for all currency pairs based on 2012-2020 data. The risk was medium. The total net profit was 221,118%. Red Hawk executed 5388 deals. The accuracy rate was 77.95%. The Profit Factor was 2.42. The maximum drawdown was 11.17%. The Risk to Reward Ratio was 2.74. The maximum win streak was 31 deals in a row.

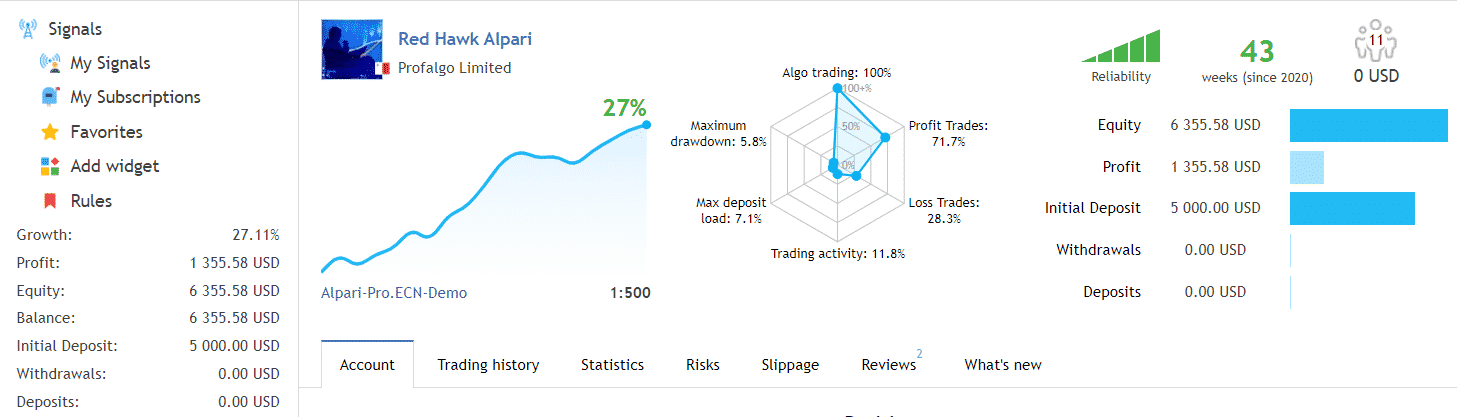

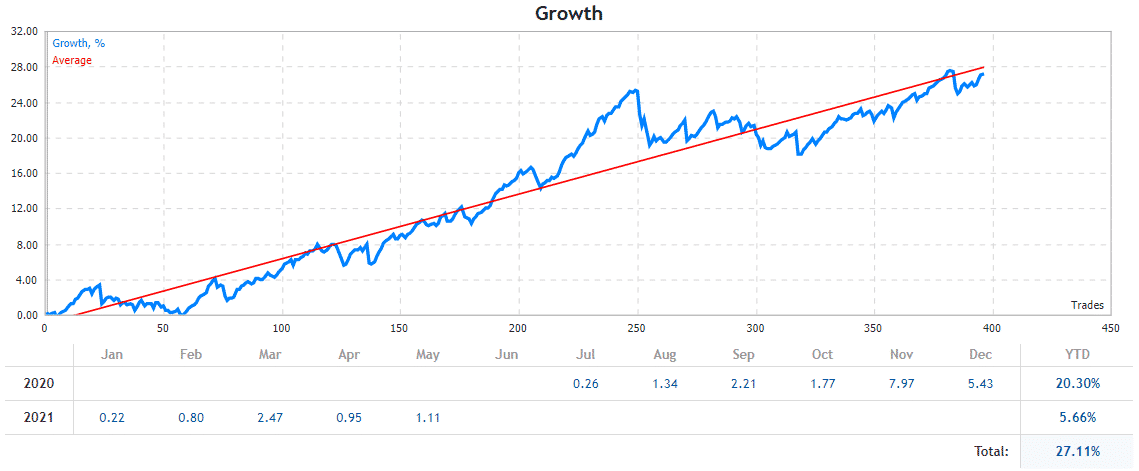

There’s no real, but only a demo ECN account on Alpari. The leverage is 1:500. The robot has been trading for 43 weeks. Signals are marketed as highly reliable. The maximum drawdown is 5.8%. The accuracy rate is 71.7%. The maximum deposit load is 7.1%. The account was deployed almost a year ago, on July 24, 2020. The deposit was set at $5,000. The Profit is $1,355.58. The growth is only 27.11%.

As we may note, this year’s profitability is quite low.

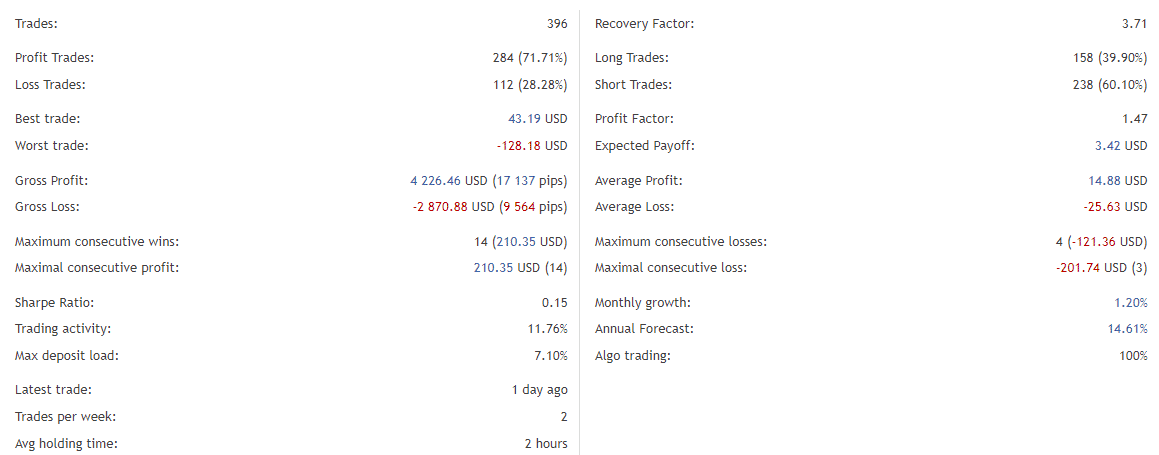

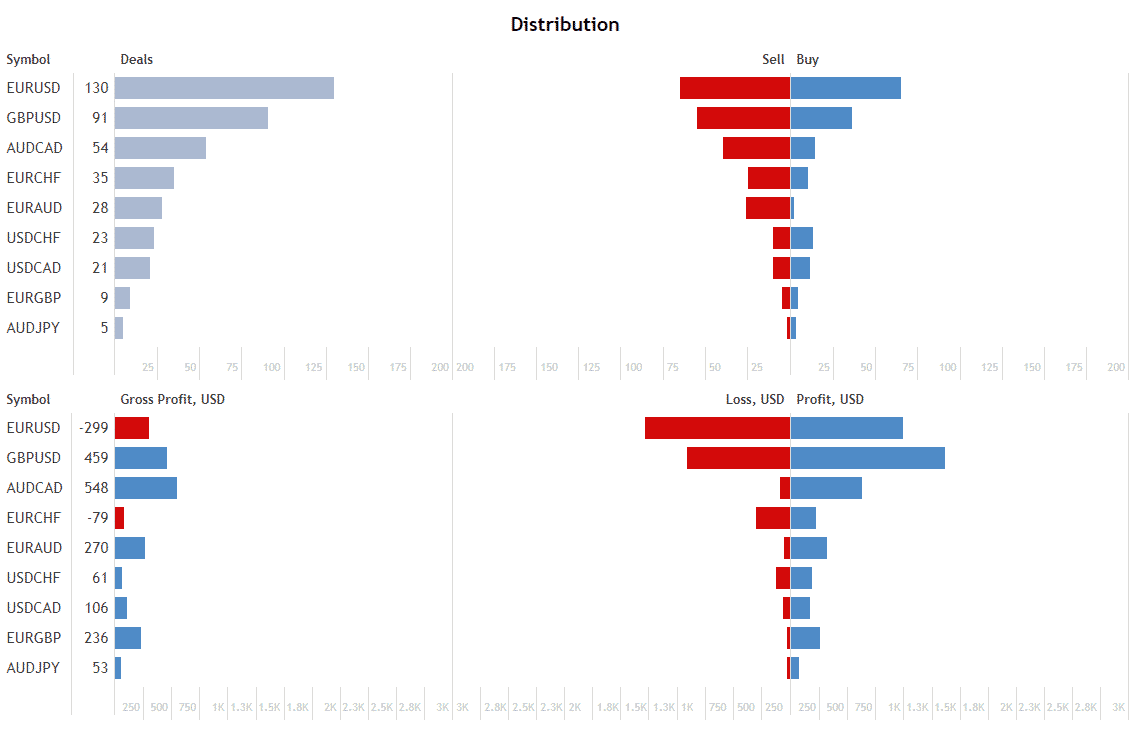

The system has closed 396 deals with a 71.71% win rate for both directions. The best trade is $43.19 when the worst trade is -$128.18. The Gross Profit is $4,226.46 when the Gross Loss is -$2,870.88. The maximum consecutive wins are 14 deals. The robots’ trading activity is low (11.76%). An average trade frequency is only two deals a week. An average holding time is two hours. The recovery factor is 3.71. The Profit Factor is 1.47. An average profit is $14.88 when an average loss is almost twice more -$25.63. The annual forecast is 14.61%.

There are two unprofitable symbols – EUR/USD (-$299) and EUR/CHF (-$79).

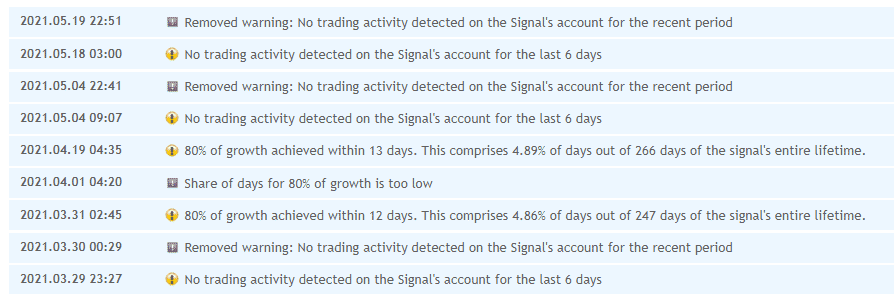

The advisor consistently has warnings from the MQL5 bot.

Pricing and Refund

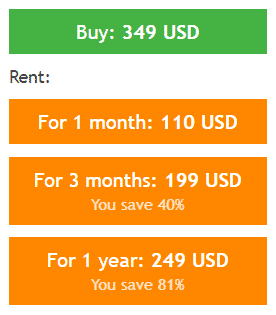

The Red Hawk is available for $349. There’s a single lifetime copy provided. There are three rental options. The one-month rent costs $110. The three-month rent with 40% OFF costs $199. The annual rent with 81% OFF costs $249. We are free to download a demo copy of the robot. We can’t rely on a money-back guarantee.

What Else You Should Know About Red Hawk

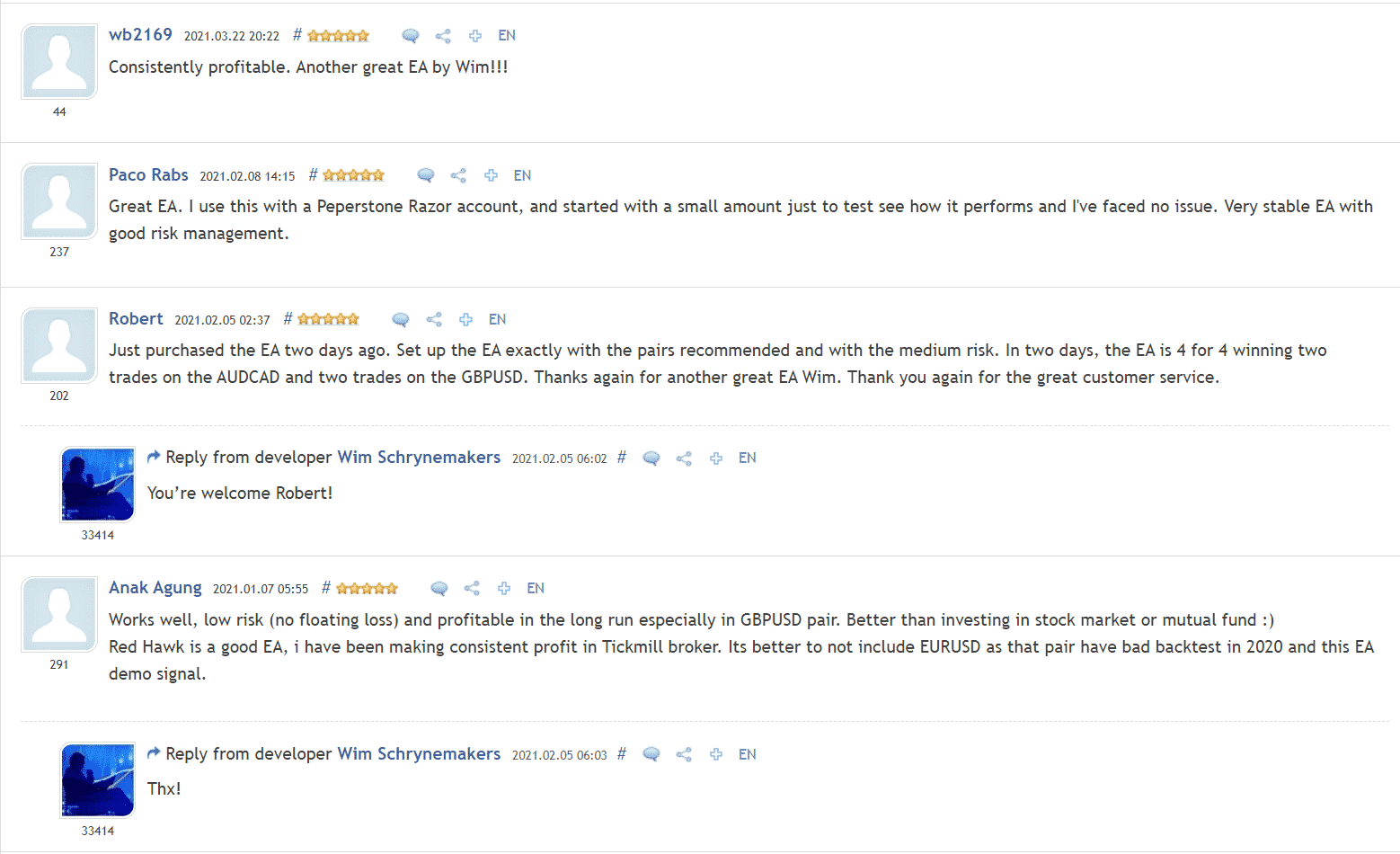

There are positive testimonials published. Alas, the last one was only in March. Since then, we have no updates.

The developer has a 35,562 rate and a 3.9 rate for his products. There are 3071 friends.

Red Hawk Conclusion

Summary

Red Hawk works for several months providing impossibly low profits. The presentation doesn’t look informative. The developer doesn’t trust real money for the system to trade. It still runs only a demo account.

Price – 3/10

Strategy – 4/10

Trading Results – 3/10

Vendor Transparency – 6/10

Customer Reviews – 3/10

Support – 3/10

Comments