After a midweek scare that saw the S&P 500 slump 2%, the market recollected on Friday on quelling inflation jitters. It opened at $416.61 and traded to a high of $418.72, finishing the week at -0.02% as it ended the week at $414.97.

Come Monday market opening, and the S&P 500 opened at $414.73. This means that it is still flirting with the weekly support at $414.48. Despite Wall Street maintaining that the market is bullish, Yahoo finance analysts worry that if the market doesn’t take a pause, the S&P 500 is in for a bubble burst.

In recent weeks, the S&P 500 has tended to make weekly lows and then rallying off to finish the week strongly. The expectation is for the same to happen this week.

SPDR S&P 500 Trust ETF thus closed the week at 11.33% YTD. Below is a breakdown of its underlying sectors and their performance over the week-May 17th to May 21st, and their corresponding sector ETF performances.

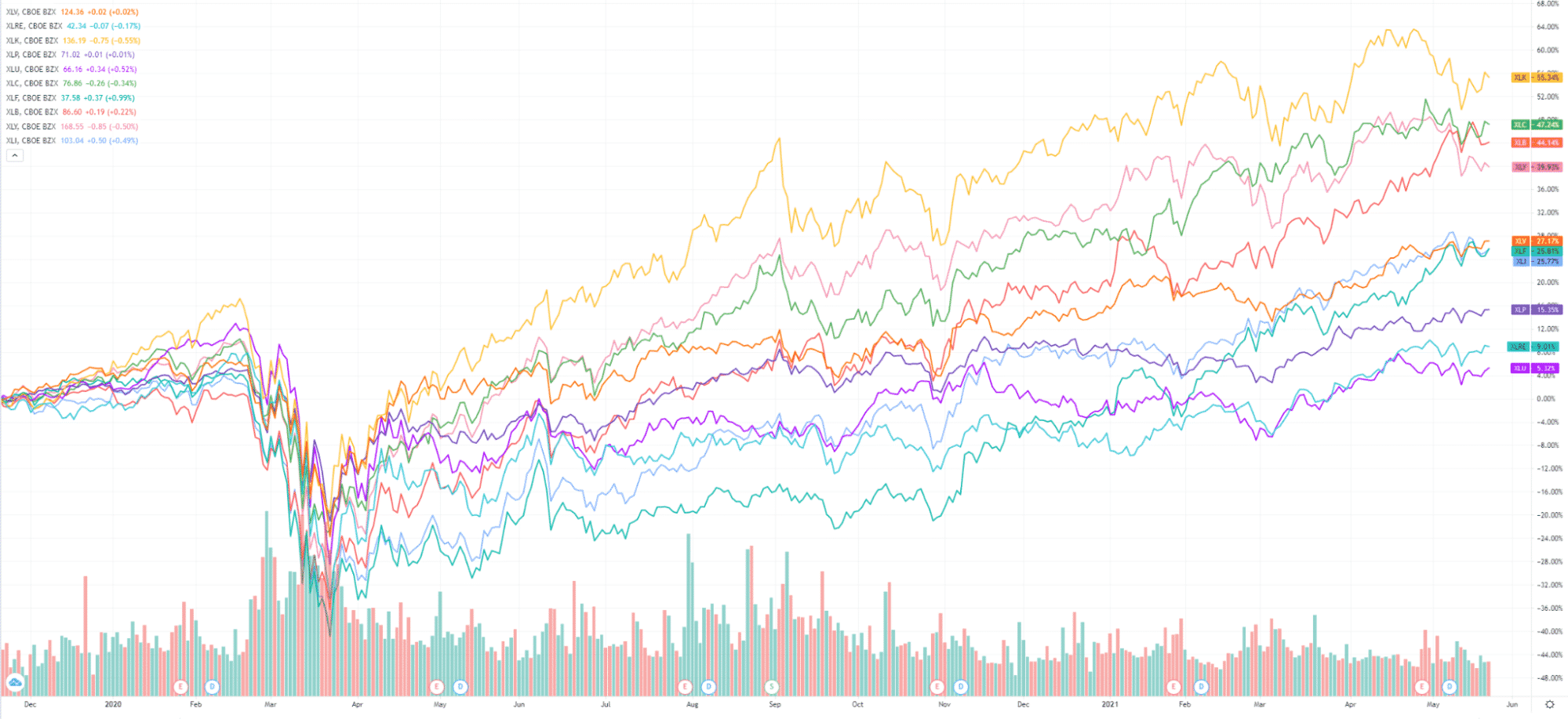

Here is a chart of the ten sectors’ year-to-date performance and how they have fared against the S&P 500.

S&P 500 industry sector weekly performance breakdown |

|||

| 1. | Healthcare | XLV | +1.68% with the accompanying health care select sector ETF |

| 2. | Real Estate | XLRE | +1.21% with the accompanying real estate select sector ETF |

| 3. | Information Technology | XLK | +0.69% with the accompanying information technology select sector ETF |

| 4. | Consumer Staples | XLP | +0.28% with the accompanying consumer staples select sector ETF |

| 5. | Utilities | XLU | +0.11% with the accompanying utilities select sector ETF |

| 6. | Communication Services | XLC | -0.05% with the accompanying communication services select sector ETF |

| 7. | Financial Services | XLF | -0.51% with the accompanying financial services select sector ETF |

| 8. | Materials | XLB | 0.76% with the accompanying materials select sector ETF |

| 9. | Consumer Discretionary | XLY | -0.81% with the accompanying consumer discretionary select sector ETF |

| 10. | Industrial | XLI | -1.19% with the accompanying industrial select sector ETF |

Comments