What investors crave apart from consistent returns is portfolio stability. The Japanese economy is characterized by very stable political structures, low valuation equities, and stringent corporate governance, setting up the stage for a robust dividend income environment in addition to stability.

Add to this the fact that the Japanese economy lies third in rank when considering nominal GDP and second by purchasing power parity. You cannot afford not to diversify your portfolio by investing in this economy geographically.

What is the composition of a Japanese ETF?

Here we look at exchange-traded funds that expose investors to the Japanese economy by either investing at least 70% of their total assets in Japanese equities or deriving at least 75% of its total revenues from the Japanese economy.

Top 7 best international ETFs

After recording the sharpest economic contraction recorded, 27.8%, Japan is on track to recover from the clutches of the novel coronavirus, and the following ETFs are in pole position to provide geographical portfolio diversification, in addition to returns.

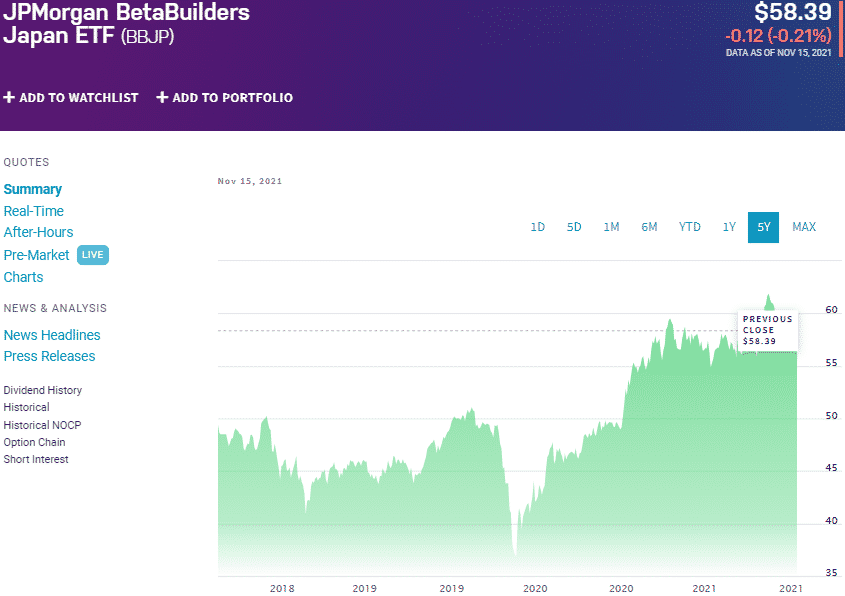

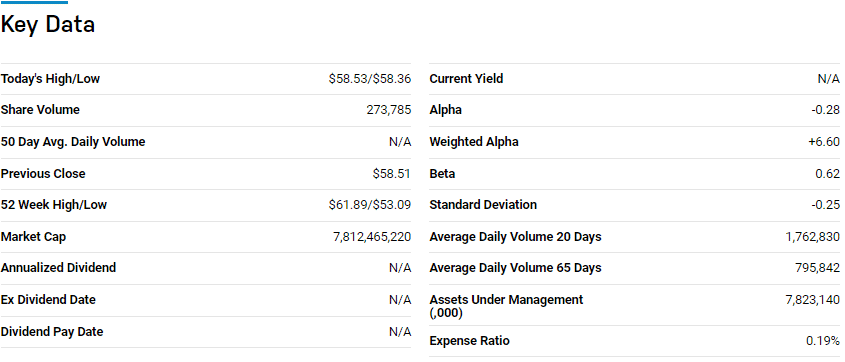

JPMorgan BetaBuilders Japan ETF (BBJP)

Price: $58.39

Expense ratio: 0.19%

Annual dividend yield: 0.54%

BBJP chart

The JPMorgan BetaBuilders Japan ETF tracks the performance of the Morningstar Japan Target Market Exposure Index, exposing investors to the best public-traded equities registered on the Nagoya Stock Exchange or the Tokyo Stock Exchange.

An evaluation of 17 Japan Stock ETFs by US News has the rank № 2 for long-term investment.

The BBJP ETF has $7.81 billion in assets under management, with an expense ratio of 0.19%. Since its launch three years ago, the BBJP has never posted negative returns, warranting a second look at investing in Japan.

The BBJP ETF has $7.81 billion in assets under management, with an expense ratio of 0.19%. Since its launch three years ago, the BBJP has never posted negative returns, warranting a second look at investing in Japan.

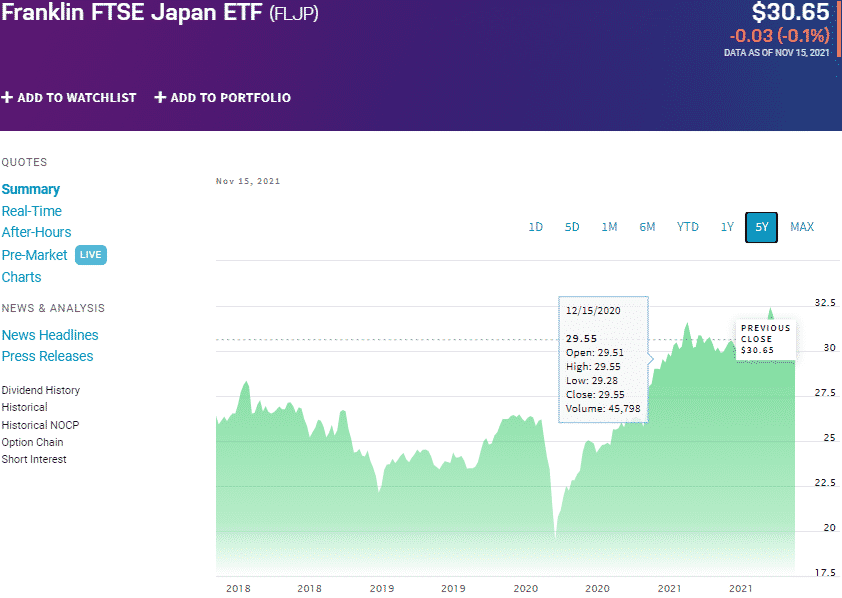

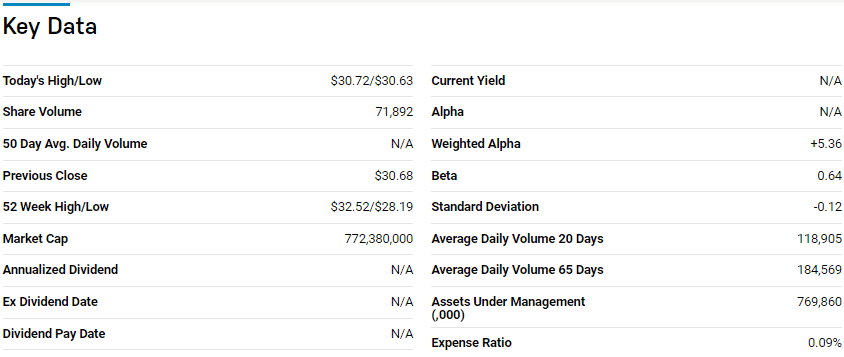

Franklin FTSE Japan ETF (FLJP)

Price: $30.65

Expense ratio: 0.09%

Annual dividend yield: 2.10%

FLJP chart

The FLJP ETF tracks the performance of the FTSE Japan RIC Capped Index, exposing investors to the best public-traded Japanese mid and large-cap equities.

An evaluation of 17 Japan Stock ETFs by US News has the rank № 1 for long-term investment.

FLJP has $773.05 million in assets under management, with an expense ratio of 0.09%. It is yet another reasonably new Japanese ETF that has posted positive returns for its investors since its inception, putting in a strong case for investment if considering this economy.

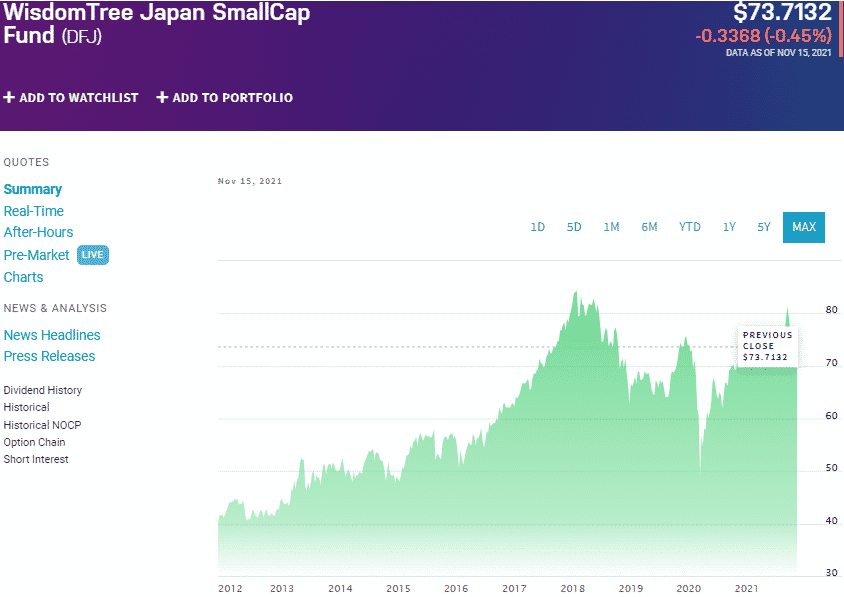

WisdomTree Japan SmallCap Dividend Fund (DFJ)

Price: $73.71

Expense ratio: 0.58%

Annual dividend yield: 2.28%

DFJ chart

The DFJ ETF tracks the performance of the WisdomTree Japan SmallCap Dividend Index, investing at least 95% of its assets in the underlying holdings of the composite index. As such, investors in this ETF get exposure to the Japanese small-cap equities that have a history of paying dividends.

An evaluation of 17 Japan Stock ETFs by US News has the rank № 3 for long-term investment.

This ETF has $232.57 million in assets under management, with an expense ratio of 0.58%. DFJ has been available to investors for more than five years now, but its category average has always posted positive returns despite underperforming.

What it lacks in terms of returns makes up for a more than average dividend yield, bringing investors regular income. The ETF has $232.57 million in assets under management, with an expense ratio of 0.58%. DFJ has been available to investors for more than five years now, but its category average has always posted positive returns despite underperforming. What it lacks in terms of returns it makes up in a more than average dividend yield, bringing investors regular income.

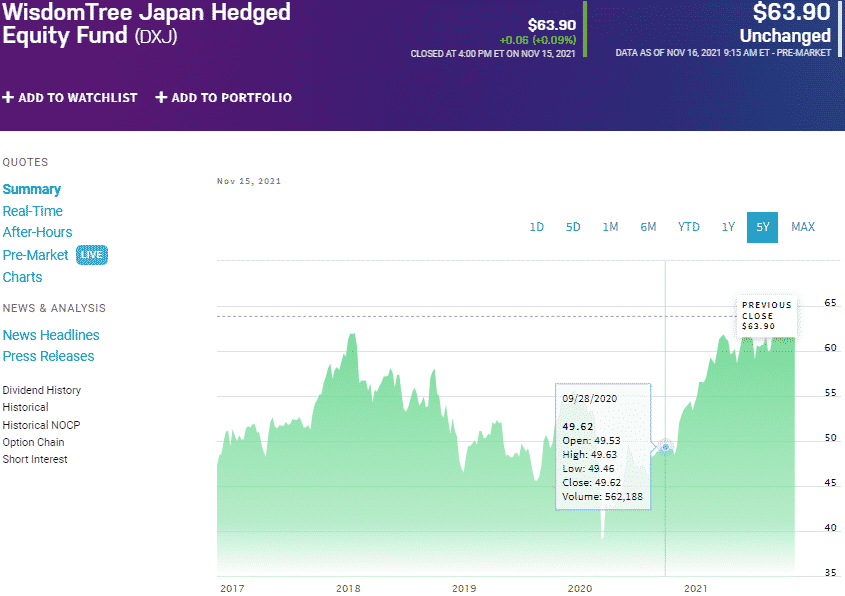

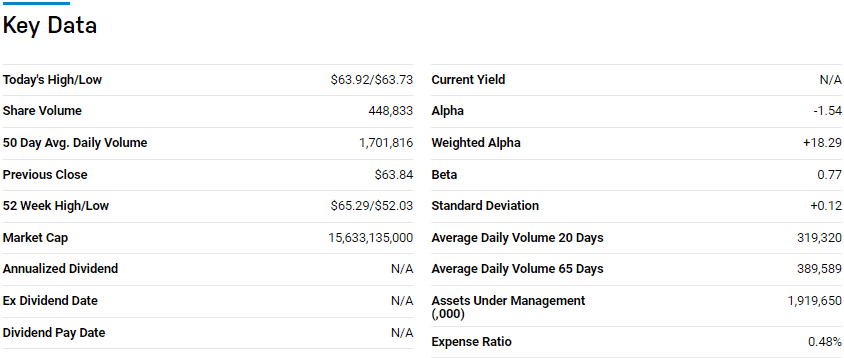

WisdomTree Japan SmallCap Dividend Fund (DXJ)

Price: $63.90

Expense ratio:0.48%

Annual dividend yield: 2.11%

DXJ chart

The WisdomTree Japan Hedged Equity Fund tracks the WisdomTree Japan Hedged Equity Index, investing at least 95% of its assets in the holdings of the composite index. It exposes its investors to the Japanese equity market while neutralizing the Japanese Yen currency fluctuation risk.

An evaluation of 17 Japan Stock ETFs by US News has the rank № 6 for long-term investment.

DXJ has $1.92 billion in assets under management, with an expense ratio of 0.48%. This ETF has outperformed its category and segment averages; 5-year returns of 58.34%, 3-year returns of 28.47%, and pandemic year returns of 26.77%. Add a more than average dividend yield, and you cannot afford to leave out this ETF in a Japanese portfolio.

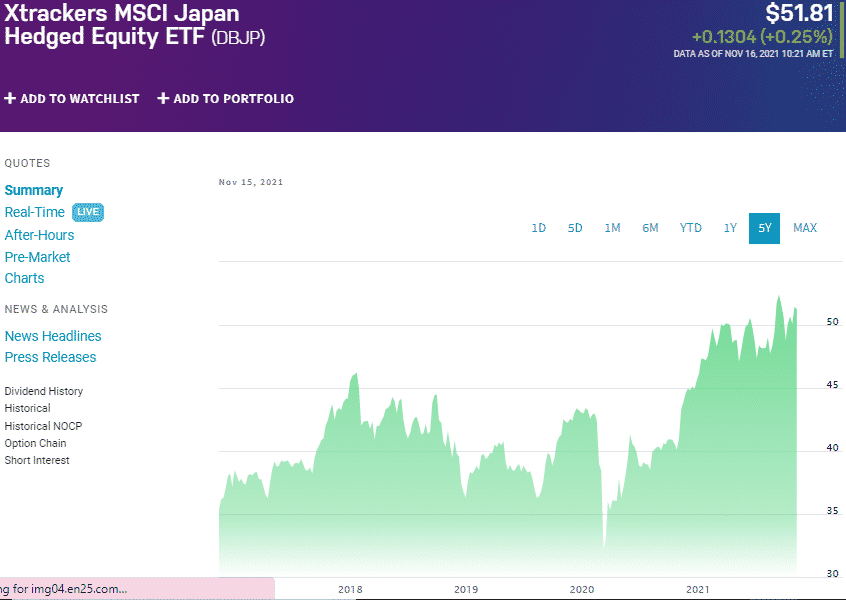

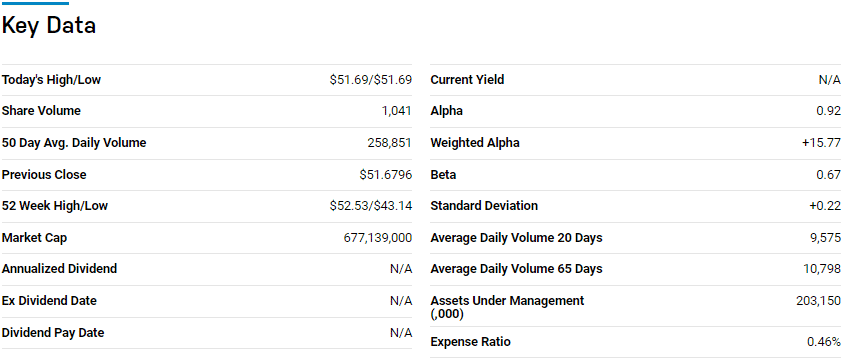

Vanguard FTSE Emerging Markets (VWO)

Price: $51.81

Expense ratio: 0.46%

Annual dividend yield: 2.29%

DBJP chart

The Xtrackers MSCI Japan Hedged Equity ETF tracks the MSCI Japan US Dollar Hedged Index, investing at least 95% of its assets in the holdings of the composite index. It exposes its investors to the Japanese large-cap equity market but at the same time protects them against fluctuations in the Japanese Yen.

An evaluation of 17 Japan Stock ETFs by US News has the rank № 4 for long-term investment.

DBJP has $204.14 million in assets under management, with an expense ratio of 0.46%. This ETF has outperformed its category and segment averages; 5-year returns of 73.30%, 3-year returns of 38.11%, and pandemic year returns of 22.80%. Add a more than average dividend yield, 2.29%, which begs for inclusion on any Japanese ETF portfolio.

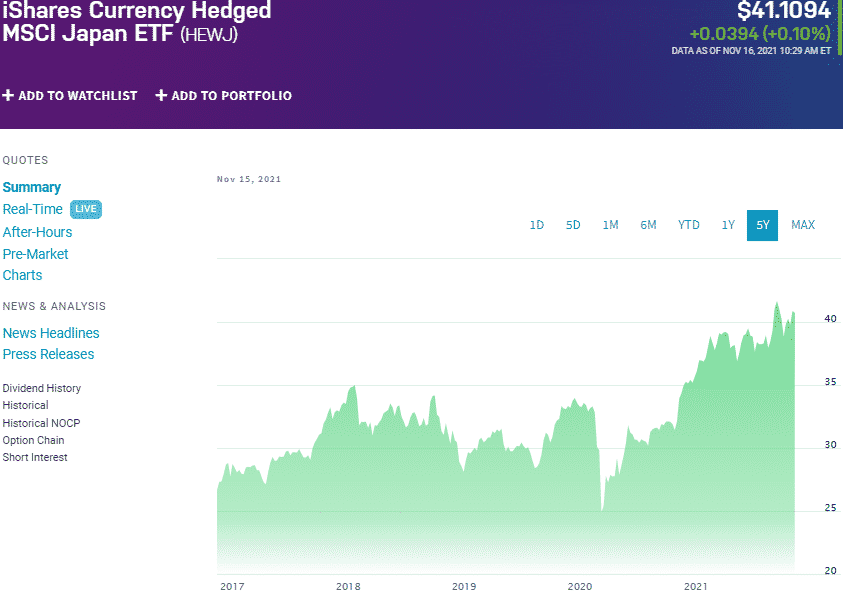

iShares Currency Hedged MSCI Japan ETF (HEWJ)

Price: $41.10

Expense ratio: 0.51%

Annual dividend yield: 1.02%

HEWJ chart

The iShares Currency Hedged MSCI Japan Fund seeks to replicate the performance of the MSCI Japan 100% Hedged to USD Index, net of expenses and fees. It invests at least 80% of its assets in the holdings of the tracked index. It exposed its investors to the Japanese equity market via the Tokyo Stock Exchange, with the inherent currency risk incorporated into the underlying index and hedged against the dollar.

The HEWJ ETF has $599.81 million in assets under management, with an expense ratio of 0.51%. In the last five years, investors have enjoyed returns above the category average; 5-year returns of 72.87%, 3-year returns of 37.36%, and pandemic year returns of 23.18%.

Analysis of these returns shows an ETF that outperforms the category and segment averages, making a strong case for consideration when investing in the world’s second-largest developed economy.

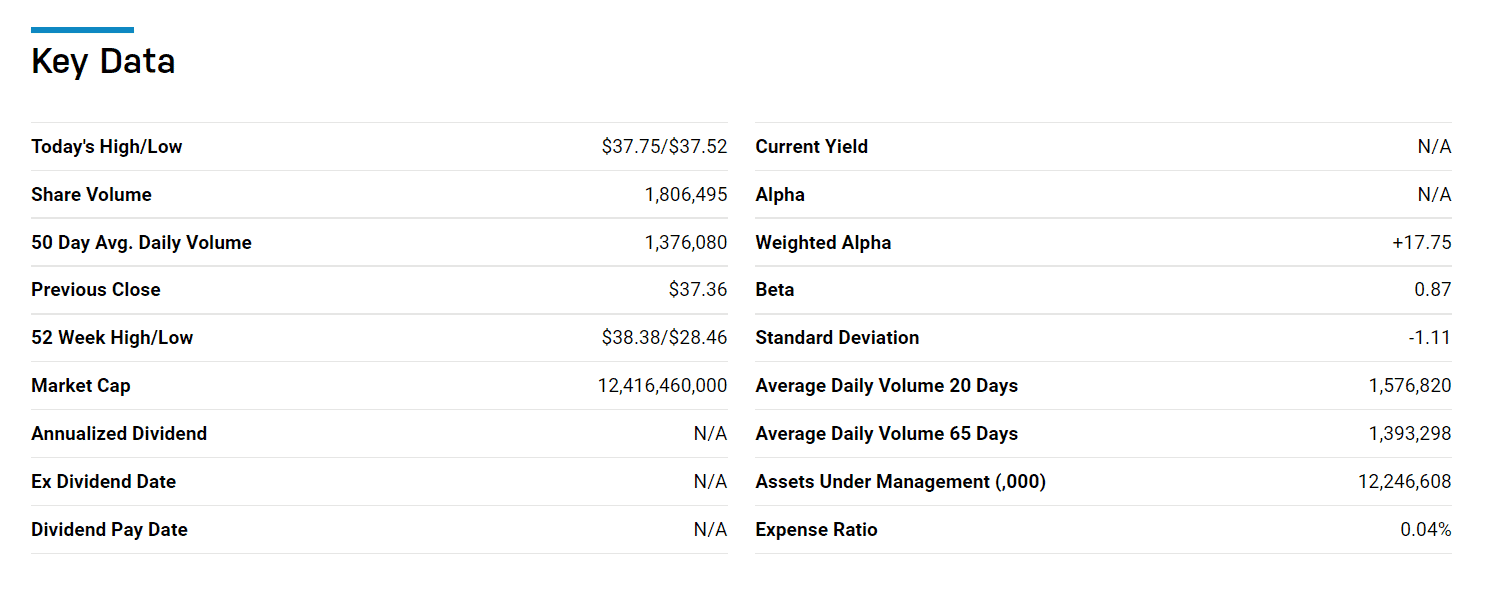

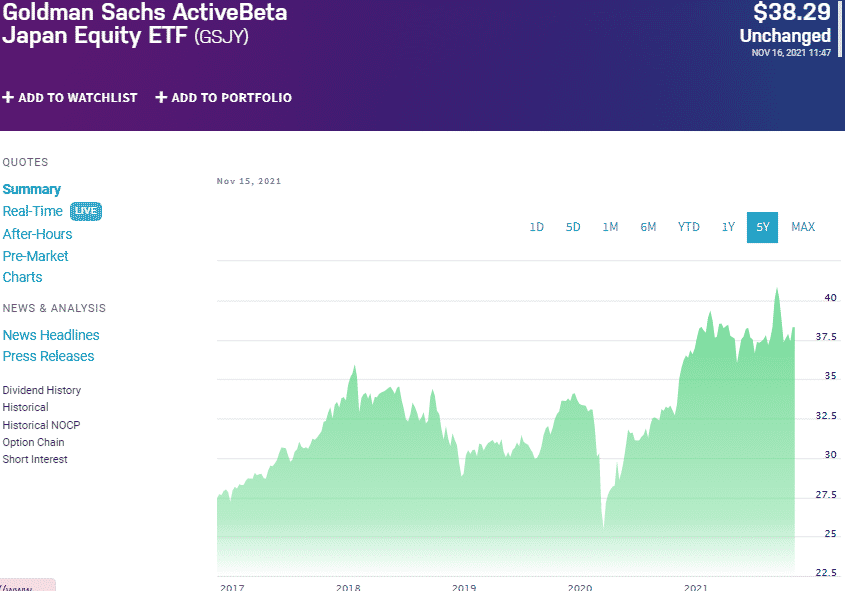

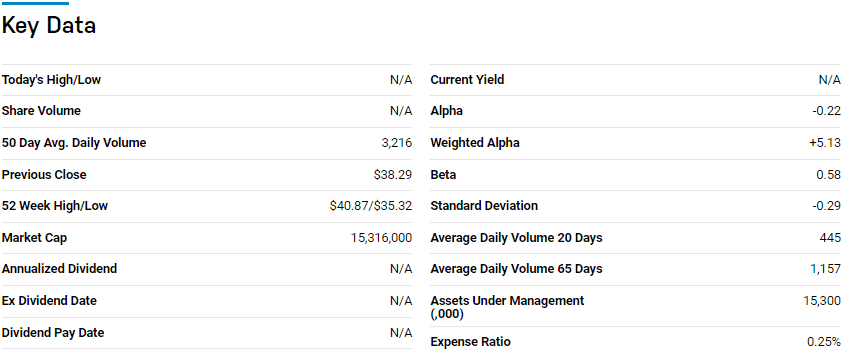

Goldman Sachs ActiveBeta Japan Equity ETF (GSJY)

Price: $38.29

Expense ratio: 0.49%

Annual dividend yield: 1.49%

GSJY chart

Goldman Sachs ActiveBeta Japan Eq ETF seeks to replicate the performance of the Goldman Sachs ActiveBeta Japan Equity Index, net of expenses and fees. GSJY invests at least 80% of its total assets in the underlying holdings of its composite index and ADRs of the underlying holdings.

The GSJY ETF has the minimum assets under management on this list, $15.06 million, but has one of the lowest expense ratios, 0.25%. Despite not amassing huge assets under management, this ETF has an impressive returns record calling for consideration; 5-year returns of 55.09%, 3-year returns of 30.86%, and pandemic year returns of 12.27%.

Final thoughts

Japan equities have lagged behind their US and Euro-based counterparts. Still, CNBC analysts believe the stage is set for a jumpstart of the Japanese economy, with equities expected to outperform the rest. The ETFs above are a great starting point for investing in the Japanese economy and its resurgence in light of this analysis.

Comments