In 2021 alone, hedged ETFs utilizing options raked in upwards of $5 billion for investors. 2021 experienced equity sell-offs, but with looming interest rate hikes, unchecked inflation rates, and the ongoing Ukraine-Russia conflict, market volatilities, and global currency fluctuations could reach unprecedented levels and result in billions of losses if unprepared.

Hedged ETFs provide an avenue for investors to protect against a market downturn and offset any losses without selling off their investments. These three ETFs hedge your portfolio against different risks in 2022’s an uncertain economic environment, ensuring that your portfolio stays in the money.

What is the composition of hedged ETFs?

Before looking into the composition of hedged ETFs, we must first look at hedging. Traditionally, hedging utilized alternative investment assets such as futures, options, swap contracts, and over-the-counter securities. These derivatives would employ sophisticated pricing algorithms to develop protective strategies available only to elite investors. However, the ETF market has evolved to provide hedged ETFs comprising derivatives instruments making hedge trading more accessible, liquid, simpler, and cheaper.

The top 3 hedged ETFs to protect your portfolio in 2022

Coming into 2022, inflation fears and looming rate hikes on the backdrop of slowing economic growth were enough to cause significant market volatilities and delay the start of earnings season. The Ukraine-Russia war has worsened by throwing into this cooking pot energy crisis, supply chain bottlenecks, and trade sanctions.

The result has been the CPI being at its hottest level since 1982. With the current indicators, businesses, consumers, and investors can expect to dig deeper into their pockets for raw materials, finished products, and investments, respectively. With all this in mind, these three ETFs let you sleep easy, knowing that your portfolio is protected against foreseeable and unprecedented market downturns.

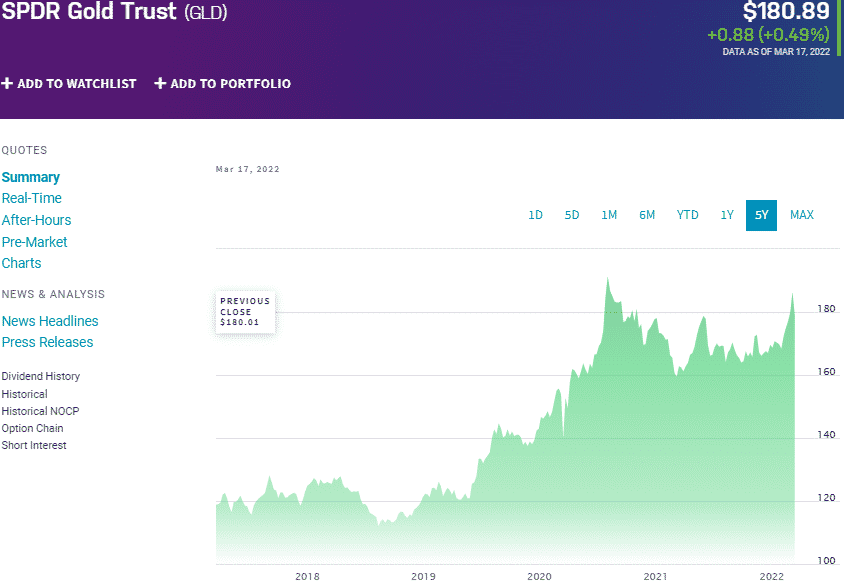

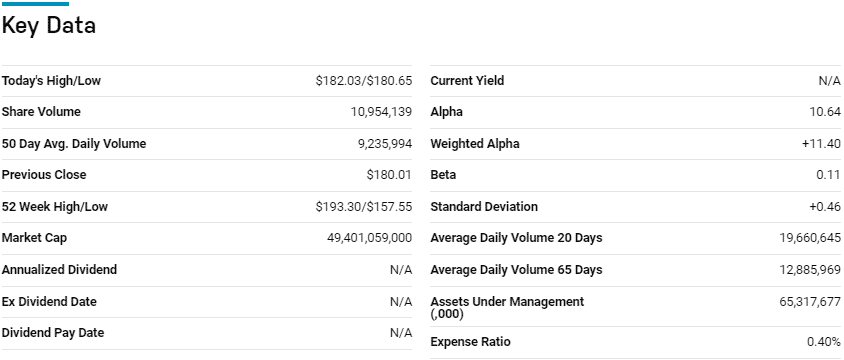

№ 1. SPDR Gold Trust Fund (GLD)

Price: $180.89

Expense ratio: 0.40%

Dividend yield: N/A

GLD chart

Cryptocurrencies might be the next currency and store of value frontier, but the world is yet to reach this point. When there is economic turmoil and uncertainty, gold has been the globally accepted store of value since time immemorial. The SPDR Gold Trust tracks the spot price of gold, net the trust’s expenses. To efficiently meet its investment objective, this fund holds physical gold bars and trades them for baskets on a need to basis depending on the market demand and price of gold.

The GLD ETF is one of the most popular funds globally, boasting $66.70 billion in assets under management, with investors having to spend $40 annually for a $10000 investment. The underlying asset feature of being both a commodity and a store of value makes this fund a multiple hedge asset against inflation, market volatility, and currency fluctuations-the green buck. Combining this with a physical backing rather than futures provides a stable fund to constantly give returns in bullish and bearish markets; 5-year returns of 54.85%, 3-year returns of 46.39%, and 1-year returns of 10.88%.

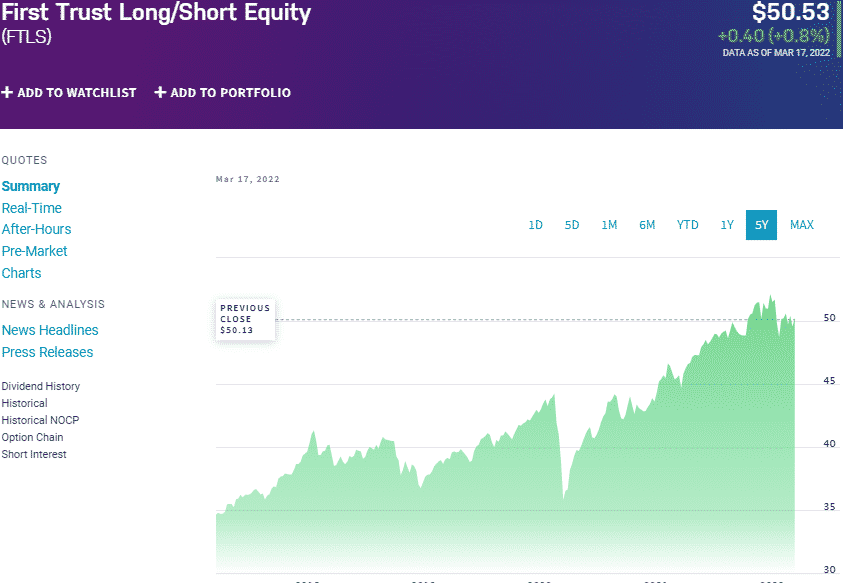

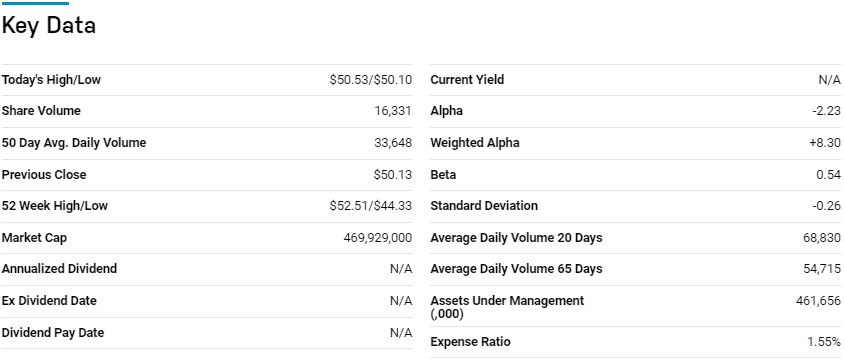

№ 2. First Trust Long/Short Equity Fund (FTLS)

Price: $50.53

Expense ratio: 1.55%

Annual dividend yield: 0.24

FTLS chart

First Trust Long/Short Equity Fund is an actively managed ETF that seeks long-term total return by investing at least 80% of its total assets, including debt financing, in US exchange-listed securities and/or exchange-traded funds US exchange-listed securities. The remaining 20% can be invested in futures contracts of US exchange-listed securities with the potential for bearish or bullish returns.

The top three holdings of this ETF are:

- US Dollar – 40.31%

- Apple Inc. – 3.45%

- Microsoft Corporation – 2.53%

The FTLS ETF has $461.6 million in assets under management, with an expense ratio of 1.55%. Active management and the discretion of short- and long-term strategies depending on individual holdings and the underlying market conditions make this fund extremely agile, resulting in money in bearish and bullish markets.

Utilizing both technical and fundamental indicators in screening for hedge stocks has resulted in a fund synonymous with consistent returns year in year out; 5-year returns of 46.95%, 3-year returns of 29.86%, and 1-year returns 8.64%.

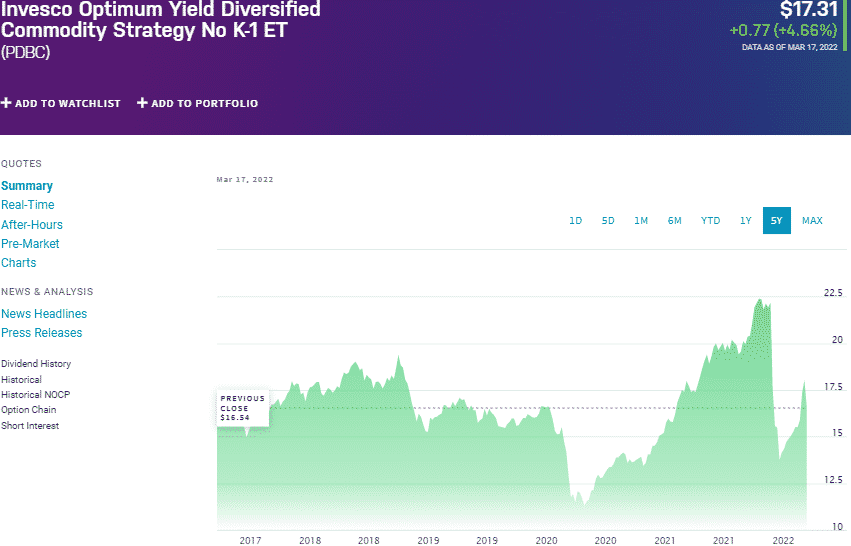

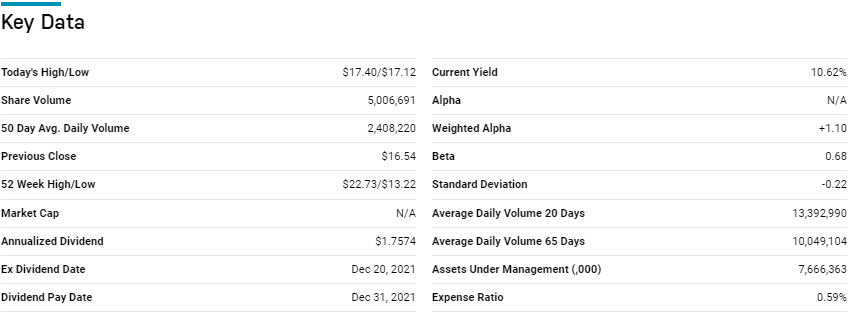

№ 3. Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF (PDBC)

Price: $17.31

Expense ratio: 0.59%

Annual dividend yield: 0.01%

PDBC chart

The Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF is an actively managed fund that seeks capital appreciation by investing in the most popular and liquid commodities and all associated financial instruments; oil, gold, aluminum, silver, copper, among others.

The top three holdings of this fund:

- US Dollar – 65.47%

- MUTUAL FUND (OTHER) – 19.18%

- The United States Treasury Bills 0.0% 18-AUG-2022 – 3.65%

The PDBC ETF has $7.71 billion in assets under management, with investors having to part with $59 annually for every $10000 investment. Unlike other commodities ETFs, the PDBC avoids negative yield roll by employing active management. Diversification across different commodities and their related financial instruments ensure resilience and an ability to outperform both the category and market averages; 5-year returns of 65.77%, 3-year returns of 55.40%, and 1-year returns of 41.39%.

Final thoughts

All roads so far point to a highly volatile market environment in 2022, necessitating the need for portfolio protection. The ETFs above are the best investment assets to protect a portfolio against multiple risks facing the current markets and ensure profits within the prevailing market uncertainty, rising inflation rates, rising interest rates, and the ongoing Ukraine-Russia conflict.

Comments