If Bitcoin’s current price is anything to go by, your crypto fund can be wiped out in mere minutes. This volatility might be the most significant factor for skeptical institutions and governments about the digital currency market. Is there a workaround to investing in this next digital and finance frontier? Mining exchange-traded funds give investors a diversified and indirect play on this $3 trillion market-capped industry.

What are mining exchange-traded funds?

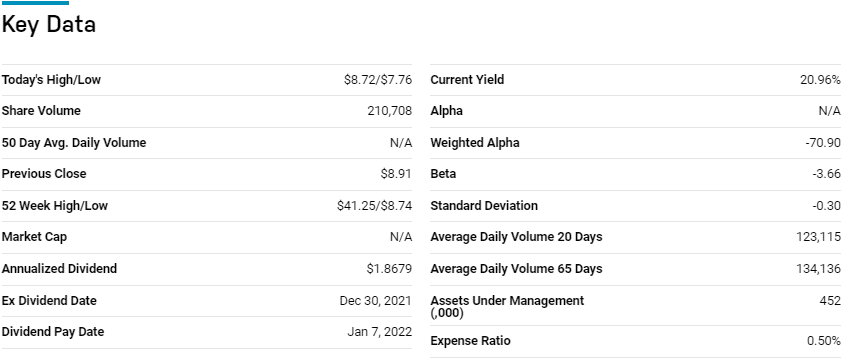

Before demystifying mining exchange-traded funds regarding digital assets and currencies, we first need to understand the mining process. Mining refers to the blockchain transaction validation process, which issues a digital token for every successful validation.

The token received are referred to as crypto coins. As such, mining ETFs comprise organizations involved in digital mining, provision of mining rigs and their setup, digital foundries, and all organizations deriving significant revenues from providing ancillary services to this crypto niche.

Mining ETFs to include in your crypto fund

Despite the volatility associated with cryptocurrencies and digital assets, institutional investors and governments’ continued interest and adoption point to an industry in infancy with much legroom for growth. The crypto mining equities will be the drivers of this revolution and development, and the five ETFs below are in pole position to benefit.

№ 1. Viridi Cleaner Energy Crypto-Mining and Semiconductor ETF (RIGZ)

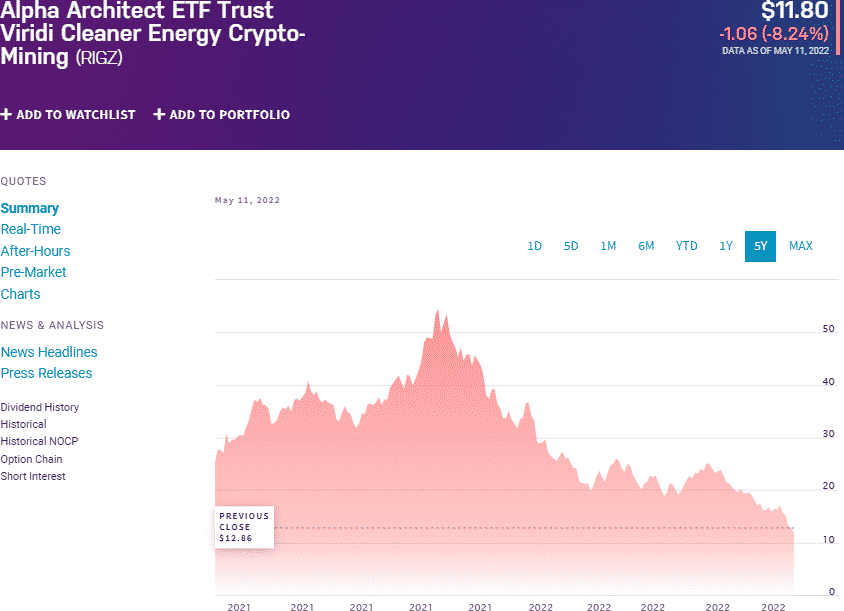

Price: $11.8

Expense ratio: 0.90%

Dividend yield: N/A

RIGZ chart

One frontier investment niche is green investing, investing in equities geared towards environmental and climate reclamation. Crypto mining is power-intensive which s detrimental to the environment. The Viridi Cleaner Energy Crypto-Mining and Semiconductor fund is an actively managed fund that exposes investors to equities utilizing sustainable green energy in crypto mining and the semi-conductor production and technologies niche.

The top three holdings for conscious-oriented investment funds are:

- Bitfarms Ltd. – 9.88%

- Core Scientific, Inc. – 9.35%

- Argo Blockchain Plc –7.47%

Since its launch in mid-2021, the RIGZ ETF has accumulated $9.2 million in assets under management, with an expense ratio of 0.90%. This fund backs equities at the forefront of the primary crypto mining challenge; massive power needs leading to environmental degradation. Diversification to include the semi-conductor industry plugs it into all future-focused consumer electronics and computing power technology evolution, strategically positioning it to benefit from all things tech-related.

Active management and a multi-factor equity screening methodology ensure this fund is agile enough to take advantage of the following disruptive green technologies in blockchain and semi-conductor niches.

№ 2. Siren Nasdaq NexGen Economy ETF (BLCN)

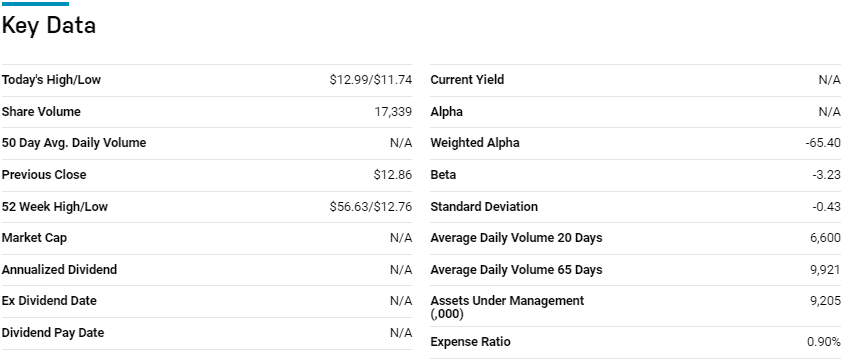

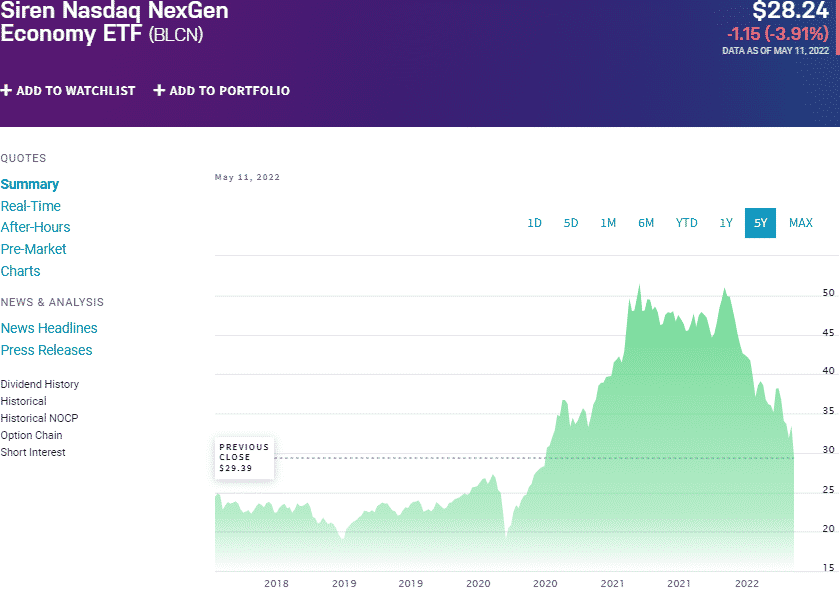

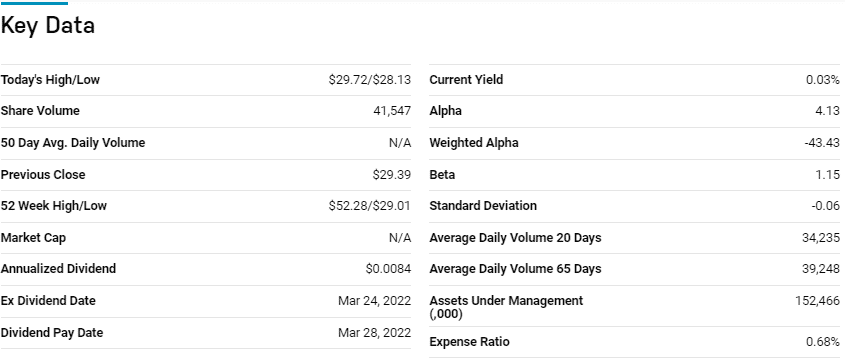

Price: $28.24

Expense ratio: 0.68%

Dividend yield: 0.61%

BLCN chart

The Siren Nasdaq NexGen Economy ETF tracks the performance of the Siren Nasdaq Blockchain Economy Index, net of expenses, and fees. It invests at least 80% of its assets in holdings making up the tracked index, exposing investors to equities along the blockchain value chain, researching, developing, innovating, supporting, and proprietary utilizing blockchain technology.

The top three holdings for this fund are:

- Bitfarms Ltd. – 10.94%

- Core Scientific, Inc. – 10.19%

- Argo Blockchain Plc –7.56%

The BLCN ETF has $152.3 million in assets under management, with an expense ratio of 0.68%. Being a pioneer blockchain ETF, this fund is passively managed but leaves enough wiggle room for managers on holding selection. The result is a fund that gives diversified mining exposure through interests along the blockchain technology value chain.

Despite the last 12 months not being the best months for this fund, it is in an elite group of ETFs; positive returns in their launch year. This phenomenon speaks to the immense growth prospects as blockchain technology adoption accelerates globally; 3-year returns of 32.55%, 1-year returns of -37.43%, and an annual dividend yield of 0.61%.

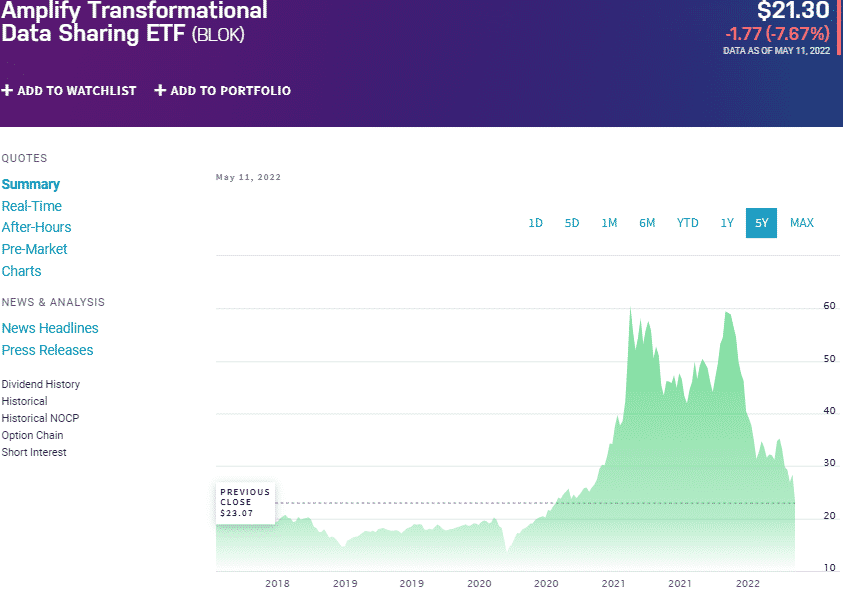

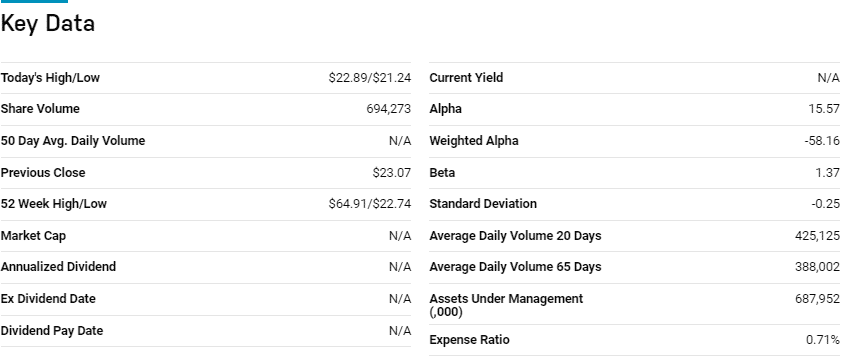

№ 3. Amplify Transformational Data Sharing ETF (BLOK)

Price: $21.30

Expense ratio: 0.71%

Dividend yield: 1.09%

BLOK chart

The Amplify Transformational Data ETF is yet another pioneer blockchain-based fund. Still, unlike BLCN, it is an actively managed fund that seeks capital appreciation by investing in organizations that develop and utilize blockchain technology, including crypto miners.

The top holdings for this fund are:

- SBI Holdings, Inc. – 5.30%

- CME Group Inc. Class A – 5.08%

- Silvergate Capital Corp. Class A – 4.40%

The BLOK ETF has $688.0 million in assets under management, with an expense ratio of 0.71%. This fund has amassed more assets under management than the BLCN ETF despite launching almost simultaneously.

Concentration on the technologies driving blockchain technology means it is a fund that features some tech big boys giving it resilience. Active management ensures that BLOK ETF is agile enough to take advantage of all opportunities created as blockchain technology adoption accelerates.

Like other blockchain-based assets, the last 12 months have not been the best, but as cryptocurrencies and blockchain technology adoption goes global, it has a lot of legroom for growth; 3-year returns of 55.82%, 1-year returns of -45.25%, and a dividend yield of 1.09%.

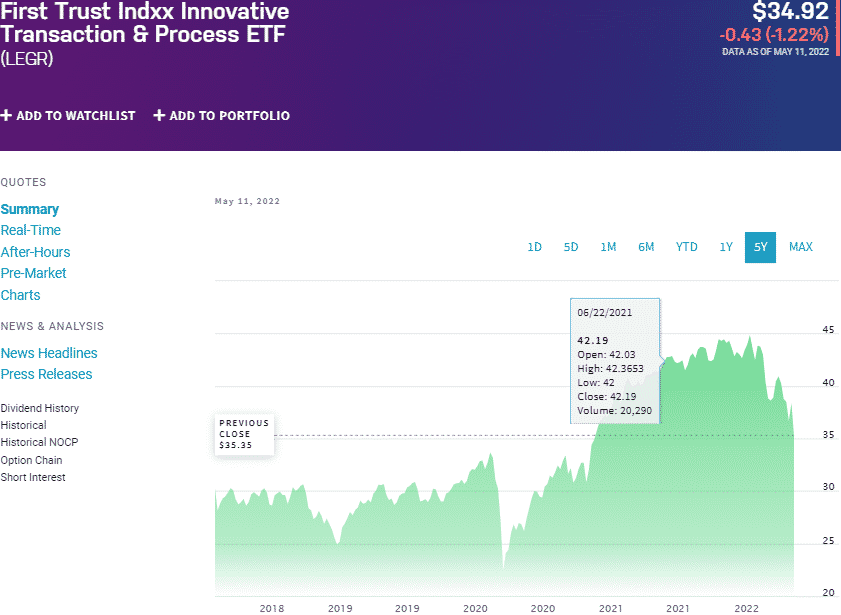

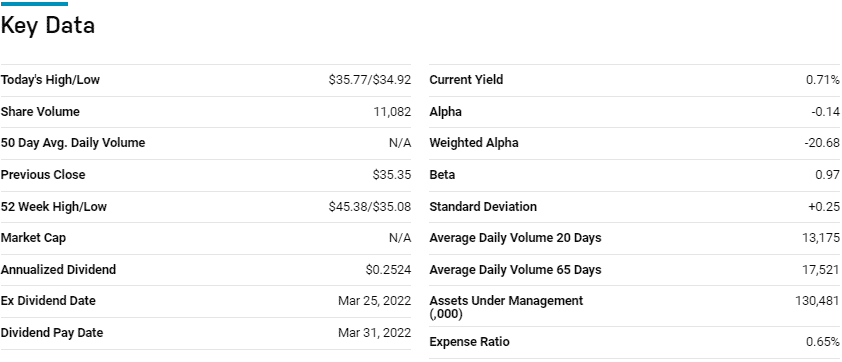

№ 4. First Trust Indxx Innovative Transaction and Process ETF (LEGR)

Price: $34.92

Expense ratio: 0.65%

Dividend yield: 1.26%

LEGR chart

The First Trust Indxx Innovative Transaction and Process ETF seek to replicate the price and yield performance of the Indxx Blockchain Index, net of expenses, and fees. It invests at least 90% of its net assets, including debt capital, in the holdings of the tracked index and all associated ADRs. It exposes investors to equities actively engaged in the blockchain ecosystem, blockchain utilization, blockchain technology development, and products benefitting from the increased adoption of blockchain technology.

The top holdings for this fund are:

- International Business Machines Corporation –1.52%

- Honeywell International Inc. – 1.48%

- Deutsche Telekom AG – 1.47%

The LEGR ETF has $130.7 million in assets under management, with an expense ratio of 0.65%. This fund is a diversified play on mining by incorporating all equities deriving more than 50% revenues from blockchain-related activities and those with more than 50% net resource investment in blockchain-related technologies.

Couple this with a pretty even weighting, and what you have is a fund that can generate both value and growth; 3-year returns of 27.70%, 1-year returns of -13.60%, and an annual dividend yield 1.26%.

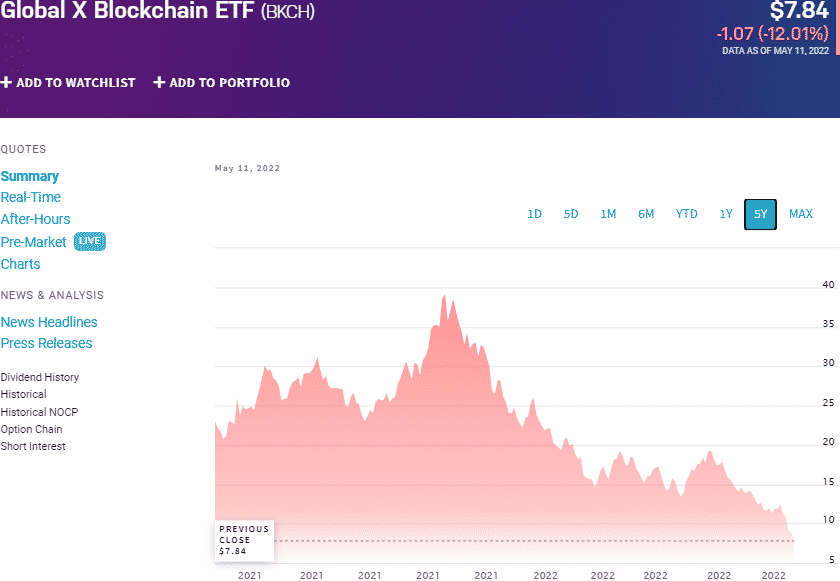

№ 5. Global X Blockchain ETF (BKCH)

Price: $7.84

Expense ratio: 0.50%

Dividend yield: N/A

BKCH chart

The Global X Blockchain ETF is an actively managed fund that seeks capital appreciation by investing in equities operating within the entire blockchain and cryptocurrency value chain. It, therefore, exposes investors to equities involved in; Blockchain & Digital Asset Hardware, Digital Asset Mining, Blockchain & Digital Asset Transactions, Blockchain Applications, and Blockchain & Digital Asset Integration.

The top three holdings of this blockchain fund are:

- Coinbase Global, Inc. Class A – 10.49%

- Riot Blockchain Inc – 9.71%

- Marathon Digital Holdings Inc – 8.71%

The BKCH ETF has $68.2 million in assets under management, with an expense ratio of 0.50%. Global exposure to the blockchain industry coupled with a pretty even weighting provides diversification and a hedge against the inherent volatility of cryptos. This fund is yet another diversified play on digital mining, with much upside potential as cryptocurrency and blockchain technology adoption by institutional investors and more retail investors.

Final thoughts

Despite the massive crypto sell-offs being experienced, analysts are still bullish on the cryptocurrency markets. The digital mining ecosystem will have to work on overdrive to meet this demand, setting the stage for the mining ETFs above to thrive and unearth significant returns.

Comments