FXZipper is an automated trading system that uses the scalping strategy. Powered by the Forex Store group, this FX EA claims to be a broker-friendly and reliable system. As per the claims of the vendor, this ATS earns small pips from several trades. No mention is made of the developer or the team responsible for the design of this EA. We could not find location information or a phone contact on the official site. The absence of vendor info including company profile, founding years, and other FX products raises our doubts regarding the reliability of this FX robot.

FXZIPPER Robot Review

In general, most of the FX robots in the market are promoted by providing an elaborate description of the features, strategy, settings, recommendations, and more. This MT4 tool is an exception as it reveals very little info about its features and other aspects.

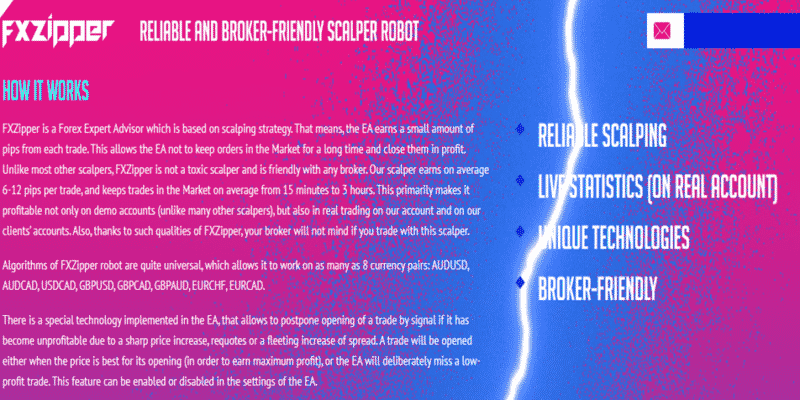

From the minimal details furnished on the site, we find that this EA uses a scalping approach with unique algorithms that enable it to postpone the execution of a trade, in case of an unprofitable market situation. This FX EA uses a timeframe ranging from 15 minutes up to 3 hours.

Trading Strategies and Currency Pairs

As a scalping system, the EA claims to use universal algorithms that enable it to support eight different currency pairs namely EURCAD, USDCAD, GBPCAD, AUDUSD, GBPUSD, EURCHF, AUDCAD, and GBPAUD. According to the vendor info, this EA can earn about 6 pips to 12 pips per trade and is profitable in both real trading and demo account trading. We could not find any recommendations on the minimum or recommended deposit for traders and other info related to safe and effective trading.

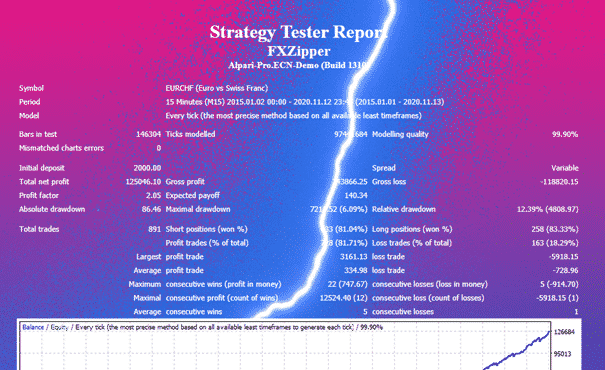

We can find backtests on the official site. Here is a screenshot of one of the strategy tests done on the EURCHF pair for a 15-minute timeframe from 2015 up to 2020.

From the above report, we can see that the modeling quality is 99.9% which is adequate to know about the spread, slippage, and other important details. For an initial deposit of $2000, the EA has gained a total net profit of 125046.10. For a total of 891 trades, 81.71% of the trades were profitable with the profit factor value of 2.05. The maximum drawdown for this account was 6.09%.

FXZIPPER Trading Statistics

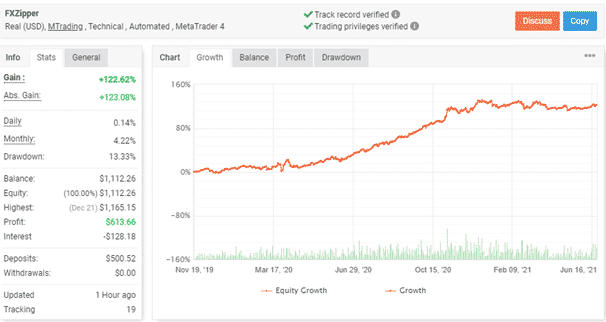

On the official site, the vendor presents a real trading account verified by the myfxbook site. Here is a screenshot of the trading details of the real USD account using the MTrading broker on the MT4 platform.

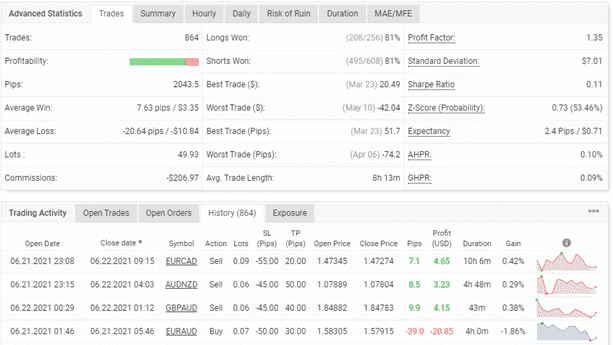

From the trading stats seen above, we can find the account has a total gain of 122.62% and an absolute profit of 123.08%. The daily and monthly profits are 0.14% and 4.22%. A drawdown of 13.33% is present for this account with a deposit of $500 and a balance of $1112.26. For the trading started in November 2019, the total number of trades completed is 864, and the profit factor is 1.35.

From the trading history, we can find that the lot sizes vary and range from 0.02 up to 0.10. While the drawdown value is low, the varying lot size is a source of concern as it indicates the approach used is a high-risk strategy. Further, the number of trades executed is also small for the duration of the trading. Comparing the results with the backtesting results, we can find that the drawdown and profit factor values differ and are much less for the real account.

Pricing and Refund

The vendor charges $345 for this EA and it comes with a money-back guarantee of 30 days. Some of the features that come with the purchase of the FX EA include a single lifetime license, compatibility with MT4 and MT5 platforms, a user guide, and 24/7 customer support. Compared to the competitor EA prices, the cost of this ATS looks expensive and not worth the money due to the unreliable system and the high-risk approach it uses.

What Else You Should Know about FXZIPPER

Reputed sites like Forexpeacearmy, Trustpilot, etc., do not have reviews from users of this ATS. While the vendor claims this is a profitable system, the absence of user feedback makes us suspect this is not a popular or effective EA.

Summary

Price – 4/10

Strategy – 5/10

Trading Results – 5/10

Vendor Transparency – 4/10

Customer Reviews – 4/10

Support – 4/10

Comments