The word financial sector elicits thoughts of banks. The truth is that the financial sector might have significant weighting in banks and includes insurance companies, credit card companies, REITs, and money markets. What does this mean?

For an economy to thrive, the financial sector is an essential component. With this in mind, the $22.5 trillion revenue from the financial sector for 2021 makes sense in the backdrop of post-pandemic economic recovery activities.

Post-pandemic resurgence is expected to drive the growth of this industry at an annual CAGR of 9.9% to 2030, setting the stage for revenue-generating opportunities. To take a piece of this pie, however, with more than average potential for success, means a ton of data gathering and analysis. However, through the following three financial ETFs, you not only gain instant diversification across the financial sector but also invest in a hassle-free way.

What is the composition of financial ETFs?

As earlier stated, the financial sector transcends banking services. Financial ETFs comprise all equities operating within the financial segment; banks, real estate investment trusts, mortgage lenders, investment houses, consumer finance firms, insurance companies, money markets, and real estate brokers.

Top 3 financial ETFs for exposure to the financial segment

Digital currencies and blockchain technology might be the next financial frontier, but the inherent volatility in their investment calls for investment in conventional financial services if risk-averse. These financial institutions provide a way to invest via established organizations with the potential for growth, value, and consistent incomes in the current inflation and interest rising environment. These three financial ETFs give you exposure to one of the most critical factors for post-pandemic economic growth.

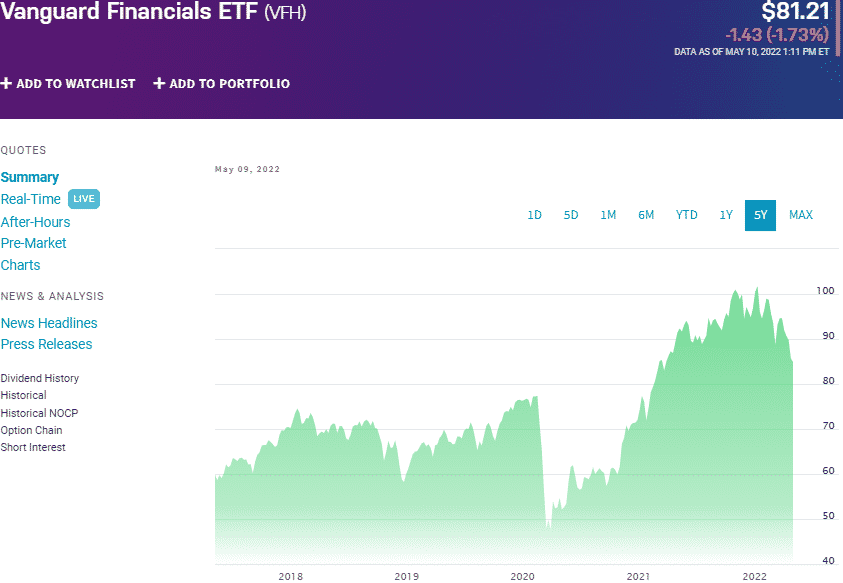

№ 1. Vanguard Financials ETF (VFH)

Price: $81.21

Expense ratio: 0.10%

Dividend yield: 1.87%

VFH chart

The Vanguard Financials ETF tracks the performance of the MSCI US Investable Market Index (IMI)/Financials 25/50, investing all of its assets in the equities making up the composite index. It exposes investors to the most liquid banks, regional banks, and insurance companies.

In a list of 31 financial exchange-traded funds, the VFH ETF is ranked № 3 for long-term investing among passively managed funds.

The top three holdings of this ETF are:

- Berkshire Hathaway Inc. Class B – 8.94%

- JPMorgan Chase & Co. – 7.83%

- Bank of America Corp. – 5.90%

The VFH ETF is has $9.90 billion in assets under management, with an expense ratio of 0.10%. Despite having similar holdings as the XLF fund, it incorporates mid-cap and small-cap equities to make an impressive 390-plus holding portfolio. Coupled with a fair share of regional ETFs, ensure some mitigation against the wall street market downturn, providing a pretty resilient fund; 5-year returns of 51.82%, 3- year returns of 28.98%, 1-year returns of -9.60%, and a pretty decent dividend yield of 1.78%.

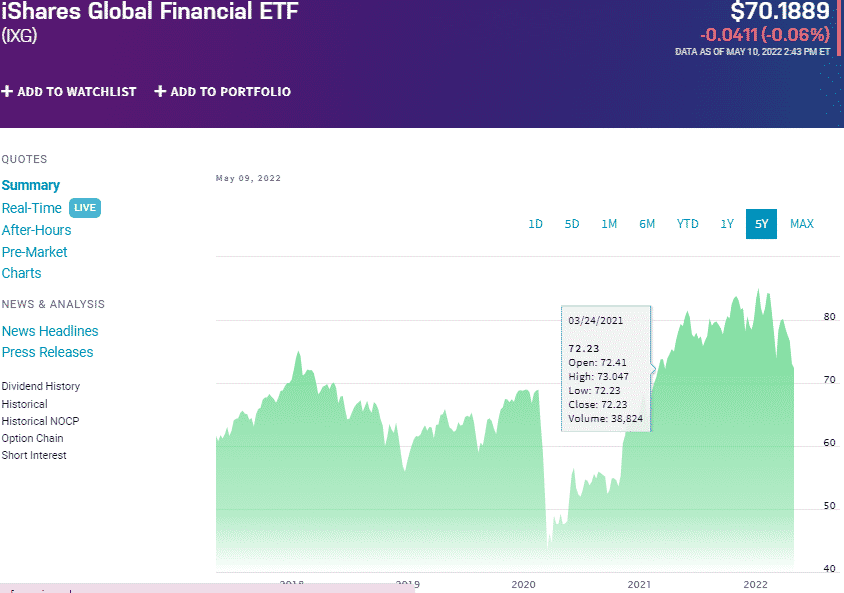

№ 2. iShares Global Financials ETF (IXG)

Price: $70.18

Expense ratio: 0.43%

Dividend yield: 1.07%

IXG chart

The iShares Global Financials ETF tracks the investment results of the S&P Global 1200 Financials IndexTM. To achieve its investment objective, it invests at least 80% of its total assets in the tracked index holdings and other investment assets of similar economic characteristics. The remaining 20% is invested in financial instruments that can help track the composite index; options, futures contracts, cash, and cash equivalents. It exposes investors to the most significant financial players in the US, emerging markets, and developed economies.

In a list of 31 financial exchange-traded funds, the IXG ETF is ranked № 15 for long-term investing among passively managed funds.

The top three holdings of this global financial ETF are:

- Berkshire Hathaway Inc. Class B – 7.81%

- JPMorgan Chase & Co. – 4.90%

- Bank of America Corp – 3.58%

The IXG ETF has $1.02 billion in assets under management, with an expense ratio of 0.43%. Global exposure ensures that investors reap from the global Covid-19 resurgence while also achieving geographical diversification, upwards of 100 holdings and a pretty even weighting compared to the others on this list results in a fund capable of providing consistent returns; 5-year returns of 28.13%, 3-year returns of 17.12%, 1-year returns of -10.44%, and a dividend yield of 1.07%.

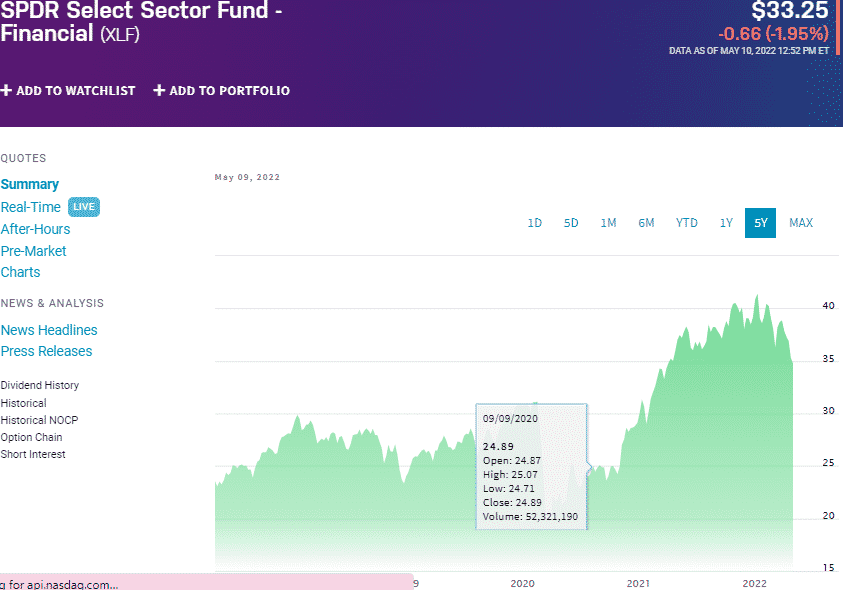

№ 3. Financial Select Sector SPDR Fund (XLF)

Price: $33.25

Expense ratio: 0.10%

Dividend yield: 1.55%

XLF chart

You cannot invest in the financial sector and overlook the most liquid and popular fund preying its trade in this segment, the Financial Select Sector SPDR Fund. It tracks the Financial Select Sector Index, investing at least 95% of its net assets in the tracked index securities. It exposes investors to companies operating within diverse niches in the financial sector; REITs, banks, financial services, insurance, and capital markets.

In a list of 31 financial exchange-traded funds, the XLF ETF is ranked № 1 for long-term investing among passively managed funds.

The top three holdings of this ETF are:

- Berkshire Hathaway Inc. Class B – 15.03%

- JPMorgan Chase & Co. – 9.43%

- Bank of America Corp – 6.87%

The XLF ETF is the largest fund in the financial sector, boasting $36.59 billion in assets under management, with an expense ratio of 0.10%. Concentrating on the who is who of the US financial sector, this ETF has the financial muscle and diversification across the segment to withstand market downturn; 5-year returns of 60.80%, 3-year returns of 31.71%, and 1-year returns of -5.98%, and a decent dividend yield of 1.51%.

Final thoughts

Interest rising environment sets the stage for financial institutions to make significant profits as both individuals and organizations look for cash to invest and expand their activities to pre-pandemic levels and beyond, respectively. The three ETFs above provide a diversified way to play this critical segment to economic growth while also providing some consistent and decent income to deal with the rising inflation rates.

Comments