ETF brokers allow you to invest in an asset or group of assets without acquiring ownership. The main advantage is to gain access to markets that would otherwise be difficult for a retail trader to reach.

Imagine foreign government bonds, real estate, or legal marijuana. ETFs are also useful for diversification as they allow you to invest in multiple assets with a single trade.

To access this multi-billion dollar space, you need to find a reliable ETF broker. Since there are hundreds of platforms in the marketplace, you also need to consider metrics such as regulation, fees, commissions, and payment methods.

In this article, we explore the best ETF brokers in the online space. We also explain how ETFs work and how you can make an investment today.

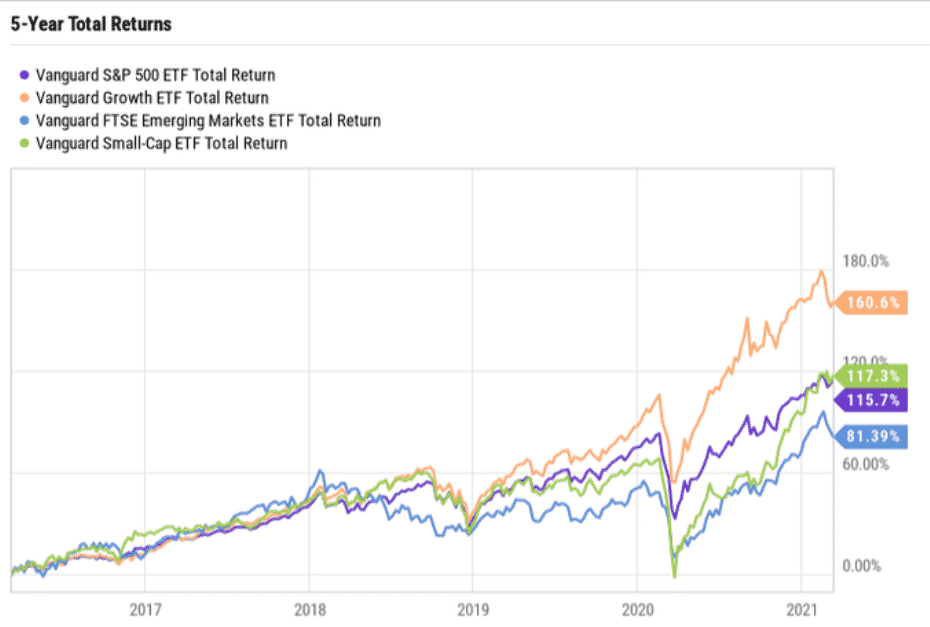

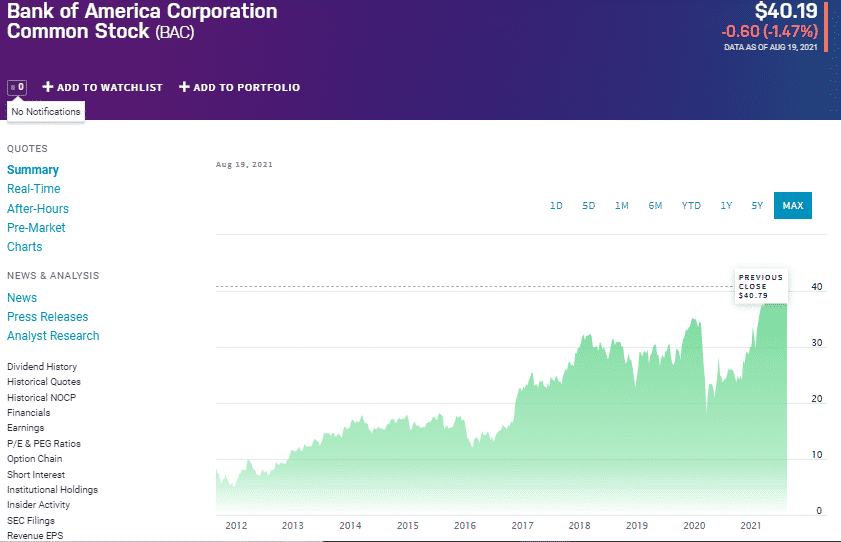

How much could you earn on ETFs for five years?

This chart goes to illustrate how profitable investing in ETFs can be. It shows how the Vanguard S&P 500 ETF moved over the last five years. While the ETF at hand is one of the most successful ones in terms of returns and longevity, there are other equally valuable and promising options for all of you with different interests and strategies.

But think about it. If you had invested in the fund five years ago, today, you would have more than two-and-a-half times the amount you dedicated at that time.

After knowing an ETF can give such a high return, you might be interested in investing in some of them. And if yes, then for this, you will need an ETF broker that will help you carry out your investment process.

Five-year total returns on the Vanguard S&P 500 ETF chart

What exactly does a broker do?

If the process is so simple, then why do you need a broker? Well, technically speaking, you can’t buy stocks or ETFs directly from an exchange. Only members can do that, and those members are brokers.

A broker serves as an intermediary, or a middle man, between you and the exchange. The person, or an institution, buys and sells stocks at an exchange on your behalf. Of course, they do that for a fee, commission, and they also get paid directly from the exchange.

The historical role of the broker was also to give advice and help you form a strategy, and many brokerages still do that. However, the rise of the internet and new technologies brought the discount brokers, which charge significantly less, but offer only the bare minimum buy-and-sell services.

Top three brokers, you should consider

To illustrate a point and show what good brokers should have or offer.

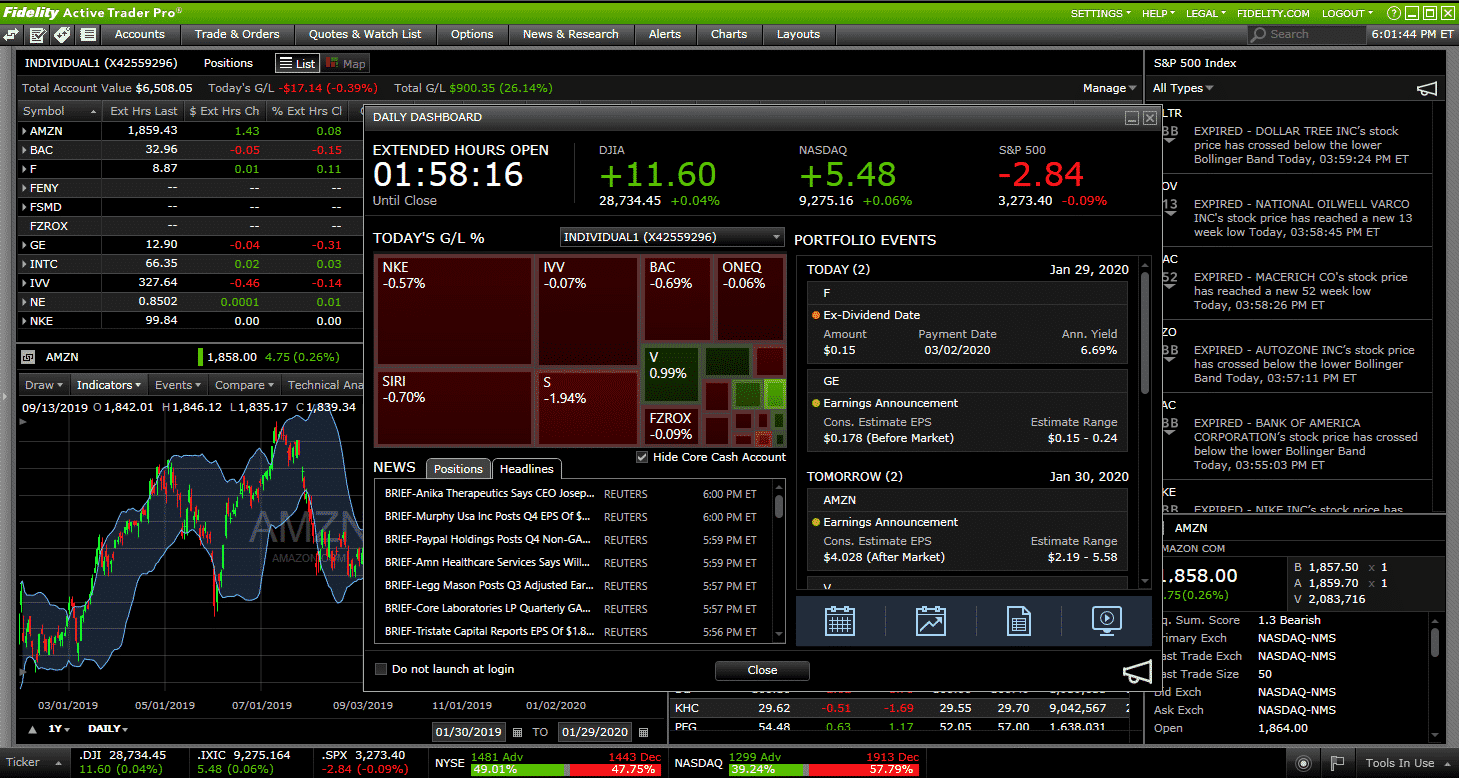

1. Fidelity Investments

If more active trading is your thing, the firm has created the Active Trader Pro downloadable trading program.

The two separate platforms helped the company meet the needs of both active traders and people relatively new to investing. The interface on both is quite enjoyable and user-friendly.

If you are new to investing, the last thing you want is the program you use to be overwhelming and rich in data you don’t know what to do with. Fidelity managed to side-step that landmine quite nicely.

Regarding the costs, all transactions are commission-free, and the array of ETFs the broker offers is high enough to satisfy the appetites of most beginner investors.

As a bonus, the software was also programmed to automatically withdraw your uninvested funds and sweep them into the money market fund until you need it again for investing. Most other platforms don’t offer this automated service, and you pretty much have to do it yourself every time.

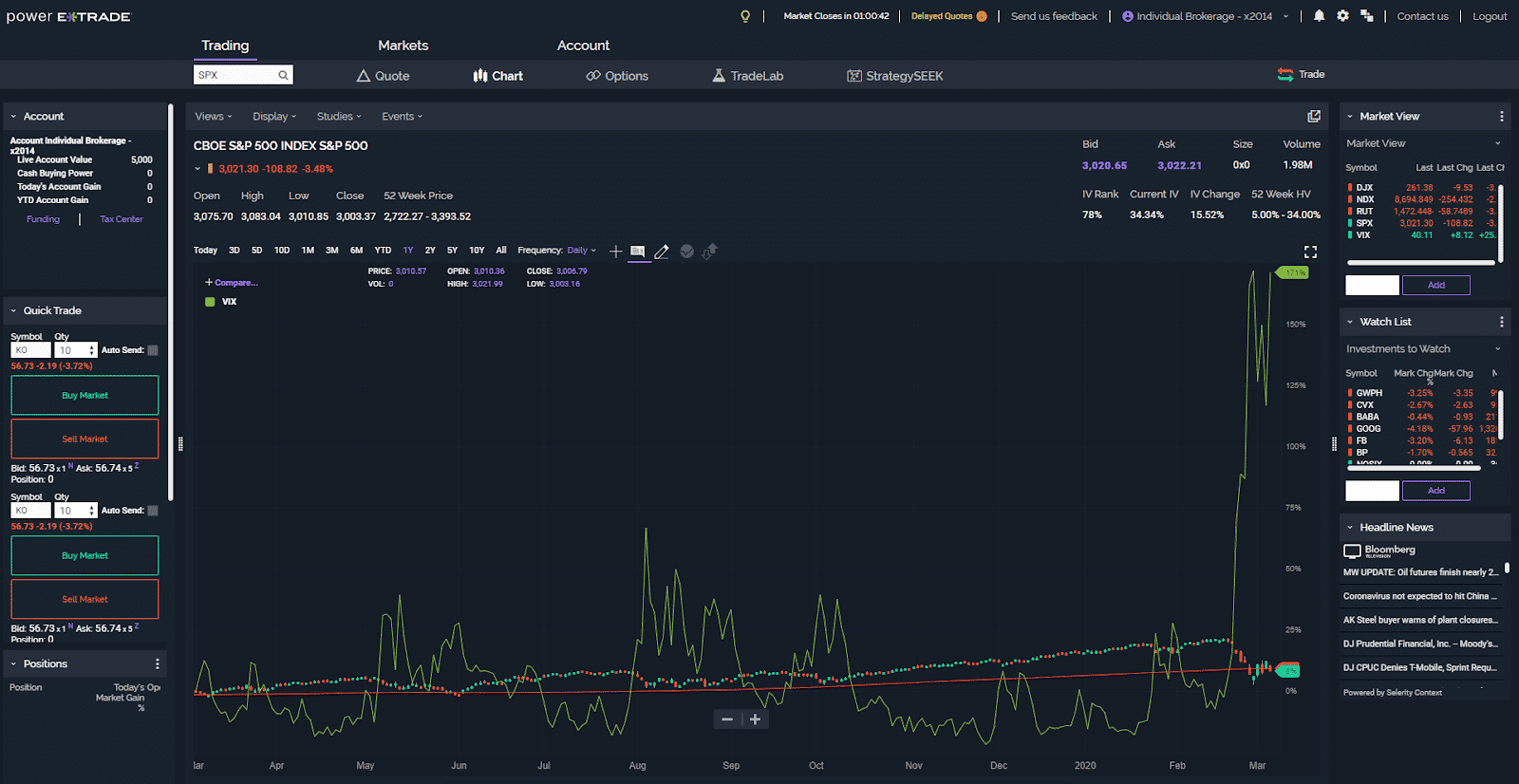

2. E*TRADE

When it comes to technology, E*TRADE has no match. Both mobile and desktop versions of its software run like clockwork and come with a robust analysis of every fund.

Another feature worth mentioning is E*TRADE’s paper trading service. Paper trading is a simulator that allows you to practice trading without the financial risk of real-life activity. E*TRADE has developed a state-of-the-art masterpiece that will make placing your practice bets an absolute joy.

If you are eager to invest but are unsure how to go about it, the company also offers pre-made portfolios of different types depending on your investment style and goals.

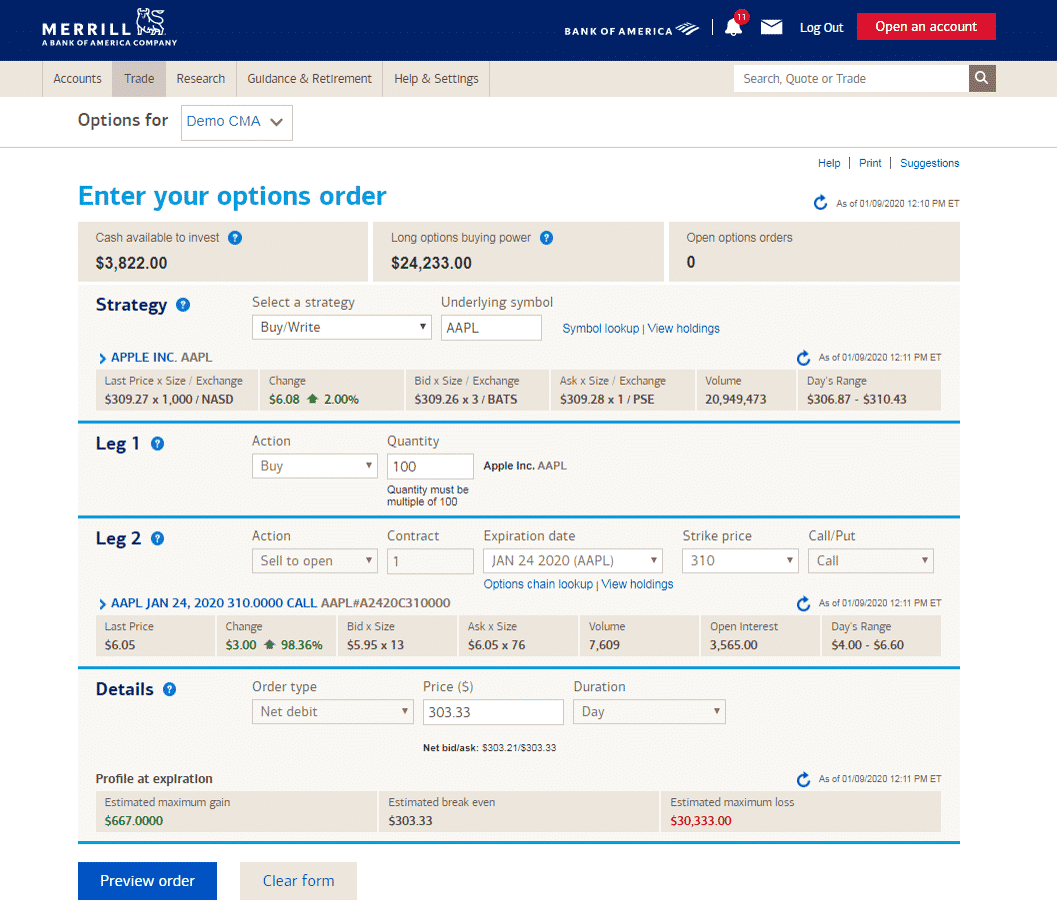

3. Merrill Edge

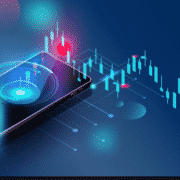

Merrill Edge is an electronic trading platform that the Bank of America’s subsidiary, BofA Securities, launched in 2010. Merrill Edge is far from being bad for experienced investors, but it is an absolute blast for beginners.

First off, you will have a comprehensive overview of your assets thanks to the company’s portfolio analysis tool. Secondly, the process of creating an account and getting started is more than simple, whether you are already using BofA’s services or not.

Thirdly, the interface will be working to your advantage if you are new to investing due to the personalization principle. Instead of making you choose and customize the platform right off the bat, the software makes the features you frequently use easier to find. That can take away a lot of the overwhelming pressure when you are first faced with the sheer abundance of figures on the screen.

Bank of America Corporation chart

To get a picture of what the name of Bank of America means in the world of investment, take a look at the chart representing how the company performed in the last nine years.

Final thoughts

When deciding what broker you will choose, you need to consider almost countless other factors before deciding to commit. Trading commissions, the number of commission-free ETFs, the minimum amount requested to open an account should all be considered when determining whether a broker is right for you.

There is no perfect solution, but there is an optimal solution for you at a given moment. So be sure to check your options, do your research, and the entire process of investing will become a whole lot more enjoyable.

Comments