Entertainment is not what it used to be sometime back. Faced with technological advancements and more knowledgeable clientele, it has moved from the conventional print media and movie theaters to our homes. Despite this shift, it remains a trillion-dollar company with an expected CAGR of 20% between 2022 and 2025.

Leading this expansion is streaming entertainment and virtual reality-based entertainment. Why invest in the entertainment industry? Long labeled as a high-risk investment venture, the global populace has learned work-life balance and the need for rest, which drives entertainment. As a result, it is a niche with significant upside potential creating high returns investment opportunities.

These three entertainment ETFs give diversified exposure to the arising opportunities in this highly dynamic industry.

What is the composition of entertainment ETFs?

The entertainment industry is quite diverse. In addition to print media and motion picture equities, entertainment ETFs also comprise equities involved in amusement parks, children’s entertainment centers, professional sports franchises, betting and fantasy sports, television programs, casino and gambling, video games, cruise lines, streaming content, commercials, and all related ancillary services.

Top 3 entertainment ETFs to profit fast

With the evolution of the internet of things and hand-held gadgets, entertainment is no longer an activity for the well-off but a part of our daily routine, easily accessible and relatively cheap. Despite this evolution and dynamism, the entertainment industry is dominated by a handful of global conglomerates, with a splash of budding equities now joining the fray to take advantage of the technological advancements driving change in this industry.

Investing in these three entertainment ETFs exposes investors to opportunities presented by the ongoing entertainment shift and significant upside potential as this industry recovers from its covid19-induced contraction.

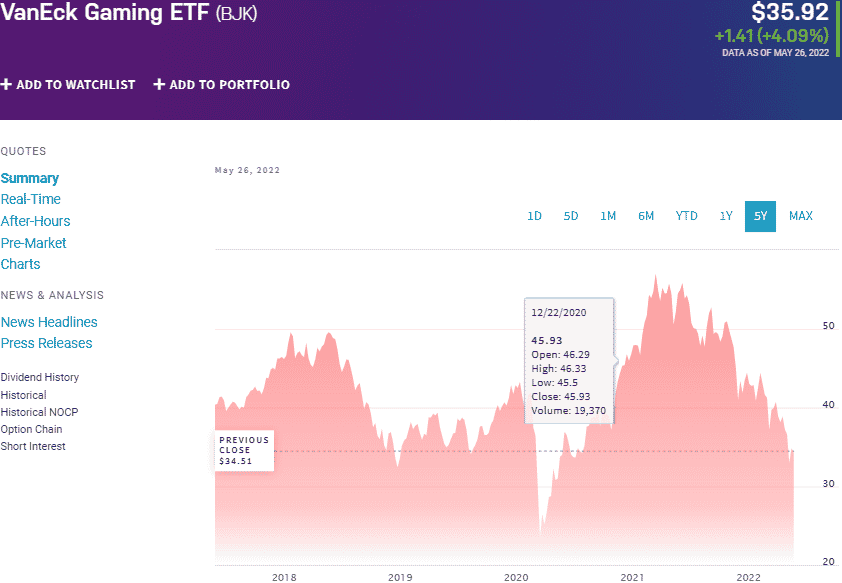

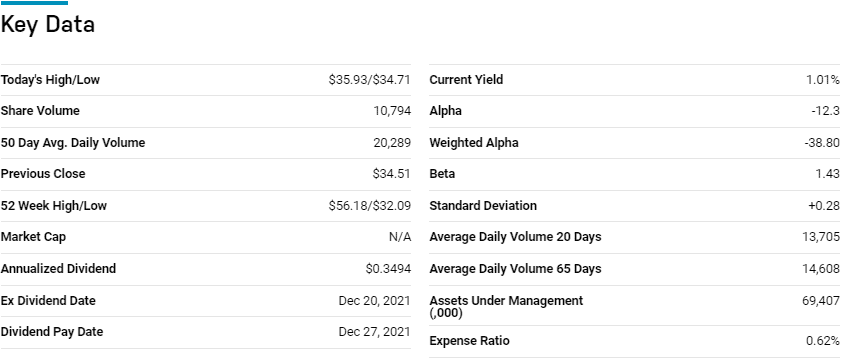

№ 1. VanEck Vectors Gaming ETF (BJK)

Price: $35.92

Expense ratio: 0.62%

Dividend yield: 0.46%

BJK chart

Video games are no longer a pastime activity for kids. This industry has evolved to become a source of entertainment that transcends all age groups and is one of the fastest-growing entertainment niches globally. For diversified exposure to this entertainment niche, investors have access to the VanEck Gaming ETF, which tracks the investment results of the MVIS® Global Gaming Index, net of expenses and fees. It invests at least 80% of its total assets in the holdings to ensure minimal returns, making up its composite index.

The top three holdings of this gaming entertainment ETF are:

- VICI Properties Inc – 8.38%

- Aristocrat Leisure Limited – 8.03%

- Flutter Entertainment Plc – 7.93%

The BJK ETF has only $69.6 million in assets under management, with investors having to cough up $62 annually for a $10000 investment. This fund is a diversified play on the gaming entertainment niche since it incorporates equities in the entire gaming value chain; casinos, gaming technology and equipment, casino resorts and hotels, lottery services, sports betting, and gaming services.

The result is a fund that exposes investors to securities not included in other conventional portfolios. As the entertainment industry recovers from the coronavirus dip, the BJK is an excellent bargain to catch the expected bullish rally early; 5-year returns of -3.54, 3-year returns of 2.04%, 1-year returns of -35.56%, and a dividend yield of 0.46%.

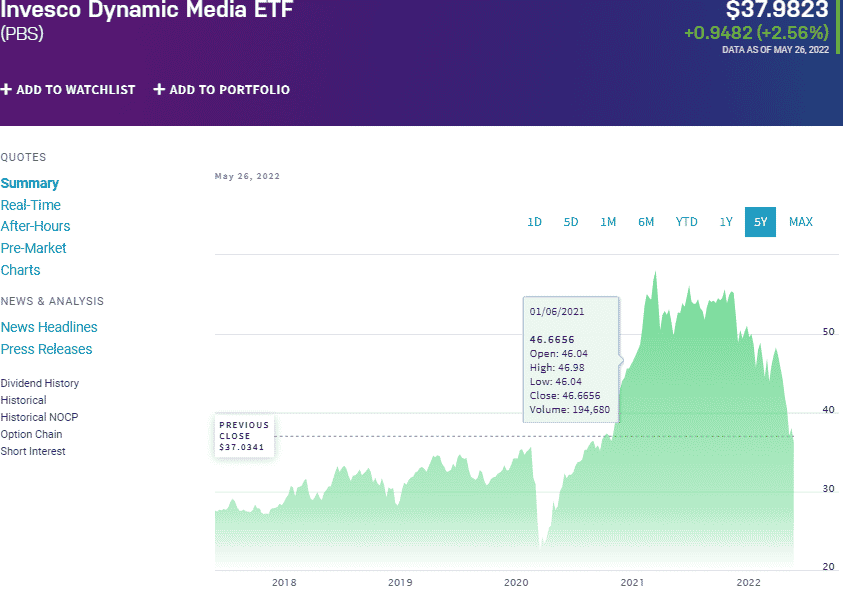

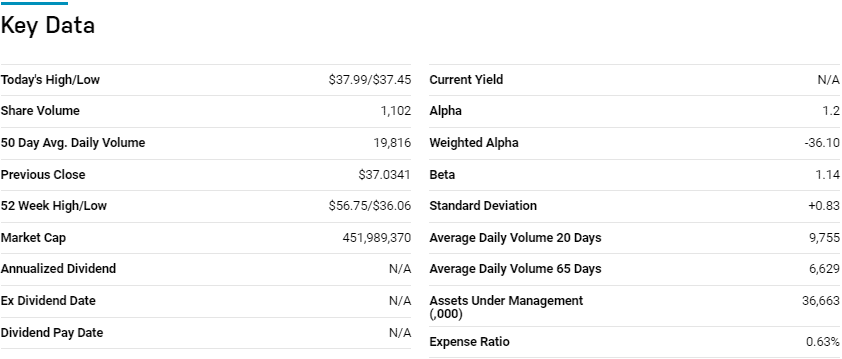

№ 2. Invesco Dynamic Media ETF (PBS)

Price: $37.98

Expense ratio: 0.63%

Annual dividend yield: 0.52%

PEJ chart

The Invesco Dynamic Media ETF tracks, as closely as possible, the performance of the Dynamic Media Intellidex Index, net of expenses and fees. It invests at least 90% of its total assets in the holdings of the tracked index. This non-diversified fund exposes investors to the US publicly traded companies primarily involved in developing, producing, manufacturing, distributing, and selling goods and services used in the media industry.

The top three holdings of this media entertainment ETF as of now are:

- Twitter, Inc. – 7.27%

- Meta Platforms Inc. Class A – 5.86%

- Alphabet Inc. Class A – 5.26%

The PBS ETF boasts $36.7 million in assets under management, with investors having to part with $63 annually for every $10000 investment. Concentration on both conventional media and tech-driven media results in a fund in tune with the changing consumer entertainment needs, providing resilience to this non-diversified fund; 5-year returns of 41.10%, 3-year returns of 14.53%, 1-year returns of -28.89%, and an annual dividend yield of 0.52%.

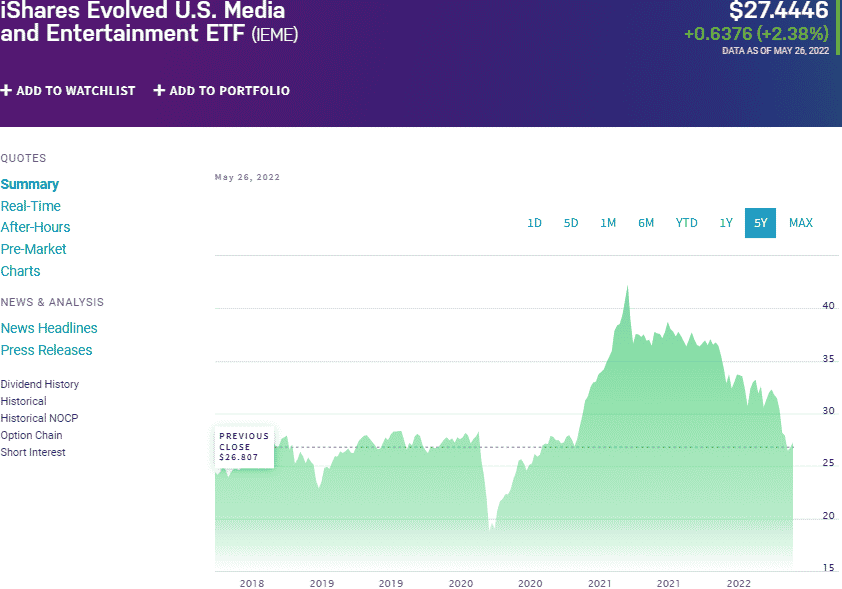

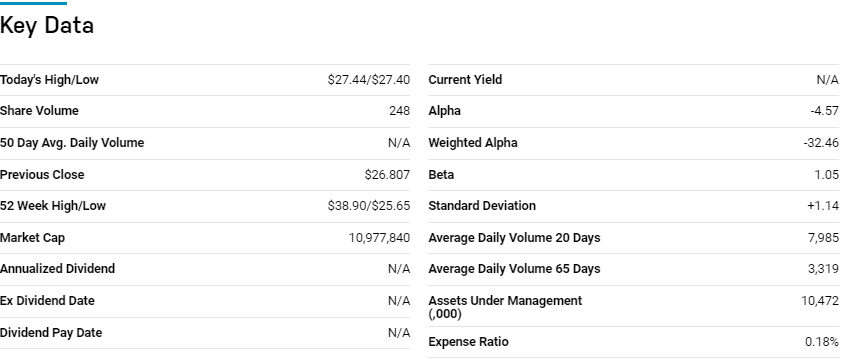

№ 3. iShares Evolved US Media and Entertainment Fund (IEME)

Price: $27.44

Expense ratio: 0.18%

Dividend yield: 0.60%

IEME chart

The iShares Evolved US Media and Entertainment Fund is an actively managed fund that seeks capital appreciation by investing 80% of its total assets in US-listed companies across the cap divide operating in the media and entertainment niches. As a result, it exposes investors to companies in the evolved media and entertainment segment and all investment assets exhibiting economic characteristics to this industry.

The top three holdings of this entertainment ETF are:

- Comcast Corporation Class A – 5.28%

- Paramount Global Class B – 5.28%

- Fox Corporation Class A – 4.94%

The IEME ETF has $10.5 million in assets under management, with an expense ratio of 0.18%. Despite being actively managed, this fund utilizes proprietary machine learning models to screen for the most liquid stocks with the best beta potential and assign weights.

The result is a neutral holding base representing the media and entertainment segment, mitigating against concentration risk; 3-year returns of 6.29%, 1-year returns of -27.35%, and an annual dividend yield of 0.60%.

Final thoughts

The entertainment industry is one of the economic segments highly susceptible to technology and consumer content consumption evolution. This is spearheaded by the changing global demographics, with more of the entertainment being tech-savvy, shaping their consumption behaviors.

As a virtual reality, augmented reality, streaming content, social, mobile, and digital media continue to evolve rapidly, the ETFs above give investors diversified exposure to significant upside potential and profitability.

Comments