The coronavirus pandemic resulted in the cessation of movement and lockdowns and changed people’s interaction dynamics. Among the worst-hit industries due to the pandemic was the leisure and travel industry losing 49.5% of its revenues.

Close confinement and social distancing meant that the covid protocols would have them either grounded or operating at below 50% capacity for the cruise expeditions. Despite the coronavirus mutating to various variants, the widespread vaccination has curbed the spread of the virus and the opening of borders resulting in the cruise business doubling its revenues in 2021 and compared to 2020.

2021, $6.65 billion, revenues are way below the $27.5 billion recorded in 2019. With an expected surge in leisure & travel of upwards of 22.5%, cruise liners already reporting increased sales for upcoming cruises, the ETFs below give investors into the world’s most popular leisure travel market.

What is the composition of cruise ETFs?

There are not many cruises exclusive exchange-traded funds given that the industry is joined to the hip with the broader travel and tourism industry. Therefore, cruise ETFs comprise organizations in the broader travel and tourism industry but with significant exposure to firms providing ocean and sea-based vacation experiences, along with their ancillary service providers.

The top 3 cruise ETFs for excellent earning opportunities in 2022

The cruise line industry recorded 2021 returns of 24.4%, which is below the broader market returns looking at SPY’s 26.9% returns over the same period. Most countries are still issuing travel advisories, especially for cruises making this industry volatile on the tailwind of the fast-spreading Omicron variant of Covid-19.

Despite this, the worst of the virus is behind us, and once it is declared safe to travel, the long periods cooped in are expected to drive the demand for leisure cruises, and the ETFs below stand to make a tidy sum.

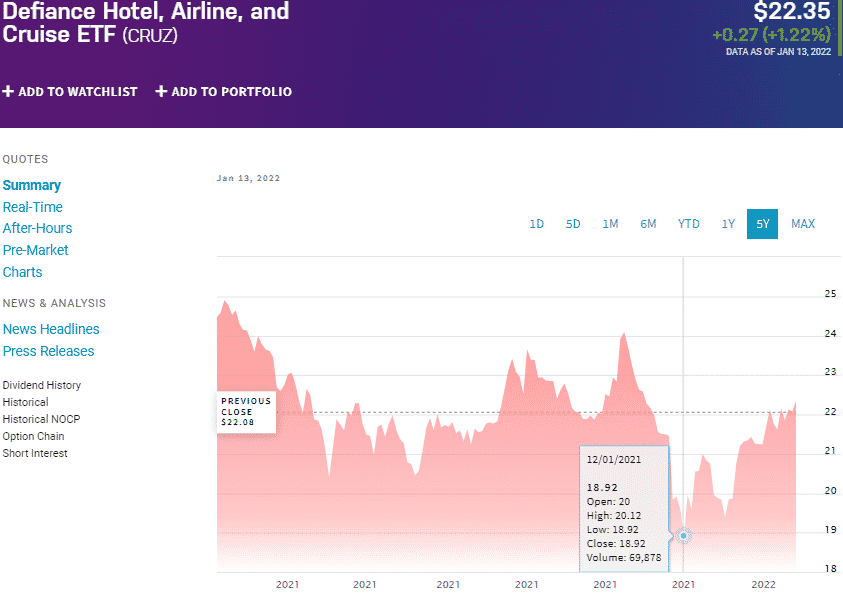

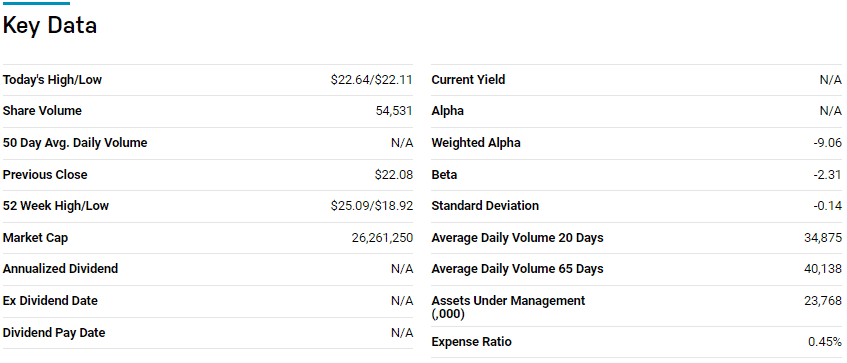

№ 1. Defiance Hotel Airline and Cruise ETF (CRUZ)

Price: $22.35

Expense ratio: 0.45%

Dividend yield: N/A

CRUZ chart

Defiance Hotel Airline and Cruise ETF tracks the BlueStar Global Hotels, Airlines, and Cruises Index, investing at least 80% of its total assets in the travel industry. The composite index is rule-based, with all its holdings deriving at least 50% of their revenues from either hotel and resort sector, passenger airline sector, or the cruise industry.

The top three holdings of this ETF are:

- Marriott International, Inc. Class A – 7.92%

- Hilton Worldwide Holdings Inc – 7.42%

- Carnival Corporation – 6.63%

CRUZ ETF has $23.8. million in assets under management, with investors spending $45 annually for a $10000 investment. A screening method that ensures the best stocks regarding liquidity, investability, and market cap across the exposure industries, with semi-annual reconstitution and quarterly rebalancing, has resulted in an agile fund. Despite launching in mid-2021 and playing sectors bashed the most by the pandemic, CRUZ has recorded positive returns so far, year-to-date returns of 3.97%.

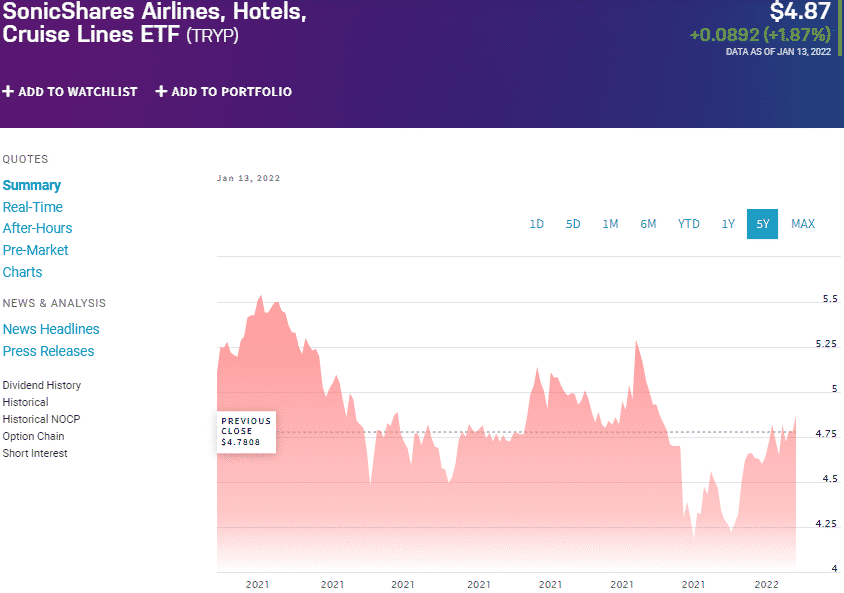

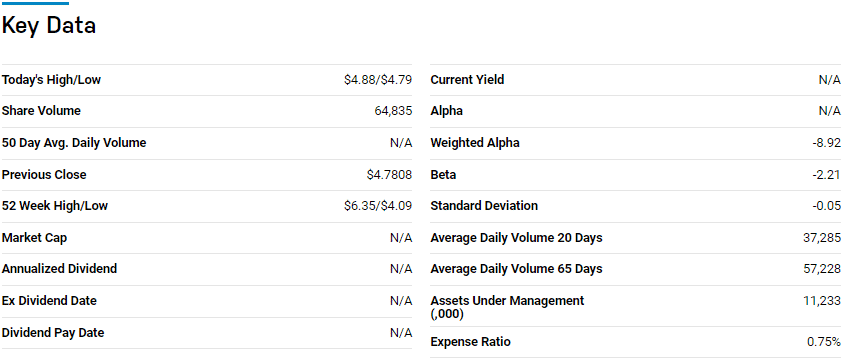

№ 2. SonicShares Airlines, Hotels, and Cruise Lines ETF (TRYP)

Price: $4.87

Expense ratio: 0.75%

Annual dividend yield: N/A

TRYP chart

SonicShares Airline, Hotel, and Cruise Line ETF tracks the Solactive Airlines, Hotels, Cruise Lines Index, investing at least 80% of its total assets in the Airline Industry, Hotel Industry, and Cruise industry. It exposes investors to equities and their related depositary receipts listed in the Eurozone, US, Japan, Singapore, UK, Switzerland, New Zealand, Canada, Brazil, Hong Kong, Israel, Mexico, and South Korea.

The top three holdings of this ETF are:

- Carnival Corporation – 4.99%

- Royal Caribbean Group – 4.85%

- Norwegian Cruise Line Holdings Ltd. – 4.69%

TRYP boasts $11.2 million in assets under management, with an expense ratio of 0.75%. A maximum capping of 4.5% on the largest market caps within its three operational industries and a 4% weight cap on the other holdings provides a well-balanced fund free of concentration risk. Like the CRUZ ETF, TRYP was launched in May of 2021 and is already in the money, with year-to-date returns of 3.03%.

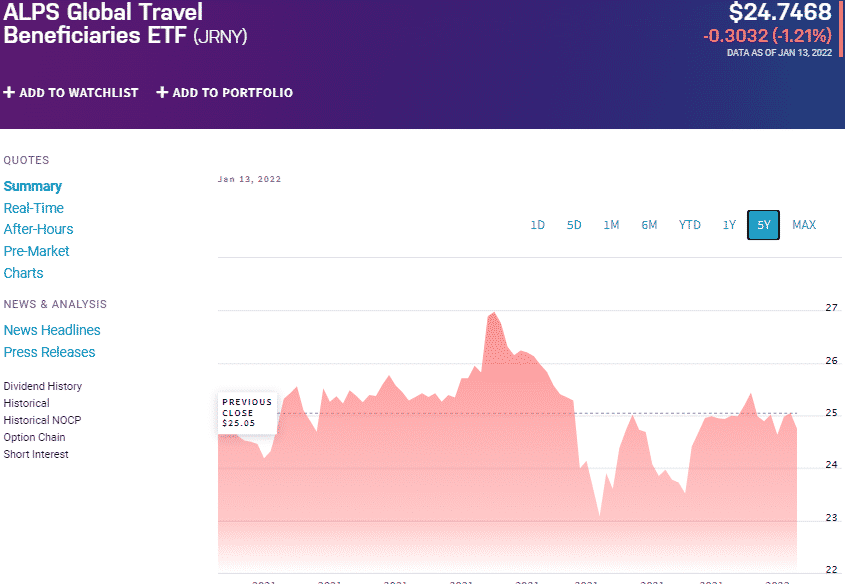

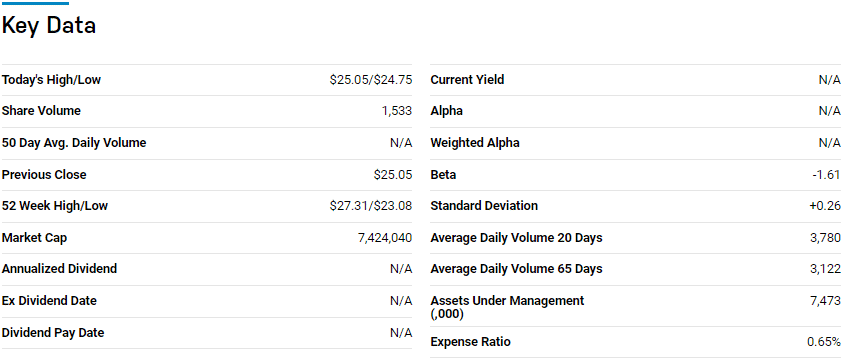

№ 3. ALPS Global Travel Beneficiaries ETF (JRNY)

Price: $24.7468

Expense ratio: 0.65%

Dividend yield: N/A

JRNY chart

ALPS Global Travel Beneficiary ETF tracks the performance of the S-Network Global Travel Index, investing at least 80% of its total assets in the securities of its composite index in the same weighting. Investors get exposure to the travel and leisure industry in the Eurozone, North Marica, Asia-Pacific region, and other emerging markets; booking and rental agencies, airlines and airports services, hotels, casinos and cruise services, and ancillary services firms in this industry.

The top three holdings of this ETF are:

- Booking Holdings Inc. – 4.87%

- American Express Company – 4.69%

- Marriott International, Inc. Class A – 4.68%

JRNY ETF has $7.5 million in assets under management, with an expense ratio of 0.65%. This ETF provides an alternative to cruise line investing by diversifying to include other organizations in the travel and leisure space.

Screening holdings based on their market cap quality and growth score has provided an ETF that has posted positive returns in its first four months of trading, launched in September 2021, and already has year-to-date returns of 0.26%.

Final thoughts

The ETF world is evolving quickly to provide instruments that cater to all industries and trader types, but there are no pure-play cruise ETFs for now. However, the funds above have significant exposure to the industry and are in pole position to benefit as it kicks off its recovery in 2022.

Comments