The hype around gold and silver has many not well versed in the precious metal world that they are the most valuable due to their rarity. The truth is that platinum is the rarest precious metal, 30X rarer than gold, due to the difficulty in its mining and that it is found deeper in the earth’s core than other precious metals.

With applications in the industrial sector, health care sector, manufacturing, and jewelry, having it in plenty in only Russia and South Africa make the platinum market characterized by demand exceeding supply.

This precious metal commodity market is expected to grow at a CAGR of 5% between 2021 and 2026.

Platinum ETF for new opportunities: how do they work?

Exchange-traded funds are investment vehicles that pool like investment assets into one tradable basket via tracking an index of similar economic characteristics. Therefore, platinum ETFs comprise organizations in the platinum value chain; exploration, mining, conversion, firms who use platinum as their main input, and firms providing ancillary services to this industry.

The best platinum ETFs to take advantage of opportunities in 2022

The world is recovering from the coronavirus clutches, and with this comes increased motor vehicle production and electrical inputs. Platinum has become the main component in these sectors and its aesthetic use in the jewelry industry.

In addition, with the volatile equity post-pandemic market, rising inflation, and currency fluctuations, platinum offers an alternative to gold and silver as a dollar hedge and an inflation-protected asset.

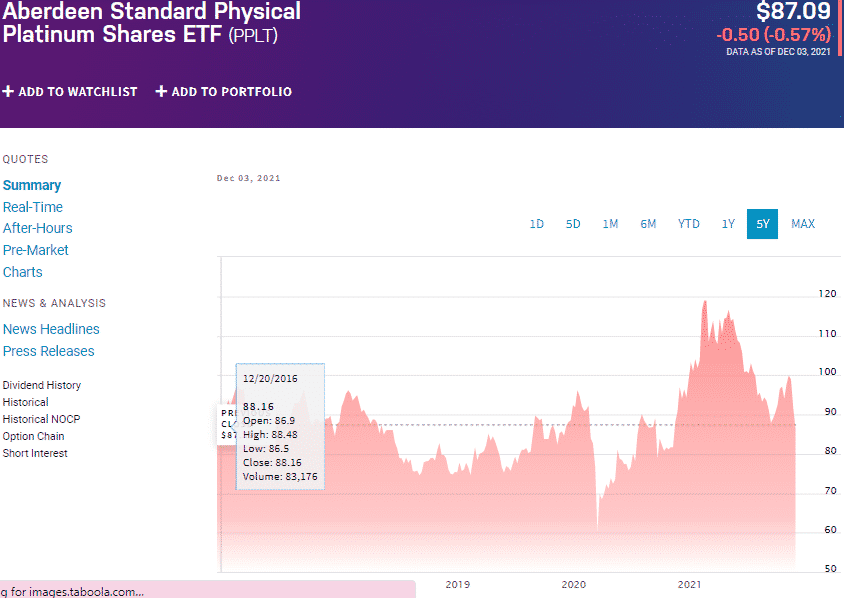

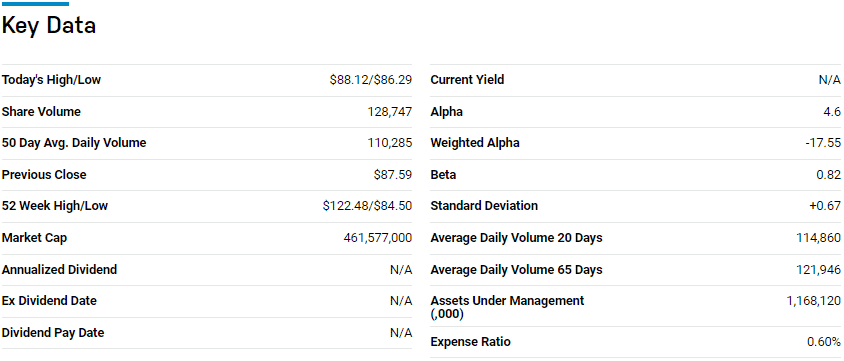

№ 1. Aberdeen Standard Physical Platinum Shares ETF (PPLT)

Price: $87.09

Expense ratio: 0.60%

Dividend yield: N/A

PPLT chart

The Aberdeen Standard Physical Platinum Shares ETF is a passively managed fund seeking to reflect the performance of silver as a commodity, net of liabilities, and fund’s operational cost. It holds physical bars of this expensive metal in vaults exposing investors to one of the rarest precious metals without the hassle of storage.

Top one holdings (100.00% of total assets):

- Physical Platinum Bullion — 100%

The PPLT currently has $1.13 billion in assets under management, with an expense ratio of 0.60%. Platinum performance is highly correlated to the automotive industry’s performance. Hence a look at its earnings in the pandemic year and year to date is negative.

However, a look at its three-year earnings shows that it has the potential for returns, +15.78%. As more and more countries call for low emission vehicles, platinum, with its rarity and the only ingredient for the necessary catalytic converters to reach zero emissions, will only become more valuable.

In the short-term, however, 2022, investors, in addition to cashing in on the resurgence of the automotive industry, can use this precious metal ETF as a hedge against rising inflation and a safe haven in uncertain economic times.

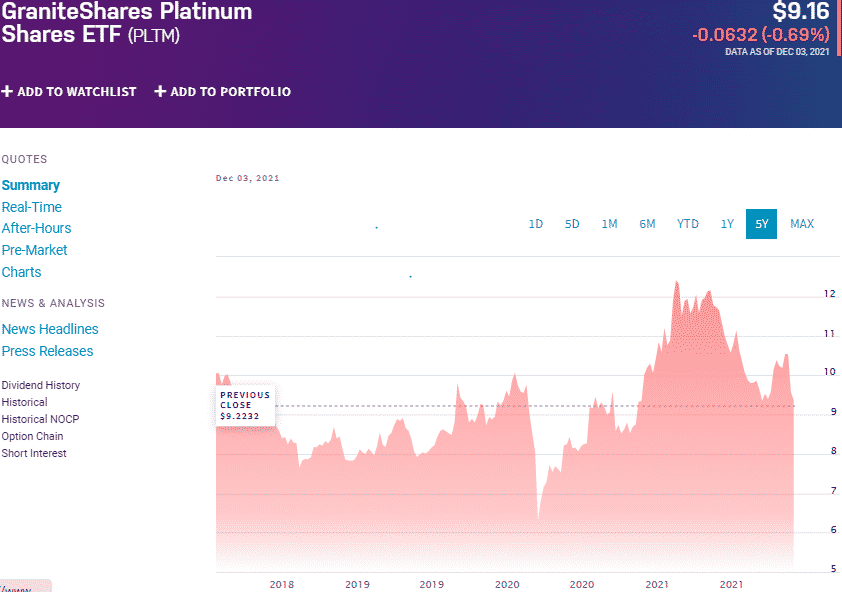

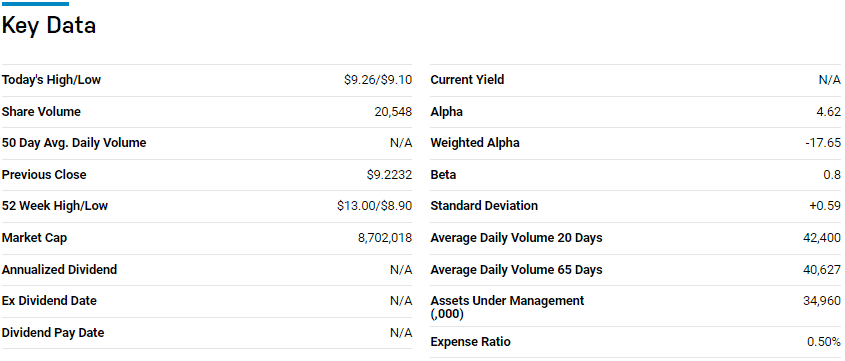

№ 2. GraniteShares Platinum Shares ETF (PLTM)

Price: $9.16

Expense ratio: 0.50%

Dividend yield: 0.66%

PLTM chart

An alternative to the Aberdeen Standard Physical Platinum Shares fund is the GraniteShares Platinum Trust ETF. It is a passively managed fund that seeks to reflect the spot price of physical platinum, net of expenses.

Top one holdings (100.00% of total assets):

- Physical Platinum Bullion — 100%

PLTM ETF, a reasonably new entrant into the platinum space, compared to the PPLT ETF, has meager assets under management, $35.19 million. However, investors part with $50 annually for every $10000 invested, which is cheaper than investing in the PPLT.

Its returns mirror those of the PPLT, which comes as no surprise since they both reflect the spot price of platinum; 3-year returns of 16%, pandemic year returns of -7.95%, and year-to-date returns of -12.89%. As economic resurgence leads to increased production capacity in the automotive industry, this ETF offers investors a cheaper option to back the platinum market growth.

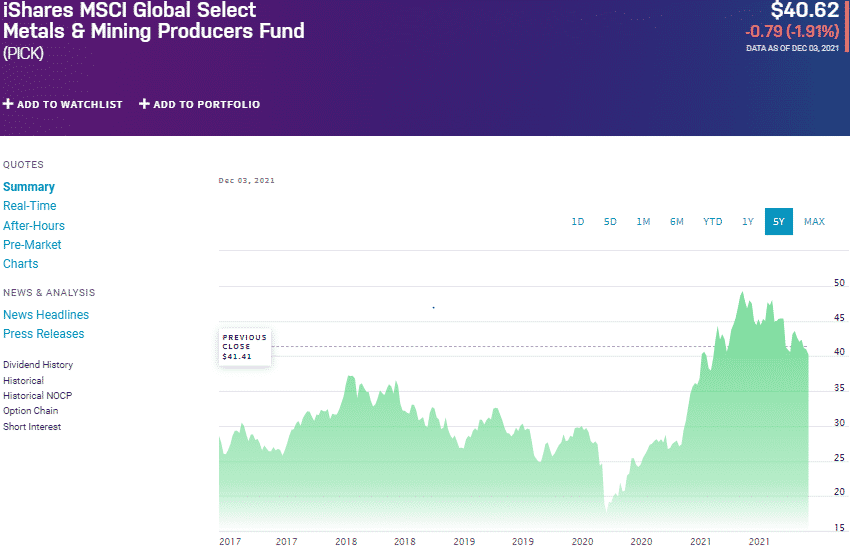

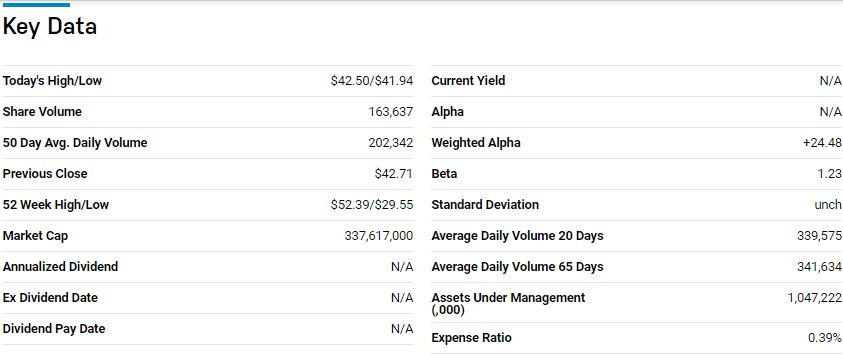

№ 3. iShares MSCI Global Select Metals & Mining Producers Fund (PICK)

Price: $40.62

Expense ratio: 0.39%

Dividend yield: 2.74%

PICK chart

iShares MSCI Global Metals & Mining Producers fund tracks the MSCI ACWI Select Metals & Mining Producers ex Gold and Silver Investable Market Index. It invests at least 80% of its total assets in the underlying holdings of the composite index. This ETF offers diversified and indirect exposure to the platinum market through the global mining and exploration industry, excluding gold and silver.

Among 13 equity precious metal ETFs, PICK is ranked № 2 by USNews.

The top three holdings of this non-diversified ETF are:

- BHP Group Ltd — 7.83%

- Rio Tinto plc. — 6.64%

- BHP Group PLC — 5.56%

PICK ETF has $1.05 billion in assets under management, with an expense ratio of 0.39%. Being an equity-focused ETF, PICK has the potential for long-term gains. In addition, it has proven to be a constant return generator, more so in inflation-rising environments; 5-year returns of 83.60%, 3- year returns of 65.56%, pandemic year returns of 24.33%, and year to date returns of 14.06%.

Investing in PICK come 2022 exposes investors to the platinum market, which is bound to grow as the automotive industry grows and diversifies its portfolio since it features the most diverse mining equity portfolio.

Final thoughts

The world is looking for ways to minimize carbon footprint, and platinum is among the few metals with the ability to make this possible. However, despite the platinum market expecting considerable growth driven by the global populace for zero greenhouse gases emission, it is a highly volatile commodity that needs careful consideration before investing.

Comments