A look at the marijuana space reveals that most pure-play cannabis firms are startups yet to reach the breakeven level. Why then should one invest in this industry?

Flip the coin and, rather than concentrate on individual marijuana stocks, assess the overall industry, and a trend starts to emerge. Since Canada’s milestone event of legalizing both medical and recreational cannabis use, the industry has not only grown but has surpassed analysts’ expectations.

At present, research shows that this industry will grow at an annual compounded rate upwards of 21%. The most significant driver for this growth is the increased pace of marijuana legalization for medicinal and recreational use across the globe. However, rather than bet on equities of firms not yet into profitability, why not invest holistically in the marijuana value chain through pot ETFs and see the returns roll in?

Best marijuana ETFs: how do they work?

Conventional exchange-traded funds are several investment assets with the same economic characteristics traded under one investment vehicle. The same is true for marijuana ETFs. They comprise firms involved in the cultivation of marijuana, it’s processing, and distribution, organizations providing ancillary services to the marijuana industry. As well as firms that provide real estate and agricultural equipment for use in the marijuana industry. It means having diversification to cushion against the volatility of small-cap pure-play marijuana equities by coupling them to more established firms in other sectors but with significant interests in the marijuana market niche.

What to consider before buying marijuana ETFs

The problem with emerging markets is that it has a lot of volatility due to uncertainty and a highly dynamic landscape. As such, investing in the marijuana space through ETFs calls for investors to be mindful of the indicators below.

- Active management

With an ever-changing landscape and full federal legalization still a dream, the best marijuana ETFs are actively managed, resulting in flexibility in exploring rising opportunities.

- Diversification

The majority of the marijuana equities are still trading in the OTC markets. Most are pushing to go public and comply with the requisite requirements for listing at major stock exchanges. Therefore, an ETF holding mix with pure-play and other firms in the marijuana value chain not only mitigates against volatility but facilitates portfolio diversification.

- Liquidity

Being an emerging market, investors should always factor in the liquidity of marijuana ETFs if there is a need for hurried liquidation.

Which are the best marijuana ETFs to buy in 2022

To get into this emerging market that is poised to grow to $145 billion by 2025, the three marijuana ETFs below are in pole position to provide some portfolio high in 2022.

№ 1. Horizons Marijuana Life Sciences Index ETF (HMLSF)

Price: $6.18

Expense ratio: 0.85%

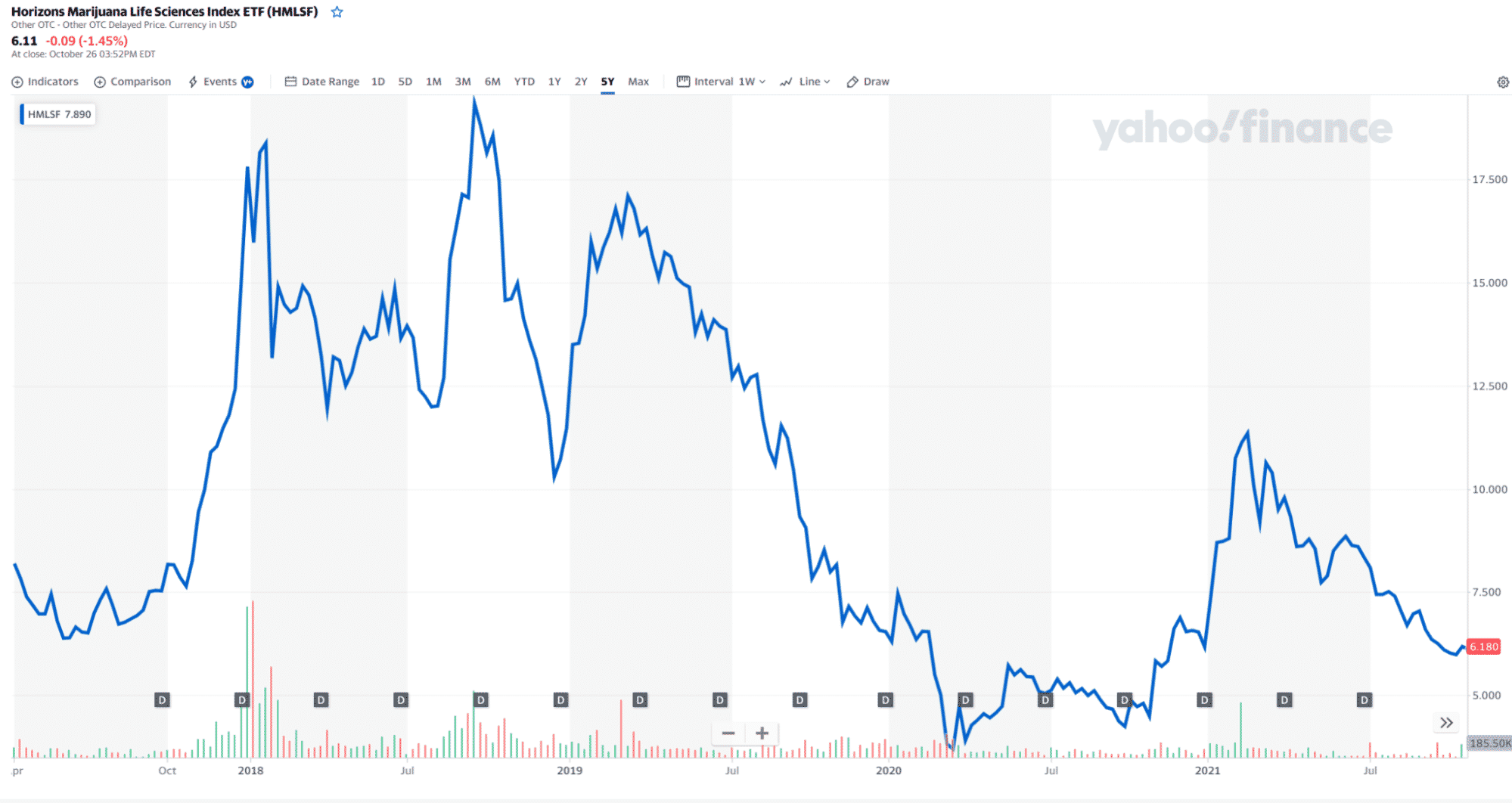

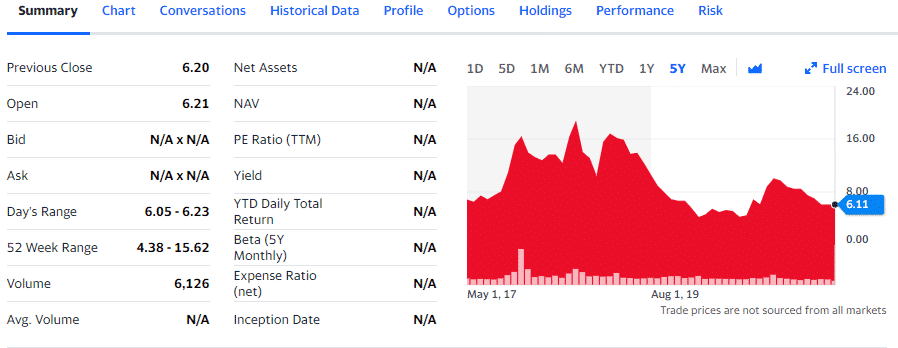

HMLSF performance chart

The HMLSF tracks the performance of the North American Marijuana Index, intending to replicate its performance as closely as possible net of expenses. It is an actively managed fund with quarterly rebalancing, which facilitates flexibility in the face of a changing industry landscape. The HMLSF gained exposure to the entire Canadian value chain and the marijuana value chain in the legalized US states.

The top three holdings of this ETF are:

- Canopy Growth Corp. — 16.10%

- Innovative Industrials Property — 13.46%

- Aphria Inc. — 13.20%

HMLSF has 356.1 million in assets under management, with an expense ratio of 0.85%. Pandemic year returns of 36.21% show that this Toronto-based pot ETF can make profits for an investor. With the expected federal legalization of marijuana in the US and the ever-increasing number of states legalizing its use, it might be time to buy the current HMLSF deep, year-to-date return of -1.24% come 2022.

№ 2. Advisor Share Pure Cannabis ETF ETF (YOLO)

Price: $15.51

Expense ratio: 0.75%

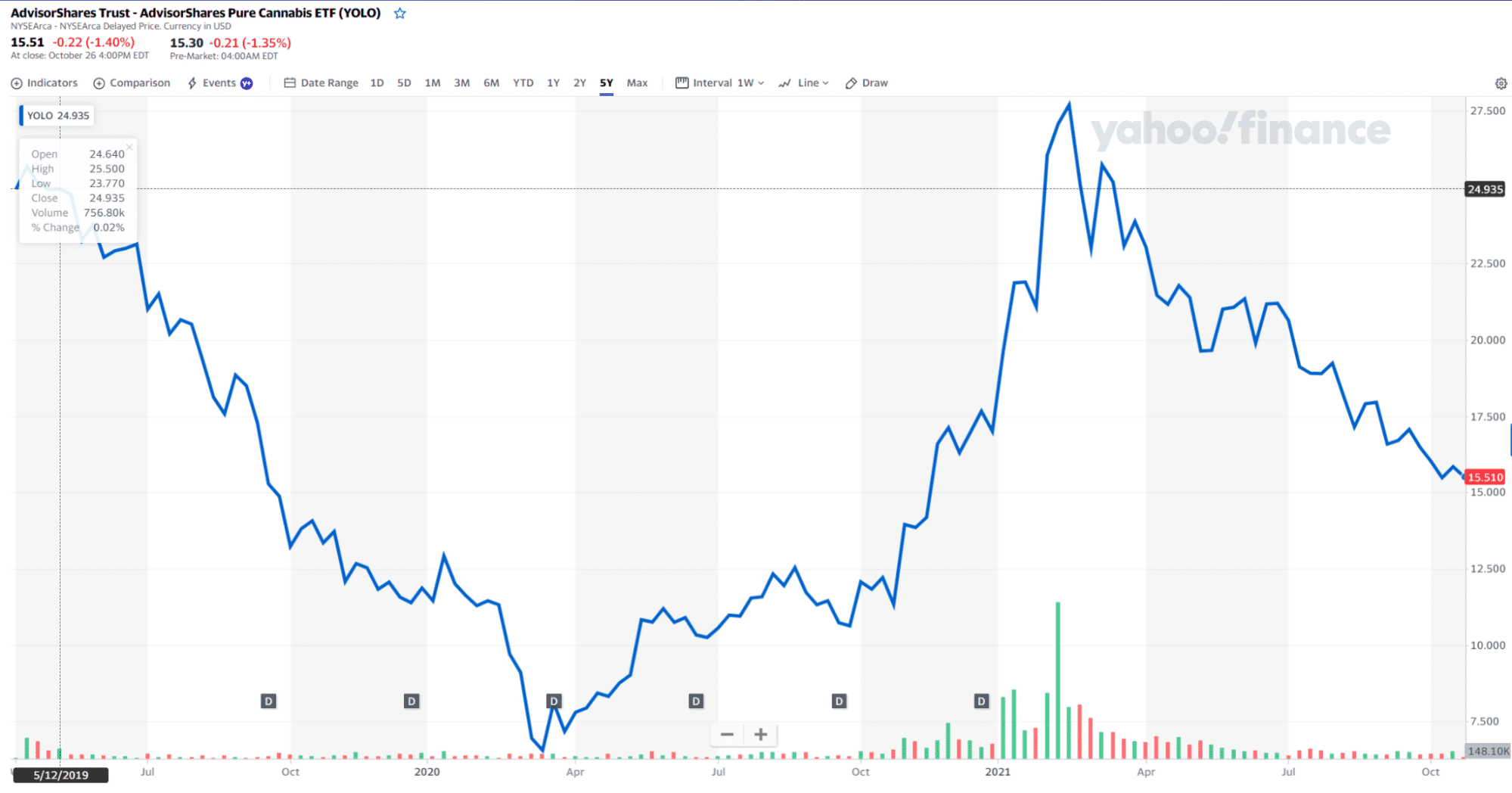

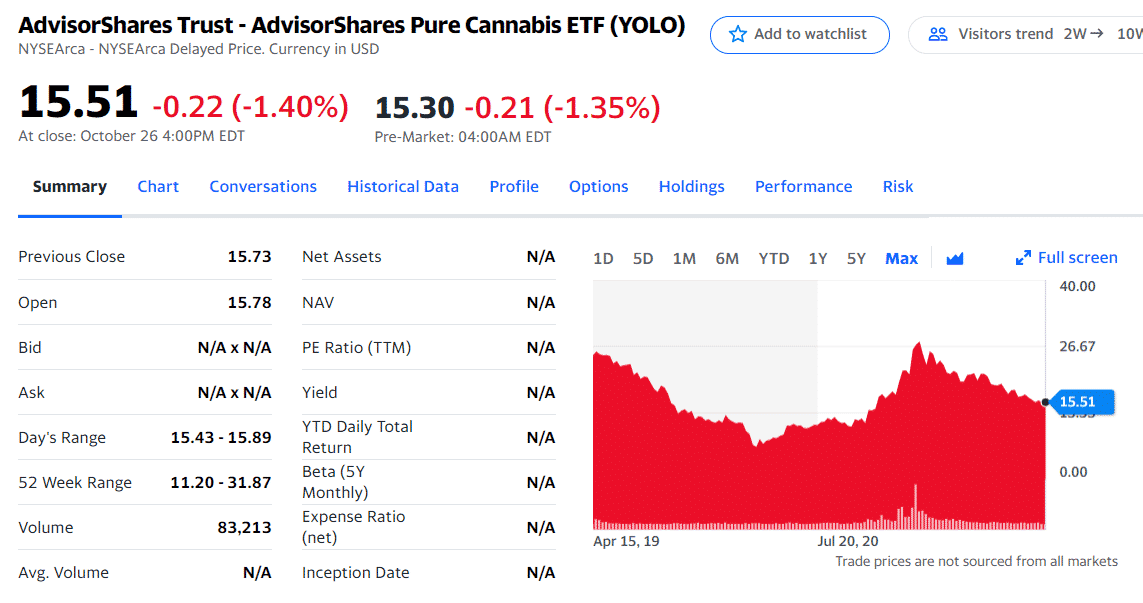

YOLO performance chart

YOLO is an actively managed marijuana fund that seeks capital appreciation for its investors. It invests 80% of total assets in organizations that derive at least 50% of their revenues from marijuana-related activities or derivatives with similar characteristics.

The top three holdings of this ETF are:

- Mutual fund (other) — 30.77%

- Innovative Industrials Property — 18.29%

- Village Farms International Inc. — 14.86%

YOLO has $237.12 million in assets under management, with investors coughing up $75 annually for a $10000 investment. Having been in the market less than a year before the pandemic hit, YOLO still managed pandemic year returns of 29.08%. The marijuana industry is bound to grow, and active management of this non-diversified fund puts it in a pole position to take advantage of the opportunities.

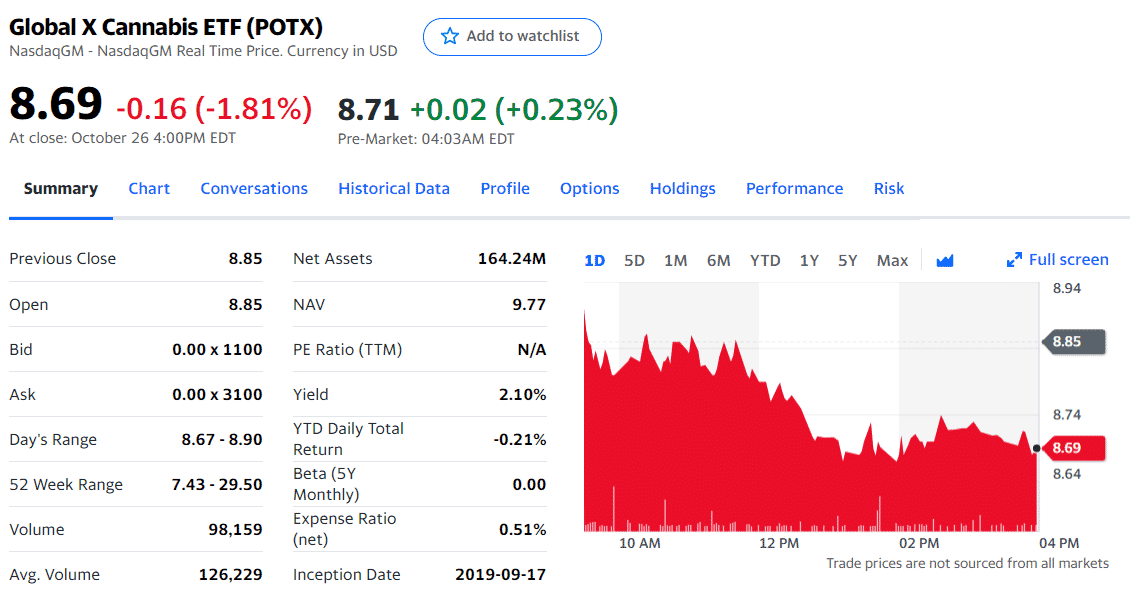

№ 3. Global X Cannabis ETF (POTX)

Price: $8.69

Expense ratio: 0.51%

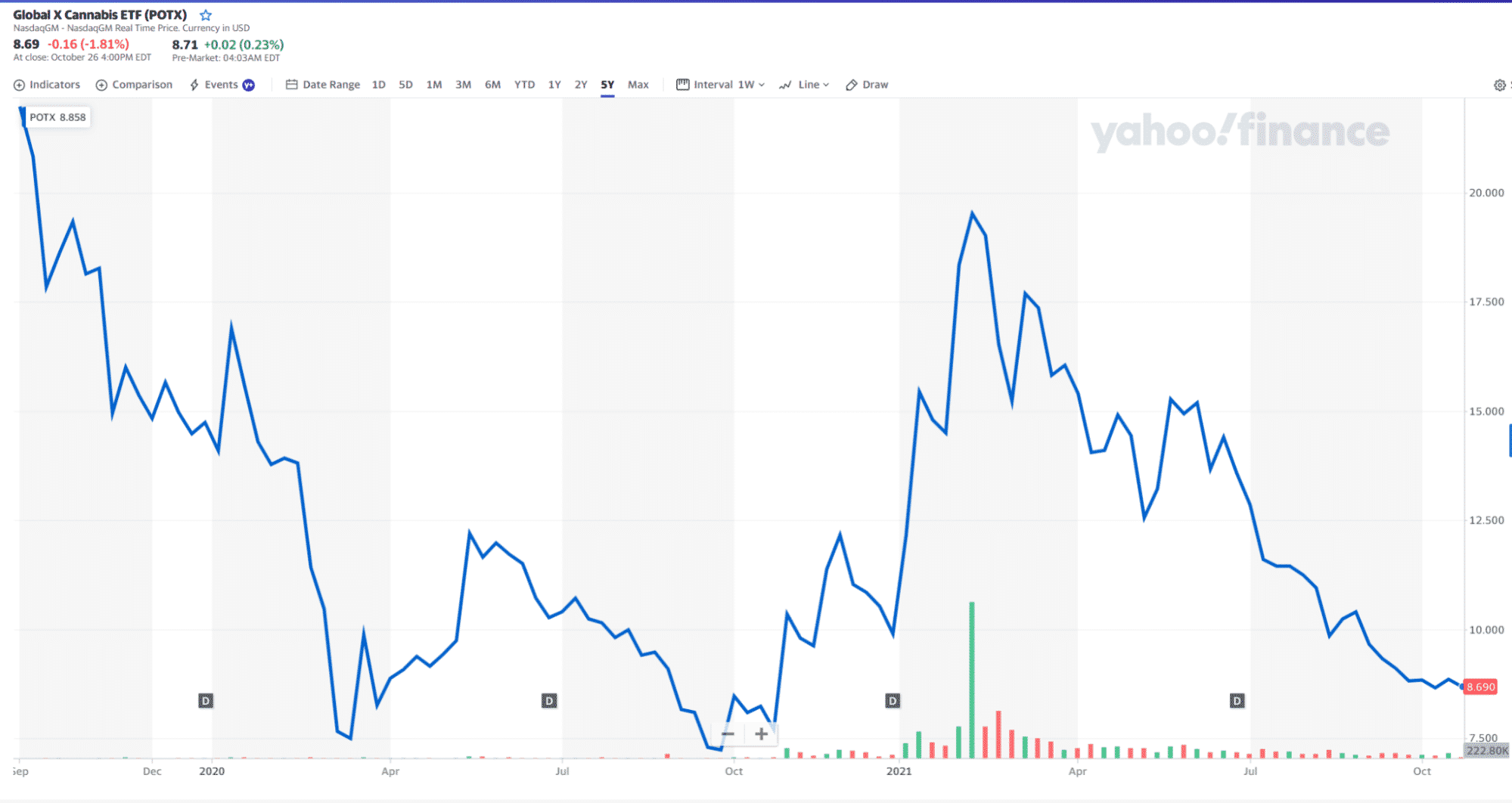

POTX performance chart

POTX ETF tracks the performance of the cannabis index, hoping to replicate its performance net of expenses and fees. It invests at least 80% of its total assets in the underlying holdings of its composite index, in addition to ADRs and GDRs. POTX investors get exposure to the global marijuana industry by having a holding base of firms defined by Solar AG as cannabis entities.

The top three holdings of this ETF are:

- Aurora Cannabis Inc. — 10.24%

- Organigram Holdings Inc. — 9.06%

- Sundial Growers Inc. — 8.12%

Global X Cannabis ETF has $125.50 million in assets under management, with the lowest expense ratio among this list of marijuana ETFs of 0.51%. With global reach and interests in the different marijuana industry niches, this ETF is one to watch out for come 2022, given that despite a September 2019 launch date, it still managed positive pandemic year returns, 9.68%.

Final thoughts

The piecemeal legalization of marijuana in the US has already created a significant new industry. As more research is done and more countries join the marijuana legalization bandwagon to take advantage of both the medicinal merits and the recreational benefits, this budding market is closely monitored to identify investment opportunities.

Comments