In the pandemic year, organizations, globally, issued approximately $269.5 billion worth of green bonds. It might not seem like much, but it is a 60% average annual growth in five years. It was achieved in a year filled with uncertainty and a decline in global economic activities due to the coronavirus pandemic.

According to Dave Chen, Chairman of Equilibrium, “Green bonds are the most effective investment instruments for sustainable financing.”

With the globe now focused on climate reclamation and sustainable business processes, the exponential growth of the green bond market calls for green-conscious investors. All to take note and position their portfolios to gain from this emerging niche.

In 2021, so far, 2021 H1 figures show global green investment to the tune of approximately $228 billion.

What are green bond ETFs?

Different investor groups define green bond ETFs in different ways. However, common in all these definitions is that they are bonds issued by both governments and corporations to fund projects sensitive to environmental, social, and governance issues.

Different bond ETF issuers classify organizations on other metrics, with weights assigned differently across the ESG categories. The good news is that green organizations cut across multiple economic sectors facilitating the composition of diversified green-based ETFs in terms of industry and organizational weight cap.

As such, green bond ETFs comprise debt raised by both organizations and governments for environmentally sound projects.

The best index funds in the 2021 investor jittery market

Most governments keep rates low to spur economic resurgence to normalcy. Thus, most investors are looking to the safe haven world of bonds for investment. Couple this status to an emerging market like the ESG niche, which has experienced phenomenal growth in the last decade. Thus, you will have a market full of opportunities to mint a truckload of money.

The three green bond ETFs below protect you against the current low rates and have the legroom for growth in the current pro-green global environment.

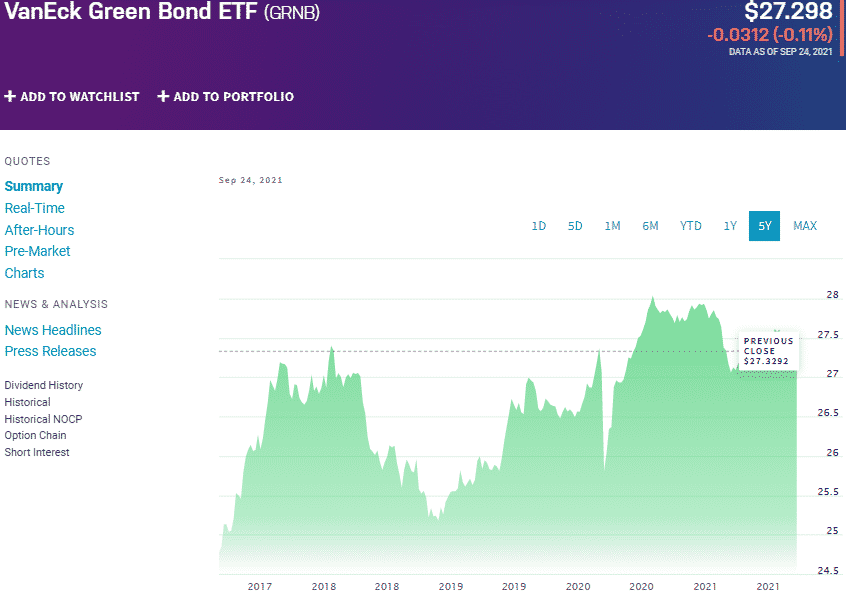

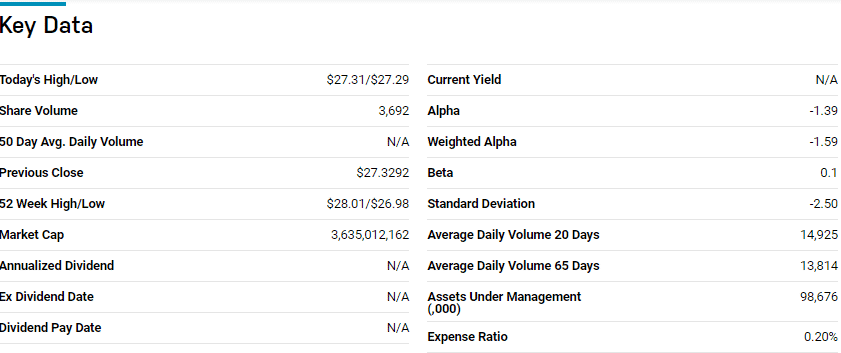

№ 1. VanEck Green Bond ETF (GRNB)

Price: $27.30

Expense ratio: 0.20%

ESG rating: 6.91/10

The VanEck Green Bond ETF tracks the performance of the S&P Green Bond US Dollar Select Index, investing at least 80% in the securities of the tracked index. It exposes investors to the global green bonds, US dollar-denominated bonds issued for green-related projects.

The top three bonds held by GRNB are:

- KfW 1.75% 14-SEP-2029-1.75%

- Fannie Mae Multifamily REMIC Trust 2019-M1 A2 3.672959% 25-SEP-2028-1.36%

- Apple Inc. 3.0% 20-JUN-2027-1.24%

GRNB has $98.32 million in assets under management, with an expense ratio of 0.20%. The GRNB in the pandemic year, 0.19% returns, leaves a lot to be desired. Meanwhile, the 3-year returns, 11.57%, show that as the world moves to sustainable investing, this ETF has the potential to mint money with a clean conscience.

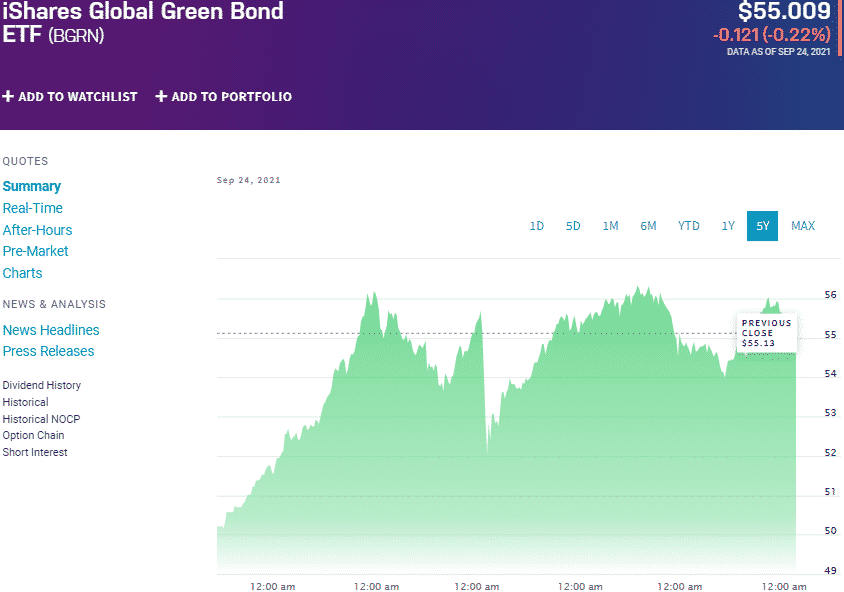

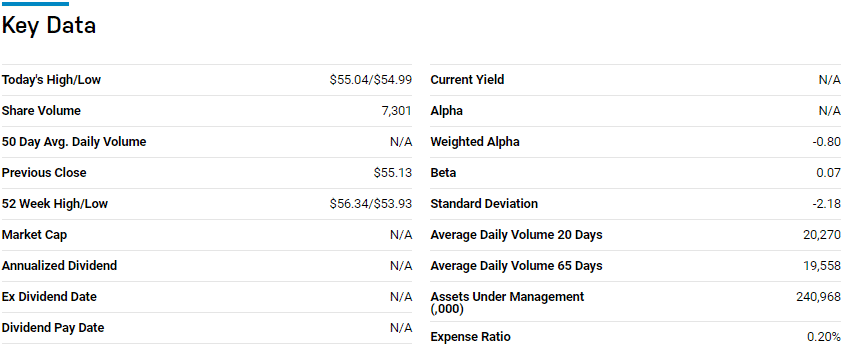

№ 2. iShares Global Green Bond ETF (BGRN)

Price: $55.01

Expense ratio: 0.20%

ESG rating: 7.64/10

The iShares Global Green Bond ETF tracks the Bloomberg MSCI Global Green Bond Select (USD Hedged) Index, investing at least 90% in the securities of the tracked index.

It exposes investors to the global investment-grade green bonds, coupled with hedging against US dollar fluctuations.

The top three bonds held by GRNB are:

- France 1.75% 25-JUN-2039-5.79%

- Belgium 1.25% 22-APR-2033-1.99%

- Netherlands 0.5% 15-JAN-2040-1.85%

GRNB has $238.63 million in assets under management, with an expense ratio of 0.20%. This green-bond ETF is yet to make positive returns for its investors.

Still, given the shift in global perception on ESG sustainability, and the record inflow of green investments, 2021 might be the year it rewards its investors and sets a precedent in the future.

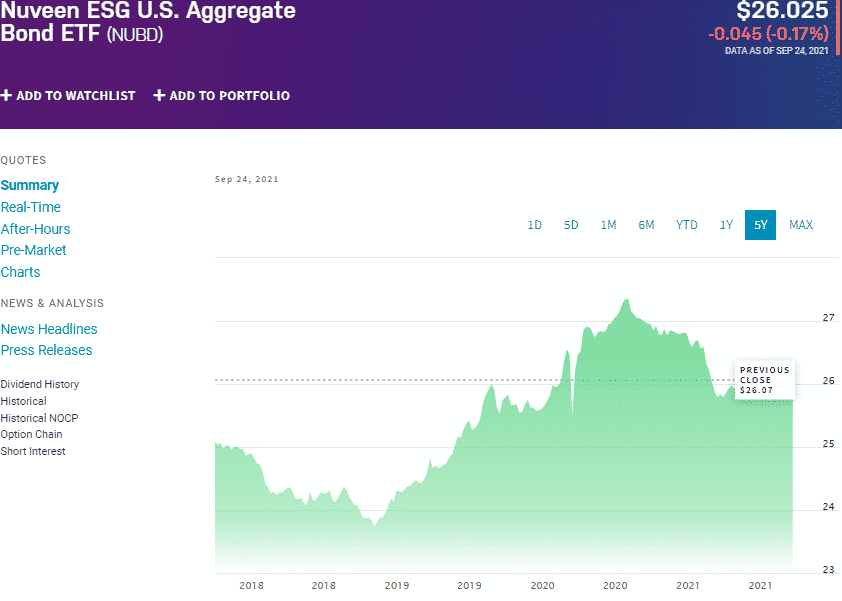

№ 3. Nuveen ESG US Aggregate Bond ETF (NUBD)

Price: $26.03

Expense ratio: 0.20%

ESG rating: 7.13/10

The Nuveen ESG US Aggregate Bond ETF tracks the performance of the Bloomberg Barclays MSCI US Aggregate ESG Select Index, investing at least 80% of its net assets in the securities of the tracked index. It exposes investors to the US taxable Investment-grade income market for securities that qualify specific ESG metrics.

NUBD is ranked №3 by US news, from a list of 17 Intermediate Core Bond ETFs for long-term investing.

The top three bonds held by GRNB are:

- United States Treasury Notes 1.875% 30-SEP-2022-3.57%

- United States Treasury Bond 2.75% 15-AUG-2047-2.06%

- United States Treasury Notes 2.0% 31-MAY-2024-1.94%

NUBD has $267.98 million in assets under management, with an expense ratio of 0.20%. Performance of the NUBD in the pandemic year, -1.52% returns, leaves a lot to be desired. Still, the 3-year returns, 15.28%, show that as the Biden-led administration focuses on ESG-based projects, the NUBD positioning might facilitate portfolio growth and wealth accumulation.

Final thoughts

Like ordinary municipal bonds, most green bonds are tax exempt in an effort by governments to steer investments towards pro-ESG activities.

In addition to facilitating higher returns due to tax exemption, green bond ETF creditworthiness is not dependent on the success of the project they fund. Still, the issuer’s financials, and in most cases, are investment-grade bonds.

The result of all these factors is bonds of the same quality as the traditional vanilla bonds, with the potential for similar returns while reclaiming earth for coming generations.

Comments