ETF full name: SPDR S&P Regional Banking ETF

Segment: US Financials

ETF provider: State Street Global

| KRE key details | ||

| Issuer | State Street | |

| Inception date | June 1,9, 2006 | |

| Expense ratio | 0.35% | |

| Average Daily $ Volume | $850.15 M | |

| Investment objective | Replication Strategy | |

| Investment geography | US Regional Banks Services | |

| Benchmark | S&P Regional Banks Select Industry Index | |

| Net Assets under Management | $3.99 Billion | |

About the KRE ETF

Historically, the financial sector’s health has proven to be a critical component of economic growth. Despite not being the most exciting segment, it rakes in significant revenues annually, making it worthwhile.

However, as a leading economic indicator, it is prone to more than average volatility calling for nuanced investing as a mitigation strategy. One of the intelligent plays into this segment is investment through regional banks, independent of Wall Street market influence. The fact that they are financial institutions despite being region-specific means a ton of data to analyze and pore through before picking stocks with a high probability of being winners.

How then do you invest in this bank services niche? State Street Global provides a hassle-free investment avenue by pooling regional banks to trade under the SPDR S&P Regional Bank ETF.

KRE fact-set analytics insight

SPDR S&P Regional Bank ETF tracks, as closely as possible, the yield performance and total returns of the S&P Regional Banks Select Industry Index, net of expenses and fees. To meet its investment objective, it invests at least 80% of its total assets in the holdings of its tracked index, which primarily exposes investors to large-cap, mid-cap, and small-cap equities operating within the US regional bank segment.

KRE annual performance analysis

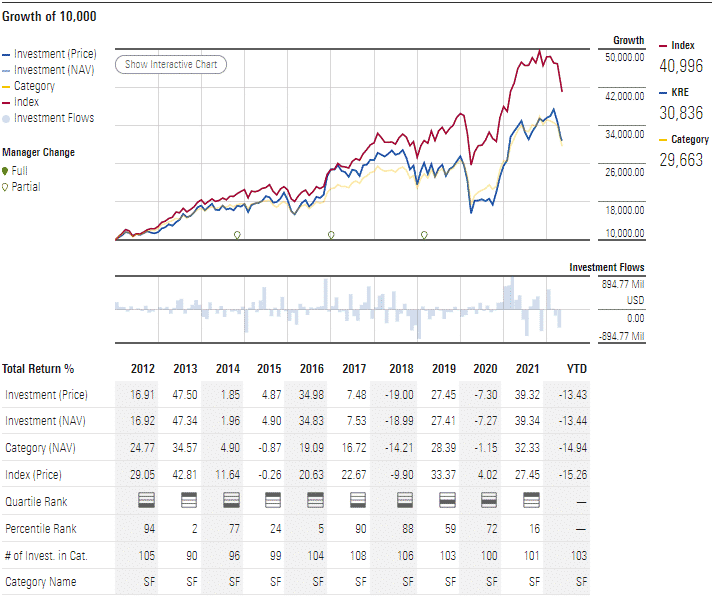

Having launched in 2006, the KRE ETF is among the pioneer regional banking ETFs making it a popular investment vehicle that provides liquidity and the financial muscle to make it a resilient fund in bearish markets. An investment of $10000 in 2006, at launch, would now be worth $30836, not accounting for income accrued over the years due to the decent annual dividend yield of 1.87%.

KRE ETF RATING |

|||||

| Resource | ETF DATABASE | ETF.COM | MARKETWATCH | Morningstar.com | Money.usnews.com |

| IPO rating | A | BBB | Quantile 2 | ** | Rank 12 in Financials |

| IPO ESG rating | 4.88/10 | 4.88/10 | N/A | 28.12/50 | 5.2/10 |

KRE key holdings

SPDR S&P Regional Bank ETF comprises between 140 and 150 holdings across the cap divide and at any given time. An equal weighting mitigates against concentration risk, while quarterly rebalancing ensures this regional bank ETF stays true to its investment objective.

The top ten holdings of this fund are below.

| Ticker | Holding | % Assets |

| MTB | M&T Bank Corporation | 1.6% |

| BPOP | Popular Inc. | 1.6% |

| FHN | First Horizon Corporation | 1.6% |

| RF | Regions Financial Corporation | 1.6% |

| EWBC | East West Bancorp Inc. | 1.6% |

| WTFC | Wintrust Financial Corporation | 1.5% |

| BKU | BankUnited Inc. | 1.5% |

| CFR | Cullen/Frost Bankers Inc. | 1.5% |

| WAL | Western Alliance Bancorp | 1.5% |

| FNB | F.N.B. Corporation | 1.5% |

Industry outlook

Despite a deceleration of economic growth, unchecked inflation rates are driving yield curve steepening. This phenomenon fits the regional banks’ core business, lending, especially given regional banks’ 79% revenue attribution to net interest income, setting the stage for significant profits. Against the backdrop of this and rising interest rates, the diversification and equal weighting of the KRE ETF ensures maximum return reaping while mitigating against single equity volatility.

Comments