Since time immemorial, when investing and trade were barter-based, the challenge many faced was how to balance between a safety net and growth and value. In the modern era of investing, worth upwards of $125 trillion for equity securities alone, it becomes overwhelming to look for the right balance between the safety of fixed income sources and equities for wealth generation and inflation hedge.

The good news is that since the launch of the first ETF in the early 1990s, this corner of the investment markets has evolved with the times to provide exchange-traded funds to suit all investment objectives, including balanced ETFs.

What is the composition of balanced ETFs?

ETFs are a pool of investment securities exhibiting similar economic characteristics relative to an investment objective at the core. They comprise a blend of equities and bonds, targeting specific target exposure, usually reflected in their names. With balanced ETFs, the composition deviates a little bit.

The best-balanced funds for a stable portfolio in 2022

Since the coronavirus pandemic, the investment market has experienced unprecedented bullish and bearish movements. In addition, supply chain bottlenecks due to cessation of movement, the Ukraine-Russia war, and unchecked inflation levels worldwide call for assets that will provide long-term returns while also providing portfolio stability. This is exactly what these three balanced exchange-traded funds bring to a portfolio and at a relatively low cost to the investor.

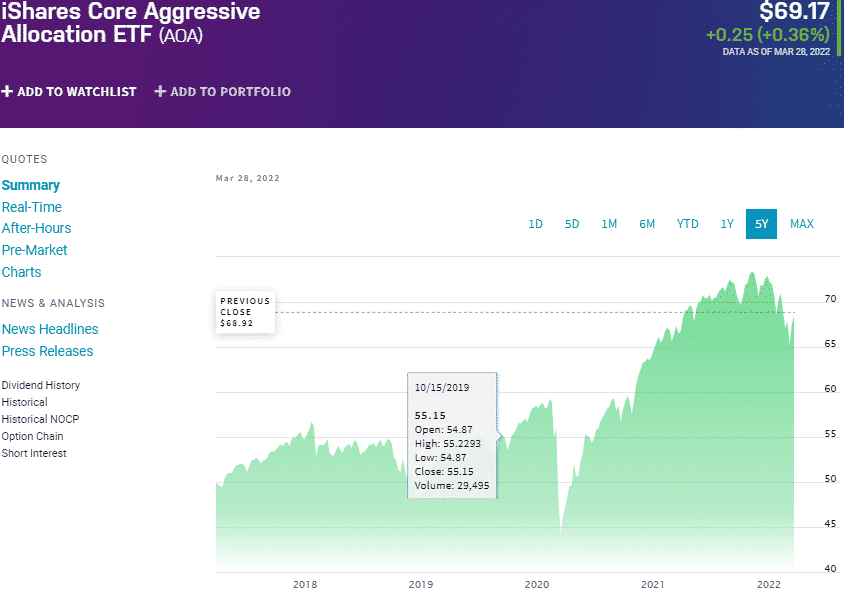

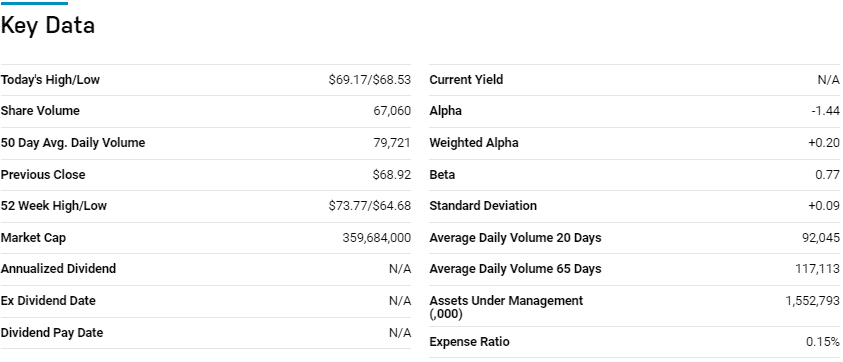

№ 1. iShares Core Aggressive Allocation ETF (AOA)

Price: $69.17

Expense ratio: 0.15%

Annual dividend yield: 1.47%

AOA chart

The iShares Core Aggressive Allocation ETF tracks the performance of the S&P Target Risk Aggressive Index, which measures the performance of the S&P Dow Jones Indices LLC proprietary allocation model. It is an ETF made up of several funds believed in an aggressive target risk allocation strategy. It invests at least 80% of its total assets to meet this investment objective.

In a list of 11 balanced global funds with a 70%-80% allocation, the AOA ETF is ranked № 2 for long-term investing.

The top three holdings of this balanced ETF are:

- iShares Core S&P 500 ETF – 43.48%

- iShares Core MSCI International Developed Markets ETF – 24.68%

- iShares Core Total USD Bond Market ETF – 16.65%

The AOA ETF has $1.55 billion in assets under management, at a relatively low expense ratio of 0.15%. Despite combining both equities for long-term growth and securities to provide fixed income, this balanced ETF is more inclined towards equities to ensure an aggressive strategy for wealth creation. Combine this with the simplicity of this fund and what you get is consistent returns with a splash of regular income; 5-year returns of 53.45%, 3-year returns of 38.88%, 1-year returns of 6.03%, and a dividend yield of 1.47%.

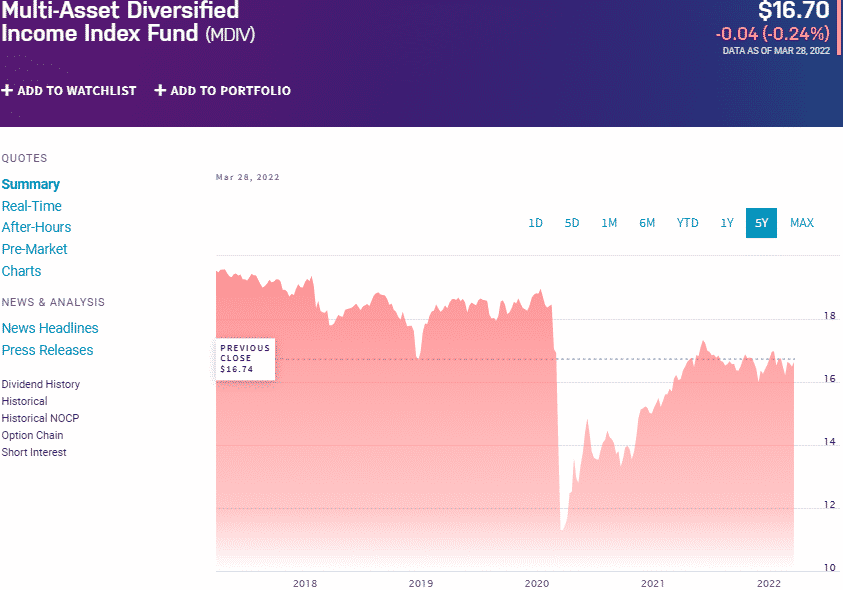

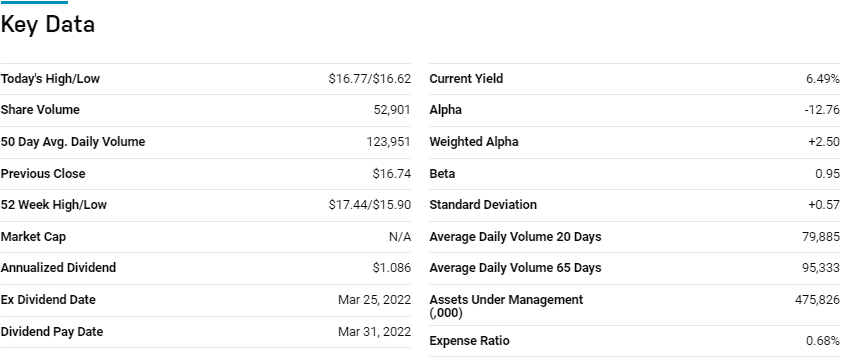

№ 2. First Trust Multi-Asset Diversified Income Index Fund (MDIV)

Price: $16.70

Expense ratio: 0.68%

Annual dividend yield: 4.91%

MDIV chart

The First Trust Multi-Asset Diversified Income Index Fund tracks the NASDAQ US Multi-Asset Diversified Income IndexSM’s net expenses and fees. It invests at least 90% of its total assets in the tracked index underlying holdings; common stocks, MLPs, REITs, depository receipts, ETF, and preferred securities. It exposes investors to five asset classes believed to result in consistent high yields.

In a list of 22 balanced global funds with a 50%-70% allocation, the MDIV ETF is ranked № 2 for long-term investing.

The top three holdings of this non-diversified ETF are:

- First Trust Tactical High Yield ETF – 19.15%

- Two Harbors Investment Corp – 1.32%

- USA Compression Partners LP – 1.30%

The MDIV ETF has $476 million in assets under management, with an expense ratio of 0.68%. Exposure to all five high-yield sectors ensures diversification and balance in this fund. Astringent screening based on yield, liquidity, size, and volatility, combined with non-traditional funds, provides a fund capable of navigating highly unpredictable markets; 5-year returns of 16.31%, 3-year returns of 8.82%, 1-year returns of 9.54%, and a dividend yield of 4.91%.

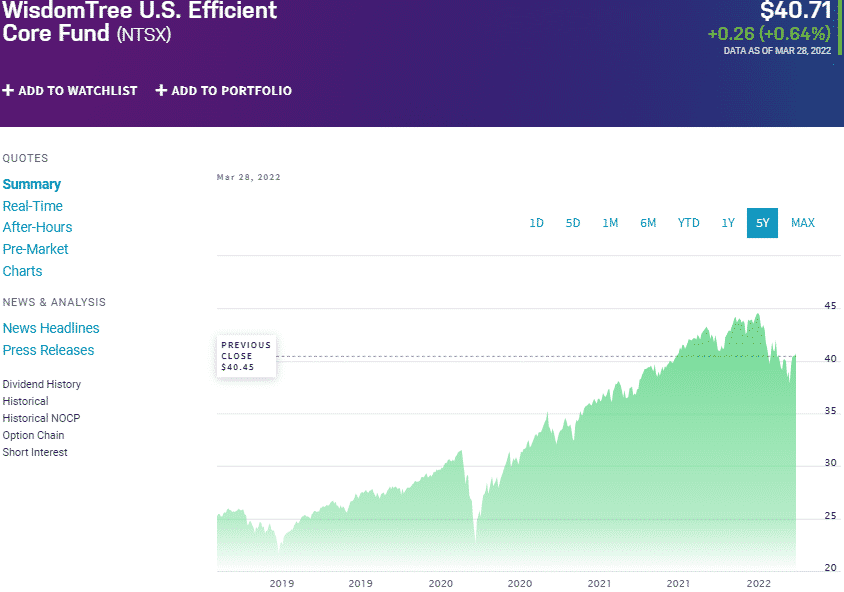

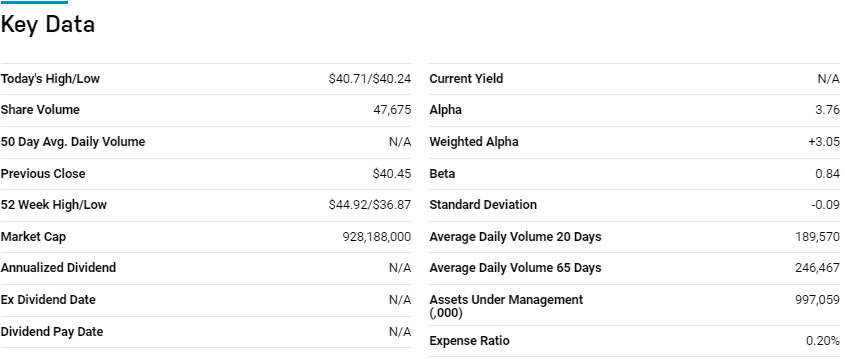

№ 3. Wisdom Tree US Efficient Core Fund (NTSX)

Price: $40.71

Expense ratio: 0.20%

Annual dividend yield: 0.92%

NTSX chart

Uncertainty and volatility sometimes call for a snap decision to mitigate risk and amplify returns. The same holds when looking for opportunities with balanced ETFs. Investors can call upon the Wisdom Tree US Efficient Core Fund. It is an actively managed fund that seeks capital appreciation and total returns by investing at least 90% of its net assets in large-capitalization US-listed equities and US treasury future contracts.

The top three holdings of this global internet fund are:

- US Dollar – 9.87%

- Apple Inc. – 6.46%

- Microsoft Corporation – 5.36%

The NTSX ETF has $925.1 million in assets under management, with a relatively low expense ratio for an actively managed fund of 0.20%. Utilizing an allocation that comprises short-term treasuries, large-cap US equities, and treasury’s futures contracts results in a special fund outperforming the broader market; 3-year returns of 63.62%, 1-year returns of 10.69%, and a dividend yield of 0.92%.

Final thoughts

ETFs have evolved to become the single most exchanged asset globally. One of the primary reasons for this popularity has been the availability of ETFs to fit each investment theme and strategy. The problem is that with such a wide selection, sometimes finding the right balance is quite the hassle. The three ETFs provide a starting point to portfolio diversification and balance for a stable fund that consistently provides returns and income.

Comments