ETF full name: AI Powered Equity ETF (AIEQ)

Segment: US Equities-Total Market

ETF provider: Exchange Traded Managers Group LLC

| AIEQ key details | ||

| Managers | ETF Managers Group LLC. & Equbot LLC | |

| Inception date | 17th October 2017 | |

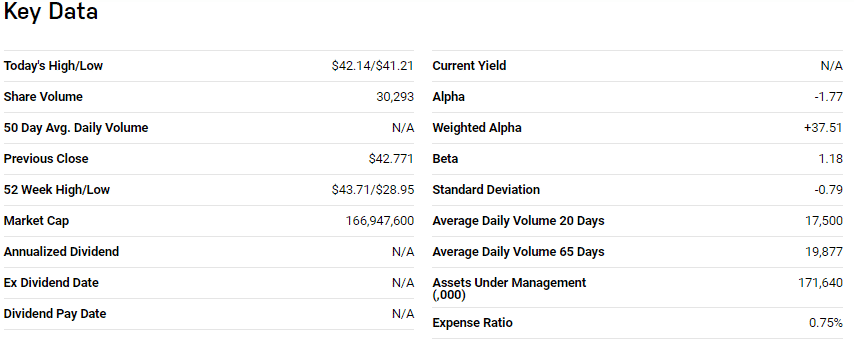

| Expense ratio | 0.80% | |

| Average daily $ volume | $721.24K | |

| Investment objective | Capital Appreciation | |

| Investment geography | US Large Cap Growth Equities | |

| Net assets under management | $173.1 million | |

| YTD Total Return | 20.5% | |

| 3 Yr Annualized Total Return | 17.0% | |

| 5 Yr Annualized Total Return | N/A | |

| Number of holdings | 84 | |

About the AIEQ ETF

Anyone who has extensive knowledge in investing and trading will attest that 90% of it is all about managing emotions rather than portfolio management. It is impossible to tell what will happen in the future, but it is possible to predict the most likely cause of action accurately with data.

With the AIEQ exchange-traded fund, this ETF uses IBM’s Watson platform to apply the proprietary EquBot LLC’s quantitate model in stock picking rather than invest in a portfolio of different artificial intelligence equities. The EquBot technology, working as the funds sub-adviser, is tagged to improve the workload of 1000 investment analysts, traders efficiently, and quants working 24/7.

In the words of Mark Cuban, “The world’s first trillionaires are going to come from somebody who masters AI and all its derivatives and applies it in unimagined ways.” Couple this with research, which shows that 62% of hiring managers expect AI to change the way work is done radically; it might be time to give AIEQ ETF a chance. It has the potential for portfolio diversification, and one to grow your wealth-has outperformed its categories average since inception.

AIEQ Fact-set analytics insight

AI Powered Equity ETF has too much analytical power to track a single index and replicate its performance. It is an actively managed exchange-traded fund that invests in US-listed investment assets, picked quantitatively by the EquBot Model. Therefore, its objective is to achieve long-term capital appreciation by outperforming the broader US equities market but within acceptable risk levels.

The artificial intelligence powering this ETF analyses millions of data points in analysts’ reports, +6000 companies’ financial statements, technical indicators, micro, and macroeconomic data, global news, and even social media updates to fulfill its goals. It clusters that different data points into four broad categories with a different weighting depending on the sector an organization operates in; management, macro, news and information, and financial models.

AIEQ ETF then utilizes its AI to sift the +6000 organizations into a list of the top a hundred and fifty organizations, presenting the highest probability for capital appreciation in the next 12 months. Being an AI with learning capabilities, this EquBot powered ETF builds upon the collective information resulting in a regularly adjusted portfolio based on an investment system for continuous growth.

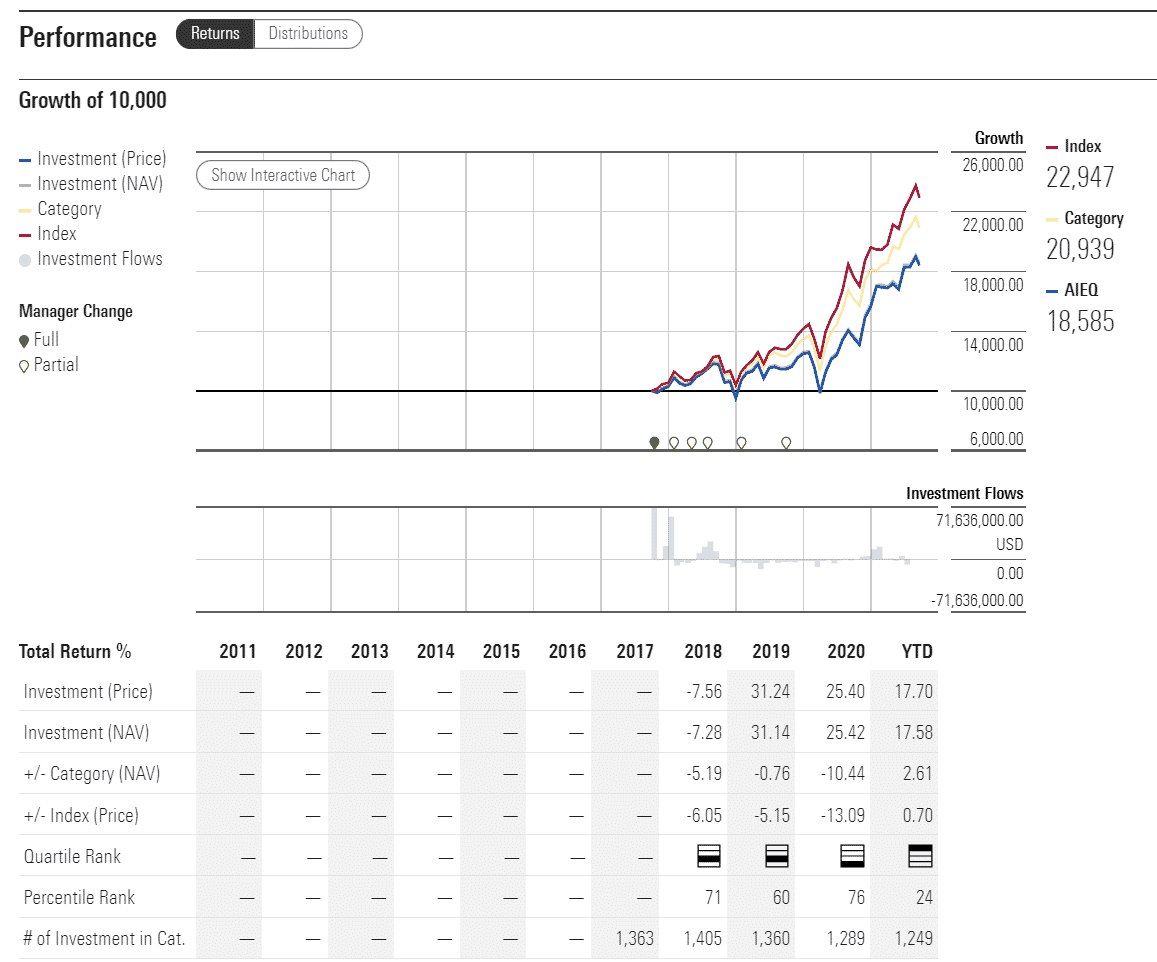

AIEQ performance analysis

Exchange-traded funds are long-term trading instruments. As such, it is rare for the investment world to analyze ETF performance in the short term.

However, the AIEQ ETF performance and objective of creating a portfolio of the best capital appreciation equities in the next 12 months shows they can also be income-generating vehicles.

AIEQ ETF RATING |

|||||

| Resource | ETF DATABASE | ETF.com | MarketWatch.com | Morningstar.com | Money.usnews.com |

| IPO Rating | A+ | C/40 | Quantile 2 | * | N/A |

| IPO ESG Rating | 5.84 out of 10 | A | N/A | 24.18 out of 50 | N/A |

AIEQ key holdings

The AIEQ fund might be non-diversified in its objectives and the equities it picks but its portfolio cuts across the entire equity, albeit with technological sector bias. To ensure its accurate fulfillment, it is highly dynamic but with the average holdings in the 70-120 range at any given time-at present 102 holdings. Despite the sector business, this fund has a 10% capping on any holdings weight, reducing the overall associated investment risk.

The top ten holdings of the AI Powered Equity ETF are as below.

| Ticker | Holding name | % of assets |

| AAPL | Apple Inc. | 7.85% |

| MSFT | Microsoft Corporation | 7.36% |

| AMZN | Amazon.com Inc. | 5.20% |

| GOOGL | Alphabet Inc. Class A Shares | 4.30% |

| COST | Costco Wholesale Corporation | 3.89% |

| PEN | Penumbra Inc. | 3.46% |

| TWTR | Twitter Inc. | 3.21% |

| ROKU | Roku Inc. Class A Shares | 2.93% |

| AGCO | AGCO Corporation | 2.88% |

| AMD | Advanced Micro Devices Inc. | 2.80% |

This tech-heavy top ten holding list accounts for 43.88% of the AIEQ weighting. A complete list of the underlying holdings shows that all equities present a bullish outlook, all indicators analyzed. Given the massive technology sector sell-offs experienced in the current year, the EquBot model powering this ETF proves once again to be free of human biases and error with its year-to-date returns of 20.60%.

Industry outlook

Artificial intelligence is no longer a question of what, how, and if but when. According to Nasdaq analysts, AI is taking all the economic sectors by storm, given its ability to ensure 100% efficiency at a fraction of the cost.

With its broad reach, it offers investors not only diversification but data processing capabilities unimaginable earlier on. With technology and healthcare taking the bulk of the weighting in the AIEQ fund and with the globe being led by technology and healthcare for the next phase of its evolution, this fund is worth having in your crosshairs, especially where large-cap investing is a consideration.

Having been in existence for just over three years, the AIEQ has been able to track the entire economy and outperform other broad-based economy funds such as the SPY.

Comments