ETF full name: iShares MSCI Europe Financials Sector ETF (EUFN)

Segment: equity (Developed Europe Financials)

ETF provider: Blackrock

| EPGFX key details | |

| Issuer | Blackrock |

| Dividend | $0.42 |

| Inception date | January 20, 2010 |

| Expense ratio | 0.48% |

| Management company | Blackrock |

| Average 3-5 EPS | N/A |

| Average Annualized Return | 15.18% |

| Investment objective | Representative sampling indexing |

| Investment geography | Developed Europe |

| Benchmark | MSCI Europe Financials Index |

| Leveraged | N/A |

| Median market capitalization | $47.3 billion |

| ESG rating | 10 / 10 (AAA) |

| Number of holdings | 80 |

| Weighting methodology | Weighted market cap |

About the EUFN ETF

The iShares MSCI Europe Financials Sector ETF tracks the financials of stocks in developed European markets. The ETF benchmarks the MSCI Europe Financials Index, which is a market-cap-weighted index. The investment objective uses representative sampling indexing instead of replicating the index. The EUFN has traded publicly on the Nasdaq Stock Exchange since January 20, 2010.

EUFN Fact-set analytics insight

The EUFN fund has a current market cap of $47.3 billion and total assets under management of $1.59 billion. Furthermore, the fund has an expense ratio of 0.48%.

The fund provides investors with exposure to the Western European financial sector. These developed markets have displayed significant volatility as well as large fluctuations in recent years.

The fund is perfect for short-term investors with specific goals.

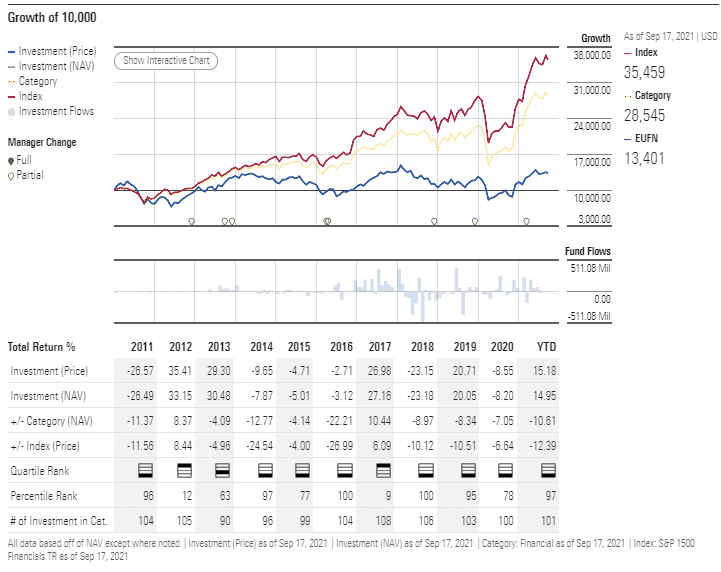

EUFN performance analysis

In terms of returns, the iShares MSCI Europe Financials Sector ETF has delivered a 15.18% annualized return. The benchmark return is at 16.03%. Therefore the fund is very close to its benchmark. Furthermore, the EUFN has a price-to-earnings ratio of 15.06 and pays dividends of $0.42.

The EUFN fund has an MSCI ESG rating of AAA based on a score of 10/10. AAA ratings are considered the best, which shows the fund has good management of environmental, social, and governance issues.

EUFN ETF RATING |

|||||

| Resource | ETF DATABASE | ETF.com | MarketWatch | Morningstar.com | Money.usnews.com |

| EUFN

Rating |

A+ | C / 86 | Quintile 5 (88th percentile) | * | 3.4 / 10 |

| EUFN ESG Rating | 10 / 10 | 10 / 10 | 10 / 10 | 10 / 10 | 10 / 10 |

EUFN key holdings

The iShares MSCI Europe Financials Sector ETF has 80 holdings. The top 10 assets make up 38.16% of the fund’s holdings, with 91% representing large-cap stocks.

Banks make up 45% of the fund, Insurance 31%, Diversified financials 24%, and Cash derivatives less than 1%.

The below table displays the top ten holdings of the EUFN fund.

| Ticker | Holding name | % of assets |

| HSBA | HSBC Holdings Plc | 6.02% |

| ALL | Allianz SE | 5.36% |

| BNP | BNP Paribas SA Class A | 4.11% |

| ZURN | Zurich Insurance Group Ltd | 3.71% |

| SAN | Banco Santander, S.A. | 3.65% |

| UBSG | UBS Group AG | 3.50% |

| INGA | ING Groep NV | 3.09% |

| CS | AXA SA | 3.05% |

| PRU | Prudential plc | 3.01% |

| ISP | Intesa Sanpaolo S.p.A. | 2.66% |

Industry outlook

According to financial experts, the EUFN is significantly undervalued and should be trading 40% higher.

Since banks make up 45% of the fund’s holdings, investors believe these holdings are at risk due to low-interest rates. As of 2020, the interest rates in the EU and UK have been kept low due to the pandemic. In some regions of Europe, interest rates are as low as -0.5%.

As a result, the EUFN fund has struggled to increase over the past decade due to monetary policy changes.

The fund tracks the benchmark MSCI Europe financials index, and since June 2021, the trailing return has been 7.35%. This performance is not too bad, showing that the companies under the fund’s holdings are still profitable.

Comments