Rising interest rates usually spell the doom for treasury investments. Currently, this is not the case. An overly overbought equity market has been on the decline since January, necessitating the need for portfolio diversification to mitigate against volatility.

Couple this with rising inflation, and investors are on the lookout for investments by providing a hedge against inflation while also providing regular income to ensure even in the face of increasing consumer prices purchasing power is not affected too much. In the current environment, these three treasury ETFs provide a hedge against inflation and a chance at significant gains as the yield curve continues to steepen.

Best Treasury ETFs: how do they work?

Before diving into the treasury ETF composition, we first define what treasury bonds are. Bonds are debt securities issued by corporations and government agencies to raise capital for a specific project. Investors purchase bonds and earn interest on their investment, with most government-backed bonds paying interest semi-annually. On the maturity period of the bond lapsing, investors are paid back their principal investment.

As such, treasury ETFs are exchange-traded funds comprising bonds guaranteed by the United States government or US government-linked agencies.

Which are the best Treasury ETFs to buy for gains

It is straightforward to focus on the now and forget that the best investment assets result in returns and income over extended periods in the current inflation-rising environment. Therefore, the following treasury ETFs are a mix of treasury inflation-protected securities (TIPS) and long-term treasury bonds for a more diversified and balanced bond portfolio.

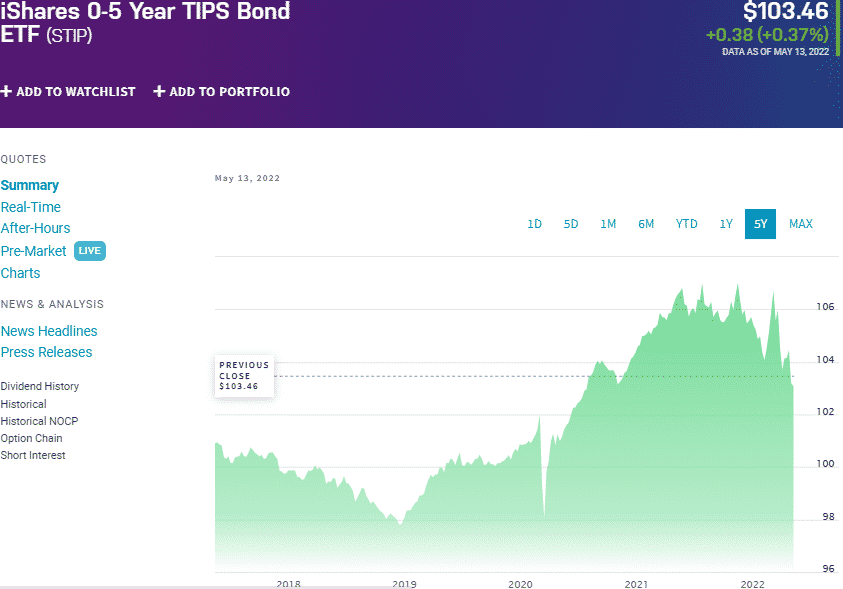

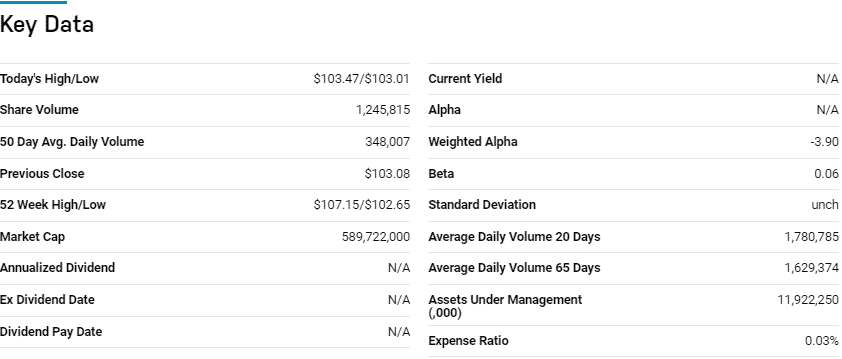

№ 1. iShares 0-5 years TIPS Bond ETF (STIP)

Price: $103.46

Expense ratio: 0.03%

Dividend yield: 3.88%

STIP chart

The iShares 0-5 years TIPS Bond ETF tracks the performance of US Treasury Inflation-Protected Securities (TIPS) 0-5 Years Index (Series-L), net of expenses and fees. It invests at least 80% of its net assets in the assets making up its composite index and a further 10% in other US Treasury securities that help track the tracked index. The result is a bond fund that exposes investors to US treasury bonds with fewer than five years of inflation-protected maturity.

Among 19 inflation-protected bond funds, the STIP ETF is ranked No.5 by USNews for long-term investing.

The top 3 holdings of this ETF as of now are:

- Government of the United States of America 0.125% 15-APR-2025 – 13.18%

- United States Treasury Notes 0.625% 15-APR-2023 – 9.76%

- Government of the United States of America 0.125% 15-OCT-2024 – 8.57%

The STIP ETF has $11.92 billion in assets under management, with an expense ratio of 0.03%. Concentration on investment-grade treasury bonds featuring inflation protection and short maturity period results in a popular fund that is highly liquid. In the current inflation rising and interest hiking environment, a combination of ultra-short- and medium-term bonds makes this fund ideal for quick gains; 5-year returns of 16.49%, 3-year returns of 13.16%, 1-year returns of 1.92%, and a more than the decent annual dividend yield of 3.88%.

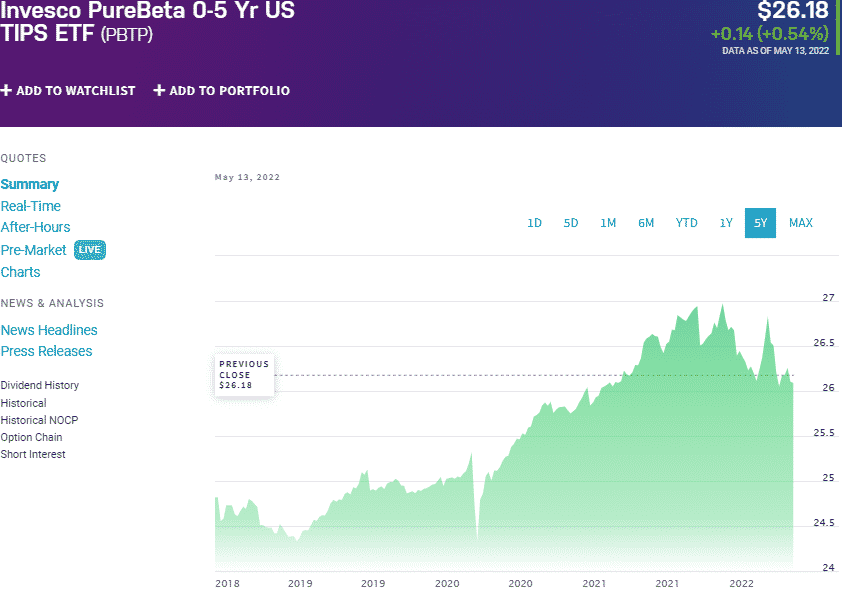

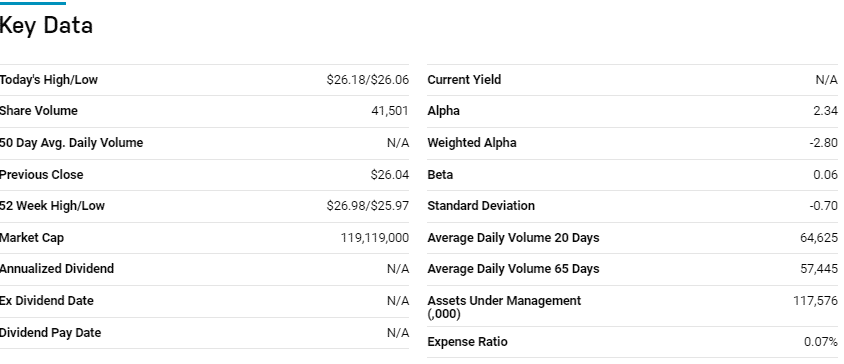

№ 2. Invesco PureBeta 0-5 years US TIPS ETF (PBTP)

Price: $26.18

Expense ratio: 0.07%

Dividend yield: 2.64%

PBTP chart

The Invesco PureBeta 0-5 years US TIPS ETF seeks to replicate the performance of ICE BofA 0-5 Year US Inflation-Linked Treasury IndexSM. It invests at least 80% of its net assets in the assets making up its composite index. The PBTP ETF exposes investors to US treasury bonds with a maturity period of fewer than five years but more than a month that is inflation-protected.

The top 3 holdings of this ETF as of now are:

- United States Treasury Notes 0.625% 15-APR-2023 – 6.01%

- United States Treasury Notes 0.625% 15-JAN-2026 – 5.71%

- United States Treasury Notes 0.125% 15-JAN-2023 – 5.62%

The PBTP ETF has $117.6 million in assets under management, with an expense ratio of 0.07%. Combining ultra-short- and medium-term bonds makes this fund ideal for quick gains in the current interest rising environment, while inflation protection ensures a steady income to cushion against rising consumer commodity prices; 3-year returns of 12.29%, 1-year returns of 1.53%, and a decent annual dividend yield of 2.64%.

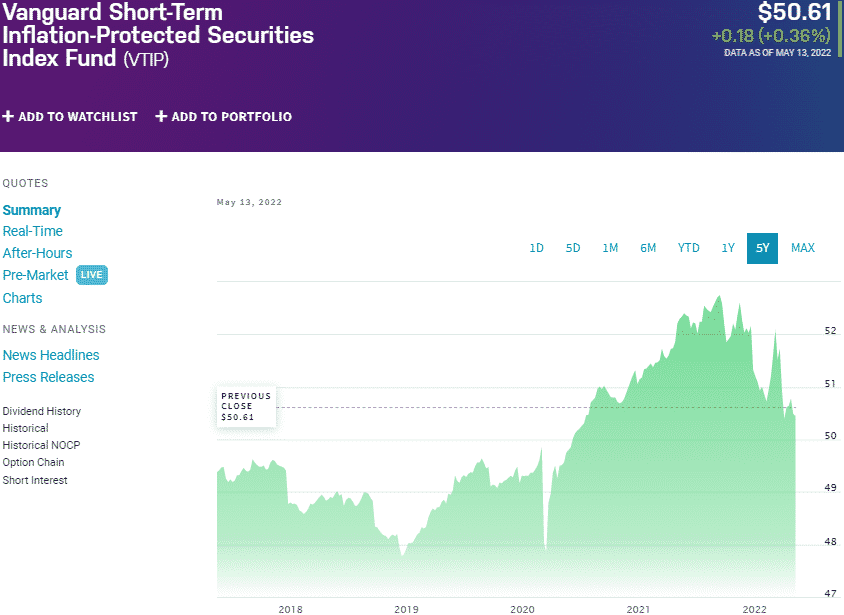

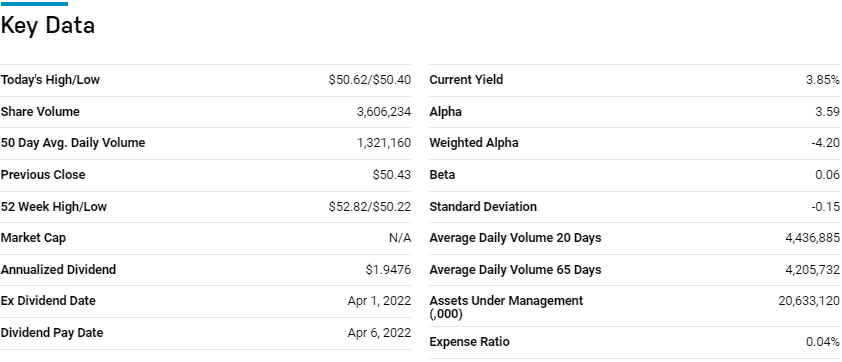

№ 3. Vanguard Short-Term Inflation-Protected Securities ETF (VTIP)

Price: $50.61

Expense ratio: 0.04%

Dividend yield: 3.40%

VTIP chart

The Vanguard Short-Term Inflation-Protected Securities ETF tracks the performance of the Bloomberg US Treasury Inflation-Protected Securities (TIPS) 0-5 Year Index. It invests all of its assets in the securities making up the composite index, apportioning the same weight as the tracked index. It exposes investors to US inflation-protected treasury obligations with fewer than five years of maturity.

Among 19 inflation-protected bond funds, the VTIP ETF is ranked No.4 by USNews for long-term investing.

The top 3 holdings of this ETF as of now are:

- United States Treasury Notes 0.125% 15-JAN-2023 – 6.56%

- United States Treasury Notes 0.375% 15-JUL-2023 – 6.38%

- United States Treasury Notes 0.625% 15-JAN-2024 – 6.09%

The VTIP ETF is the largest treasury ETF on this list, boasting $20.64 billion in assets under management, with an expense ratio of 0.04%. This low expense ratio, combined with Vanguard’s zero-commission trading, secures the investors’ bottom line. Coupling ultra-short US-backed debt obligations with medium maturity bonds protects against diminishing returns due to rising inflation and subsequent rate hikes to curb inflationary pressure.

The result is a fund capable of protecting investors against declining purchasing power by providing steady returns and income; 5-year returns of 16.49%, 5-year returns of 16.45%, 3-year returns of 13.06%, 1-year returns of 2.26%, and a more than the decent annual dividend yield of 3.40%.

Final thoughts

Inflation is no longer transitory with the effects felt in each consumer purchase made. The continued rate hikes by FED to try and curb the rising inflation are also eating at returns. The result has been inflows into inflation hedged securities as investors target steady incomes and diversified portfolios to weather the current inflation and rising interest.

The three treasury ETFs herein have a balanced and diversified holding of both ultra-short, short, and medium-term US-backed obligations to ensure maximum gains in the current environment.

Comments