Technological evolution has ensured the accelerated growth of the pharmaceutical industry. It is one of the fastest-growing segments among the already established markets. In 2020, it was valued at $1.27 trillion, and at the end of 2021, it was valued at $2.8 trillion, a 120.5% growth. Why such exponential growth?

The pharmaceutical industry mixes established blue-chip equities and little fast-growing biotech equities, making it a high-risk, high-return investment market. Therefore, the following pharmaceutical ETFs give you diversified exposure to this fast-paced industry while mitigating idiosyncratic risks.

What is the composition of pharma ETF?

Pharma ETFs comprise organizations operating within the pharmaceutical space; research, design, development, manufacture, sales, marketing, and distribution of pharmaceuticals, genomics, drugs, food production, and biofuels.

The best 3 pharma ETFs to achieve both portfolio growth and value

The pharmaceutical industry is heavily regulated, with organizations spending millions of dollars on developing products without guaranteeing their approval. The result is a highly volatile industry with a significant number of small cap and mid cap equities despite a few established blue-chip companies, making it a high-risk, high-return market. These three pharma ETFs expose investors to this high-growth industry and offer a chance to create portfolio value and growth.

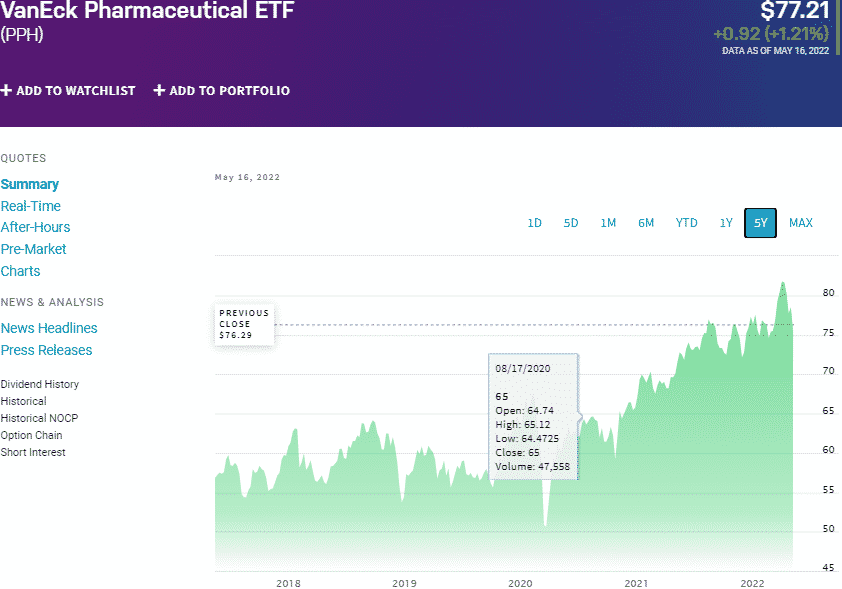

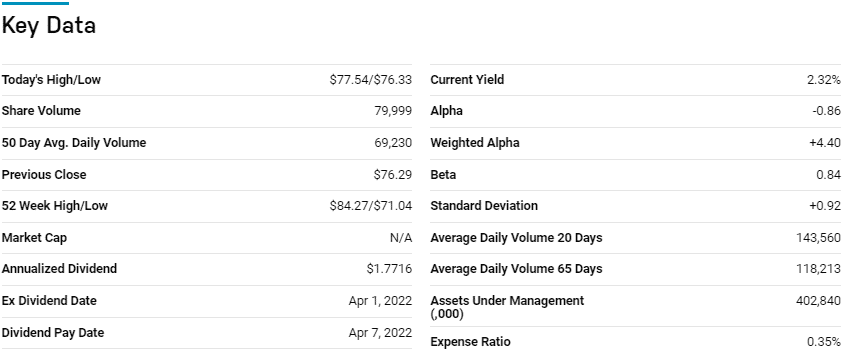

№ 1. VanEck Pharmaceutical ETF (PPH)

Price: $77.21

Expense ratio: 0.35%

Annual dividend yield: 1.63%

PPH chart

The VanEck Pharmaceuticals ETF tracks the yield and price performance of the MVIS® US Listed Pharmaceutical 25 Index, net of expenses and fees. It invests at least 80% of its net assets in equities making up the tracked index, including all associated depository receipts. It exposes investors to mid-capitalization pharma companies, including global companies in the same segment listed on US exchanges.

In a list of 52 health funds, the PPH ETF is ranked № 15 for long-term investing.

The top three holdings of this global pharma ETF are:

- Merck & Co., Inc. – 5.83%

- Bristol-Myers Squibb Company – 5.59%

- Eli Lilly and Company – 5.54%

The PPH ETF has $402.7 million in assets under management, with investors parting with $35 annually for a $10000 investment. Despite the top ten holdings accounting for more than 50% of the total fund weight, concentrating on US-listed, mid-cap, and small-cap equities has resulted in a resilient fund.

Incorporating a blended strategy that looks for value and growth ETFs across the developed markets ensures consistent value and growth creation; 5-year returns of 46.02%, 3-year returns of 37.68%,1-year returns of 8.21%, and an annual dividend yield of 1.63%.

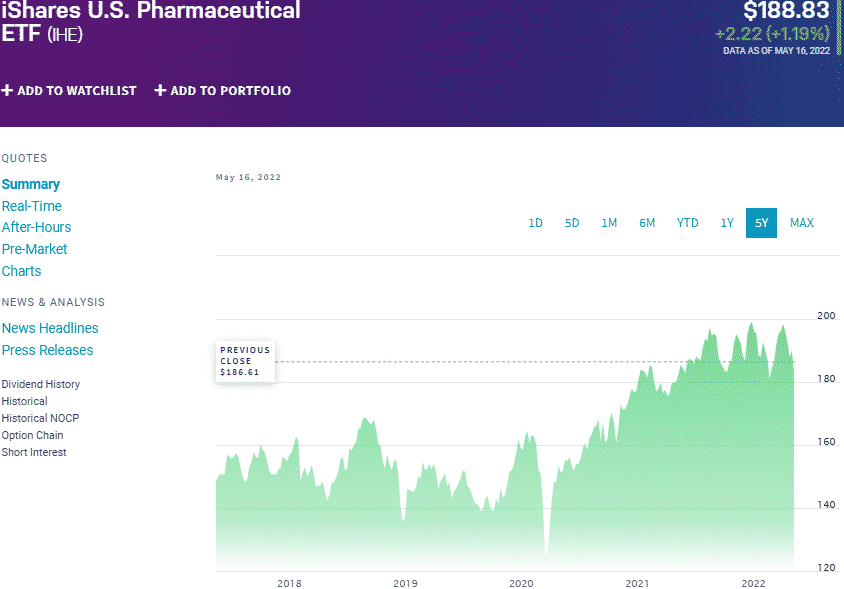

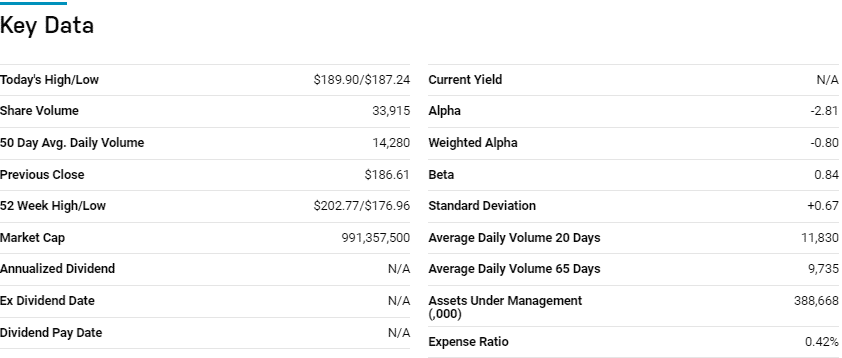

№ 2. iShares US Pharmaceuticals ETF (IHE)

Price: $188.83

Expense ratio: 0.42%

Annual dividend yield: 1.39%

IHE chart

The iShares US Pharmaceuticals ETF tracks the performance of the Dow Jones US Select Pharmaceuticals Index, net of expenses and fees. To meet its investment objective, it invests at least 80% of its total assets in the tracked index underlying holdings and other investment assets displaying similar economic characteristics to the composite index holdings’. It exposes investors to US companies involved in researching, designing, and manufacturing vaccines, over-the-counter, and prescription drugs, excluding vitamins.

In a list of 52 health funds, the IHE ETF is ranked № 20 for long-term investing.

The top three holdings of this pharma ETF are:

- Johnson & Johnson – 23.74%

- Pfizer Inc. – 21.26%

- Merck & Co., Inc. – 5.28%

The IHE ETF has $388.7 million in assets under management, with an expense ratio of 0.42%. This fund has the top three holdings accounting for almost 50% of the total fund weight. However, these holdings have their hands on several cookie jars and are established blue-chip companies with the financial muscle to withstand the market downturn.

The remaining 50% weighting is assigned to equities from all cap divides with growth and value attributes across the pharmaceutical biotechnology niches, ensuring consistent returns; 5-year returns of 32.14%, 3-year returns of 30.92%, 1-year returns of 3.47%, and a decent annual dividend yield of 1.39%.

№ 3. First Trust Nasdaq Pharmaceuticals ETF (FTXH)

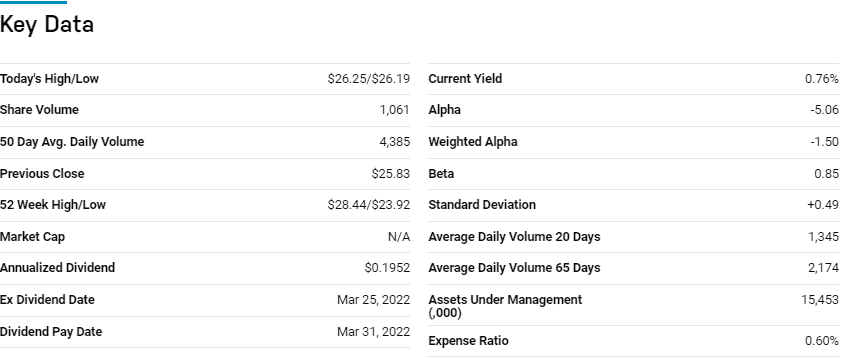

Price: $26.19

Expense ratio: 0.60%

Annual dividend yield: 0.86%

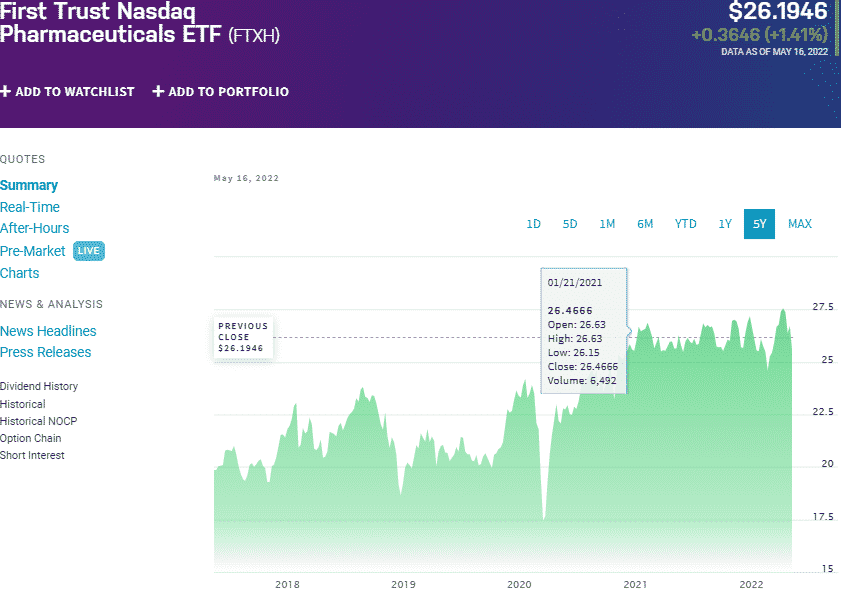

FTXH chart

The First Trust Nasdaq Pharmaceuticals ETF tracks the performance of the Nasdaq US Smart Pharmaceuticals IndexTM, net of expenses and fees. It invests at least 90% of its net assets in the tracked index underlying holdings and associated depository receipts, ensuring it tracks its composite index as closely as possible. A non-diversified fund exposes investors to the most liquid US-listed pharmaceutical equities.

The top three holdings of this pharma fund are:

- Bristol-Myers Squibb Company – 8.62%

- Johnson & Johnson – 8.39%

- AbbVie, Inc. – 8.11%

The FTXH ETF is the smallest fund on this list, with $15.5 million in assets under management, at an annual expense ratio of 0.60%. Despite such low investments under control, this fund screens its holdings based on their liquidity and then weights them using multiple indicators score; volatility, value, and growth.

The result is a highly liquid fund that provides both value and growth by concentrating on the 30 most liquid US pharma equities; 5-year returns of 33.76%, 3-year returns of 26.77%, and 1-year return of 1.45%, and an annual dividend yield 0.86%.

Final thoughts

Investing in small-cap and mid-cap equities is fraught with risk. These equities take a nig chunk of what makes the pharmaceutical industry, providing a high-reward high-risk investment opportunity. On the same breadth, lifestyle diseases are rising, creating an opportunity for all these pharmaceutical companies to leverage technological advancement to solve global health problems. The result is a high-paced growth industry with numerous investment opportunities, and the ETFs above are ahead of the pack to reap both value and growth.

Comments