Over the years, businesses and investors have expressed increasing concerns over issues affecting the environment and society. While most investors focus on profit-seeking, several business executives start thinking about the impact of climate change, for example, on business. In addition, companies now have a growing understanding that discrimination in the workplace and service provision are not generally acceptable.

That is why companies now integrate environmental, social, and governance (ESG) practices in the conduct of their business. At the same time, index providers started ranking companies based on how responsible they are with the environment, employees, customers, and other stakeholders. As a result, ESG investing has gained the attention of many as of late.

Therefore, if you want to invest responsibly to make a positive change to the world at large, consider putting your dollars in ESG funds. With due diligence, you will find that these investment options are accessible, affordable, and highly rewarding.

Three high-level ESG metrics

ESG investing is about putting your money in companies with high ESG ratings. You can get these ratings from research groups and third parties providing these figures. If you invest in ESG funds, you are in luck because these funds tend to perform well in both good and bad market conditions.

As the term suggests, ESG investing involves three criteria for evaluating companies:

-

Environment

With these criteria, you can check how a company impacts the environment in which it operates. This may include the discharge of toxic wastes to nearby bodies of water in its manufacturing plants, carbon footprint, and others. If a company treats water to remove hazardous chemicals before discharge, it means the company’s operations are environmentally friendly. This is one factor that boosts the company’s ESG score.

-

Social

Does the company promote social equality within the company and in the society where it belongs? These social factors may include fairness in staff hiring and promotion regardless of ethnic origin, eligibility in-company programs, and gender neutrality, among others. In addition, you can investigate if the company participates or initiates programs that benefit society. By looking into the company’s activities, you can infer the company’s disposition toward corporate social responsibility.

-

Governance

Do management and the board of directors bring about positive change? One of the things that make employees stay, apart from the reasonable pay, is support from management. Employees would appreciate it if management would provide a venue where they can voice their concerns and get solutions. Governance also covers diversity in leadership and executive pay.

How to invest in ESG funds

After some research, you might find that ESG investing is less stressful than stock investing. This is because you can let an index or fund manager pick suitable investments for you. Compared to checking each stock, searching for mutual funds online is a bit easier too.

If you are familiar with some fund companies or brokerages, you can narrow down your search by including them in your search queries. Of course, your search keywords should consist of something like “top 10 ESG funds in 2021”.

When investing in ESG funds that appeal to you, keep in mind the expense ratios involved. While a high ESG score is essential, you should consider the transaction cost as well. Over the years, the expense ratios have gone down already. However, compared to other types of funds, ESG funds have higher prices on average.

If you target specific ESG sectors, you might pay a slight premium to invest in those funds. This small surcharge is reasonable, though, since you are investing in your values. Just take note of this anyhow. If you get to pay an additional premium that does not translate to slightly better performance, this could diminish the returns you make over the long term.

Top 3 best ETFs on the ESG scale

Here are the top three ETFs in terms of ESG rating that you can consider in your investment decisions.

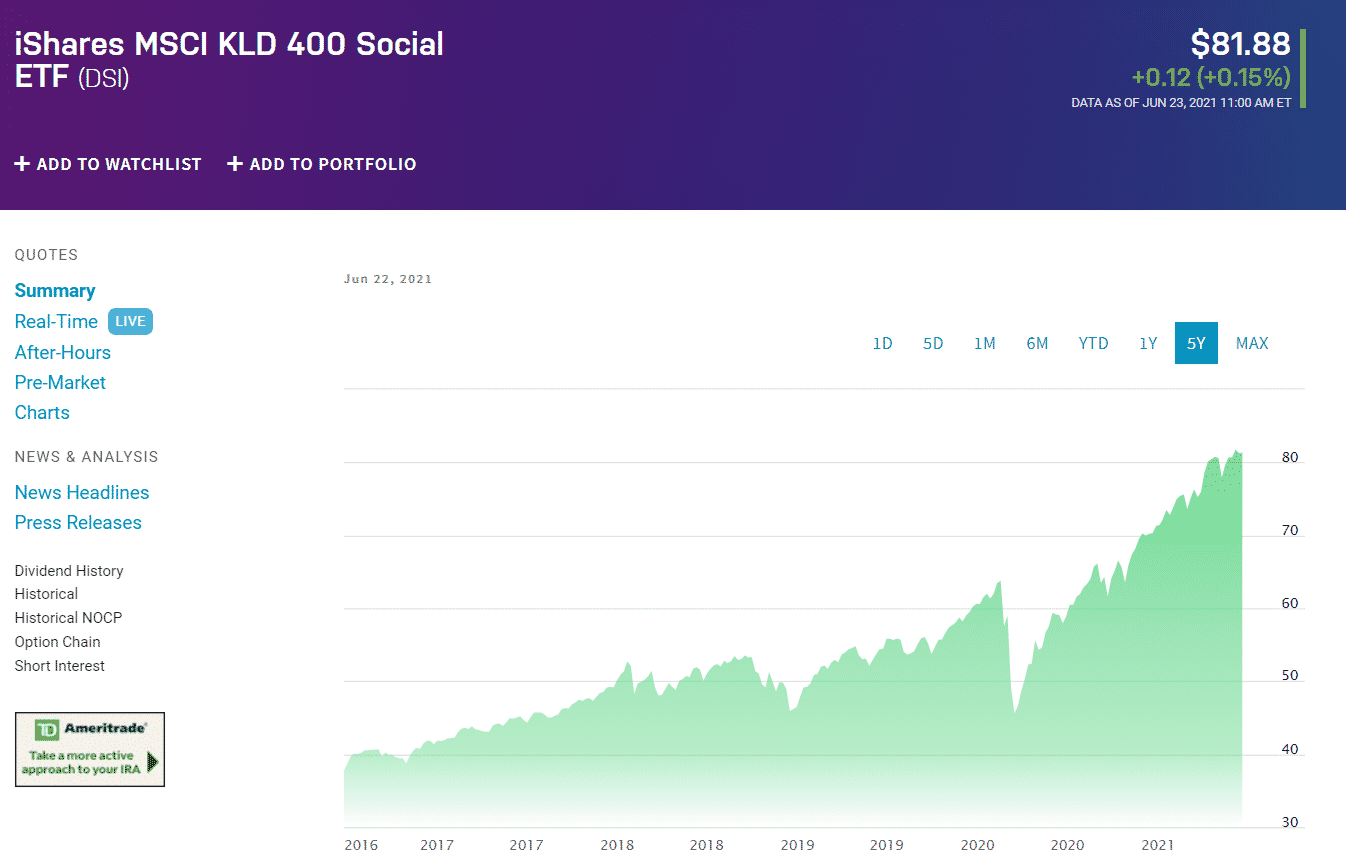

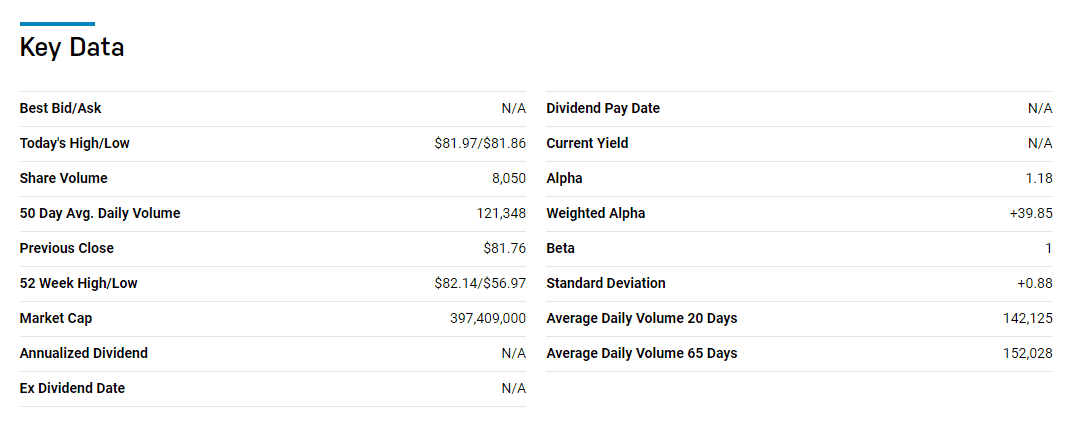

№ 1. iShares MSCI KLD 400 Social ETF (DSI)

This fund has nearly $2 billion worth of assets. With this fund, not only can you invest in a well-known socially responsible option, but it allows you to gain access to a fund with an enormous volume and size.

This fund gathers about 400 large companies in America that include big names such as Facebook and Microsoft. All these companies show off ESG ratings above the industry average. If you plan to invest in this fund, note that this ETF mainly focuses on technology companies.

About 45 percent of these stocks operate in the field of communication or information technology. Depending on your investment goals, you might find this information good or bad. Just be aware of this fact.

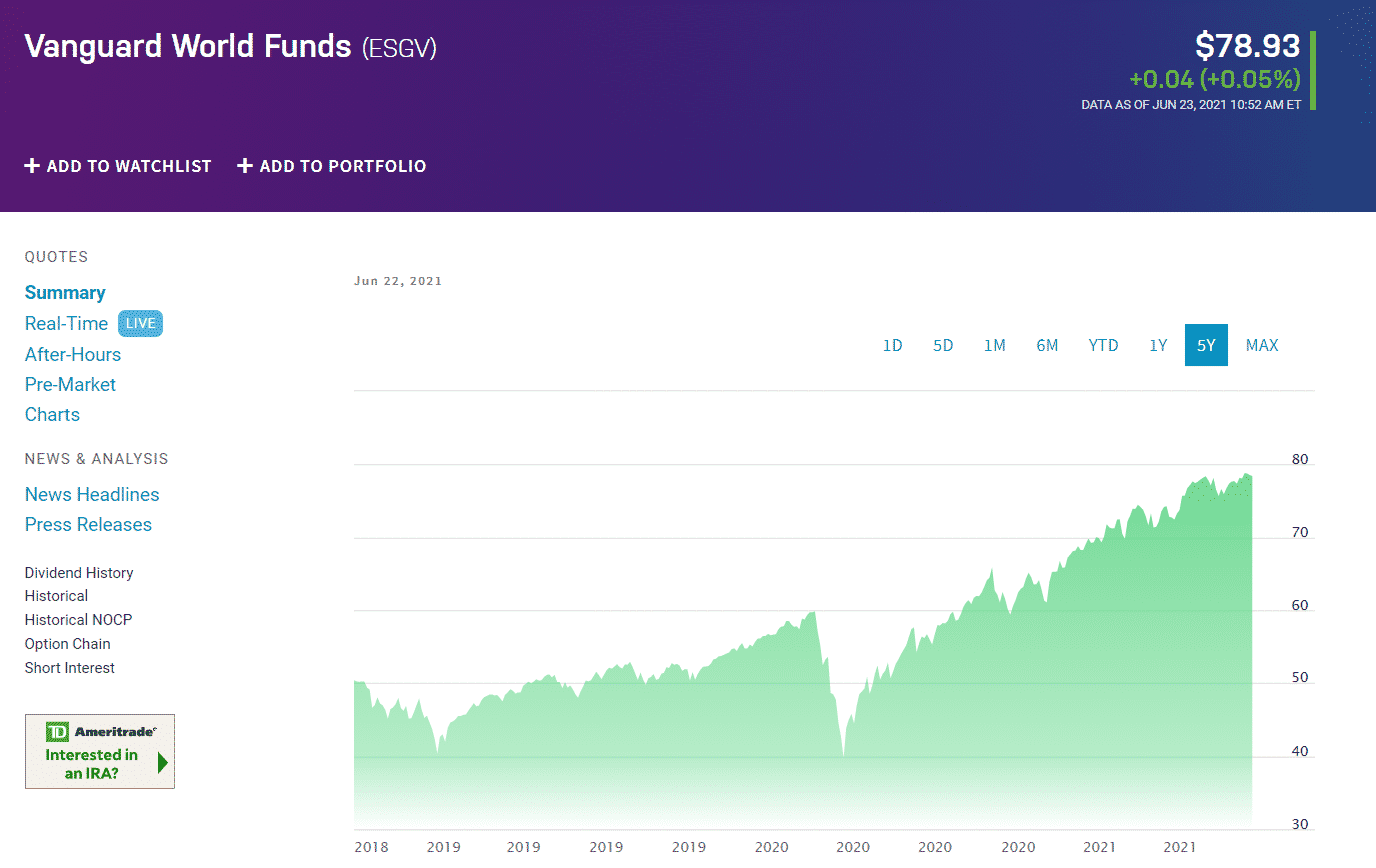

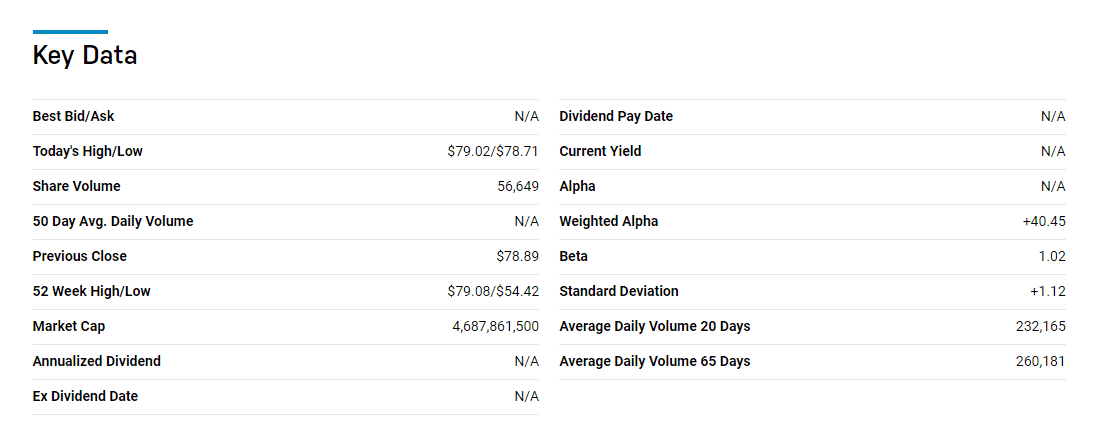

№ 2. Vanguard World Funds (ESGV)

This mutual fund holds a net asset of about $1.3 billion. Connected to a large holding with approximately 1,500 companies, Vanguard is no less significant in comparison to iShares.

Similar to iShares, Vanguard includes in its list those U.S. companies having ESG ratings above average. Due to the number of individual stocks that it holds, not all of these companies are big names.

Within the list are an array of lesser-known stocks that operate in various sectors. Still, you can find familiar names in this list as well, such as Apple.

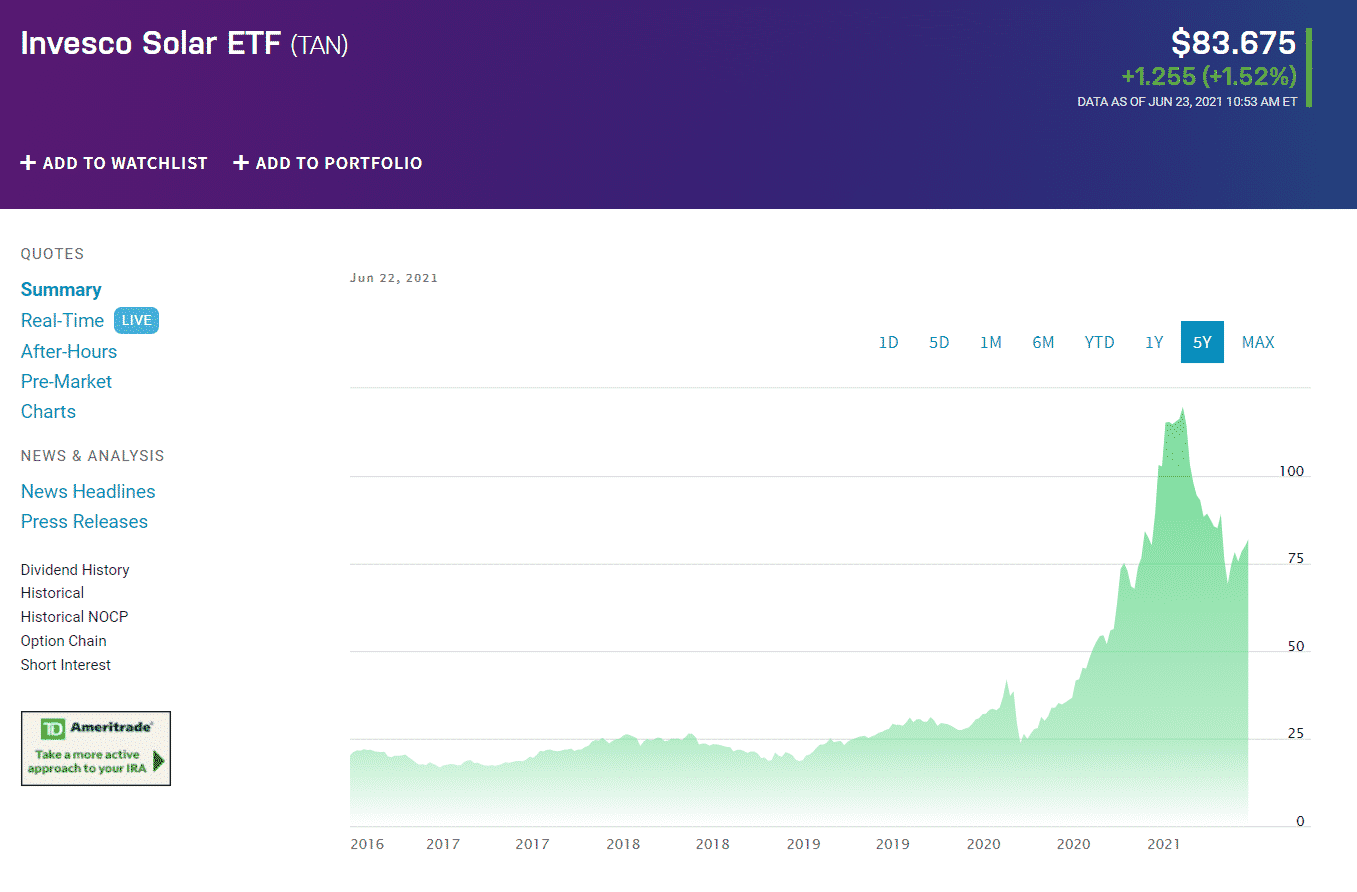

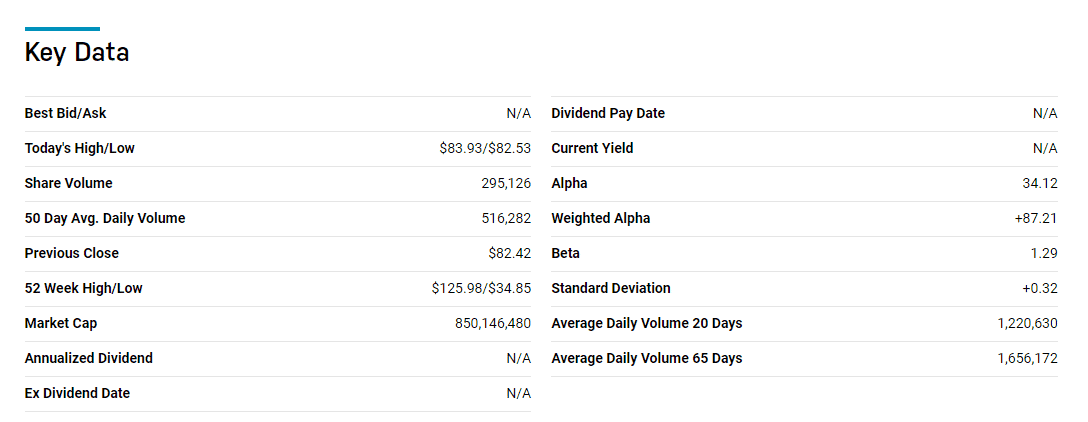

№ 3. Invesco Solar ETF (TAN)

This ETF has been in existence for more than ten years. As a socially responsible investor, you would be delighted to know that Invesco works in the solar energy industry. Of course, you have other popular options in this field, such as SolarEdge Technologies (SEDG) and First Solar (FSLR).

You can include these funds into your investment portfolio, along with Invesco. Just do not put all your investments in one type of sector. Be aware that sales in the solar industry considerably fluctuate from one year to the next.

Final thoughts

Many people think that ESG investing not only measures companies in terms of how they serve their stakeholders: community, employees, shareholders, customers, and the environment. How a company impacts society and the environment is a benchmark of quality ESG investing.

Executives integrating ESG practices into their companies make their companies robust to continue doing business far into the future. A company that strives to serve the five stakeholders stated above is simply a well-run company. Such a company is absolutely a good stock for investors to own.

Comments