Hunting for some stakes in the technology sector, market participants may invest in Exchange Traded Funds (ETFs) that track the Nasdaq. Trading in Nasdaq refers to investing in a tech-heavy Nasdaq composite index involving more than 2500 companies, including established, dominant, and struggling players. You can’t ignore the size and quality of these companies, as some of them have already reached a trillion-dollar market cap.

The Nasdaq 100 index is a place for several types of investors interested in tech stocks. Many of them are long-term investors who might be interested in a solid diversified portfolio and may like innovation and emerging markets. Among those companies, you need to find the potentially profitable ones to hold your investment for a particular time to make profits.

The pandemic in 2020 caused dramatic movements in several stocks, commodities, ETFs, and so on. May creates a chance for the tech and long-term traders to make enormous profits.

Here is a list of the top 10 potential Nasdaq ETFs to buy in 2021 based on their equity and recent growth.

What are Nasdaq ETFs?

Nasdaq 100 is another way for investors to track the broader Nasdaq Composite, which involves tracking the 100 largest non-financial companies listed on this stock exchange. This index covers the world’s largest tech companies, industrial stocks, biotechnology, healthcare, and retail.

Besides all these stocks, the Nasdaq 100 covers companies like soft drink maker PepsiCo Inc. (PEP) and video game maker Activision Blizzard Inc. (ATVI).

The Nasdaq 100 provided a total return of 52.7% in the past 12 months as it outperformed the border market, which is more than the S&P index (made 50% total return). Not just last year, this tech-heavy index has been outperforming for years as Nasdaq 100 made nearly 445% since the beginning of 2011. The Nasdaq 100 index began in 1985. Historically and even still, this index is dominated by tech stocks.

Top 10 Nasdaq ETFs to buy

Now move to the core part to see a summary of all ETFs to help you decide which instrument you should buy now.

- Invesco QQQ Trust (QQQ)

- ProShares UltraPro Short QQQ (SQQQ)

- ProShares Short QQQ (PQS)

- ProShares UltraPro QQQ (TQQQ)

- ProShares Ultra QQQ (QLD)

- Invesco Nasdaq NextGen 100 ETF (QQQJ)

- ProShares UltraShort QQQ (QID)

- Invesco Nasdaq Internet ETF (PNQI)

- Invesco NASDAQ 100 ETF (QQQM)

- Simplify Growth Equity PLUS Convexity ETF (QQC)

Now move to the core part to see a summary of all ETFs that will help you decide which instrument you should buy now.

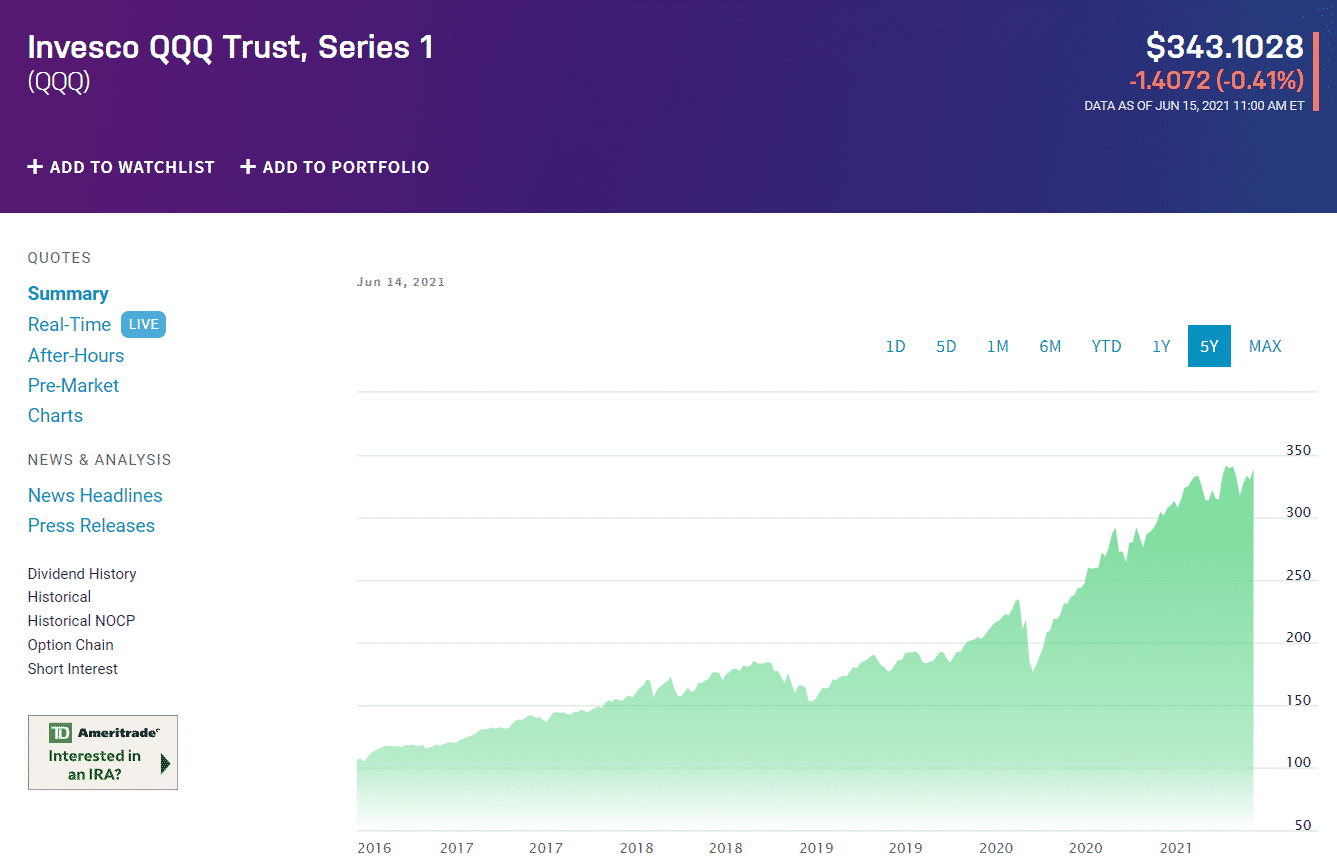

Invesco QQQ Trust (QQQ)

The issuer of this fund is Invesco and founded on March 10, 1999. The Invesco QQQ has become one of the most popular ETFs with assets under the management worth $161.26B. QQQ has huge tech exposure but not a pure tech fund.

Expense ratio

The expense ratio for this asset is not so much 0.20% that makes it more attractive to the investors who may want to invest in the long term. Less expense on management fees and larger trading volume make this ETF one of the most potential Nasdaq ETFs to buy in 2021.

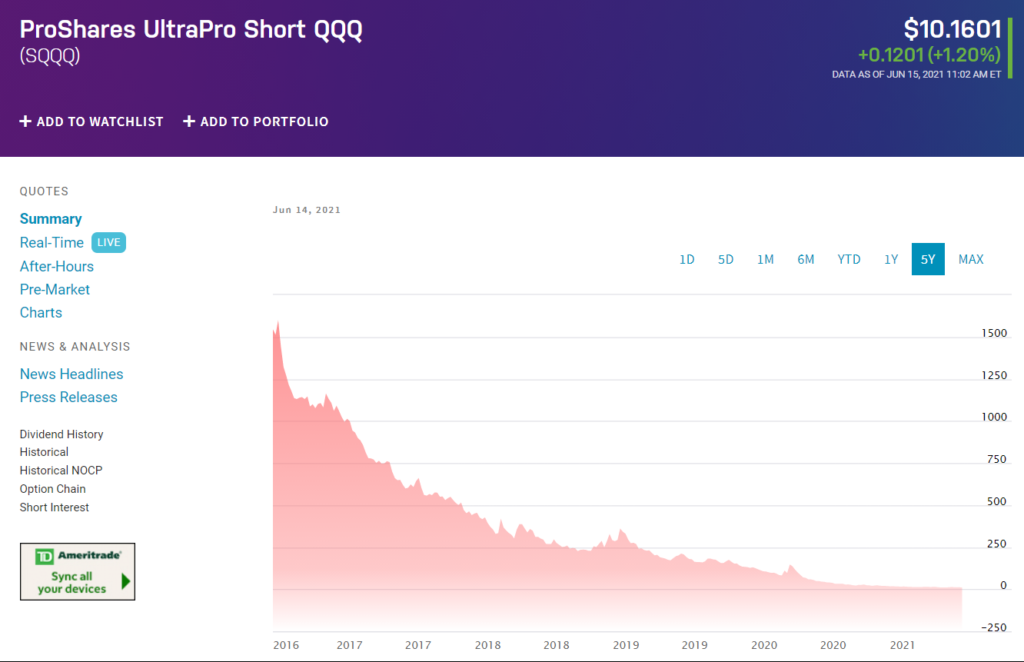

ProShares UltraPro Short QQQ (SQQQ)

ProShares UltraPro Short QQQ is the second on our list, with a market cap of 1.81B. This ETF has a 3x leverage facility, and like other inverse and leveraged products, it is designed to provide a daily basis exposure (not over a long time horizon). Index of SQQQ making a straight low recently that may open an opportunity to invest in this asset.

Expense ratio

The expense ratio for this asset is 0.95.

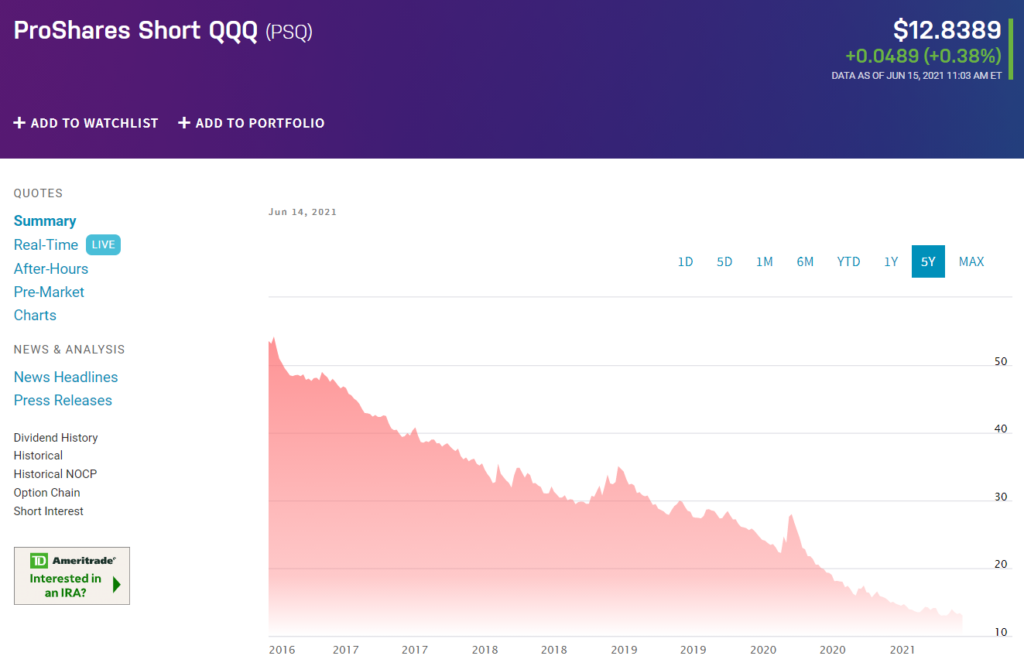

ProShares Short QQQ (PSQ)

The third on our list is ProShares Short QQQ (PSQ). The issuer of this Nasdaq ETF is also Proshares, which has assets under management worth $500.50M. The average (60 days) spread is 0.08% for this Nasdaq ETF.

Expense ratio

The legal structure of this asset is an Open-Ended Fund with an expense ratio of 0.95%. The recent falling chart may allow investing now and getting an accountable return by the end of 2021.

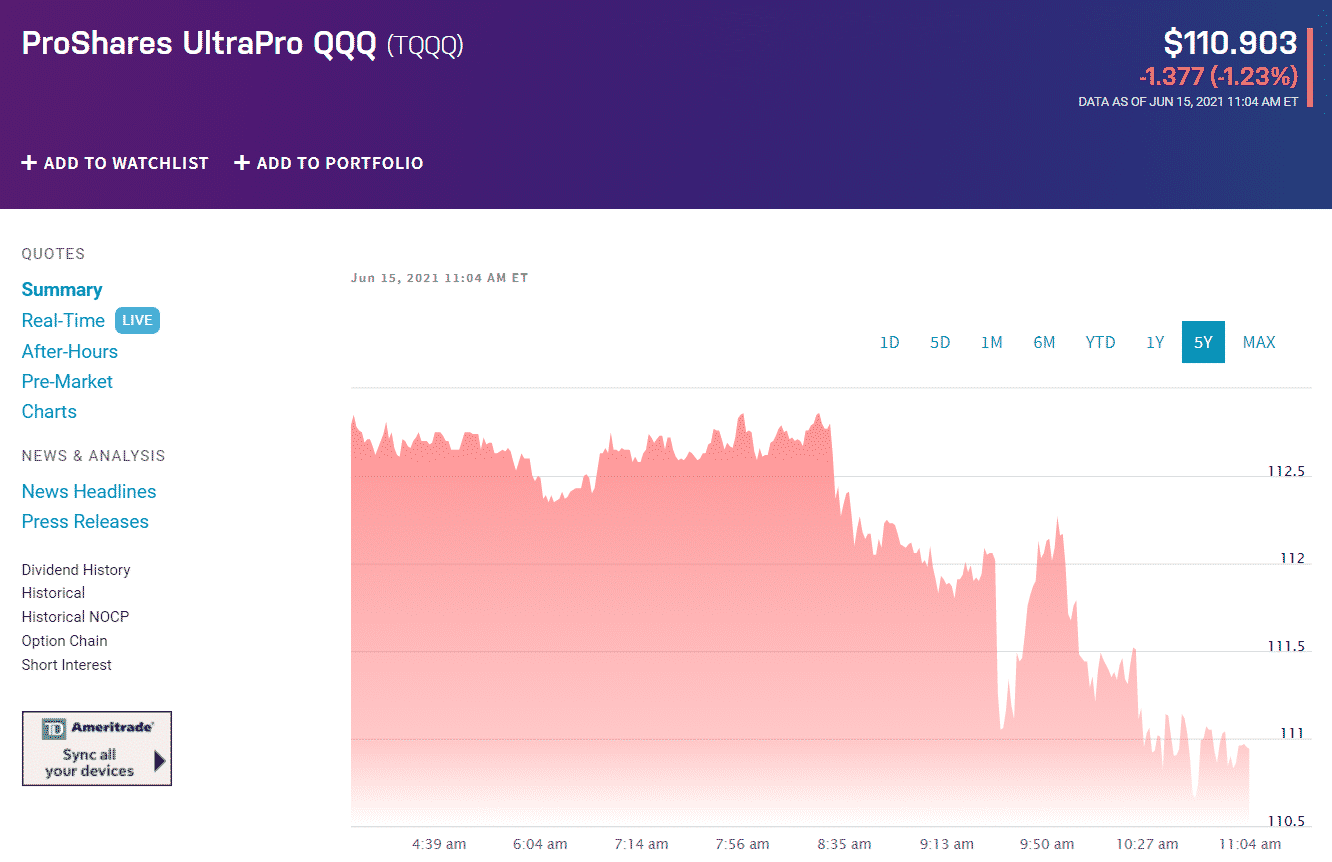

ProShares UltraPro QQQ (TQQQ)

ProShares UltraPro QQQ was also issued by Proshares, which was founded back on September 2, 2010. It has an open-ended structure and assets under management worth $11.81B.

Expense ratio

The expense ratio for this Nasdaq ETF is 0.95%, and the average (60 days) spread for this asset is as low as 0.01%. It is a short-term investment type fund, not like funds that buy and hold.

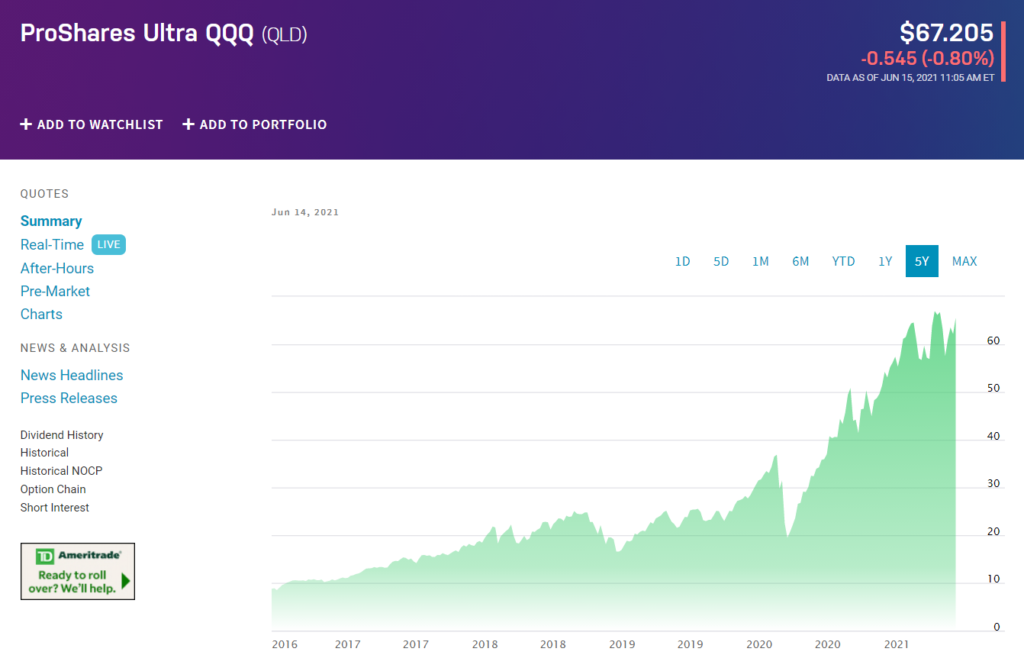

ProShares Ultra QQQ (QLD)

The issuer of ProShares Ultra QQQ (QLD) is also Proshares. Assets under the management of this fund are worth 4.40B. The inception date was June 19, 2006.

Expense ratio

This fund has an expense ratio of 0.95% and an average (60 days) spread of 0.02%. This fund is dominated by tech stocks and provides 2x leveraged exposure. The fate of QLD is related to the technology market; therefore, it’s a poor proxy for the broader US-large cap market.

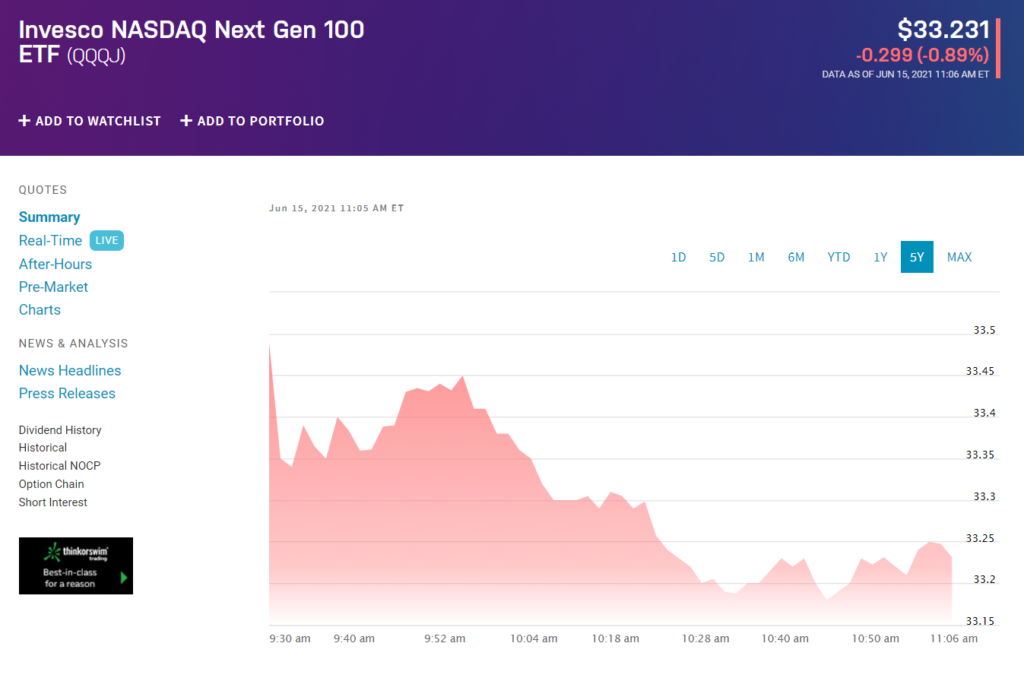

Invesco Nasdaq NextGen 100 ETF (QQQJ)

The issuer of Invesco Nasdaq NextGen 100 ETF (QQQJ) is Invesco. The inception date of this fund is October 13, 2020.

Expense ratio

It has assets under management worth 6.4M with an expense ratio of 0.15%. More than 46% of this fund comes from communication and technology. Additionally, it is less top-heavy than QQQ, as 22% of this fund comes from the top 10 Nasdaq stocks.

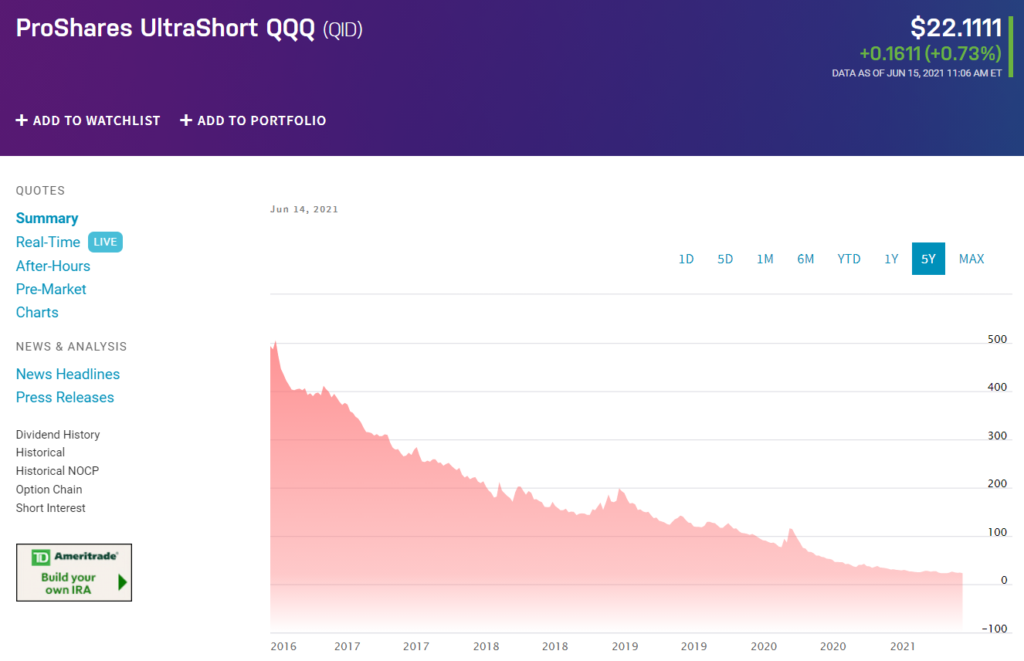

ProShares UltraShort QQQ (QID)

The next on our list is ProShares UltraShort QQQ (QID), founded on November 7, 2006. The issuer of this fund is also Proshares which has assets under management worth $212.72M.

Expense ratio

This fund has an expense ratio of 0.95% (same as PSQ), and the average (60 days) spread is 0.04%. It is a more aggressive version of its similar type of fund, PSQ. Both tracks Nasdaq 100, but it provides -2x exposure compared to PSQ’s -1x.

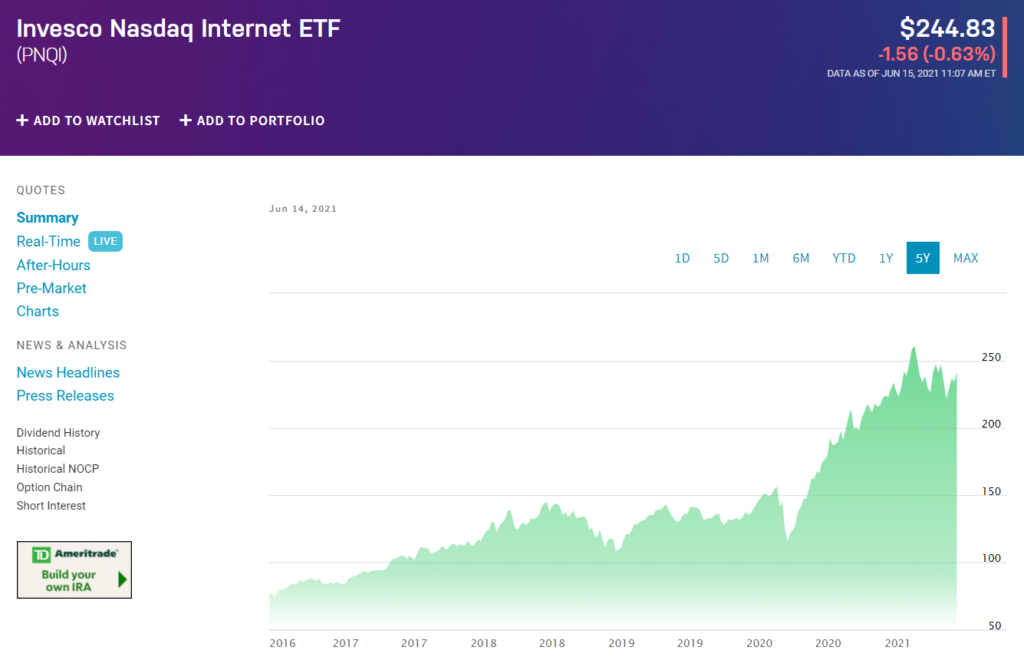

Invesco Nasdaq Internet ETF (PNQI)

The internet has become an essential part of life. The next on our list is Invesco Nasdaq Internet ETF. The inception date for this fund is December 6, 2008. This fund generally tracks companies’ performances engaged in internet-related business and listed on the New York Stock Exchange (“NYSE”).

Expense ratio

The expanse ratio of this fund is 0.60%.

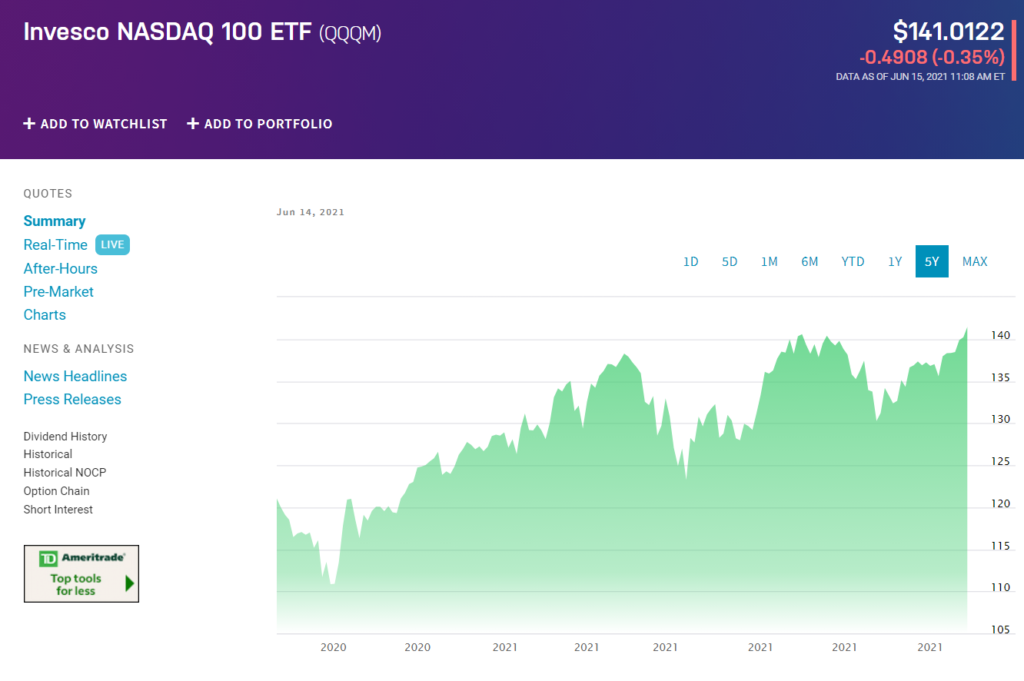

Invesco NASDAQ 100 ETF (QQQM)

Invesco NASDAQ 100 ETF (QQQM) is also known as a smaller version of QQQ. The issuer of this fund is Invesco, and its inception date was October 10, 2020. This fund is rebalanced quarterly and reconstituted annually.

Expense ratio

This fund has assets under management worth $975.83M with an expense ratio of 0.15%.

Simplify Growth Equity PLUS Convexity ETF (QQC)

The last of our list’s top 10 Nasdaq ETFs is Simplify Growth Equity PLUS Convexity ETF (QQC). The issuer of this index is Simplify Asset Management Inc. which was incepted on October 12, 2020.

Expense ratio

Assets under management of this fund are worth $2.79M with an expense ratio of 0.45%.

Conclusion

Finally, this informative article might help you understand the Nasdaq ETF market and make you familiar with some of the best Nasdaq ETFs to buy. Nasdaq 100 involves the best tech companies such as Amazon, Apple, Microsoft, Alphabet, etc.

Before investing your money in ETFs, you must choose your broker carefully, have a stable strategy and trade management.

Comments