ETF full name: Roundhill Ball Metaverse ETF (META)

Segment: Equity: Global Internet

ETF provider: Roundhill Investments

| META key details | |

| Issuer | Roundhill Investments |

| Dividend | N/A |

| Inception date | 21 June 2021 |

| Expense ratio | 0.75% |

| Management company | Ball Metaverse Research Partners |

| Average 3-5 EPS | N/A |

| Average Annualized Return | The fund is less than one year in existence |

| Investment objective | Investment in globally-listed equities which are considered future iteration of the internet |

| Investment geography | Global |

| Benchmark | Ball Metaverse Index |

| Leveraged | N/A |

| Median market capitalization | $70.9 Billion |

| ESG rating | 5.36 / 10 |

| Number of holdings | 41 |

| Weighting methodology | Tiered |

About the META ETF

The Roundhill Ball Metaverse ETF inception was on 21 June 2021. The fund trades under the symbol META on the New York Stock Exchange. The META fund tracks the Ball Metaverse index, and the objective of the fund is to provide investors exposure to the Metaverse.

The equities in the META fund are defined as Metaverse, which includes seven categories: hardware, computer, networking, virtual platforms, interchange standards, payments, assets, and identity services. The fund caps these at 25%, and the index is tiered-weighted into pure-play, core, and non-core.

META Fact-set analytics insight

The META fund has a median market cap of $70.9 billion, and the fund has $289 million assets under management. In terms of management fees, the META fund has an expense ratio of 0.75%.

META performance analysis

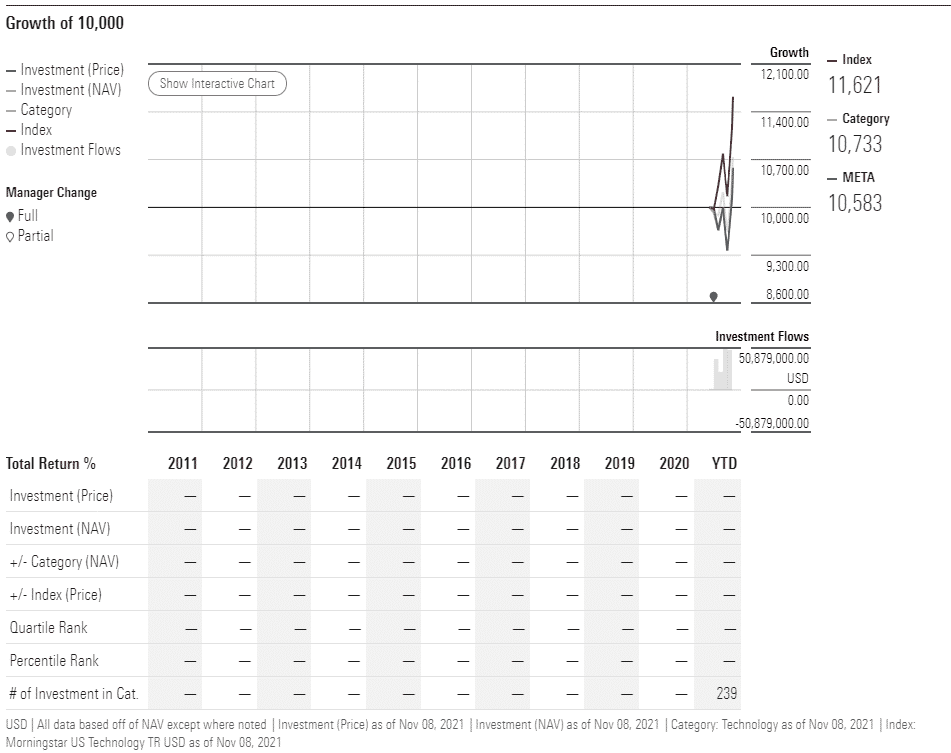

The META fund is new and has only been active for six months. Therefore, it does not have annual returns to date. However, the fund had a three-month return of 10.66%.

The fund has no dividends due yet. The ESG rating for the META fund is 5.36 out of a score of 10.

META ETF RATING |

|||||

| Resource | ETF DATABASE | ETF.com | MarketWatch | Morningstar.com | Money.usnews.com |

| META Rating | N/A | N/A | N/A | N/A | N/A |

| META ESG Rating | 5.36 / 10 | 5.36 / 10 | N/A | N/A | N/A |

META key holdings

The META ETF has 41 holdings. The geographical footprint of the fund includes investments in equities based in the USA, Hong Kong, Taiwan, Singapore, Japan, France, Korea, Sweden, and China.

In terms of the top five sectors, the META ETF invests in semiconductors (29.32%), software (23.07%), internet services (13.24%), IT services (9.21%), phones and handhelds (3.71%).

The top ten holdings are listed below.

| Ticker | Holding name | % of assets |

| NVDA | NVIDIA Corporation | 10.38% |

| MSFT | Microsoft Corporation | 7.20% |

| RBLX | Roblox Corporation | 6.25% |

| FB | Meta Platforms Inc. | 6.04% |

| U | Unity Software Inc. | 5.34% |

| ADSK | Autodesk Inc. | 4.46% |

| AMZN | Amazon.com Inc. | 3.88% |

| SE | Sea Ltd. (Singapore) | 3.76% |

| TWD | Taiwan Semiconductors | 3.56% |

| TCEHY | Tencent Holdings | 3.53% |

Industry outlook

The META ETF is an innovative investment led by Matthew Ball of EpyllionCo. They teamed up with Roundhill investments to create the ETF. The premise behind the META ETF is for people to invest in companies already working towards metaverse creation.

The fund, although pretty new, already surpassed the $250 million AUM. Analysts predict the price to reach $20 per share as metaverse investments grow continually.

Comments