The increasing demand for crypto asses makes them volatile, which usually moves a lot more than other financial assets like currency pairs, stocks, or commodities. So no wonder that this crypto industry is attractive to short-term traders or day traders, and they are using the best charting tools to make constant profitable trading positions.

However, there are many charting tools you can find on your platforms, but it is mandatory to know about the best tools and the use procedure to obtain the best results. This article will list the top five crypto day trading tools that will help you catch the most potent short-term trades.

What is crypto day trading?

The primary goal of day trading is to perform trades without holding overnight and making regular profits. It usually participates in trades that involve buying and selling within a day. Day traders often perform trades in the first hour of the market opening and the last thirty minutes of the market sessions as assets remain most volatile in these periods.

You can trade crypto assets 24/7. Meanwhile, the European market opens at 7:00 AM GMT, and the United States market opens at 2:30 PM GMT.

Crypto day trading strategies

BTC day trading

Crypto traders follow several techniques for day trading, including scalping, swing trading, etc. All strategies involve using several tools and different approaches in the marketplace:

-

Technical analysis

It is popular with crypto day traders. Digital currencies investors use many chart patterns and indicators to determine the market context alongside identifying the best trading positions.

-

Fundamental analysis

It involves learning the supply-demand and micro-and macroeconomic data for any trading asset to anticipate the future direction of price movements. You can consider the news about commercial uses of any crypto coin or new blockchain upgrades as fundamental data for crypto assets. Cause these factors affect the demand-supply of that asset. Many market participants combine fundamental data with technical analysis to determine the best trading positions.

-

Copy-trading

It is a method that allows individual market participants to copy the trade executions of successful traders in real-time. For example, the world’s largest copy trading platform, eToro, has 20+ million users worldwide.

Top five day trading tools for professionals and novice traders

This part will list the top five tools that successful crypto day traders use.

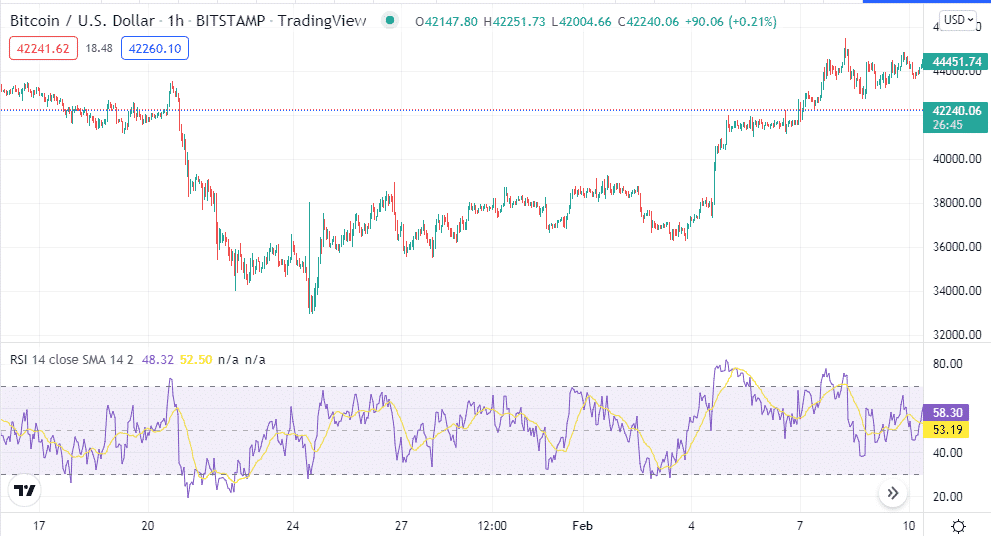

Relative Strength Index (RSI)

The first crypto day trading tool on our list is RSI. This indicator shows results on an independent window that contains a dynamic signal line that moves within or beyond three levels.

RSI indicator

When the dynamic line reaches the upper line or above it, that represents the overbought condition on the asset price, and maybe a possible selling pressure is coming and vice versa. Traders often use the divergence of the dynamic line to determine trading positions.

Is it useful for copy traders?

Copy traders can use the logic of this technical tool on several time frames and combine it with any other tool when seeking the best trading positions.

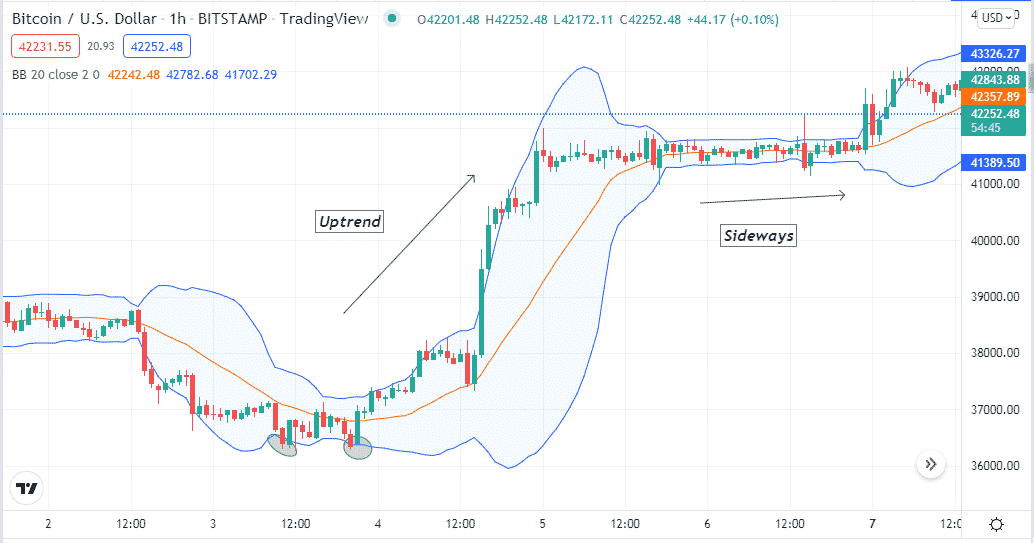

Bollinger Bands (BB)

BB is another top crypto day trading tool on our list. It contains three bands on the main chart, and price movement occurs within these bands. These bands help declare dynamic support resistance levels alongside overbought and oversold levels.

When the price reaches the lower band, it indicates that the asset’s price reaches a support level or oversold condition, and a possible bull pressure is coming. Moreover, the price moves sideways when these bands come closer, and a potential swing force is coming. When bands are wider, it declares more volatility.

BB indicator

However, the price can remain on any band for a certain period and no guarantee that reversal will occur at the moment when the price touches any band.

Is it useful for copy trading?

Copy traders can use the concept of this tool to anticipate future price movements and determine the best trading positions.

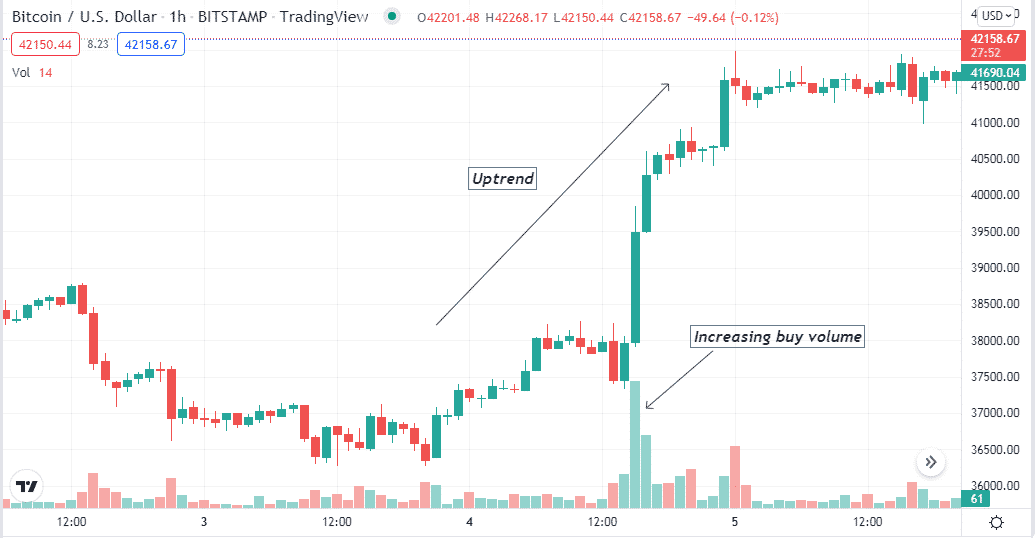

Volume indicator

Volume data is beneficial to obtain the market context. It is an easy applying trading indicator for any novice trader or professional. It shows the buying and selling volume of a specific period.

Volume indicator

When the buying pressure increases, it creates green and red bars when the selling pressure increases. A higher volume in any direction declares a strong trend and vice versa.

Is it useful for copy trading?

Copy traders can use the concepts of this tool to determine market context, trend directions, valid breakouts, etc. Then combine that info with other tools to make invincible trading methods.

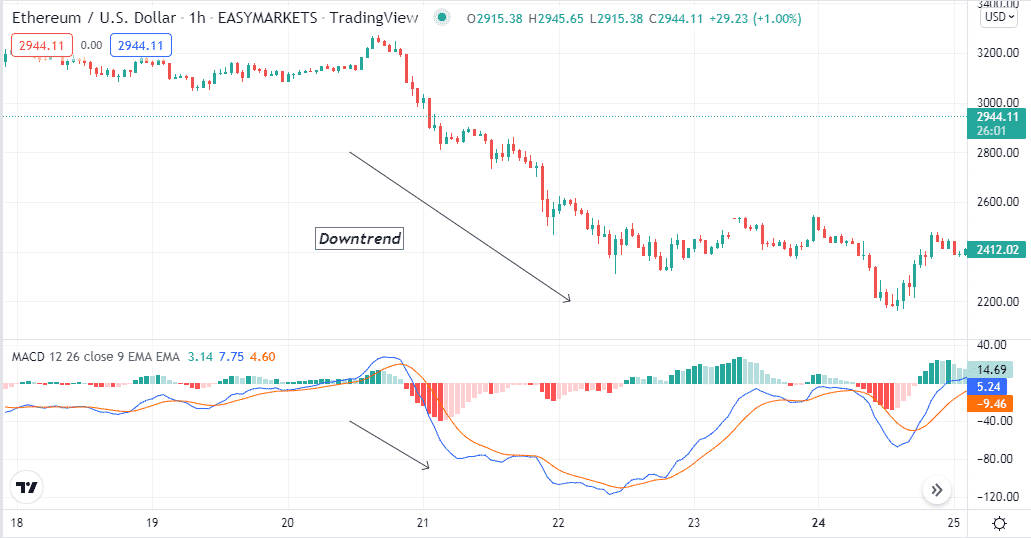

MACD

This indicator shows results on an independent window that contains two dynamic lines and histogram bars on both sides of a central line. It is a popular trading tool for day traders. Not just in crypto trading, financial market participants from various sectors use this tool to identify potential trades such as currency, commodity, stock trading, etc.

MACD indicator

When the dynamic blue line crosses the dynamic red line on the upside, it declares initiation of bullish momentum and vice versa for the exact opposite crossover. Meanwhile, green histogram bars take place above the central line, and red histogram bars take place below that line for downward price movements.

Is it useful for copy trading?

MACD is a handy tool for copy trading practice.

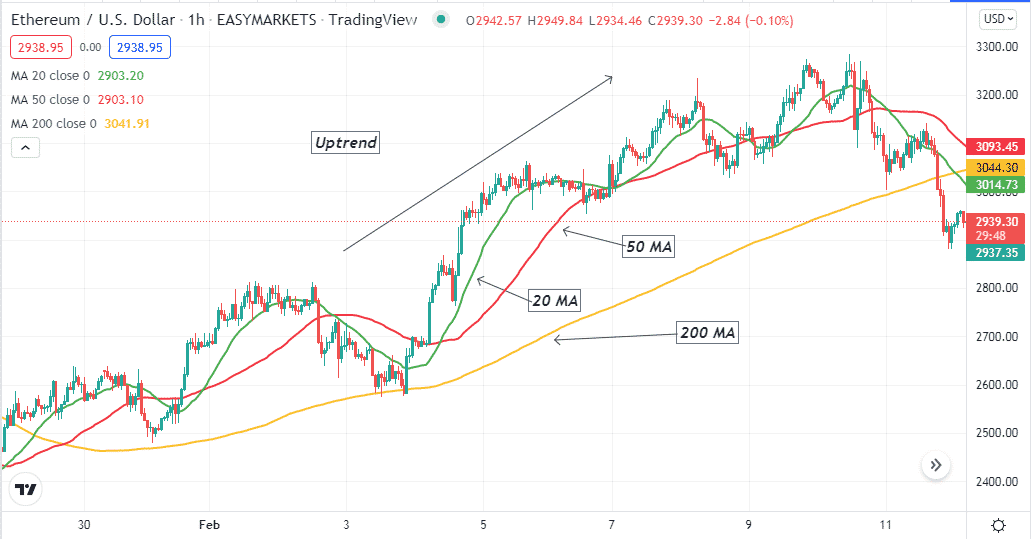

Moving average (MA)

MA is the last helpful day trading tool on our top five list. Crypto traders often use crossovers between two MA lines to determine trading positions and identify trends through an MA line. When MA line with ower value crosses an MA line with a higher value on the upside declares a bullish momentum, the exact opposite crossover expresses a downward pressure on the asset price.

MA concepts

For example, when the green MA (20) crosses the red MA (50) upside, it initiates a bullish trend. Meanwhile, the price remains above the yellow MA (200), which declares the price is at a bullish trend.

Is it useful for copy trading?

Copy traders often use these MA concepts to generate ultimate profitable trading ideas.

Pros and cons

| Pros | Cons |

|

|

|

|

|

|

Final thought

Finally, these are the best tools to generate short-term or day trading ideas for crypto assets. You can use multiple tools and combine all information to catch the most potential trades.

Comments