It does not mean that this market corner has come out of the pandemic unscathed. The one thing the coronavirus pandemic has not been able to change is the appetite the global populace has; they have to feed to function. The way diners and consumers access food has evolved, setting the stage for new opportunities for this segment, which means more upside and profitability for savvy investors. Thus, since the pandemic, approximately 70% of the eat-out sales revenues have been attributed to food chains’ delivery services.

The problem with investing in this segment is the cutthroat nature of this industry results in many equities winding up within the first three years. How do you invest then in this industry without risking portfolio wipeout?

Food ETFs are the answer, and the three below give you diversified exposure to this multi-trillion-dollar industry with the potential for more upside than meets the eye.

What is the composition of food ETFs?

Food ETFs comprise equities operating within the food segments; manufacturing of agricultural machines for food production, marketing, sales, and delivery of food, alcohol, beverages, groceries, and cigarettes.

The best 3 food ETFs that offer more upside than meets the eye

The worst thing about the food segment is that being a necessity, you cannot do without food, especially for consumer staples. If you have been at a grocery store or the pump lately, you know you have to part with much more than what you are used for on any particular product. The beauty in investing in this segment is that most food ETFs combine consumer staples and cyclical equities, resulting in mitigated volatility. With rising inflation and the Ukrainian war, these three food ETFs can help you harvest returns as prices continue to soar.

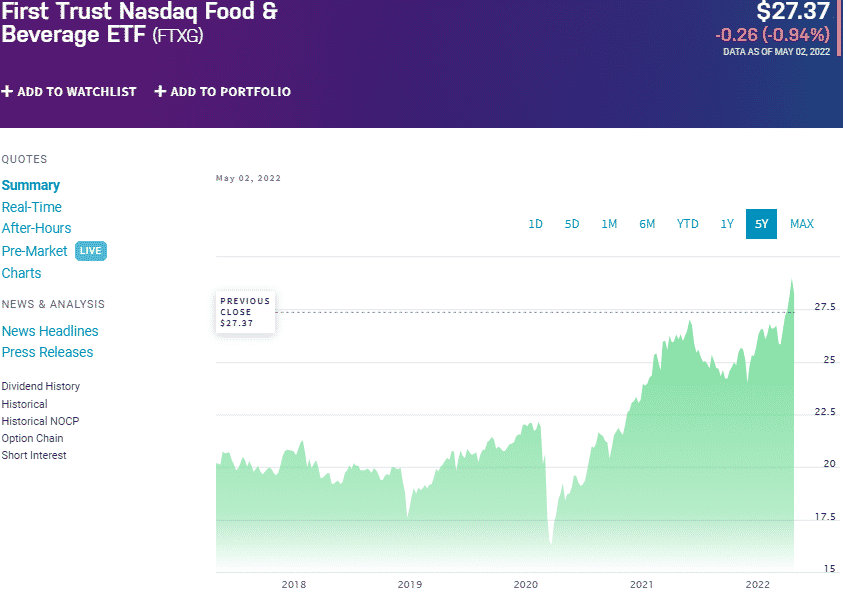

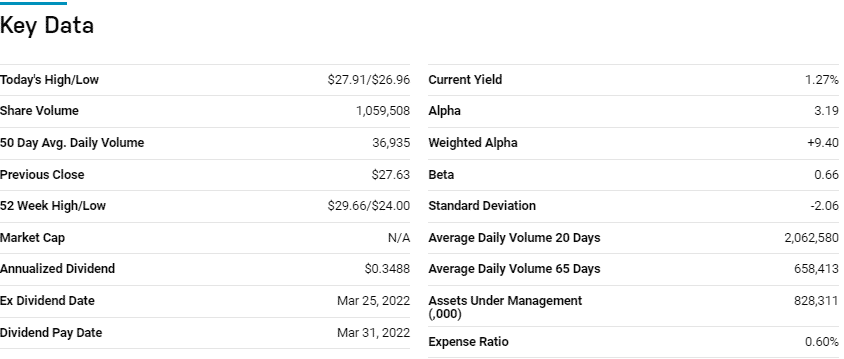

№ 1. First Trust Nasdaq Food and Beverage ETF (FTXG)

Price: $27.37

Expense ratio: 0.60%

Dividend yield: 1.36%

FTXG chart

The First Trust Nasdaq Food and Beverage ETF tracks the yield and price performance of the Nasdaq US Smart Food & Beverage IndexTM, investing at least 90% of its net assets, including debt capital, insecurities of its composite index, and their associated depository receipts. This non-diversified fund exposes investors to equities operating in the consumer food and beverage segments.

Among 15 of the best consumer defensive ETFs, FTXG is ranked No. 5 for long-term investing by USNews.

The top three holdings of this food ETF are:

- Archer-Daniels-Midland Company – 8.75%

- Bunge Limited – 8.30%

- Papa John’s International, Inc. – 5.86%

The FTXG ETF has only $828.4 million in assets under management, with investors having to cough up $60 annually for a $10000 investment. Historical analysis on volatility, strong growth based on positive 12-month price returns, and desirable value based on positive cash flows to price ratio results in thirty of the best equities operating within the food and beverage segments.

Utilizing a multi-factor liquidity-based weighting methodology provides resilience and consistent returns; 5-year returns of 44.60%, 3-year returns of 41.92%, 1-year returns of 7.63%, and current year-to-date returns of 7.10%.

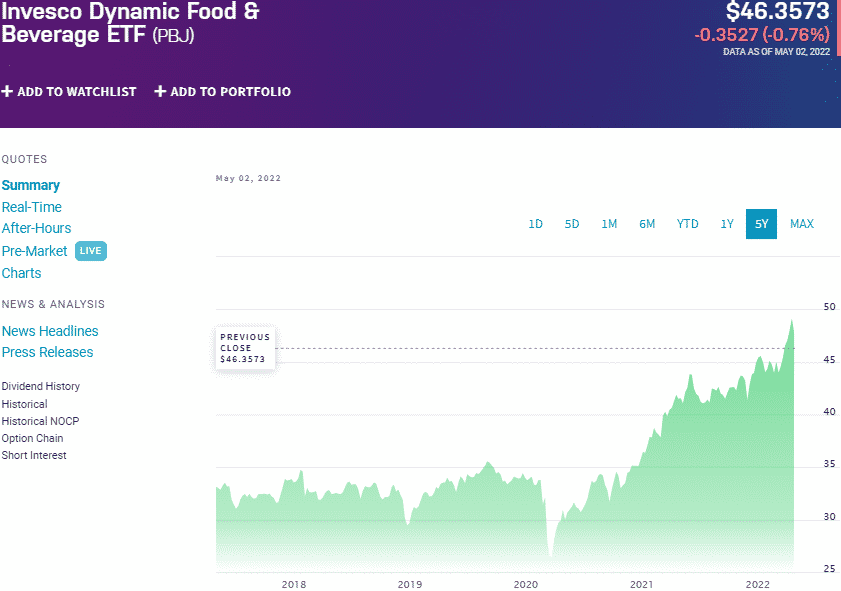

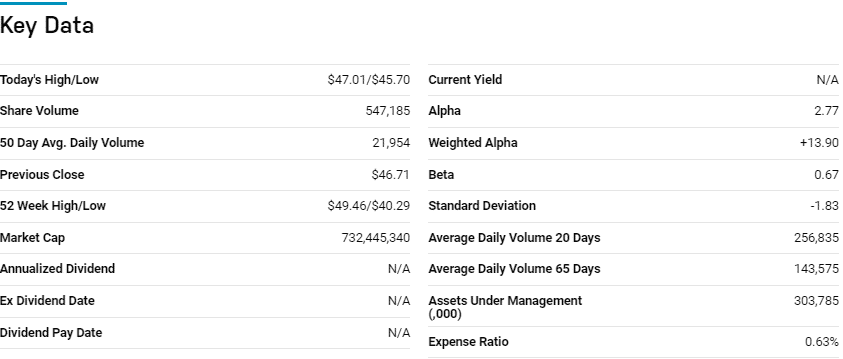

№ 2. Invesco Dynamic Food and Beverage ETF (PBJ)

Price: $46.35

Expense ratio: 0.63%

Annual dividend yield: 0.73%

PBJ chart

The Invesco Dynamic Food and Beverage Fund track the performance of the Dynamic Food & Beverage IntellidexSM Index, investing at least 90% of its total assets in the holdings of the composite index. Investors get exposure to organizations that manufacture, sell, market, and distribute food and beverage products, products related to the development of new food technologies, and agricultural products.

Among 15 of the best consumer defensive ETFs, FTXG is ranked No. 7 for long-term investing by USNews.

The top 3 holdings of this food ETF as of now are:

- Archer-Daniels-Midland Company – 5.53%

- Constellation Brands, Inc. Class A – 5.37%

- Hershey Company – 5.28%

The PBJ has $309.5 million in assets under management, with investors having to part with $63 annually for every $10000 investment. Combining both cyclical and consumer staples equities and a rigorous quantitative-based equity screening methodology ensures holdings that generate positive alpha.

The result is a fund capable of withstanding market downturn and providing returns consistently; 5-year returns of 46.70%, 3-year returns of 43.71%, 1-year returns of 13.30%, and current year-to-date returns of 3.84%.

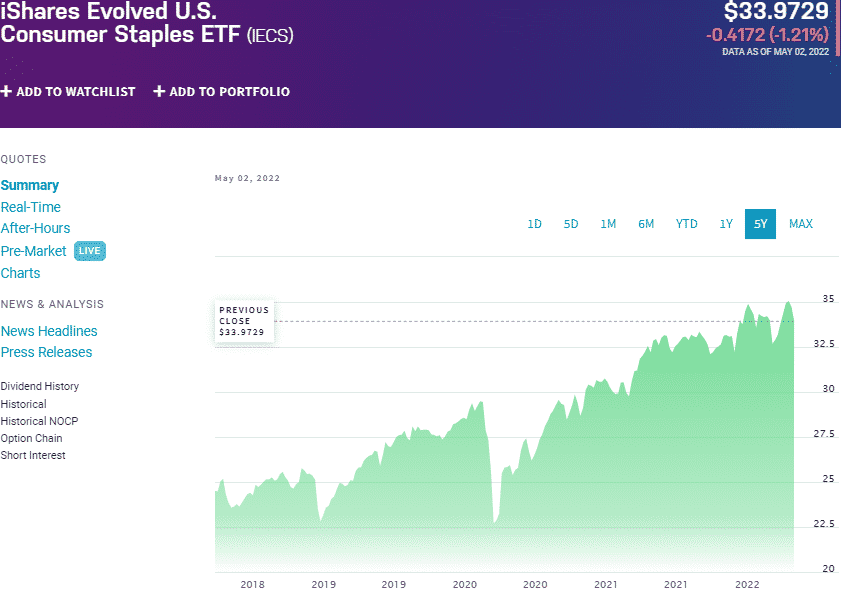

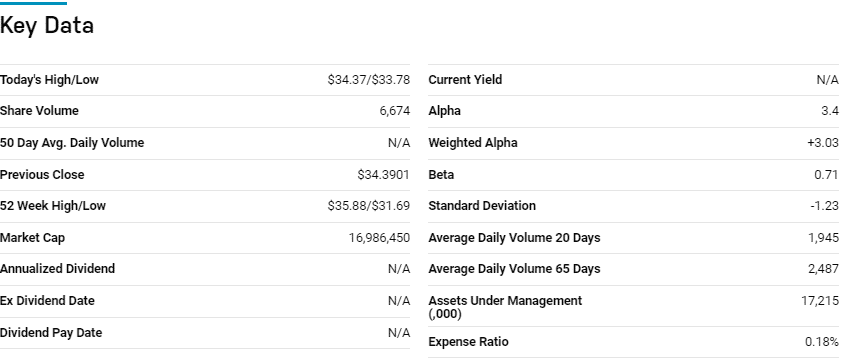

№ 3. iShares Evolved US Consumer Staples ETF (IECS)

Price: $33.97

Expense ratio: 0.18%

Dividend yield: 2.28%

IECS chart

iShares Evolved US Consumer Staples ETF is an actively managed fund that seeks capital appreciation by investing at least 80% of its net assets in the US-listed common stock operating within the consumer staples segment.

The top three holdings of this ETF are:

- Coca-Cola Company – 11.81%

- PepsiCo, Inc. – 10.71%

- Procter & Gamble Company – 8.46%

The IECS ETF has $17.6 million in assets under management, with an expense ratio of 0.18%. It uses data science and text analysis to group equities into the evolved consumer segment.

The result is a fund that invests in the next generation food technology and incorporates equities from the cap divide, ensuring both value and growth; 3-year returns of 39.90%, 1-year returns of 8.01%, current year to date returns of 1.22%, and a more than the decent annual dividend yield of 2.28%. Active management of this fund allows the administration to invest in the emerging food trends and technologies, making it ideal for the current consumer taste-changing environment.

Final thoughts

The truth is that the food segment features equities that aren’t glamorous. However, the insatiable demand of the consumer staples segments provides for inflation-hedged investment assets that can defend portfolios in the current environment.

In addition, they have a history of enviable dividend growth, which also adds to the investor’s bottom line and can be used for accelerated wealth accumulation. The three food ETFs above provide a diversified play on this segment and are in pole position to offer more upside potential than meets the eye.

Comments