Financial experts and investment gurus all agree that investing and trading is 90% psychology and emotions. Note that this does not mean picking any investment vehicle with the blinders on and managing your emotions, hoping for the best.

The one constant about any economic sector is that in the long run, it will grow. However, this growth journey is full of market setbacks due to extenuating circumstances. Therefore, do you liquidate a position in a market downturn and invest afresh in bullish markets, or is there another option?

There are two other options, shorting the markets or investing in inverse ETFs. Market shorting involves borrowing and selling an asset today, hoping that prices decline and you repurchase them at a lower price. There are a lot of assumptions when it comes to shorting and more variables unaccounted for, which is why inverse ETFs came to mitigate against inherent risks of market shorting.

Best Nasdaq inverse ETFs: how do they work?

By definition, exchange-traded funds are a pool of investment assets exhibiting similar characteristics that track an index made up of holdings of similar economic characteristics to the ETF pool. The norm is for the fund to invest in the underlying holdings of the tracked index, therefore, getting the same results with minimized standard deviation. Inverse ETF composition is similar to the standard fund, but rather than invest in the underlying holdings. It invests in derivatives of the underlying index to achieve inverse results to those of the tracked index; future contracts, swaps, options, and future agreements.

Investors should also be mindful of the two types:

- Inverse fund that seeks proportionate inverse performance to the tracked index

- Leveraged inverse fund, which seeks amplified inverse results to those of the tracked index.

What to consider before buying?

At the surface, inverse ETFs move in the opposite direction to the tracked index. This assumption cannot be further from the truth because their movement is much more nuanced. As such, the considerations below should be at the forefront of the mind when investing in inverse ETFs:

There are leveraged inverse ETFs and non-leveraged inverse ETFs. Leveraged inverse ETFs have the potential for amplified returns, but since they are high-risk, high-reward assets, they also have the potential for unprecedented losses very fast.

- Compounding effect

All inverse ETFs are repriced daily. As such, they are daily trading assets with compounding Effects on both losses and profits. If held for more than a trading day, it calls for close monitoring due to the compounding effect.

Which are the best Nasdaq inverse ETFs to buy in 2022

With the market volatilities that have plagued the markets post-pandemic, the inverse ETFs below are piped by Nasdaq to run high and provide a hedge option for investors.

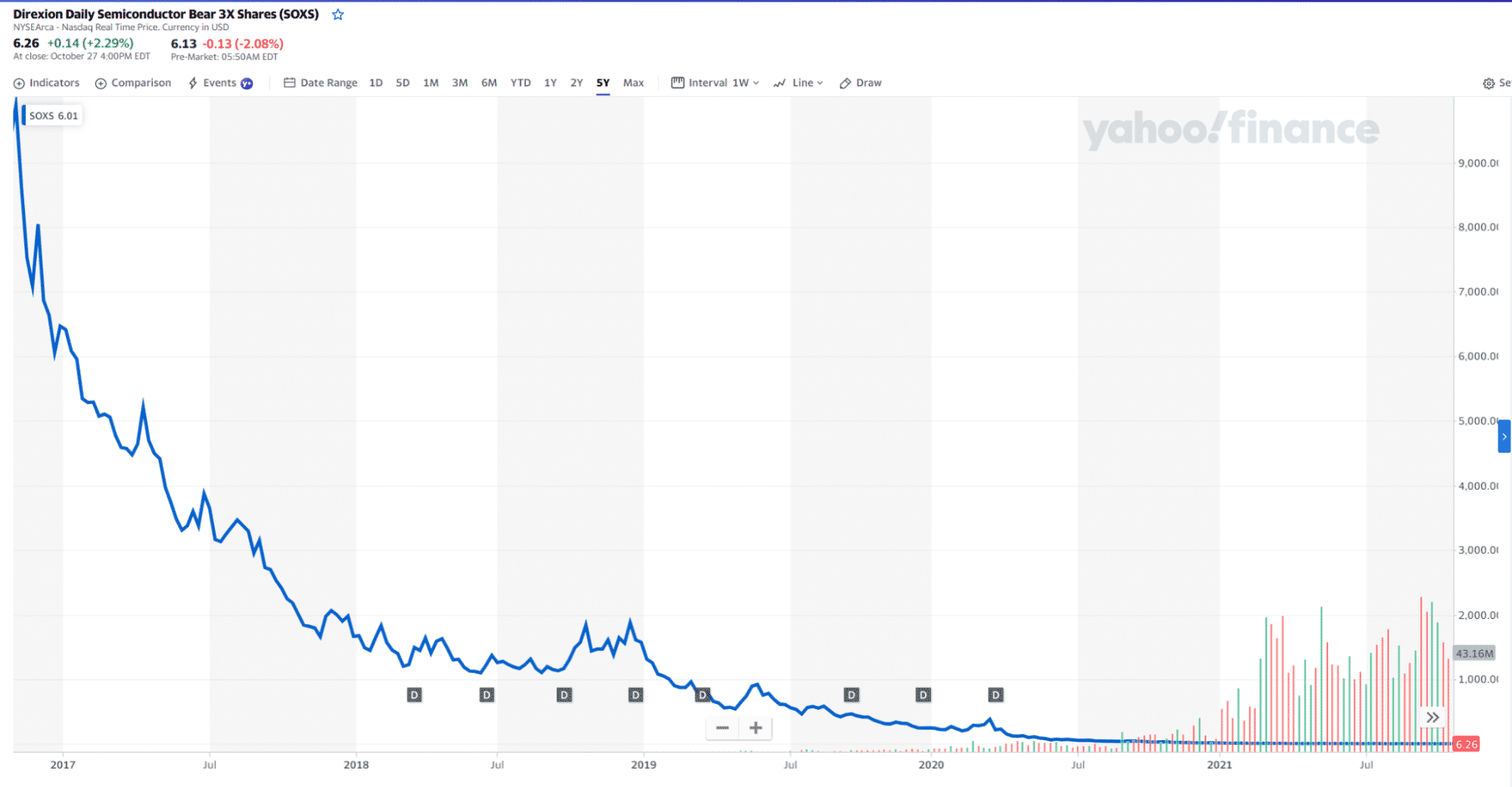

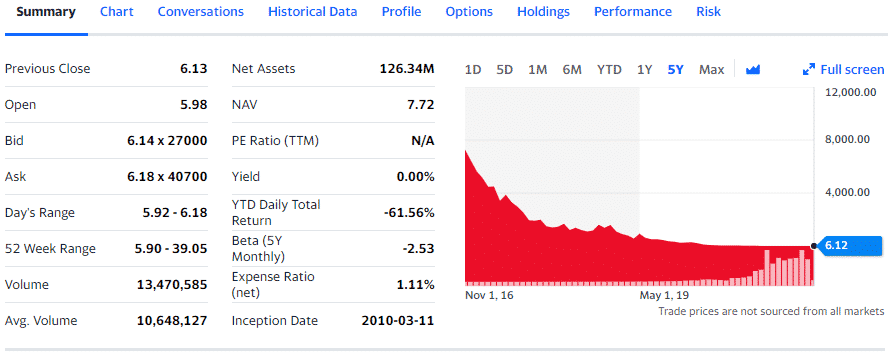

№ 1. Direxion Daily Semiconductor Bear 3X Shares ETF (SOXS)

Price: $6.12

Expense ratio: 1.11%

SOXS chart

The SOXS ETF tracks the performance of the PHLX Semiconductor Sector Index, intending to replicate its inverse performance 300%. It invests at least 80% of its total assets in swaps, futures, financial instruments, and short positions that result in inverse exposure to its composite index to achieve its objective.

The top three holdings of this ETF are:

- US Dollar — 43.06%

- Goldman Sachs Trust Financial Square Treasury Instruments Fund Institutional — 30.18%

- Mutual Fund (other) — 16.42%

The fund has $123.49 million in assets under management, with an expense ratio of 1.11%. As expected, the historical performance shows negative returns but remember, inverse ETFs are short-term volatility instruments. However, being a leveraged ETF that compounds, the current one-month returns of 1.66% showed an inverse ETF worth monitoring closely in 2022 as an option to take advantage of bearish moves in the semiconductor sector.

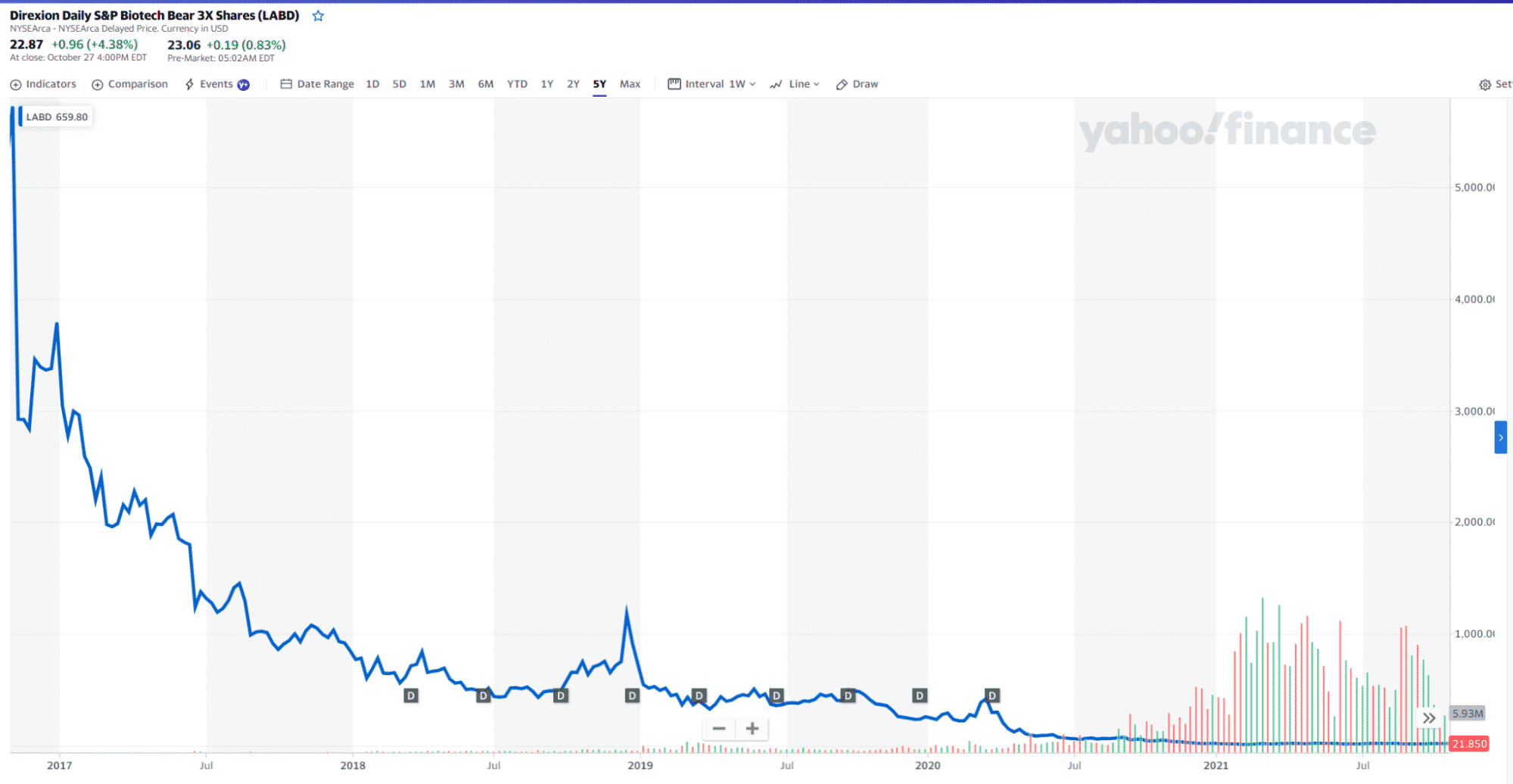

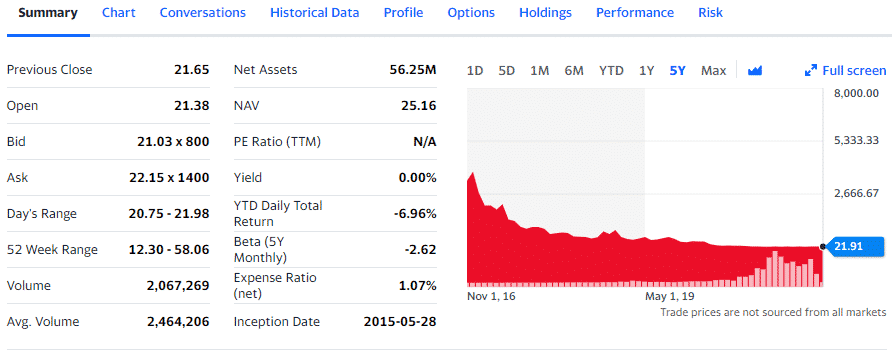

№ 2. Direxion Daily S&P Biotech Bear 3x Shares ETF (LABD)

Price: $21.91

Expense ratio: 1.07%

LABD chart

The Direxion Daily S&P Biotechnology Bear 3x shares ETF tracks the performance of the S&P Biotechnology Select Industry Index, intending to replicate its inverse performance 300%. It invests at least 80% of its total assets in swaps, futures, financial instruments, and short positions that result in inverse exposure to its composite index to achieve its objective.

The top three holdings of this ETF are:

- US Dollar — 46.57%

- Goldman Sachs Trust Financial Square Treasury Instruments Fund Institutional — 44.90%

- Dreyfus Government Cash Management Funds Institutional — 8.52%

LABD has $44.1 million in assets under management, with an expense ratio of 1.07%. As expected, the historical performance shows negative returns, but inverse ETFs are short-term volatility instruments. However, being a leveraged ETF that compounds, the current one-month returns of 16.40% show that it is an inverse ETF worth monitoring closely in 2022 as an option to take advantage of bearish moves in the biotechnology sector.

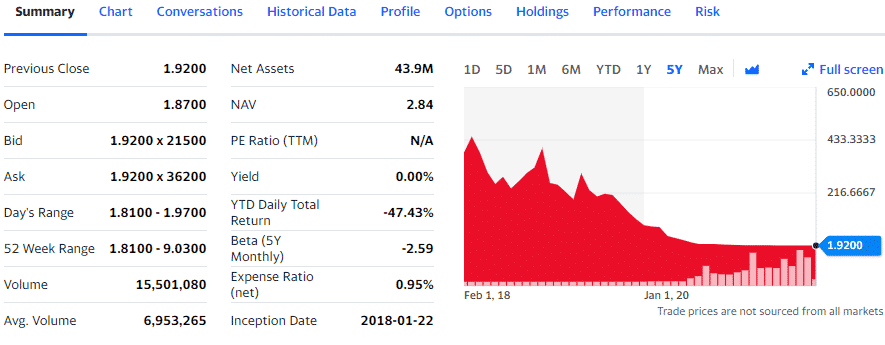

№ 3. BMO REX MicroSectors FANG+ Index -3X Inverse Leveraged ETN (FNGD)

Price: $2.00

Expense ratio: 0.95%

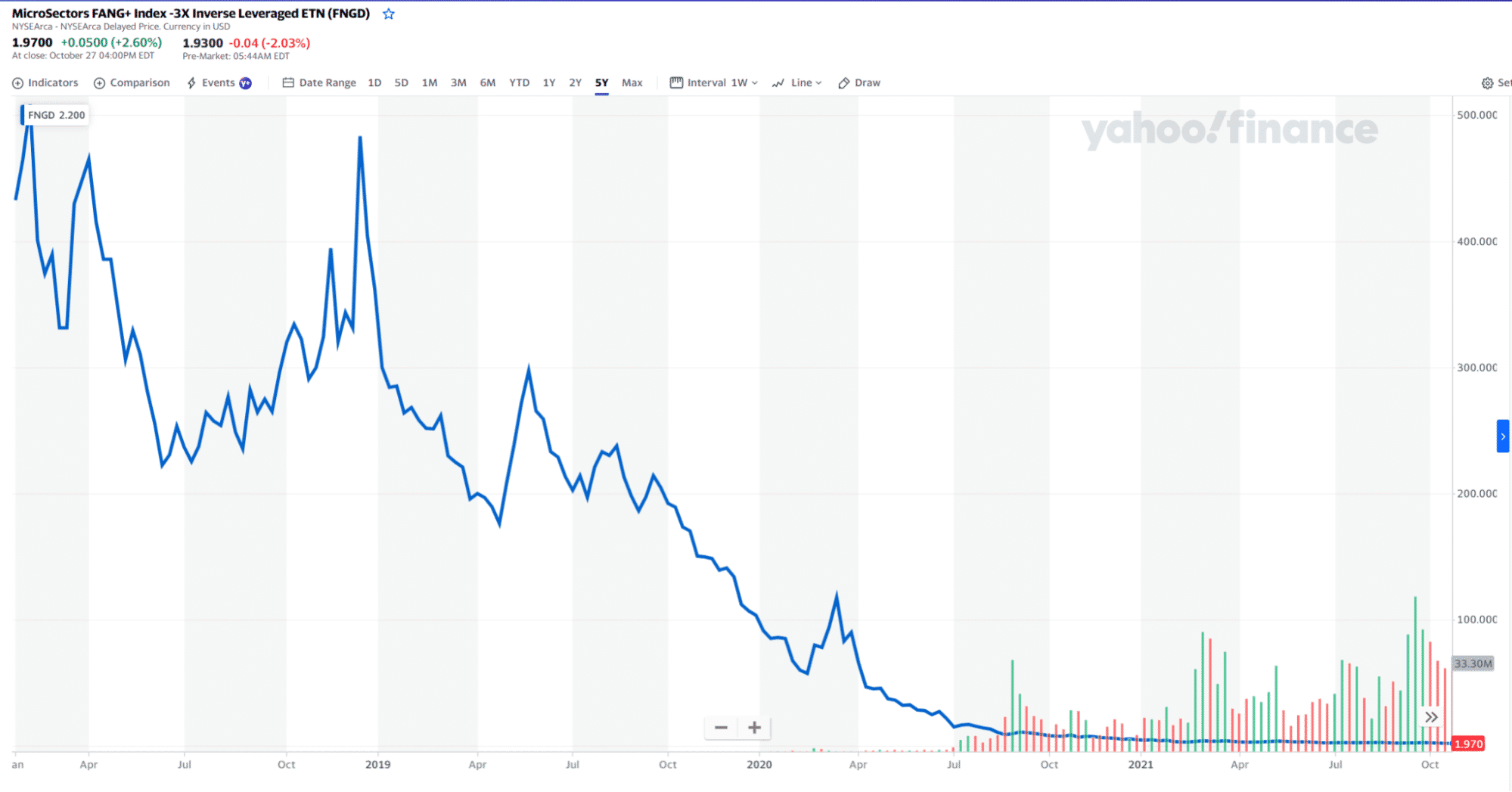

FNGD chart

FNGD has $63.60 million in assets under management, with an expense ratio of 0.95%. As expected, a look at the historical performance of this ETN shows negative returns. However, this is mainly attributable to the compounding effect since ETNs are for daily trading to take advantage of volatility.

The top three holdings of this ETN are:

- Alibaba Group Holdings — 10%

- Alphabet Inc. Class A Shares — 10%

- Amazon Inc. — 10%

The Post-pandemic era has seen momentary significant sell-offs of tech-enabled equities, necessitating the need to have this ETN on the crosshairs come 2022 to take advantage of further bearish moves.

Final thoughts

Speculation in the markets has proven to be a loss-attracting strategy. Rather than try and time the market come 2022 in times of market downturn, inverse funds provide a relatively safer way to make profits if played right.

Comments