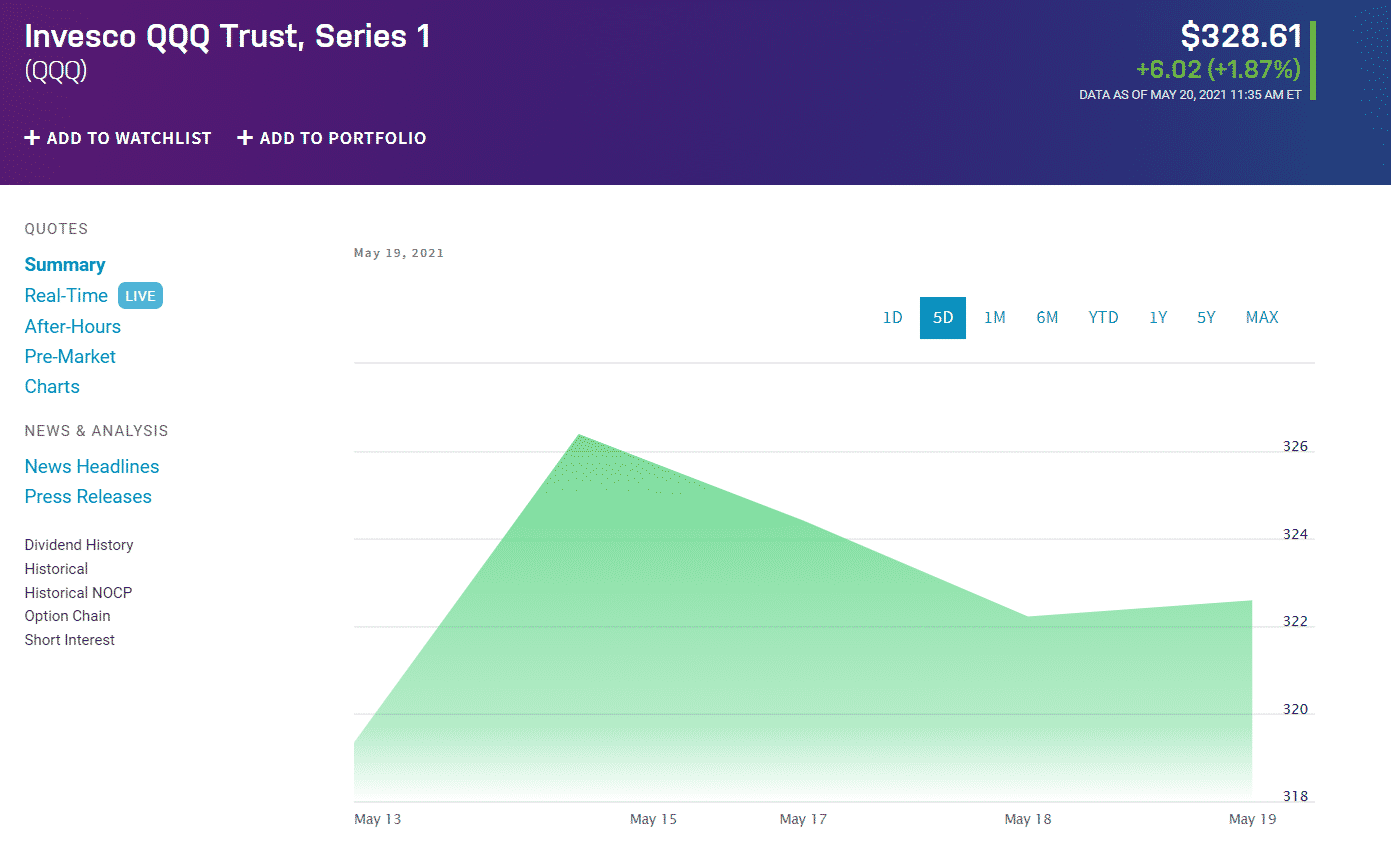

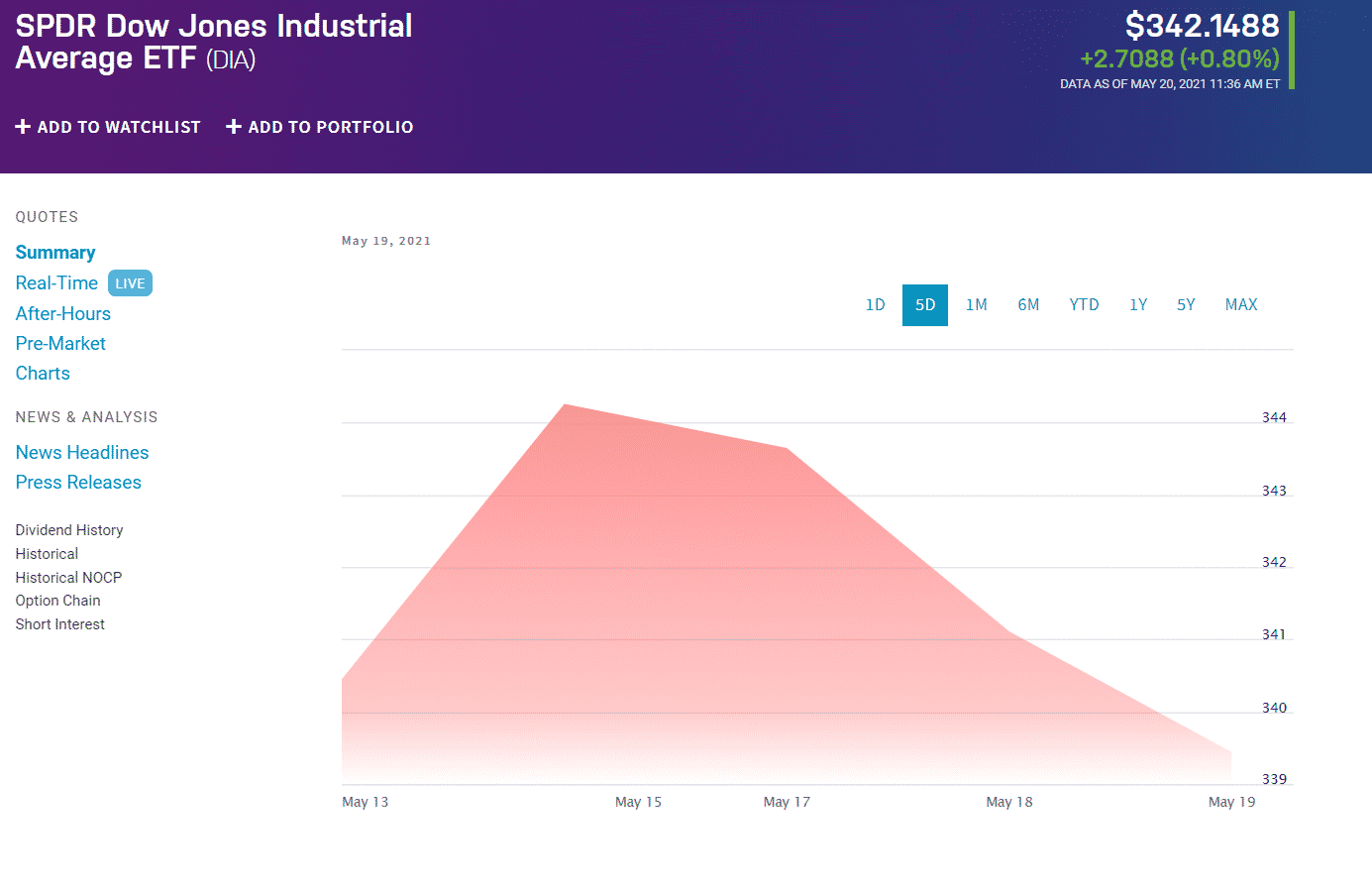

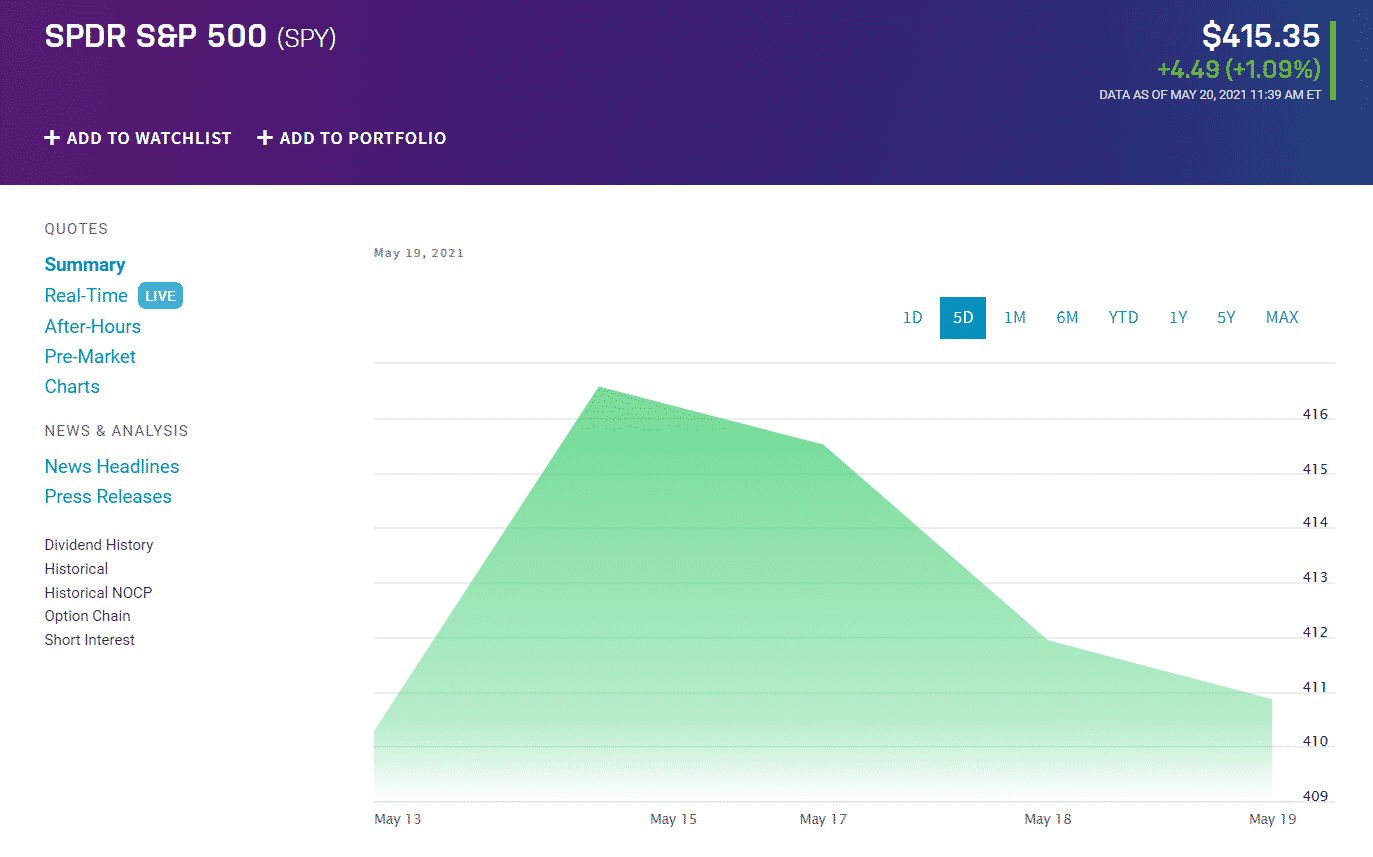

Cryptocurrencies have landed in trouble together with NASDAQ, Dow Jones, and S&P 500, while stocks and ETFs collapse overnight for the third day on Wednesday afternoon after the FOMC meeting minutes. All different markets are noticing a sharp drop with key technical levels in red.

There was a drop of 586 points, touching the low of the day. Dow Jones went in red with a 0.76% fall, whereas the S&P 500 saw 0.9% and Nasdaq Composite loss of 0.7% as all the sectors were in deep red. Major stock ETFs also fell on Wednesday. In addition, investors and traders were seen dumping their cryptocurrencies.

All three main indexes massively went low before 1:00 PM EST.

| Invesco QQQ Trust (QQQ) | SPDR Dow Jones Industrial Average ETF (DIA) | SPDR S&P 500 ETF Trust (SPY) |

|

|

|

What happened?

The fall started with tech stocks and soon went with the sentiment in other markets.

“We’ve been telling our clients that we’re probably entering a period where there’s going to be increased chop going forward,” Matt Orton, Carillon Tower Advisors, told Yahoo! Finance. “We’ve had a pretty extreme rotation from growth into value. We’ve seen fits and starts of rotating back into the growth.”

“Now investors need to digest what could potentially be happening with inflation,” he added.

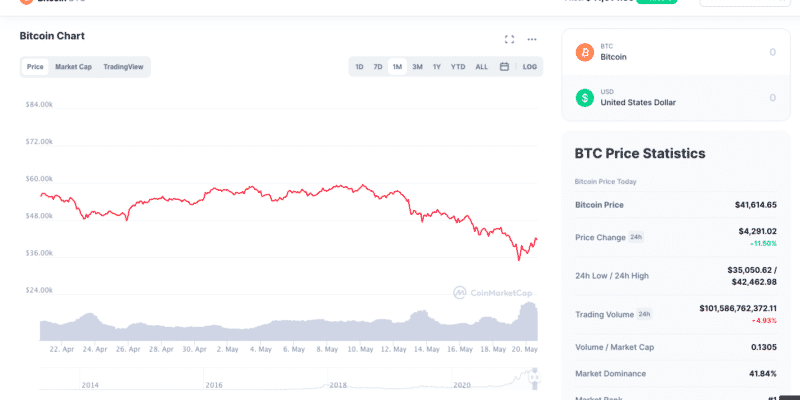

Bitcoin being the king, fell from $64,000 all-time high in mid-April to almost $30,000, frightening many investors. There is a rumor that China’s statement to the financial institution for not conducting crypto-related business might be one reason for this fall.

Not just BTC but almost all the crypto coins such as DOGE, ETH, CAKE saw a massive price cut with 45%,40%, and 38% downfall. Rates of all the coins were dropping and in red. The retail traders, investors, and stocks who had their investment in Bitcoin also saw a significant loss in the shares. MicroStrategy, Tesla, Coinbase, and some other corporations with a significant share of Bitcoin fall by 10%,4%, and 10%.

“There is no question that Bitcoin has been the poster child for rampant market speculation and risk appetite,” said Peter Boockvar, chief investment officer at Bleakley Advisory Group. “Thus, it should be monitored in gauging the pulse of risk-taking, and now risk aversion.”

What to expect?

While Bitcoin is down 30 percent, Ethereum, the second-largest cryptocurrency globally, is down 40 percent. Dogecoin, the meme crypto popularised by Elon Musk, has lost 45 percent.

“The major question for markets right now is whether the Fed is right and this increase in inflation is just temporary because if inflation is not temporary, it could unleash a harrowing period for virtually all investors,” Tom Essaye, founder of Sevens Report, said in a note.

Later today, Google, Facebook, Trip.com, Target gave buy signals. But as the current market scenario is not favorable for a buy signal.

Comments