Is it possible to make money when the markets are in a downturn? One of the primary driving factors for the popularity of the ETF market is that there is a fund fit for every situation imaginable.

When the equity markets are in a downturn, investors have the option of inverse ETFs. They comprise derivatives and other instruments coupled to the index tracked, intending to move in the opposite direction of the reference index.

The primary safe-haven investment in times of economic meltdown is bond investing. The problem is that conventional bond structure results in investment assets beyond the realm of the everyday investor due to pricing.

Bond ETFs solve this issue by pooling similar bonds and trading at relatively lower prices in major stock exchanges. However, as the economy recovers, bond prices fall, characterized by rising interest rates, necessitating hedge strategies to offset such losses. The ETF market has provided investors with inverse bond ETFs that move counter to the prevailing bond market direction.

What are inverse bond ETFs, and how do they work?

Inverse bond exchange-traded funds are investment vehicles that move counter to their relative index. When bond market prices rise, inverse bond ETF prices decline and vice versa. The primary reason for investing in bonds is to hedge against falling interest rates. By moving in the counter direction to bond ETFs, inverse bond funds are bond hedge assets.

Whereas conventional bond ETFs invest in index bonds, they track inverse bond ETFs investing in derivatives, options, and futures contracts to ensure their objectives are met. For example, when a bond market declines by 5%, the inverse bond ETF appreciates 5%. As an investor, it is essential to distinguish between pure inverse bond ETFs and leveraged inverse bond ETFs because they present different risks.

The best inverse bond funds

Bond ETFs are considered a safe-haven investment because it is unheard of for governments to default on their debt, especially in developed economies. However, investment in bond ETFs accrue losses in an environment where interest rates are rising. As the global community recovers from the ravages of Covid-19, communications are ongoing on letting interest rates rise to spur economic growth necessitating the need for a hedge asset.

The inverse bond ETFs below can profit investors and offset accrued losses due to rising interest rates.

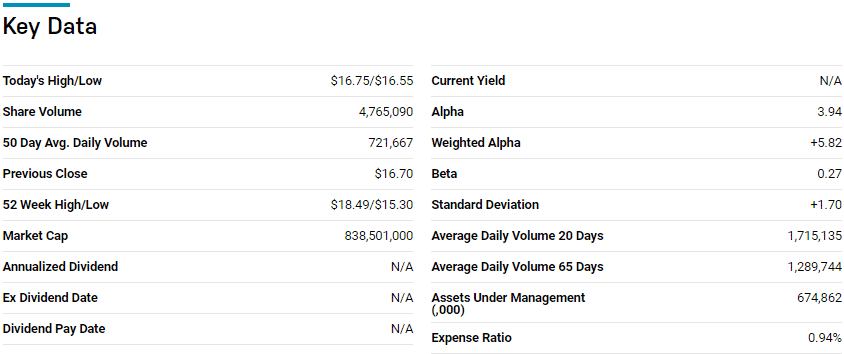

№ 1. ProShares Short 20+ Year Treasury (TBF)

Price: $16.67

Expense ratio: 0.94%

The TFB tracks the ICE US Treasury 20+ Year Bond Index, intending to give inverse results to the tracked index, -1X.

It exposes investors to derivatives, options, and futures contracts attached to US Treasuries securities with a maturity period of 20 years and above, with a face value of $300 million or more. In its underlying holdings, it excludes anything attached to securities under the custody of the federal bank.

TBF has $723.97 million in assets under management, with an expense ratio of 0.94%. Inverse ETFs are short-term investment vehicles, so looking into the historical performance of the TBF would paint a pretty grim picture.

Thus, 5-year returns of -18.09% and 3-year returns of -27.15%. However, a look at the short-term gains shows that TBF has the potential to mint money in periods of interest rate uptrend; 1-year returns of 9.38% and year-to-date returns of 5.64%.

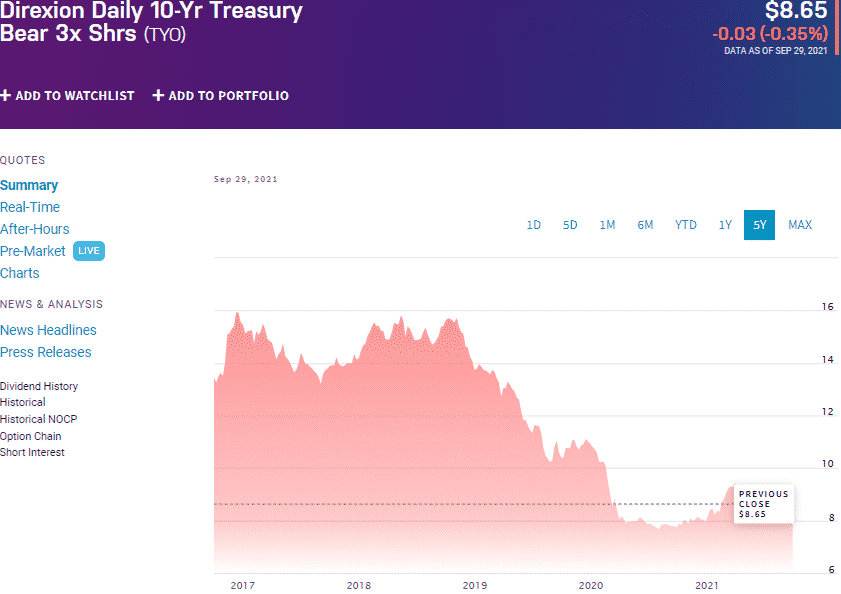

№ 2. Direxion Daily 10-Yr Treasury Bear 3X Shrs (TYO)

Price: $8.65

Expense ratio: 1.07%

A look at the historical results shows that this fund is for short-term investing only.

Thus, 5-year returns of -32.26%, 3-year returns of -42.74%, 1-year returns of 12.19%, and year-to-date returns of 9.76%.

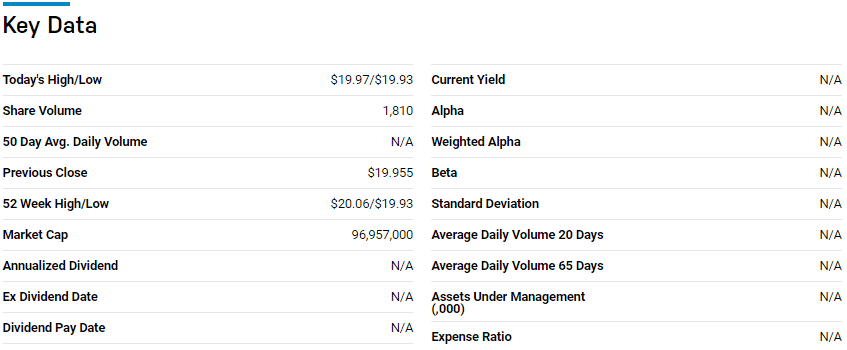

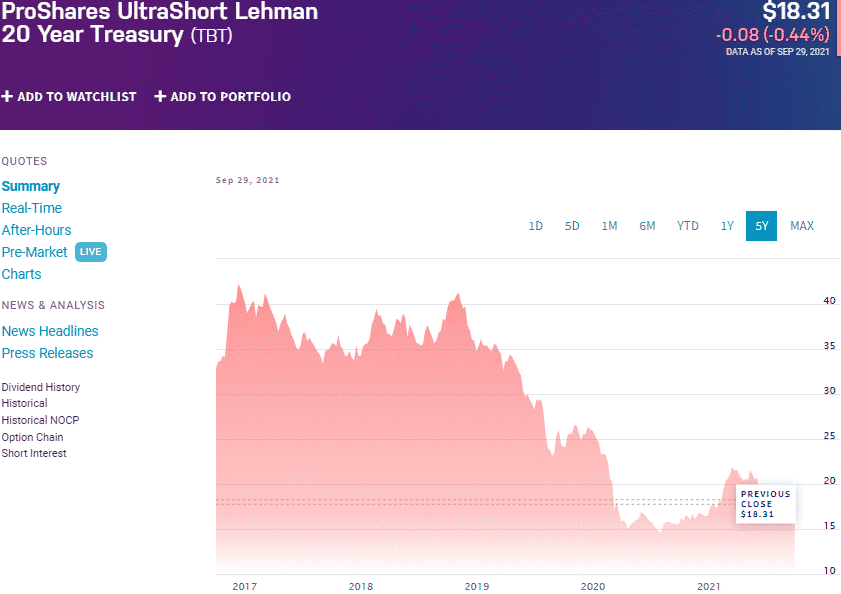

№ 3. ProShares UltraShort 20+ Year Treasury Fund (TBT)

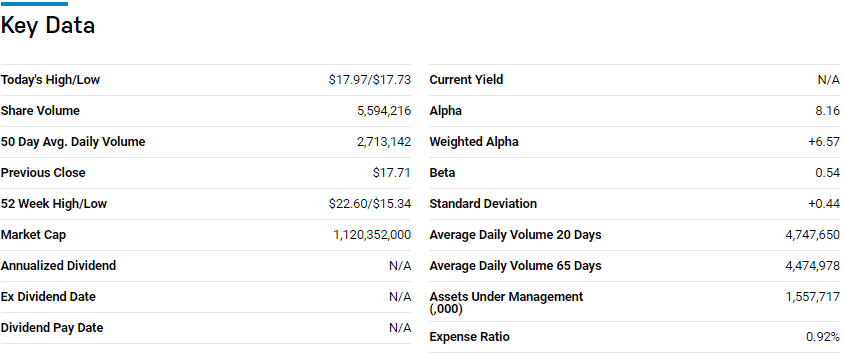

Price: $18.31

Expense ratio: 0.92%

It tells investors that derivatives, options, and futures contracts attach to US Treasuries. Therefore, it is a non-diversified fund that exposes investors to bearish US long-term treasuries, a maturity period of 20 years and above with an outstanding balance of $300 million and above.

TBT has more assets under management than its sister inverse ETF, the TBF, $1.59 billion, piping it on the expense ratio front to stand at 0.92%. Whereas the TBF is for short-term investing, the leveraged nature of the TBT makes it a daily investment vehicle for taking advantage of concise volatility movements in the bond ETF market.

Like its sister ETF, historical results confirm that this fund is for short-term investing.

Thus, 5-year returns of -39.33%, 3-year returns of -50.90%, 1-year returns of 18.82%, and year-to-date returns of 11.51%. These returns are pretty consistent with the leveraging factor in comparison to the TBF returns.

Final thoughts

The talk of the town right now is the FED’s early interest rate policy, expected to result in increasing rates in early 2022. With the bond investment enjoying returns given the current 0% interest rates to spur economic resurgence, the inverse bond ETFs above are worth monitoring for when the interest rate hike race starts.

Comments