ETF full name: VanEck EM High Yield Bond ETF

Segment: High-yield bonds

ETF provider: VanEck

| HYEM key details | |

| Issuer | VanEck |

| Dividend | $0.10 |

| Inception date | May 9, 2012 |

| Expense ratio | 0.40% |

| Management company | VanEck |

| Average 3-5 EPS | N/A |

| Average Annualized Return | 1.90% |

| Investment objective | Replication |

| Investment geography | US Fund Emerging Markets Bond |

| Benchmark | N/A |

| Leveraged | N/A |

| Median market capitalization | $1.35 billion |

| ESG rating | MSCI 2.95/10 |

| Number of holdings | 1,012 |

| Weighting methodology | Market value |

About the HYEM ETF

The HYEM VanEck EM High Yield Bond ETF fund inception was May 2012. The fund’s objective is to gain returns from investments in high-yield corporate bonds. The fund provides exposure to junk bonds of companies whose headquarters are in the emerging markets.

HYEM Fact-set analytics insight

The HYEM VanEck EM High Yield Bond ETF trades on the New York Stock Exchange, Arca. The fund consists of 1,012 holdings spread across companies ranging from Brazil to the Philippines.

The fund tracks the performance of the ICE BofA Diversified High Yield US Emerging Markets Corporate Plus index.

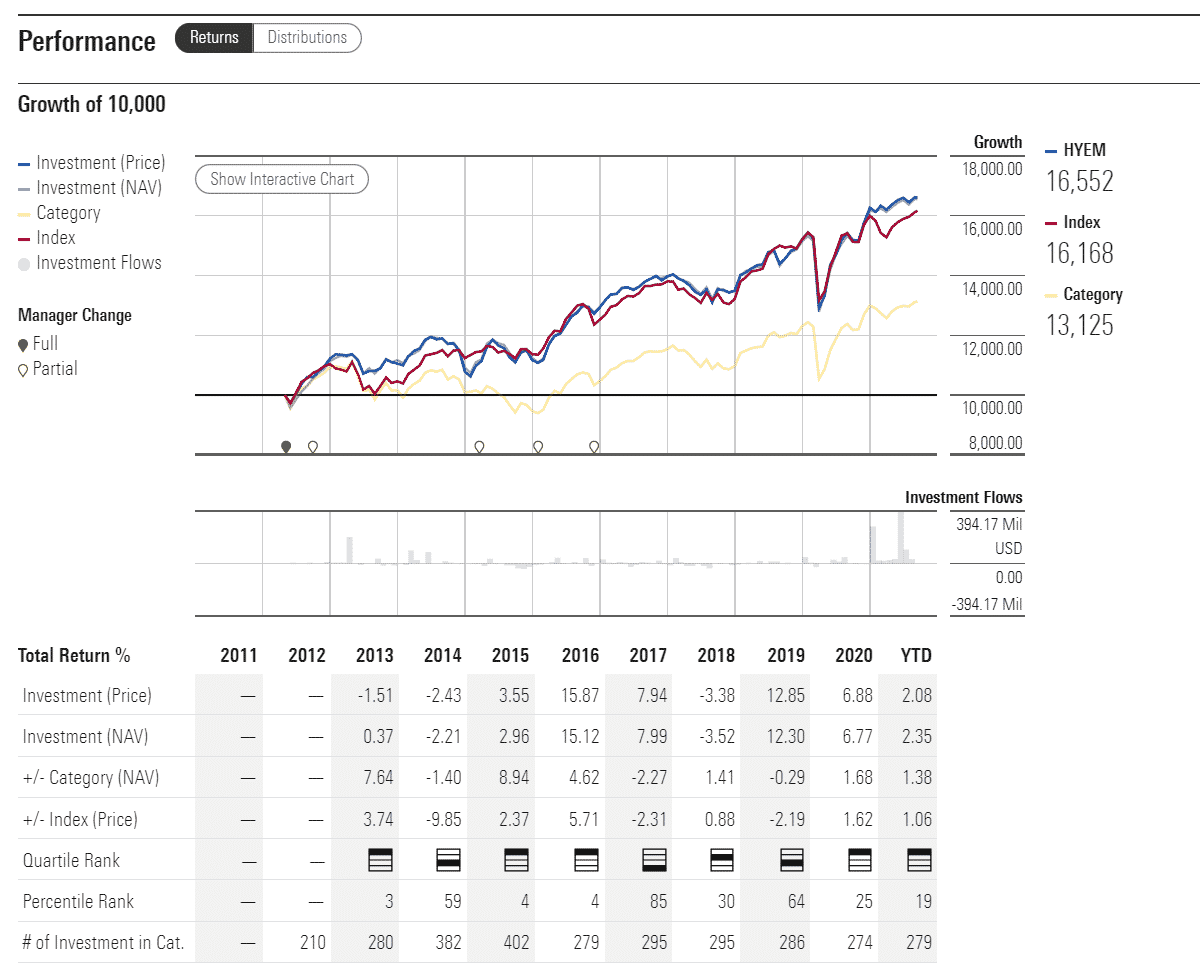

HYEM performance analysis

The fund’s chart shows a significant rise in value since its inception in 2012. It reached a peak in 2013 and started declining steadily from roughly $27 and fluctuated between $21 and $24 up until 2020. The sharp decline in 2020 was due to the Covid-19 pandemic, which disrupted most financial markets globally. The fund reached an all-time low of around $16.50 but then recovered and is again trading just under the $24 mark.

HYEM VanEck EM High Yield Bond ETF has dividend payouts of $0.10 and an annualized return of 1.90%. The expense ratio is 0.40%.

HYEM ETF RATING |

|||||

| Resource | ETF DATABASE | ETF.com | MarketWatch | Morningstar.com | Money.usnews.com |

| HYEM Rating | A+ | B | Quintile 1

(11th percentile) |

**** | 6.4 / 10 |

| HYEM ESG Rating | 2.95 / 10

(BB) |

2.95 / 10

(BB) |

N/A | N/A | N/A |

HYEM key holdings

The fund has no singular asset, and the total holdings are 1,012. The top ten holdings constitute 5.5% of its assets.

The list below contains the top ten holdings of the fund.

| Holding name | % of assets |

| Teva Pharmaceutical Finance Netherlands III BV 3.15% 01-Oct-2026 | 0.74% |

| Teva Pharmaceutical Finance Netherlands III BV 2.8% 21-JUL-2023 | 0.65% |

| Ecopetrol SA 6.875% 29-APR-2030 | 0.63% |

| Ecopetrol SA 5.875% 28-MAY-2045 | 0.56% |

| SB Capital SA 5.125% 29-OCT-2022 | 0.54% |

| Southern Gas Corridor CJSC 6.875% 24-MAR-2026 | 0.54% |

| Ecopetrol SA 5.875% 18-SEP-2023 | 0.50% |

| Tullow Oil plc 10.25% 15-MAY-2026 | 0.47% |

| DP World Limited 6.0% PERP | 0.44% |

| CEMEX SAB de CV 3.875% 11-JUL-2031 | 0.44% |

Industry outlook

Emerging market corporate bond investments are high-yield but low-risk investments. Furthermore, the HYEM VanEck EM High Yield Bond ETF fund focuses on US dollar-denominated debt, eliminating foreign currency risk.

According to VanEck.com, the emerging corporate bonds market has grown by almost $400 billion since 2005. Emerging market bonds are more attractive because the rating systems for bond issuers are subject to more stringent requirements than developing markets.

Furthermore, the HYEM fund is the only US-listed emerging market fund that provides high yield returns.

Comments