Low-cost passive investing through exchange-traded funds is currently the most popular investment strategy globally. The most popular ETFs, research shows, are the largest in terms of market capitalization. It is attributable to significant exchange-traded funds being able to trade at either 0 cost or meager fees, which passes on to investors as savings.

For example, the SPY invests in the largest ETF of all, investor parts with $9 annually for every $10000 investment. On the other hand, for the same investment in the iShares 20+ Year Treasury bond ETF, an investor would have to part with $15-$6 more than the SPY investment.

The top 5 ETF issuers

With more than 7500 ETFs available globally, it stands to reason that investors might have a preference for their ETF issuer. Investors categorize ETF issuers based on their earnings potential, assets under management, average expense ratio, or the number of ETFs they offer.

Going by market capitalization, the top 5 ETF issuers are:

- Blackrock Financial Management — largest ETF issuer with $2.39 trillion in assets under management, offering 389 ETFs to investors.

- Vanguard — has $1.99 trillion in assets under management, offering 82 ETFs to investors.

- State Street Global — has $979.66 billion in assets under management, offering 132 ETFs to investors.

- Invesco — has $390.49 billion in assets under management, offering 240 ETFs to investors.

- Charles Schwab — has $264.92 billion in assets under management, offering 26 ETFs to investors.

The exchange-traded fund giants?

A dig deep into the biggest exchange-traded funds reveals that they are from the biggest issuers globally. As such, if impartial to a particular ETF provider, you are guaranteed that they have an ETF large enough to stake a claim as the largest ETF globally, and you enjoy benefits that come with this tug.

Here we explore the largest ETFs by market capitalization and their benefits as investment vehicles.

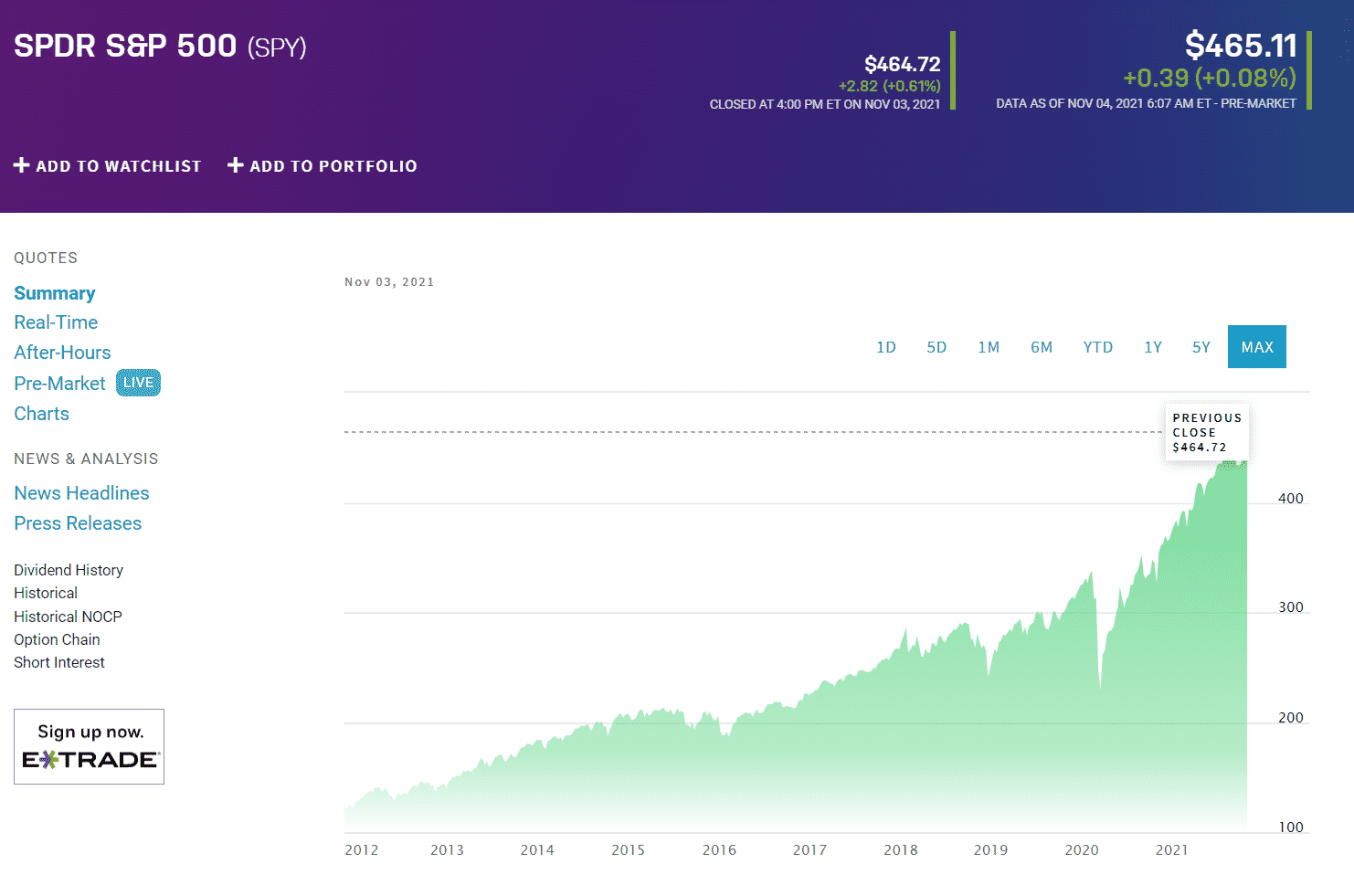

№ 1. SPDR S&P 500 Trust (SPY)

Assets under management: $374.03 billion

Expense ratio: 0.09%

Annual dividend yield: 1.30%

SPY chart

As the pioneer ETF, the SPY is the world’s most traded ETF with the most extensive arsenal in assets under management, $374.03 billion. It comprises the 500 best US equities and is used as the US economic litmus test in the investment world. Since its inception in 1993, the SPY average annual market returns stand at 10.31%. The SPY ETF is an excellent play on the US economy through the most established blue-chip equities.

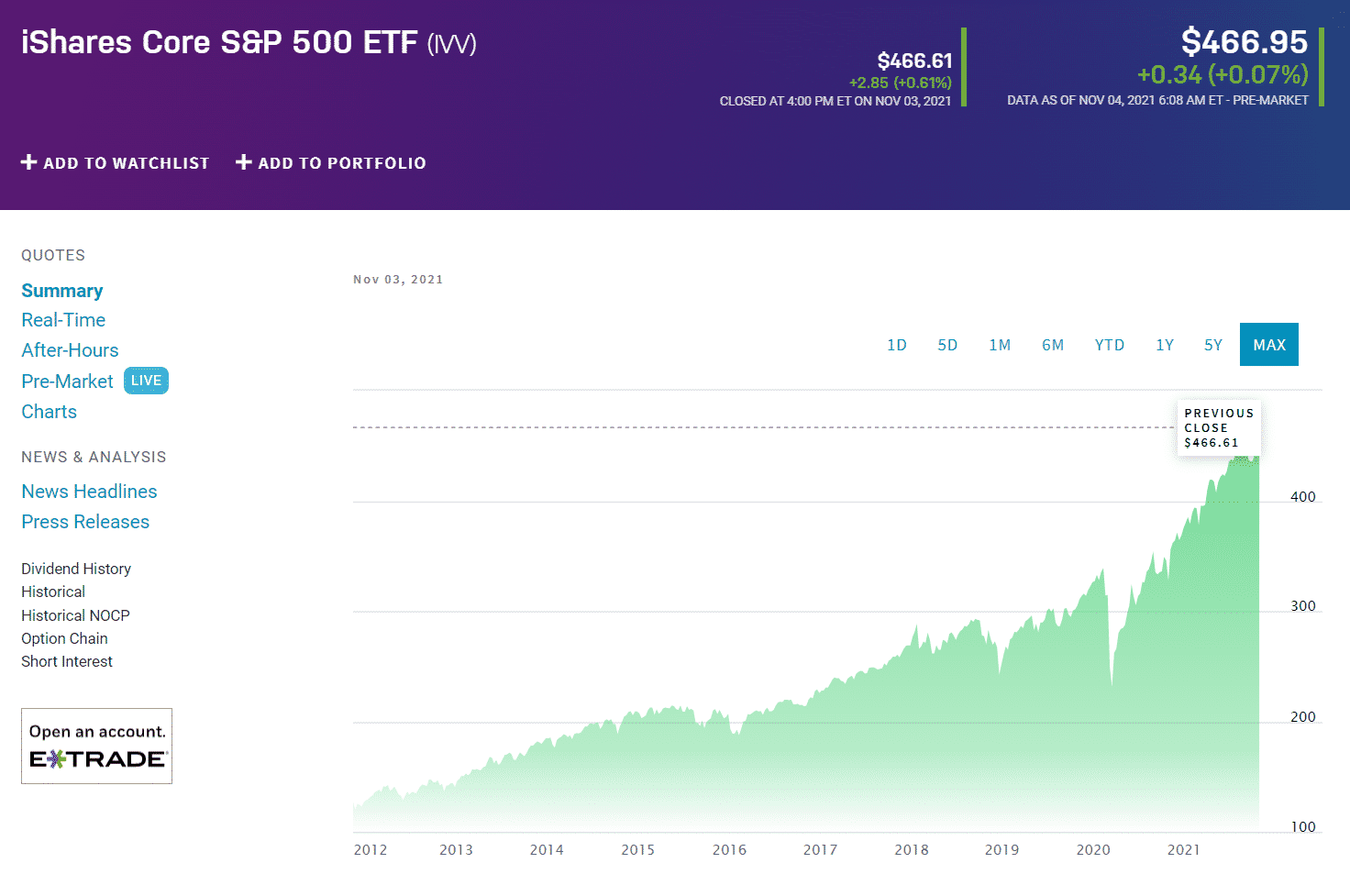

№ 2. iShares Core S&P 500 ETF (IVV)

Assets under management: $294.95 billion

Expense ratio: 0.03%

Annual dividend yield: 1.28%

IVV chart

IVV is the most popular ETF from Blackrock Financial Management. It also tracks the popular S&P 500 index and has $294.95 billion in assets under management, at one of the lowest expense ratios in the investment world, 0.03%. It is a great buy and holds option since it exposes the best US blue-chip companies known for profitability.

Since its inception, IVV’s average annual market returns have stood at 7.21%.

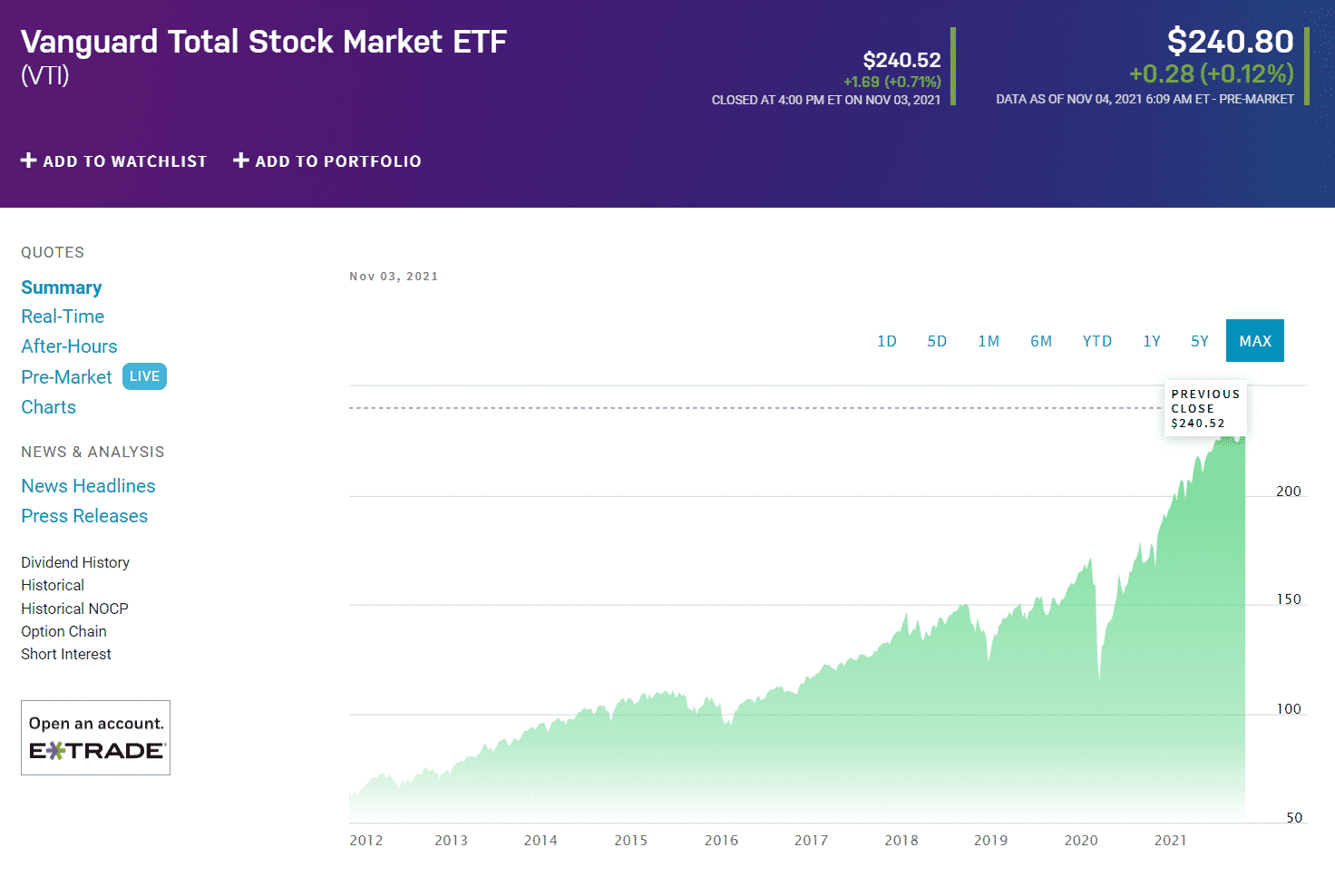

№ 3. Vanguard Total Stock Market ETF (VTI)

Assets under management: $1.26 trillion

Expense ratio: 0.03%

Annual dividend yield: 1.26%

VTI chart

From the ETF issuer that might have revolutionized the way the investment world and the globe at large viewed ETFs come to the third-largest ETF globally, the Vanguard Total Stock Market ETF. The VTI has $1.26 trillion in assets under management, at a relatively low expense ratio of 0.03%.

It does not take the top spot because its assets under management also come from other investment assets under the same flagship. It is one of the cheapest ETFs globally and comes with commission-free trading while using a vanguard account.

The VTI’s average annual market return since inception stands at 8.86%.

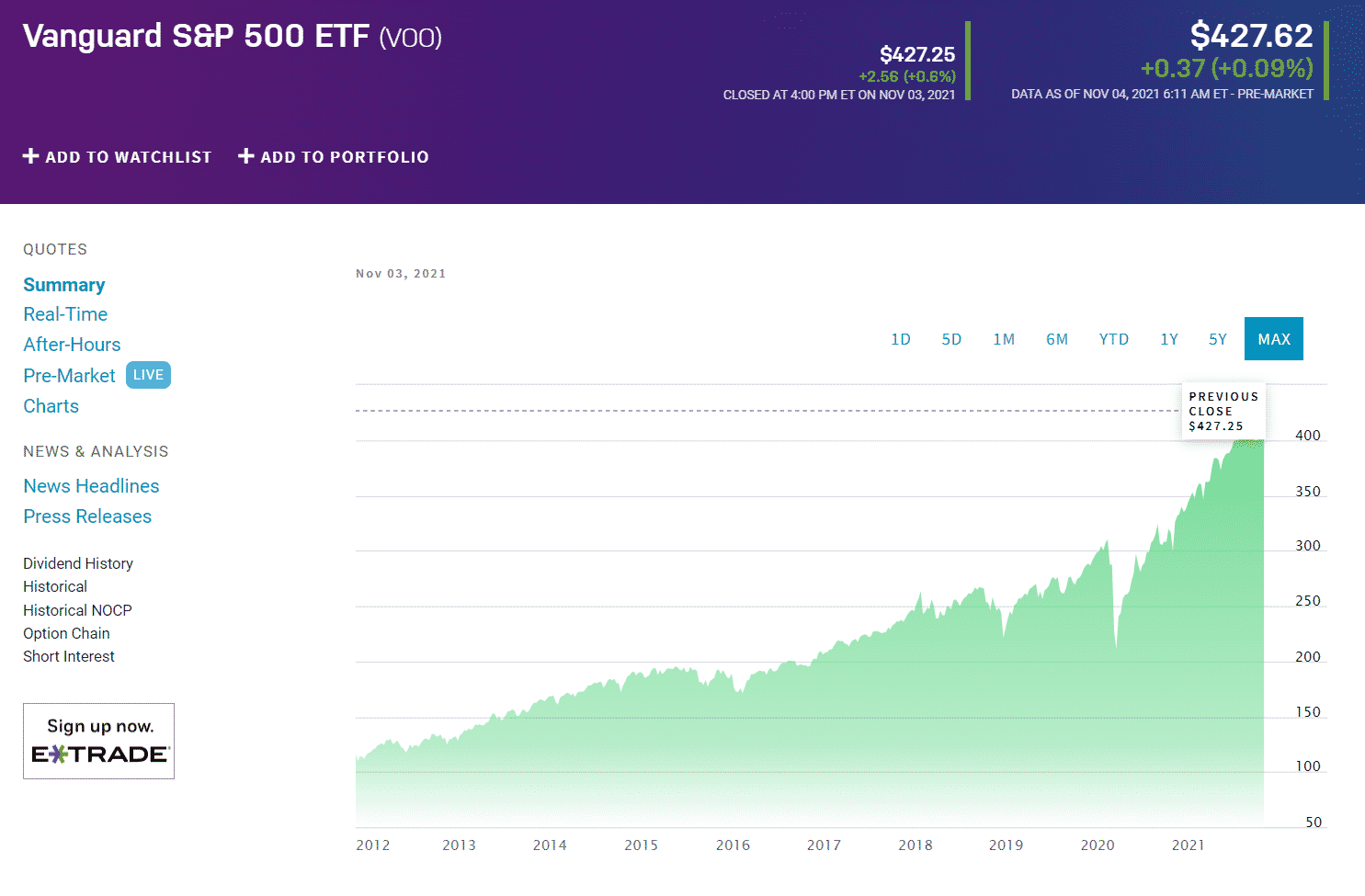

№ 4. Vanguard S&P 500 ETF (VOO)

Assets under management: $753.41 billion

Expense ratio: 0.03%

Annual dividend yield: 1.34%

VOO chart

As the most popular ETF issuer globally, it comes as no surprise that Vanguard has two ETFs among the top five ETF giants’ list. The VOO has $753.41 billion in assets under management, at a relatively low expense ratio of 0.03%.

Similar to the VTI, VOO’s assets under management also come from other investment class assets under the same flagship. In addition to the low expense ratio, you get to trade commission-free if the holder of a vanguard account.

The VOO’s average annual market return since inception stands at 15.35%, the best among the funds in this list.

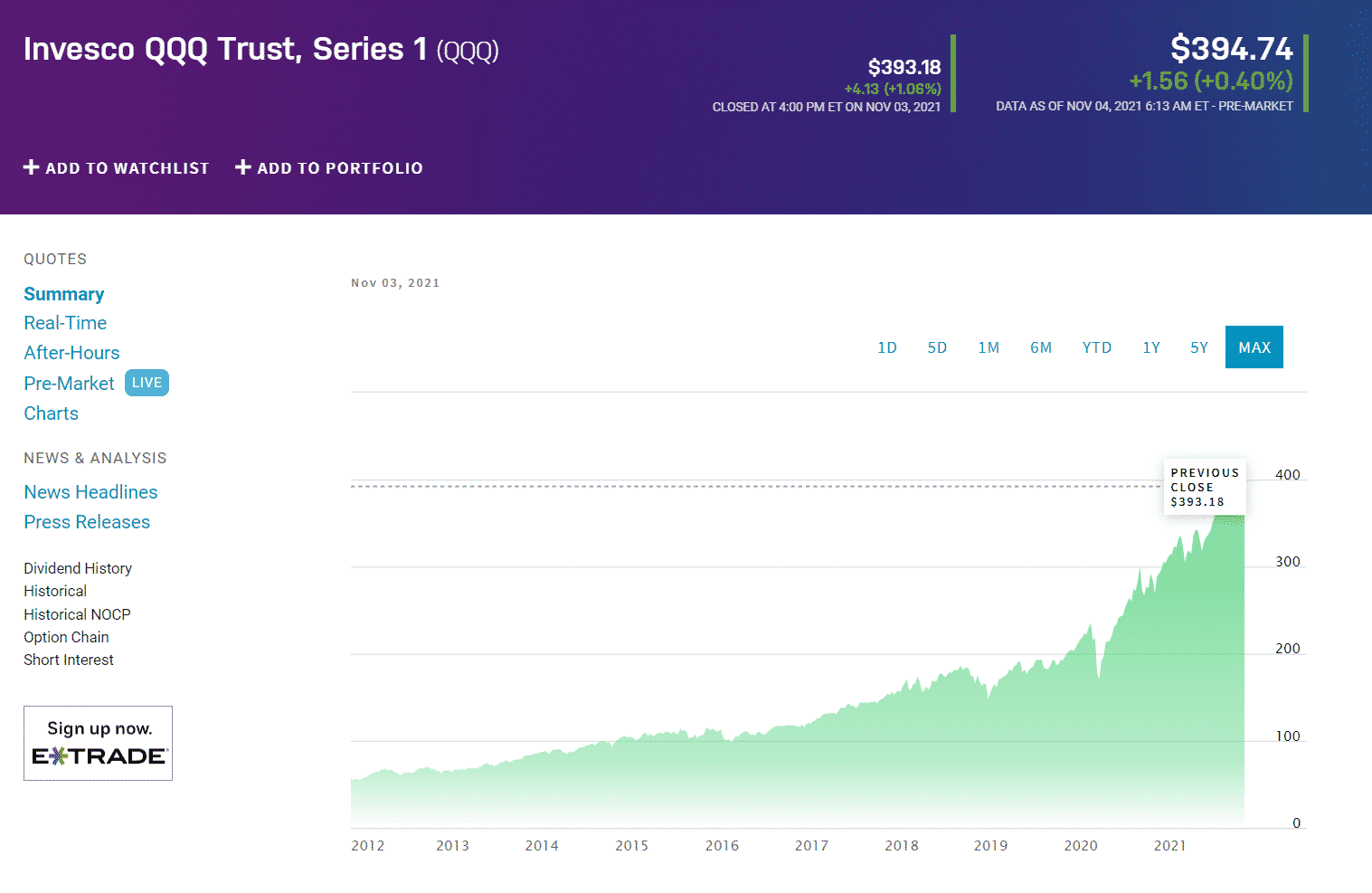

№ 5. Invesco QQQ Trust (QQQ)

Price: $174.51 billion

Expense ratio:0.20%

Annual dividend yield: 0.49%

QQQ chart

The Invesco QQQ fund tracks another popular index fund, the Nasdaq Index. This exchange-traded fund exposes investors to the top 100 non-financial US-listed equities by tracking the Nasdaq 100 index.

The primary disadvantage of the QQQ is concentration bias since the tracked index is biased towards the technology sector. With the increased pace of technological adoption globally, the QQQ is expected to continue outperforming the SPY and hence worth having in an investment portfolio; 3-year returns of 133.15% compared to 79.21% for the SPY.

The QQQ has $174.51 billion in assets under management, at a relatively higher expense ratio than the other firms on this list of 0.20%.

The VOO’s average annual market return since inception stands at 9.70%.

Final thoughts

Market analysts always pick their best ETFs depending on different indicators. However, when it comes to the most significant ETF funds, they all agree that not only do these funds have the financial capability to withstand the market downturn, they have the diversification to weather short-term market volatilities.

The giant ETFs choices discussed above can be used either as solo investment vehicles for diversification or be bought together to form a growth investment portfolio.

Comments