ETF full name: Global X Video Games & Esports ETF (HERO)

Segment: Large Cap Growth Equities

ETF provider: Mirae Asset Global Investment Co. Ltd.

| HERO key details | ||

| Manager | Team Managed | |

| Dividend | 0.74% | |

| Inception date | 25th October 2019 | |

| Expense ratio | 0.50% | |

| Average Daily $ Volume | $4.11M | |

| Investment objective | Replication Strategy | |

| Investment geography | Global Video Games and eSports Equities | |

| Benchmark | Solactive Video Games and eSports Index | |

| Weighted Average Market Cap | $71.35B | |

| Net Assets under Management | $471.3 Million | |

| Number of holdings | 40 | |

| Weighting methodology | Market capitalization | |

About the HERO ETF

The gaming and esports industry was one of the few industries to benefit from long lockdowns due to the coronavirus. With nothing much to do, people turned to video games and esports communities not only to pass the time but to socialize. As a result, this industry valuation in the pandemic year was $173.70 billion, and it is expected to grow at an annual CAGR of 13.20% by 2028.

Not only consumers are taking note of the immense opportunities in this industry. Technology advancements and the internet of things are accelerating the growth of this industry. More and more people are taking note and adopting this entertainment niche to wind down, especially with fully immersive gaming technologies.

Facebook has rebranded to Meta to align its new direction towards metaverse space. The problem with tech-based equities is that it is hard to pick a single stock and be sure of success. For this reason, when it comes to gaming and esports, investors have an option in the Global X Video Games and eSports ETF.

HERO Fact-set analytics insight

Global X Video Games and eSports ETF tracks the Solactive Video Games & Esports Index, intending to replicate its performance as closely as possible, net of expenses and fees. It invests at least 80% of its total assets in the securities of the composite index and the tracked index underholdings’ ADRs and GDRs.

HERO investors get exposure to the global companies that stand to benefit from the growth of the gaming and esports universe. The fund is producers of video games and esports hardware, owners and operators of competitive esports league sites, distributors of esports and gaming content, and firms involved in the live streaming of video games and esports content.

HERO performance analysis

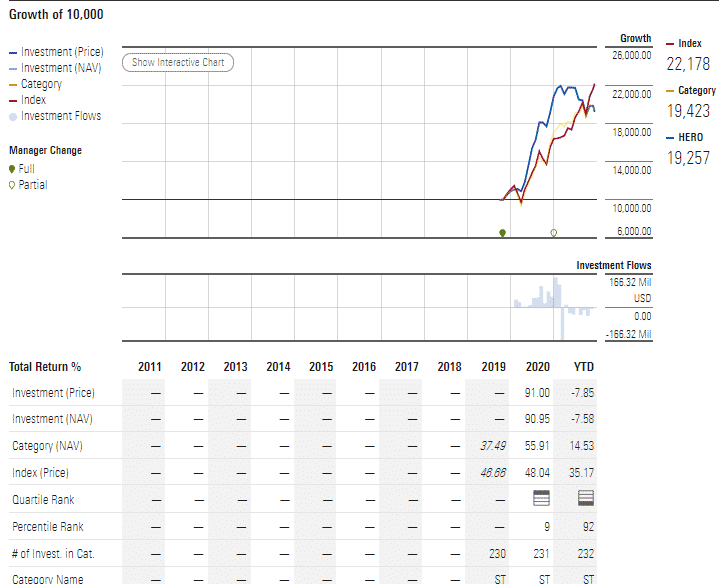

A look at the chart below shows that an investment of $10000 on HERO at launch would right now be worth $19257, an investment price increment of 91%. Couple this to returns of 55.91%, and this ETF is among an elite group to have posted positive returns in its inaugural year.

HERO ETF performance chart

With such numbers, it is no surprise that this ETF is ranked No 9 among the 104 best technological funds.

HERO ETF RATING |

|||||

| Resource | ETF DATABASE | ETF.com | MarketWatch.com | Morningstar.com | Money.usnews.com |

| IPO Rating | A | N/A | N/A | N/A | Rank 9 in technology |

| IPO ESG Rating | 5.39 out of 10 | 4.37 out of 10 | 5th Quantile | 19.11 out of 50 | 5.1 out of 10 |

HERO key holdings

HERO ETF has a higher concentration of organizations involved in distributing and streaming gaming and esports content, especially in its top holdings. Still, overall, it is diversified across the gaming value chain. The result is a fund with the weighting diversification to weather the volatility of this industry niche.

| Ticker | Holding | % Assets |

| NVDA | NVIDIA Corporation | 11.25% |

| SE | Sea Ltd. (Singapore) Sponsored ADR Class A | 6.32% |

| NTES | NetEase, Inc. Sponsored ADR | 6.06% |

| EA | Electronic Arts Inc. | 5.67% |

| 7974 | Nintendo Co., Ltd. | 5.31% |

| TTWO | Take-Two Interactive Software, Inc. | 4.81% |

| 9766 | KONAMI HOLDINGS CORP | 4.56% |

| 3659 | NEXON Co., Ltd. | 4.45% |

| ATVI | Activision Blizzard, Inc. | 4.15% |

| 9684 | Square Enix Holdings Co., Ltd. | 4.08% |

Industry outlook

The rise of augmented reality and virtual reality and the ever-evolving technology capabilities have ensured that there is something for everyone despite their age. The result is an ever-expanding cross-generational market that has attracted the attention of bettors, advertisers, and streaming networks, all clamoring for a piece of the action. With exposure to cloud gaming, semi-conductor industry, and gaming hardware, HERO has tentacles in every segment of this industry expected to grow, calling to be in the crosshairs for long-term investing.

Comments