With the coronavirus came lockdowns and cessation of movement, changing the dynamics of how people relate, socialize, and even their eating habits. People who used to eat at sit-in restaurants had to contend with drive-throughs or delivered foods.

Pre coronavirus pandemic, the restaurant and bars industry had witnessed a 70% increase in spending over the last decade. As the pandemic clutch eases on the back of widespread vaccination, diners are expected to flock back into the restaurants to compensate for the time spent cooped up at home.

Rather than try and pick individual stocks that will benefit from reopening, it’s prudent to bet on the growth of this niche as a whole via restaurant ETFs, especially since it is a cutthroat industry that results in 60% of new firms failing within their first year of operation. Furthermore, data shows that restaurant spending post-pandemic has surpassed grocery spending at present.

What is the composition of restaurant ETFs?

The coronavirus forced businesses and people to rethink how they carry out operations. As a result, restaurants previously renowned for their sit inexperience had to adapt and find a way to get their products to the clients at home. This adaptation might have been attributed to 70.2% of all eat-out sales going to fast food chains that could deliver during the pandemic. As such, restaurant ETFs comprise organizations involved in manufacturing, marketing, sales, and delivery of food and beverages.

The best 3 restaurant ETFs to invest in for 2021/2022

The restaurant niche has underperformed the industry so far this year, but as the pandemic restrictions ease, people are back to eating at restaurants and indulging in restaurant-related activities. Supply chain disruptions and changing consumer eating habits have disrupted the restaurant industry, but these three restaurants’ ETFs have value and growth potential.

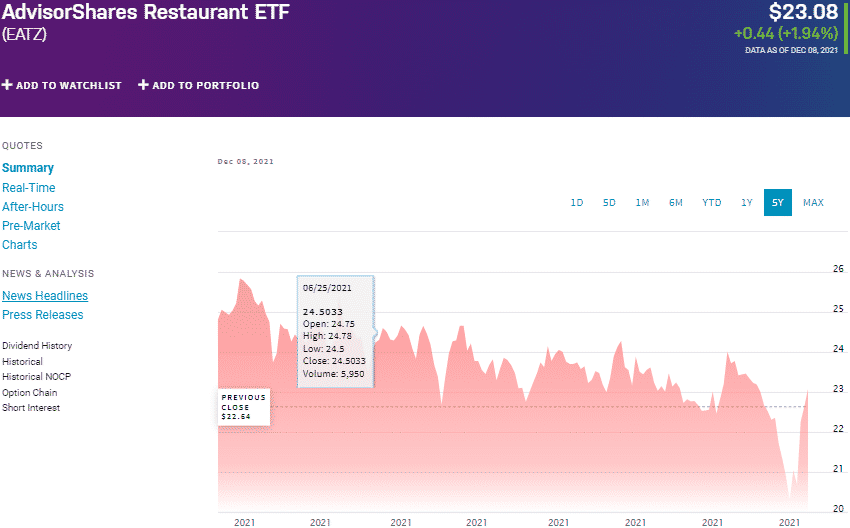

№ 1. AdvisorShares Restaurant ETF (EATZ)

Price: $23.08

Expense ratio: 0.79%

Dividend yield: N/A

EATZ chart

The AdvisorShares restaurant ETF is a new entrant in the industry, having launched in April of 2021. It is an actively managed fund investing at least 80% of its total assets in securities and related ADRs of organizations that derive at least 50% of their total revenues from restaurant-related activities. It exposes investors to dominant market players in the restaurant sun-industry; fast-food chains, pubs, catering services firms, restaurants, and bars.

The top three holdings of this ETF are:

- Del Taco Restaurants, Inc. – 9.64%

- RCI Hospitality Holdings, Inc. – 6.17%

- Papa John’s International, Inc. – 5.86%

EATZ ETF has only $4.6 million in assets under management, with investors having to cough up $79 annually for a $10000 investment. This ETF features global icons in the food services universe despite not posting positive returns. In addition, active management makes it agile to take advantage of arising opportunities in the restaurant space as the world opens up post-pandemic.

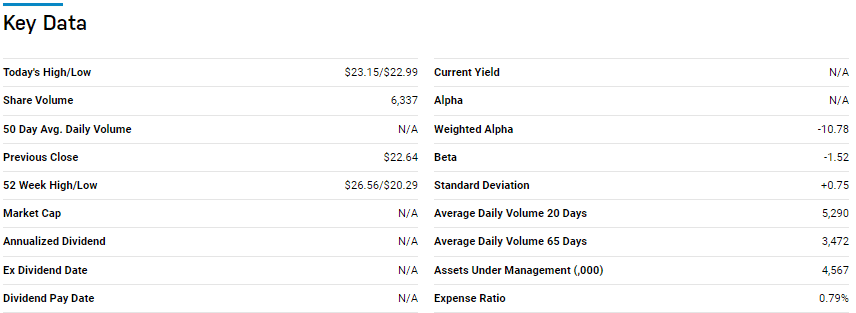

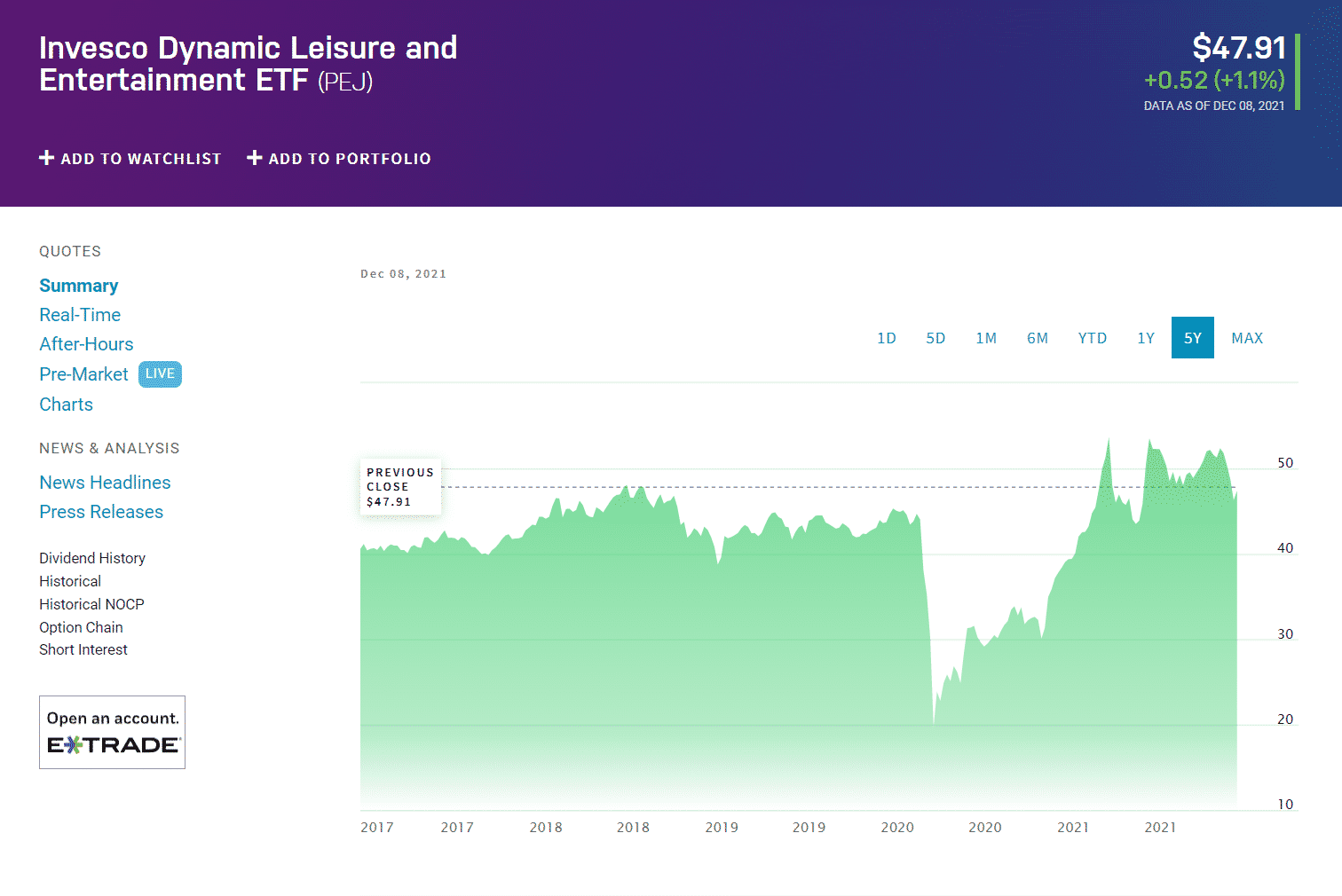

№ 2. Invesco Dynamic Leisure and Entertainment ETF (PEJ)

Price: $47.91

Expense ratio:0.63%

Annual dividend yield:0.73%

PEJ chart

The Invesco Dynamic Leisure and Entertainment fund track the performance of the Dynamic Leisure & Entertainment Intellidex Index, investing at least 90% of its total assets in the holdings of the composite index. Investors get exposure to organizations that design, produce and distribute goods and services in the leisure and travel niches.

Among cyclical consumer ETFs, PEJ is ranked No. 13 by USNews among the 35 best funds for long-term investing.

The top three holdings of this ETF as of now are:

- McDonald’s Corporation – 5.24%

- Marriott International, Inc. Class A – 5.11%

- Chipotle Mexican Grill, Inc. – 5.08%

PEJ boasts of $1.42 billion in assets under management, with investors having to part with $63 annually for every $10000 investment. With its rigorous holdings’ evaluation metrics, this fund is always on track to make money for its investors; 5-year returns of 21.67%, 3-year returns of 12.82%, pandemic year returns of 25.01%, and current year to date returns of 18.06%. Despite having a holding base of 30 organizations, PEJ is has one of the evenest weight distributions.

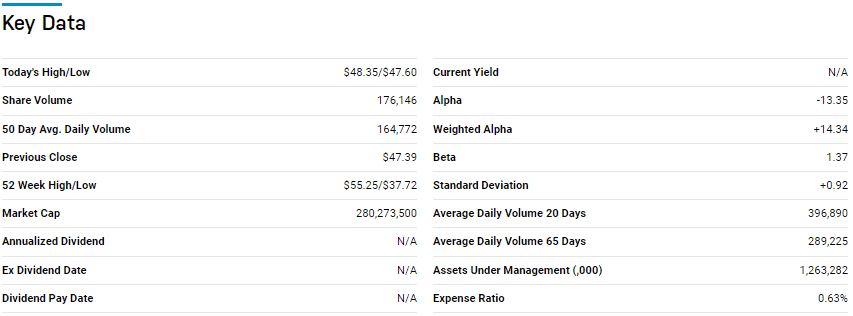

№ 3. Invesco S&P SmallCap Consumer Discretionary ETF (PSCD)

Price: $114.72

Expense ratio: 0.29%

Dividend yield: 0.52%

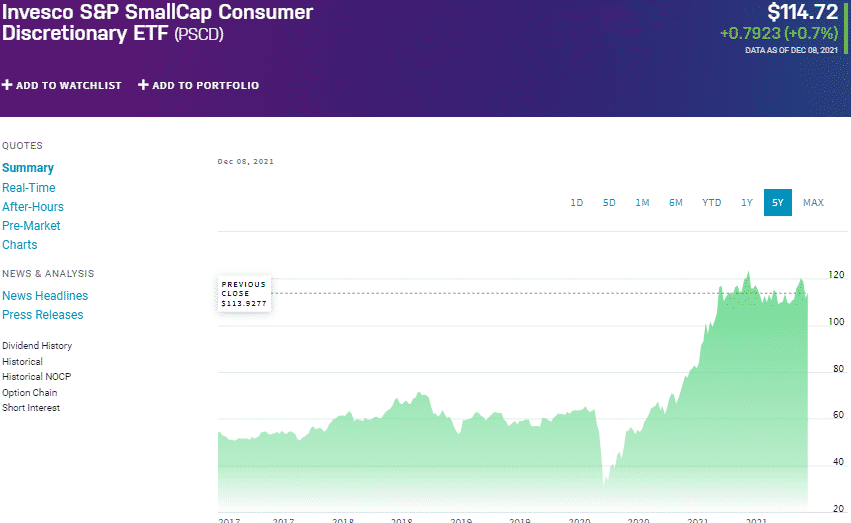

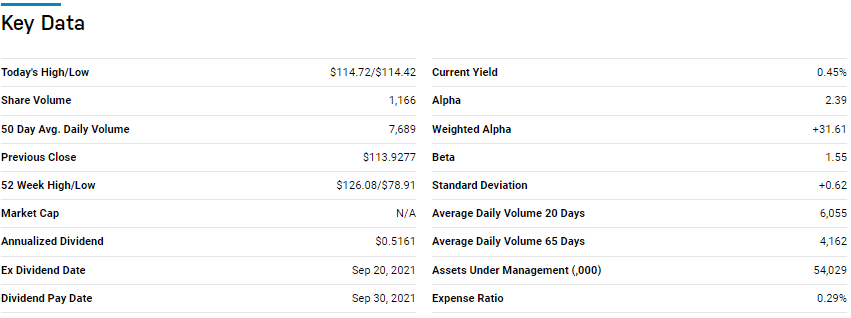

PSCD chart

Invesco S&P small-cap consumer discretionary ETF tracks the performance of the SmallCap 600® Capped Consumer Discretionary Index, investing at least 90% of its assets in the securities of publicly traded US small-cap consumer discretionary equities. Investors get exposure to restaurants, retailers, leisure products and services, and automakers.

The top three holdings of this ETF are:

- Macy’s Inc. – 6.12%

- Signet Jewelers Limited – 3.31%

- Meritage Homes Corp. – 3.20%

PSCD fund has $54 million in assets under management, with an expense ratio of 0.29%. This ETF provides an alternative to restaurant-targeted investing by diversifying to include other organizations in the cyclical consumer goods and services universe.

In addition, it is made up of a blend of small and medium cap stocks hence providing both value and growth opportunities, which translates to more than average earnings; 5-year returns of 125.47%, 3-year returns of 97.44%, pandemic year returns of 42.37%, and current year to date returns of 40.26%.

Final thoughts

There are few pure-play restaurant ETFs, but funds with significant exposure to the industry are available for investment. With data showing that 56% of the American population eats out and orders food delivery services 2-3 times a week, the reopening of the economy post-pandemic will only drive these numbers higher, setting the stage for earnings season. With the limited selection in restaurant-specific ETFs, the three above are a great starting point.

Comments