Experts say that 95% of the active traders in the forex market lose all their investment. Investing in the FX is one of the riskiest and daunting activities in the financial world. Is it possible to mitigate against the risks in the forex markets and make money?

The article seeks to answer these questions by looking at forex or currency exchange-traded funds.

What are forex ETFs?

Exchange-traded funds are a pool of investment that exposes investors to a particular industry segment. For example, forex ETFs, also known as currency ETFs, refer to funds exposing investors to changes for a specific currency pair or in several such couples.

Similar to the other, forex ETFs trade like stocks — throughout the day. Currency ETFs are passively managed with the underlying currency value. They are held either in a single country, usually globally accepted, or as a pool of different currencies.

The benefits of forex ETFs:

- A fast, cost-effective, and straightforward way of exposure to global currencies.

- Ease in trading and available on almost all the broker platforms.

- One-stop solution to hedge against fluctuating forex value for overseas investments.

- A convenient way to reduce the time spent analyzing individual forex pairs.

- Excellent for FX speculation and portfolio diversification.

How to be part of the forex ETF market?

There are two approaches to get into the forex ETF market:

- Using traditional brokers where you call for them to place your orders.

- Using electronic broker platforms to establish the positions yourself.

Both brokers offer the ETFs for investment and trading: investing is actual ownership of the ETF. In contrast, trading involves speculation on the change in an ETF price through a contract for differences, CFDs.

Whether trading or investing in the forex ETFs, it is a simple 3 step process.

|

Step 1 |

Step 2 | Step 3 |

| Find a forex ETF whose underlying currencies align with your investment objectives and portfolio management rules-use broker platform or screener. | Analyze the currency ETF and establish its liquidity, risk exposure, and returns. | Buy the forex ETF of choice. |

Top 3 currency ETFs worth buying in Q2 2021

Suppose you want to diversify your portfolio via forex ETFs and hedge against foreign exchange risk for overseas investments held. In that case, you analyze the entire range of currency ETFs and choose the best. Forex ETFs offer investors an avenue to benefit from currency changes at low risk, increased diversity, and high liquidity.

So, the question is, which are the top three forexes ETFs to buy in Q2 2021?

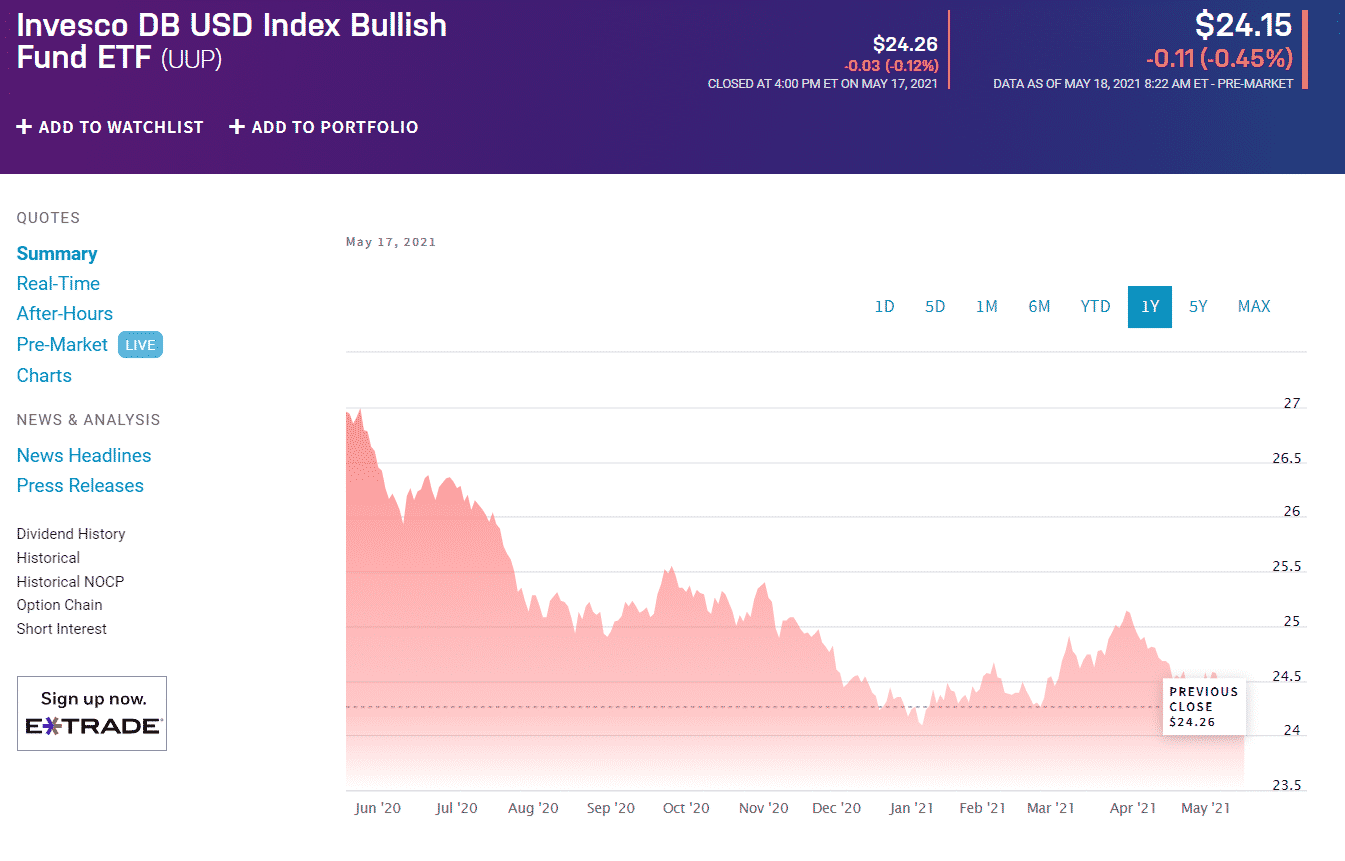

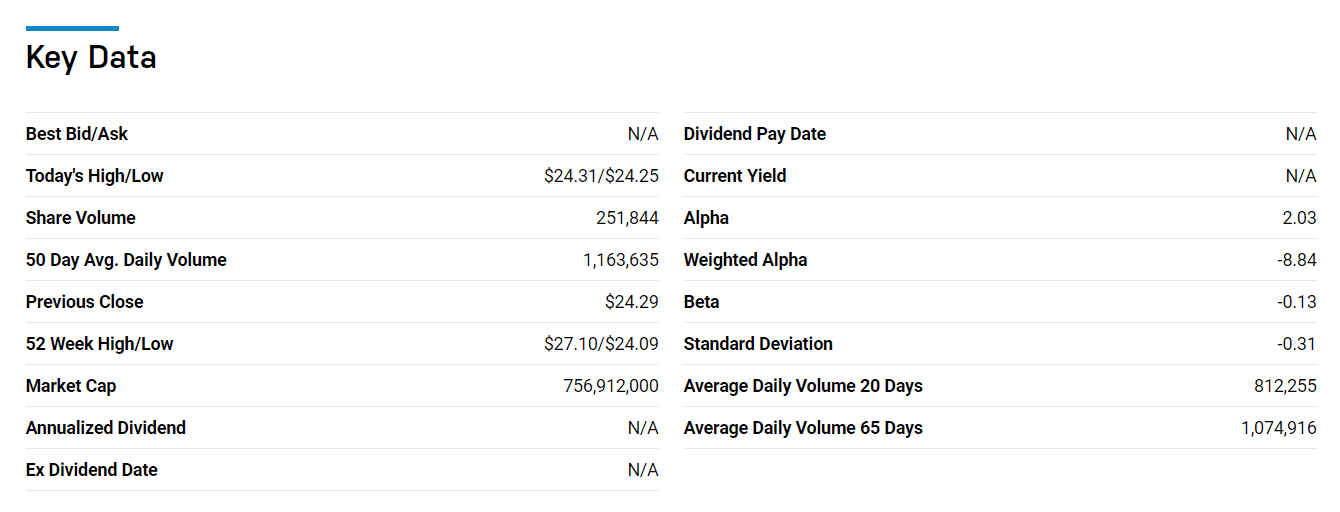

№ 1. Invesco DB US Dollar Index Bullish Fund (UUP)

Price: $24.15

Expense ratio: 0.75%

This Forex exchange-traded fund seeks to establish long positions in the future contracts of the ICE US Dollar Index. In addition, it offers exposure to a basket of currencies relative to the US dollar.

The fund is positively correlated to the dollar value. So if the dollar value increases, it increases, and when the dollar value reduces, it also reduces. So it tracks changes in the underlying Index Treasury Income, Money Market Income, Deutsche Bank Long USD Currency Portfolio Index, and T-Bill ETF income.

The US is among the countries worst hit by the Covid19 pandemic, as evidenced by the decline of the UUP fund by 10.64% last year. However, successful elections and the coronavirus vaccine have seen the dollar value rebound — 0.23% year to date return is cause for celebration.

So this forex ETF has $368.49 million in assets under management. The current dividend payout is at $0.53, annually per share every quarter.

The UUP is a fund for investors seeking exposure to the leading world market currencies and those interested in an inversely correlated fund to the broader stock market.

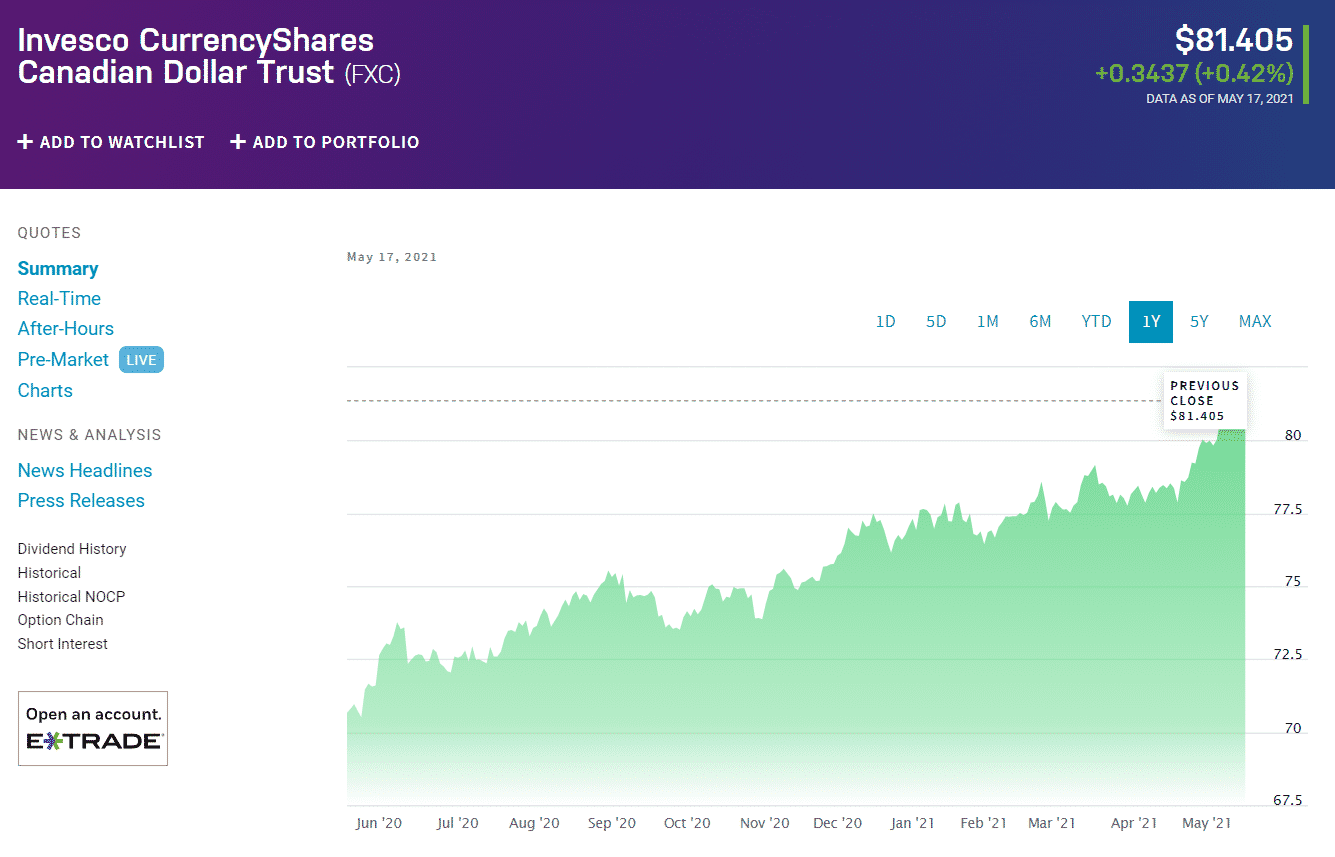

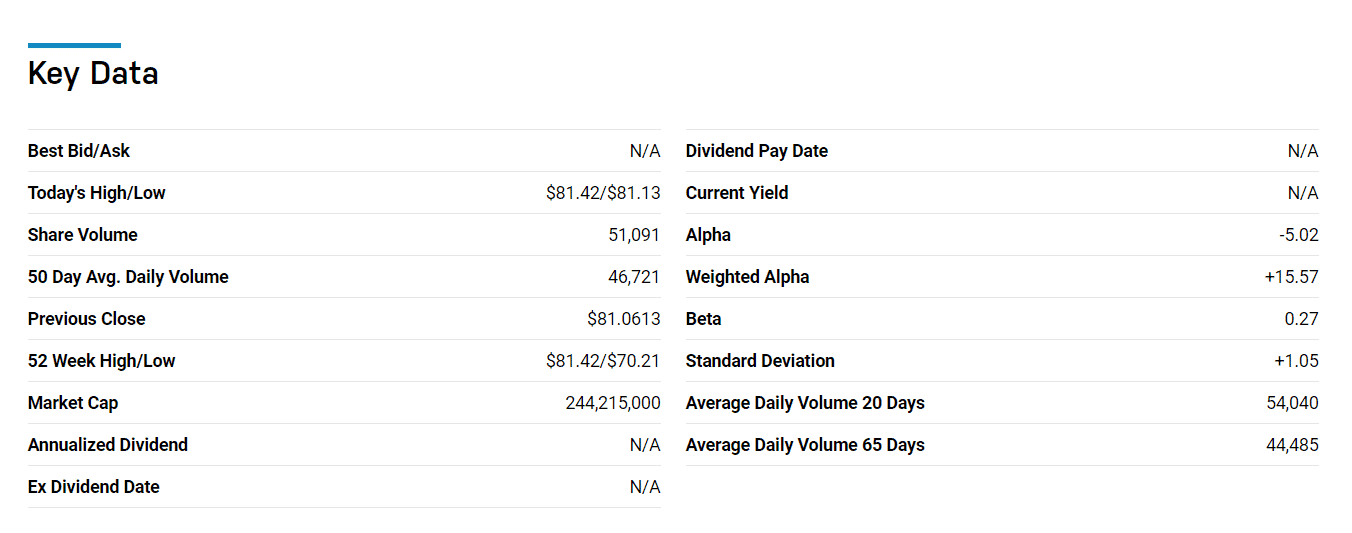

№ 2. Invesco Currency Shares Canadian Dollar Trust (FXC)

Price: $81.405

Expense ratio: 0.4%

The Invesco Currency Shares Canadian Dollar Trust Fund tracks the price of the Canadian dollar to provide investors with cost-effective, low-risk forex investments compared to traditional forex markets. Despite the global Сovid19 pandemic, this forex ETF has been on a bullish run for the last 12 months, 1-year return of 16.06%, and shows no signs of slowing down, year to date return so far of 5.14%.

FXC has $171.665 million in assets under management and an expense ratio of 0.4%. In addition, investors enjoy monthly dividends currently at $0.06 per share.

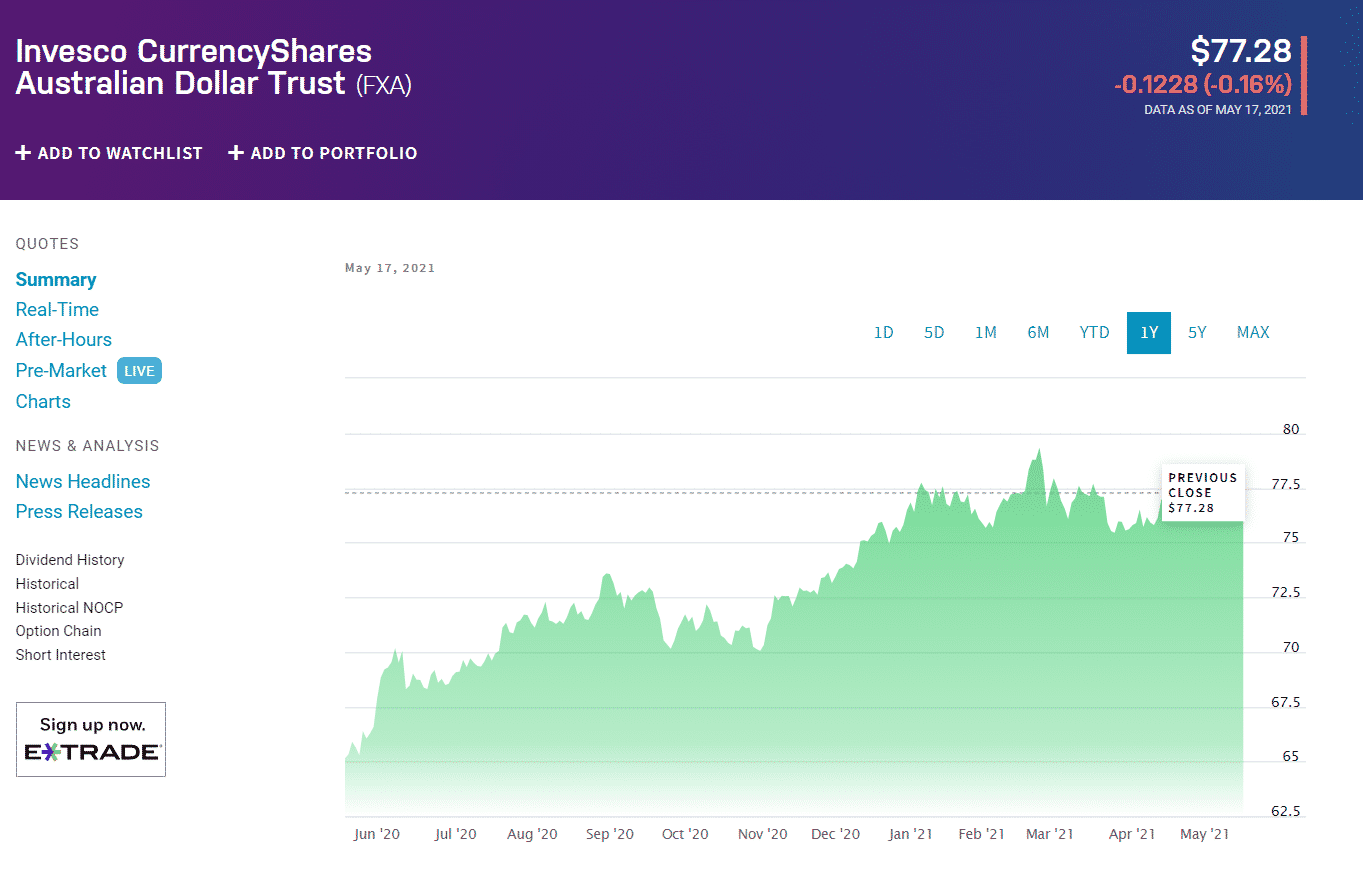

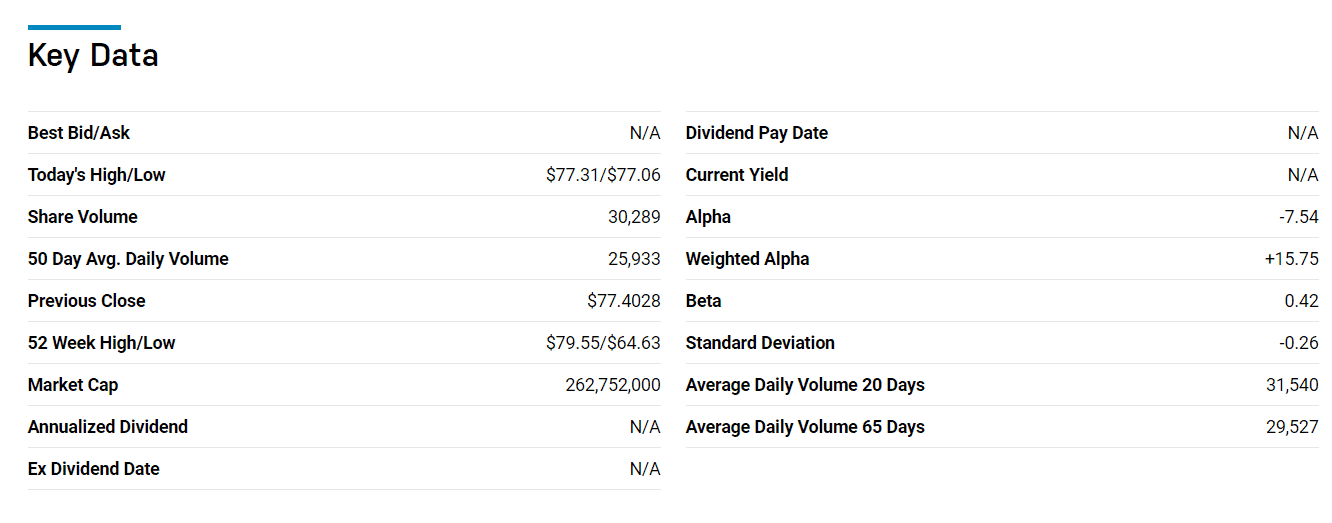

№ 3. Invesco Currency Shares Australian Dollar Trust (FXA)

Price: $77.28

Expense ratio: 0.4%

The Invesco Currency Shares Australian Dollar Trust Fund tracks the price of the Aussie dollar to provide investors with cost-effective, low-risk forex investments compared to traditional forex markets. Despite the global Сovid19 pandemic, the pacific islands were able to contain the virus efficiently and resume regular economic activity within their borders, as evidenced by its bullish run for the last 12 months, 1-year return of 20.47%, and shows no signs of slowing down, year to date return so far of 0.53%.

FXA has $157.56 million in assets under management and an expense ratio of 0.4%. In addition, investors enjoy monthly dividends currently at $0.01 per share.

What are the risks of forex ETFs?

Currencies represent the stock of a particular country, and before taking part in the forex market, whether via individual currencies or ETFs, the following factors need consideration since they have a bearing on currency value:

-

Politics

The internal political, economic, and social health of a country determines the value of its currency.

-

Central bank

Monetary policies set by a country’s central bank have a direct correlation to how its currency performs.

Price gaps

Currency ETFs are not as liquid as their underlying currencies. As such, Forex ETF investing experiences price gaps as a result of the liquidity mismatch.

Comments