ETF full name: Invesco DB US Dollar Index Bullish Fund

Segment: currency

ETF provider: Invesco

|

IPO key details |

||

| Issuer | Invesco | |

| Inception date | February 20, 2007 | |

| Expense ratio | 0.76% | |

| Management company | Hubbard, Baum, and Theodore | |

| Average Daily $ volume | 22.7 million | |

| Investment objective | Hedge | |

| Investment geography | Treasury bonds and bills | |

| Benchmark | Deutsche Bank Long US Dollar Index | |

| Leveraged | N/A | |

| Net Assets under Management | $371.85 million | |

About the UUP ETF

February 2007 saw the availing of the UPP fund to investors and a chance for them to hedge against overseas investment hits due to change in currency value, especially in Europe.

The unabbreviated name for this currency ETF is the Invesco DB US Dollar Index Bullish Fund. It is a non-diversified fund comprising a basket of developed economies currencies against the Dollar, the Euro, the Japanese yen, the British pound, the Swedish krona, and the Swiss franc.

Since its inception, this currency ETF has 60-day average spreads of 0.04%. In addition, the currency weightings have never changed since 1973.

UUP fact-set analytics insight

The Invesco DB US Dollar Index Bullish Fund objective is establishing bullish positions in the ICE US Dollar Index futures contracts. It tracks changes in the Deutsche Bank Long US Dollar Index, the index’s treasury incomes, money markets, and T-bills. In addition, it invests in long Deutsche Bank Long US Dollar Index futures contracts.

The fund has a positive correlation to the Dollar value-if the trade-basket value increases, it declines, and suppose the Dollar value increases, it also increases.

UPP annual performance analysis

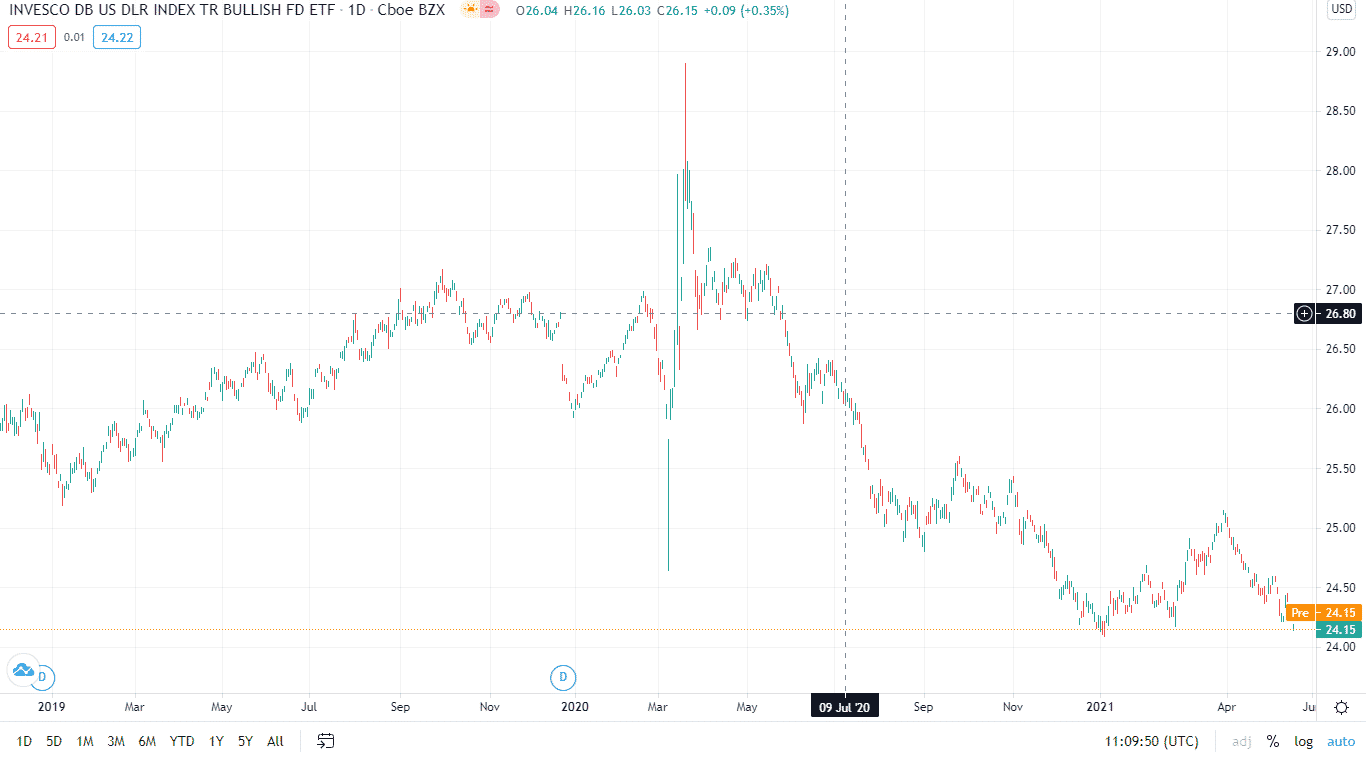

Among the global community and economies, the United States is one of the countries hardest hit by the novel coronavirus. The countrywide lockdown and uncertainty exhibited during an election year compounded, leading to the decline of the UUP fund by 10.64% last year.

However, the worst seems to be behind this currency ETF. Currently, the fund is resting above significant support. The resumption of economic activities on the back of the Covid19 vaccine, coupled with a new regime in power, is the catalyst for the Dollar recovery.

Near the end of Q2 2021, the fund has a year-to-date return of -0.43% only which is much better than what investors experienced last year. In addition, UUP ETF boasts $371.85 million in assets under management with an annual dividend payout of $0.53 per share.

IPO ETF RATING |

|||||

| Resource | ETF DATABASE | ETF.com | MarketWatch | Morningstar.com | Money.usnews.com |

| IPO Rating | A- | N/A | 3 | N/A | N/A |

| IPO ESG Rating | N/A | N/A | N/A | N/A | N/A |

UUP key holdings

The most significant underlying investment asset of the Invesco DB US Dollar Index Bullish Fund is the Invesco Short-Term Investments Trust Government & Agency Institutional Class Fund — 23.83%. It seeks the current income maximization for liquidity maintenance and capital preservation. As more economic sector resumes full operation post-pandemic, capital reserves expansion is inevitable, spurring a bullish run on this fund and, as a result, a bullish outlook on the UUP.

Next on the list is Invesco Treasury Collateral ETF — 6.73%. It tracks the short-term publicly traded non-convertible federal obligations. As the economy resumes and the economic stimulus package reduces, these obligations are ripe for redemption at a good value.

Next on the list are an assorted basket of five 0% treasury bills redeemable within the year, taking the total of these assets to over 57% of this funds weighting.

Here are the most significant underlying assets of the UUP currency ETF.

| Ticker | Name | Weight | Maturity date |

| AGPXX | Invesco Short-Term Investments Trust Government & Agency Institutional Class Fund | 23.83% | N/A |

| CLTL | Invesco Treasury Collateral ETF | 6.73% | N/A |

| N/A | United States Treasury Bills 0% | 6.42% | 5th Aug 2021 |

| N/A | United States Treasury Bills 0% | 6.08% | 12th Aug 2021 |

| N/A | United States Treasury Bills 0% | 5.05% | 9th Sept 2021 |

| N/A | United States Treasury Bills 0% | 4.27% | 7th Oct 2021 |

| N/A | United States Treasury Bills 0% | 4.15% | 4th Nov 2021 |

Industry outlook

A peep at the charts shows the Dollar’s continued slide, but the federal minutes and the inflation rates in the eurozone show that the UPP fund is in for a bullish run.

The LMAX analysts agree with this view and state that the Dollar’s continued slide is uncalled for, and a market correction is on the horizon.

Comments