When you talk about food, corn is not the first thing that comes to mind. However, the global market corn volume in 2020 was 1.14 billion metric tons and is expected to grow at a CAGR of 5.3% by 2026.

With corn farming activities alone valued to hit $51.5 billion in 2022, the corn value chain provides tremendous potential for investors to make money. Thus, corn is one of the few commodities representing economic activity across producers, consumers, and merchants.

What is the composition of corn ETFs?

The fallacy attached to corn and its investing is being a source of food only. The truth is that corn, in addition to its use as a food source, is utilized in starch and sweetener production, ethanol fermentation, and the sustainable production of plant-based plastics. As such, corn ETFs comprise equities in the corn value chain or other agricultural ETFs with significant exposure to corn.

The best 3 corn ETFs to buy in 2022

The grain industry and, by extension, the agricultural commodity segment is essential for global food supply resulting in a vibrant buy and sell market that transcends borders. However, the underlying commodities are highly volatile because their demand and supply are pegged on factors not entirely controllable; weather, population, and seasons, just to name a few. The same is true for corn necessitating diversity from single equities for investments. Thus, the three corn ETFs below give investors diversified access to this multi-billion industry.

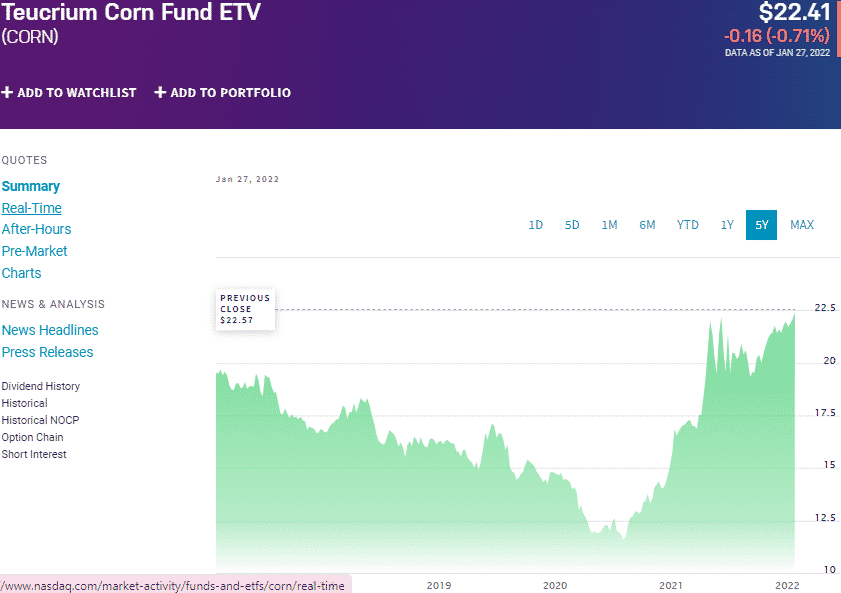

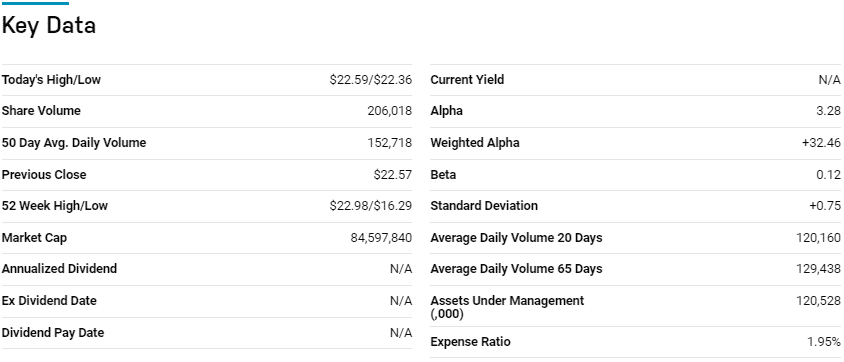

№ 1. Teucrium Corn Fund ETV (CORN)

Price: $22.41

Expense ratio: 1.95%

Dividend yield: N/A

CORN chart

There is no investing in corn as a commodity without mentioning the Teucrium Corn Fund. It is the only pure-play corn ETF available to investors. The CORN ETF tracks the Teucrium Corn Index, investing 100% of its total assets in the futures contract making up its composite index. As a result, it exposes investors to the closing settlements of three corn futures contracts traded on the Chicago Board of Trade.

CORN has $121.0 million in assets under management, with an expense ratio of 1.95%. CORN is one of the few pure-play agricultural ETFs available to investors exposing them to one of the most critical agricultural commodities.

It also eliminates contango by diversifying maturity periods for its futures contract, making it both a short-term and long-term investment asset. In the last half a decade, CORN has consistently rewarded its investors with returns that either match the category average or outperform it; 5-year returns of 15.80%, 3-year returns of 38.38%, and 1-year returns of 35.64%.

Food prices contribute to the broader uptrend in prices, and with multiple uses of corn, this pure-play corn ETF is worth a look.

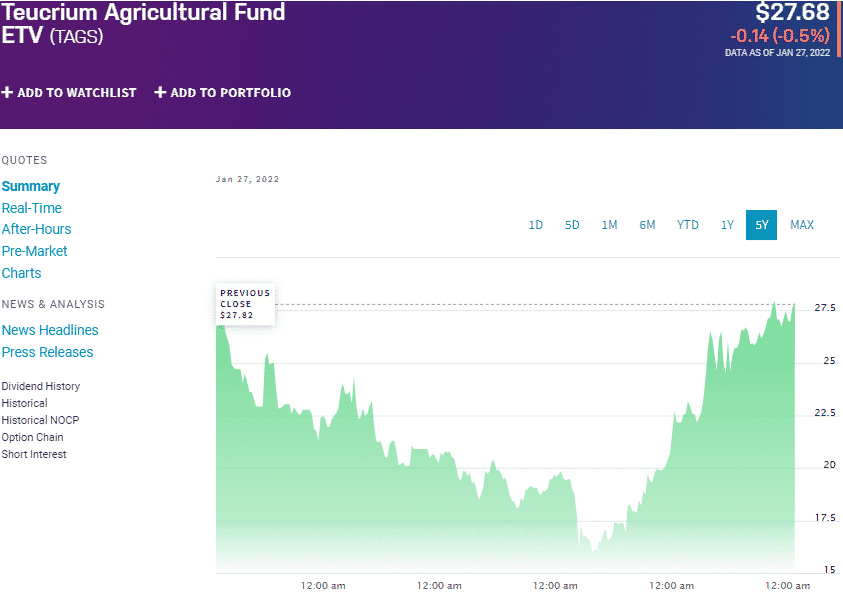

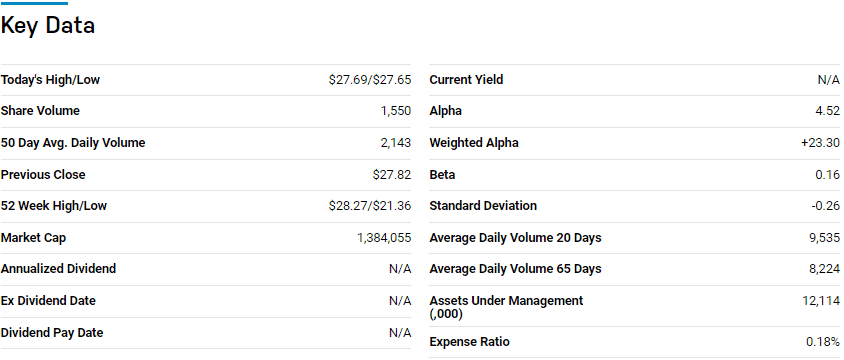

№ 2. Teucrium Agricultural Fund ETV (TAGS)

Price: $27.68

Expense ratio: 0.18%

Dividend yield: N/A

TAGS chart

This ETF tracks the performance of four commodity funds; Teucrium Corn Fund, Teucrium Wheat Fund, Teucrium Soybean Fund, and Teucrium Sugar Fund. Normally, TAGS ETF invests all its assets in equal shares in the four commodity funds seeking to provide daily investment results that total to the combined performance of its composite funds.

The three holdings of this ETF are:

- Teucrium Sugar — 25.34%

- Teucrium Corn Fund — 25.00%

- Teucrium Soybean — 24.98%

The TAGS ETF has $12.2 million in assets under management, with an expense ratio of 0.18%. It is the only commodity ETF that provides diversified exposure to pure-play agricultural commodities; sugar, corn, wheat, and soybeans.

With investors always worried about inflation, it is an ETF that provides an inflation hedge and the reason why in the last half a decade, its returns have been positive; 5-year returns of 5.98%, 3-year returns of 34.27%, and 1-year returns of 25.88%.

Couple inflation hedge with the rising global prices of natural resources and inputs, and the TAGS ETF becomes an indirect play on the markets to take advantage of these market drivers.

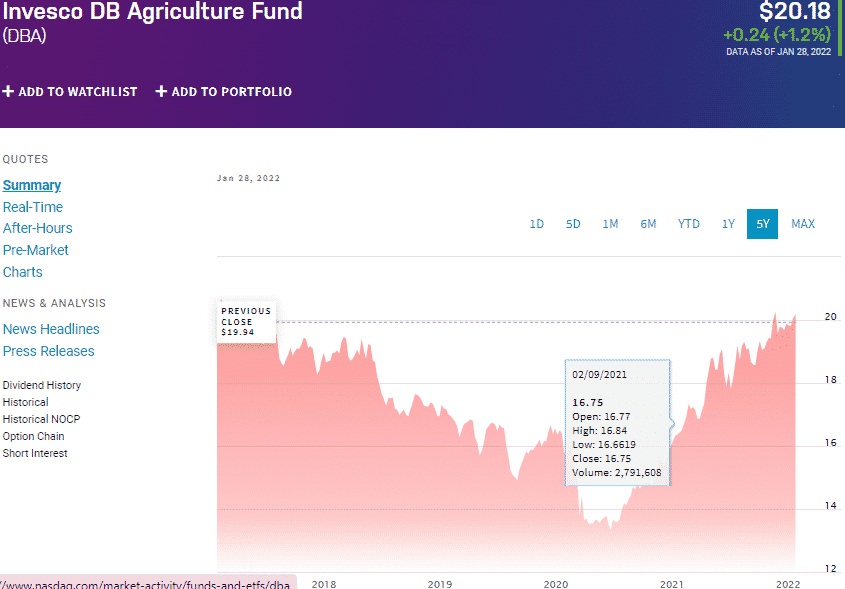

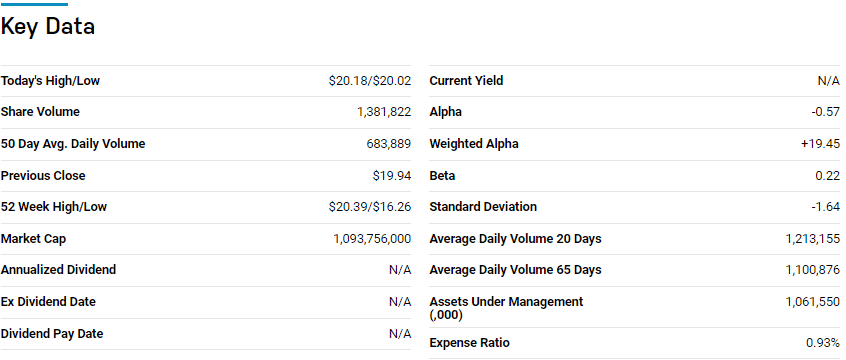

№ 3. Invesco DB Agriculture Fund (DBA)

Price: $20.18

Expense ratio: 0.93%

Dividend yield: N/A

DBA chart

This ETF tracks negative and positive changes to the DBIQ Diversified Agriculture Index TR and its excesses over the expense; money markets, T-Bills RTF Income, and Treasury income. The composite index combines several index commodities to expose investors to the entire agricultural industry through some of the most popular and liquid futures contracts in this market.

The top three holdings of this ETF are:

- MUTUAL FUND (OTHER) — 63%

- Invesco Treasury Collateral ETF — 8.40%

- US Dollar — 7.53%

DBA ETF has $1.06 billion in assets under management, with investors having to part with $93 for every investment worth $10000 annually. In inflation-rising environments, like the present circumstances, investors seek inflation-hedged assets in the commodity industry, with the go-to niches being energy and agriculture.

The DBA provides a diversified investment option to the agricultural corner of the commodities market by exposing investors to a basket of agricultural, natural resources. This diversification has seen the DBA consistently bear fruits for its investors, putting in a strong case for consideration if eyeing investment in the agricultural sector; 5-year returns of 0.69%, 3-year returns of 18.56%, and 1-year returns of 21.36%. Having US treasury securities as part of this fund’s underholding also provides regular income.

Final thoughts

The most direct and hassle-free investment risk mitigation strategy in rising inflation and uncertain economic times is investing in commodities. Right now, the global economies are struggling to find a balance between curbing rising inflation and spurring economic resurgence. The ETFs above provide an avenue to hedge against inflation by investing in one of the most liquid global commodities, bound to benefit as resurgence picks up pace due to its multi-usage.

Comments