Despite the coronavirus pandemic and the current inflation levels, the size of the middle-class consumer class and the rich continues to expand, increasing the global purchasing power. The result is an industry growing by 4% annually since 2000, to hit 4 billion consumers by the end of 2021, taking the value of consumer spending annually to over $5 trillion.

Couple this with the rising inflation and the uncertain economic conditions. It is time to invest in the consumer sector since all these factors, traditionally, have provided an updraft for this sector to outperform the broader markets. Rather than pick through a plethora of consumer equities and try picking those that have the potential for returns, why not bank on the growth of the whole sector with these three consumers ETFs.

Consumer ETFs for profits in 2022: how do they work?

Consumer exchange-traded funds comprise of equities involved in the provision of consumer products and all associated ancillary services; warehouse clubs, manufacturing, apparel and electronics stores, general merchandise stores, marketing, fast foods, specialty stores, footwear stores, media house, accessories stores, department stores, entertainment, home improvement, and discount stores.

Top 3 consumer ETFs to outperform the markets

These three consumer ETFs expose the consumer sector as an avenue to be defensive against the current market volatilities and corrections due to rate hikes. Rate hikes and unchecked inflation reduce purchasing power, necessitating going defensive. However, a red-hot economy on its way to pre-pandemic resurgence coupled with full employment means consumer spending is on the verge of expanding.

№ 1. Consumer Discretionary Select Sector SPDR Fund (XLY)

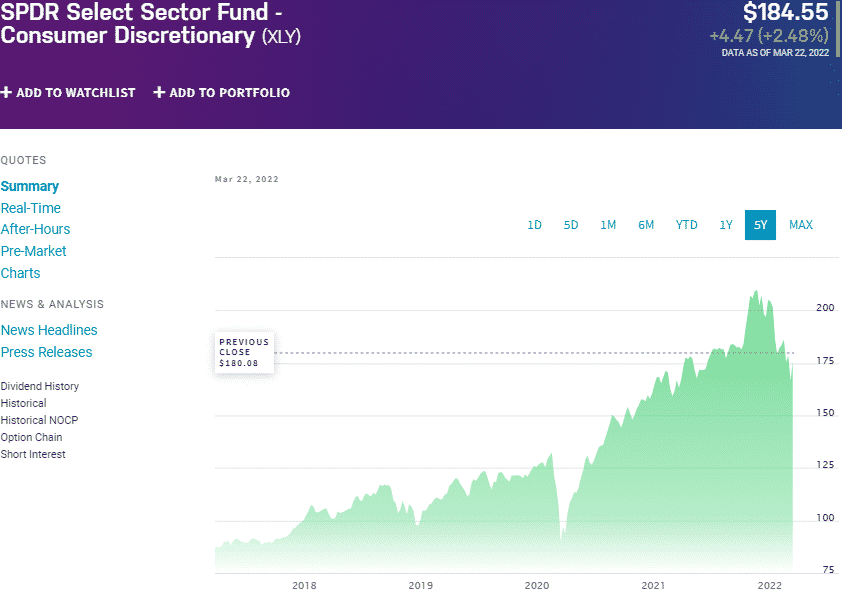

Price: $184.55

Expense ratio: 0.10%

Dividend yield: 0.54%

XLY chart

If you are investing in the consumer sector, then you ought to start with the XLY fund, which tracks the performance of the Consumer Discretionary Select Sector Index, net of expenses, and fees.

It invests at least 95% of its total assets in the underlying holdings of the tracked index, offering exposure to the largest entire consumer industry; leisure products, retail, auto components, hotels, restaurants and leisure, distributors, textiles, apparel, and luxury goods, automobiles, household durables, and diversified consumer services.

Among 36 cyclical consumer funds, the XLY is ranked №4 by USNews.

The top three holdings of this retail ETF are:

- Amazon.com, Inc.– 24.20%

- Tesla Inc – 1.43%

- McDonald’s Corporation – 4.80%

The XLY ETF is the largest consumer ETF boasting $19.08 billion in assets under management, with an expense ratio of 0.10%. This ETF has concentration bias, with the top two holdings accounting for 42% of the total fund weight. However, a concentration on the best blue-chip companies operating in the consumer space provides for a fund known for consistent returns; 5-year returns of 117.89%, 3-year returns of 64.65%, and 1-year returns of 8.84%. Couple this to high liquidity, deep exposure, and cost efficiency, and this fund is worth considering investing in the consumer sector.

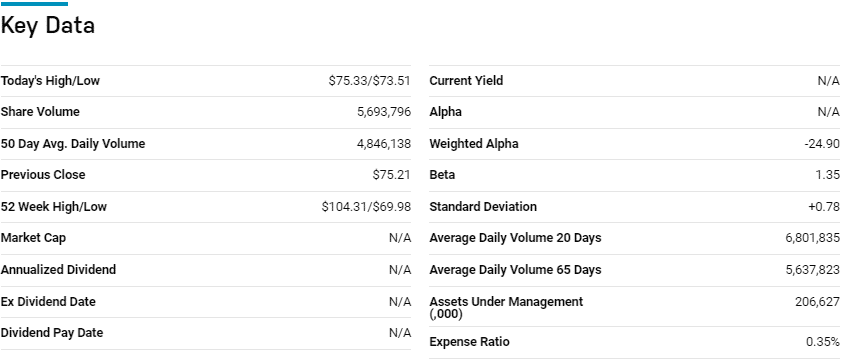

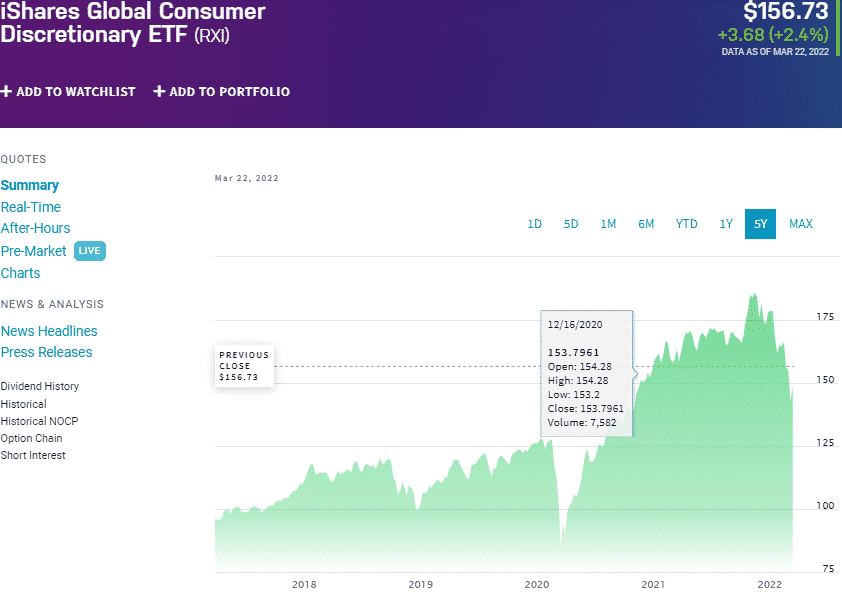

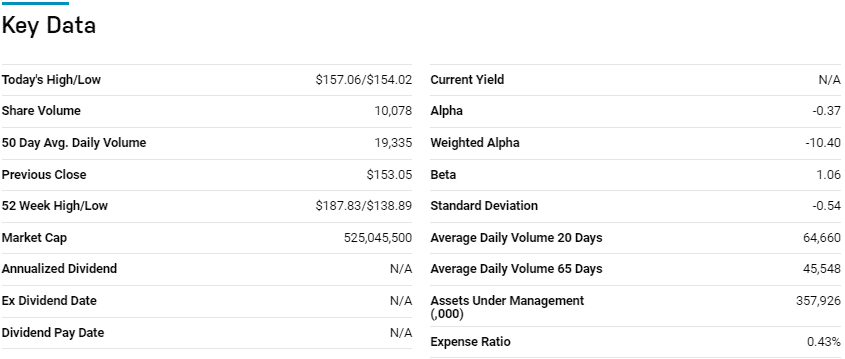

№ 2. iShares Global Consumer Discretionary ETF (RXI)

Price: $156.73

Expense ratio: 0.43%

Dividend yield: 0.64%

RXI chart

The iShares Global Consumer Discretionary ETF tracks the performance of the S&P Global 1200 Consumer Discretionary (Sector) Capped IndexTM, net of expenses and fees. It invests a minimum of 80% of its total assets in its composite index, other assets believed to exhibit the same economic characteristics as those of the tracked index holdings. It exposes investors to the US and global consumer discretionary equities.

The top three holdings of this ETF are:

- Tesla Inc — 9.89%

- Amazon.com, Inc. — 9.73%

- Home Depot, Inc. — 4.27%

The RXI ETF assets under management are meager than the XLY, $336.7 million. Investors’ part with $43 for every investment worth $10000, annually, to gain access to a high beta fund that outperforms bullish markets; 5-year returns of 62.36%, 3-year returns of 36.97%, and 1-year returns of -9.00%. It also provides a more evenly weighted fund via its capped weighting methodology, diversification, and mitigation against concentration risk.

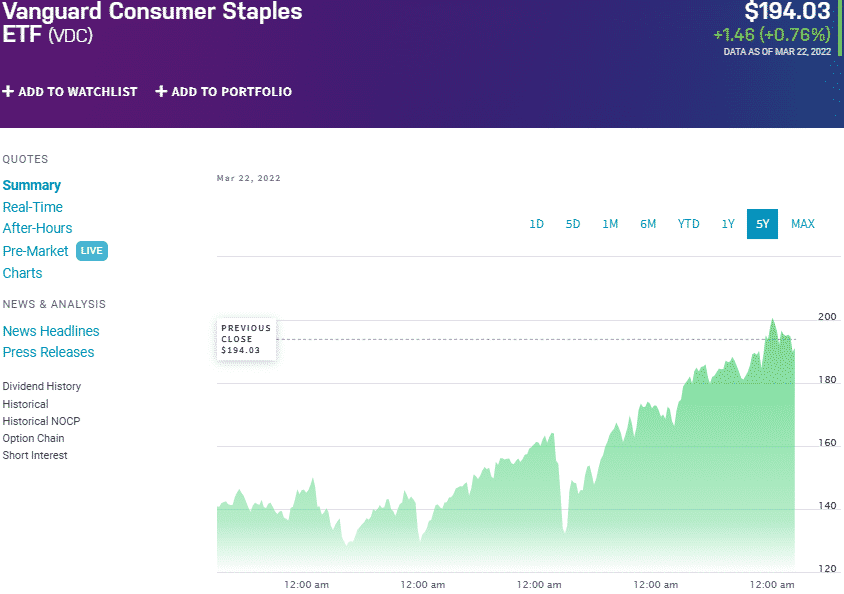

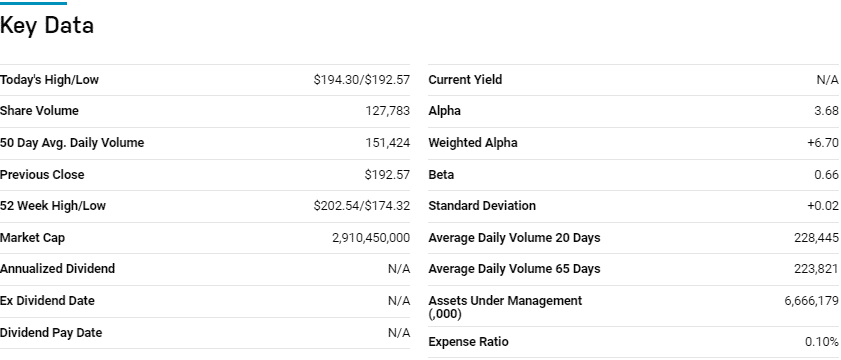

№ 3. Vanguard Consumer Staples ETF (VDC)

Price: $194.03

Expense ratio: 0.43%

Dividend yield: 2.42%

VDC chart

The Vanguard Consumer Staples ETF tracks the performance of the MSCI US Investable Market Index/Consumer Staples 25/50, net of fees and expenses. It invests all of its assets in the holdings of its composite index, exposing investors to US large, mid, and small-cap equities operating in the consumer staples sector.

Among 14 consumer defensive funds, the VDC fund is ranked № 1 by USNews.

The top three holdings of this diversified ETF are:

- Procter & Gamble Company — 13.64%

- Coca-Cola Company — 8.83%

- Costco Wholesale Corporation — 7.83%

The VDC ETF has $6.67 billion in assets under management, with investors having to part with $10 for every investment worth $10000 annually. Having 100 holdings spread across the cap divide with no biasness towards mega-caps provides for a diversified fund free of concentration risk with the ability to provide both value and growth; 5-year returns of 53.59%, 3-year returns of 46.20%, 1-year returns of 13.48%, and consistent income at a 2.42% dividend yield.

Exposure to the consumer staples market, consumer products households can do without, means a year-round demand hence stability for this fund and significant returns.

Final thoughts

The modern-day consumer has gone digital, allowing the consumer sector to be global and continue to increase. The beginning of 2022 has already proved a volatile market, SPY, down year to date to -5.89%, necessitating the need for defensive and relatively more stable investment assets. These three consumer ETFs provide this stability and a chance to earn and outperform the market in this highly volatile economy.

Comments