If you are new to investing, you might have heard about exchange-traded funds. They are essentially groups of stocks put together so you can more easily invest in companies and industries you favor. As the name suggests, you can buy and sell them at an exchange, making the entire process easier and cheaper.

With such a vast number of options out there, you must have asked yourself: how do ETFs come to life? Who creates them and decides what they are going to look like? The answer is simple: issuers or providers.

What do ETF issuers do?

ETF providers are financial firms, or parts of those firms, that specialize in creating ETFs. They are also in charge of marketing the funds and, you’ve guessed it, selling them.

When creating a fund, the companies need to decide many things, ranging from the fund’s size, the number of holdings, pull, rebalancing times, dividend payouts, and similar aspects, all the way to using leverage or inverted leverage for a fund.

Moreover, there is a matter of logistics because the provider also has to find the fund’s custodians, auditors, and administrators.

What are some of the best ETF issuers?

To decide what a good ETF issuer is, you first have to set some criteria. In most cases, people look at performance, assets under management, and the number of holdings. Other people look at how long the company has been in business and any public scandals in the past.

We will combine all of those factors and point out five different ETF providers we think hold value.

1. BlackRock Financial Management

BlackRock is somewhat of a staple name in the investment world, and you will soon find out why. Its combined assets under management amount to a whopping $2.3 trillion, which is exactly why it made it to the very top of our list.

Moreover, its combined revenue came in at $4.3 billion, while you will also not be high and dry when it comes to the number of ETFs that you can choose from, as it offers 395.

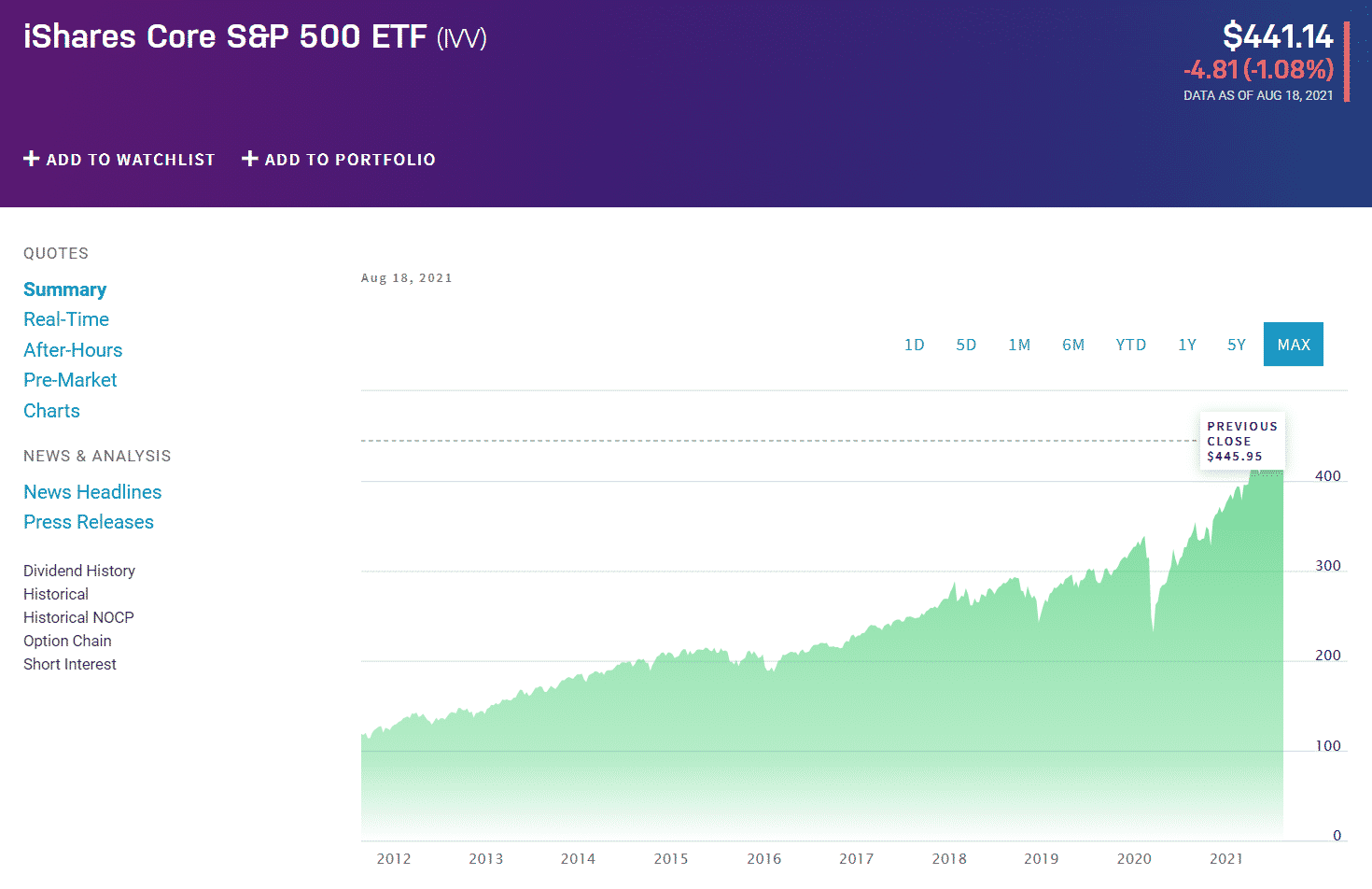

iShare Core S&P 500 ETF chart

Its most well-known fund, IVV, has become one of the largest ETFs worldwide, and it tracks one of the most popular indices in existence, the S&P 500. If you are new to the world of investing, BlackRock is a sure thing.

An exciting feature of almost all American ETFs is that they pay periodic dividends. For equity funds, this usually happens four times a year. IVV is no exception, with a dividend yield of approximately 2.5%.

2. Invesco

Why we chose Invesco to go second is its revenue and return. Invesco doesn’t follow right after BlackRock regarding assets under management, as it ranks fourth on the list provided by ETF.com in that aspect, with its AUM estimated at $369.2 billion. With a much smaller AUM, this issuer still manages to reap a $1.1 billion revenue and an 8.34% return.

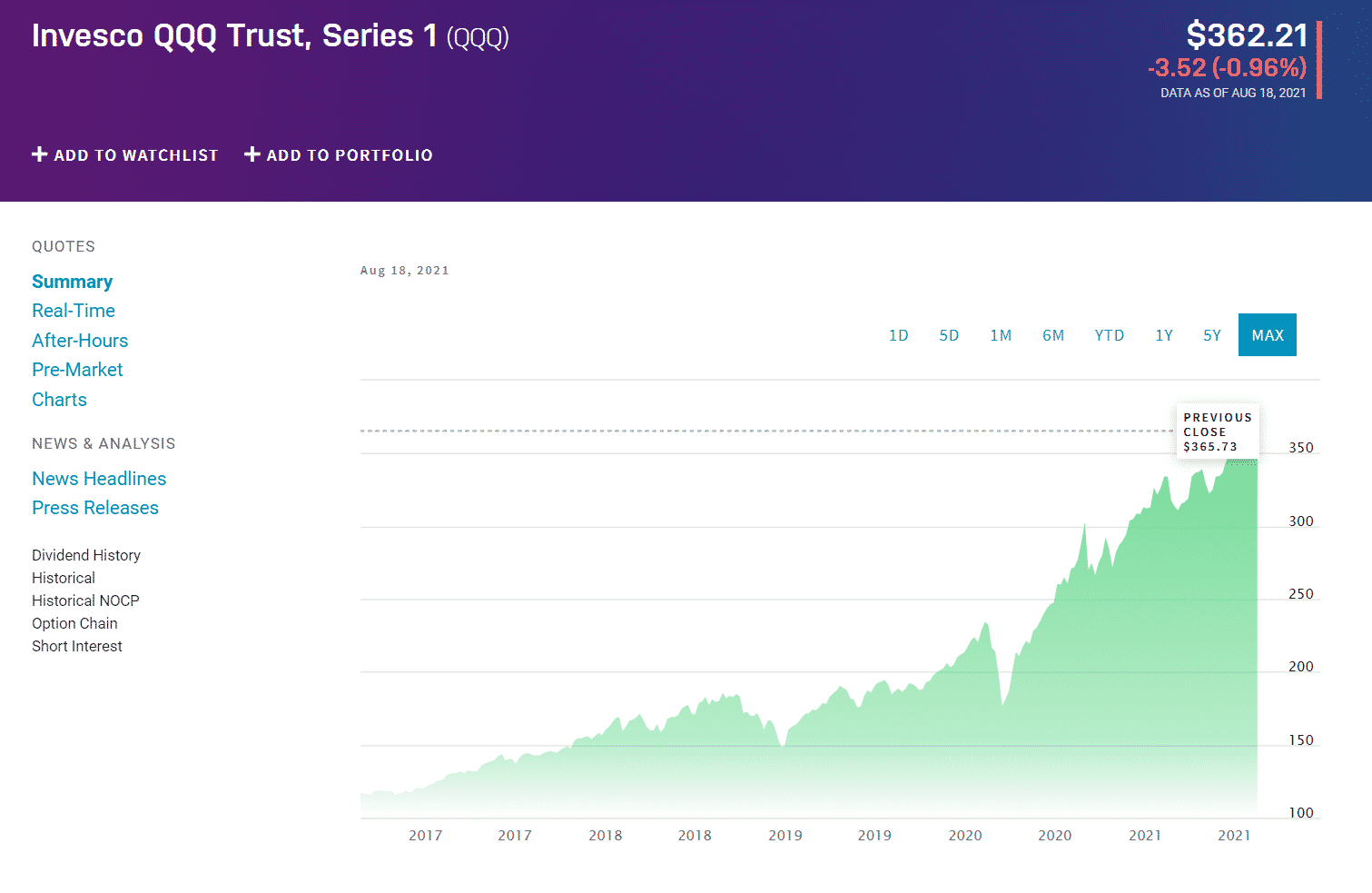

Invesco QQQ Trust, Series 1 chart

The provider’s most interesting fund, in our opinion, is by far the QQQ ETF, which tracks the Nasdaq index. The beauty of the fund is that you can use it as both a trading vehicle due to its high daily volumes and as a part of a buy-and-hold investment strategy if you are confident that the technology sector will expand in the future.

3. ProShares

Now, ProShares doesn’t shine when it comes to the sheer size of the funds in terms of the AUM. It ranks 10th on ETF.com, with less than $60 billion of assets under management. But, as we said, it’s not all black and white when it comes to determining what issuer can be right for you.

With a not-so-impressive AUM figure, this issuer still managed to accrue $468.3 million in revenues, and it still offers 131 different ETFs for you to choose from.

ProsShares S&P 500 Dividend Aristocrats ETF chart

The one that caught our attention was NOBL. It is a fund that looks to provide you with exposure to S&P 500, much like IVV. On the flip side, NOBL comprises only large-cap companies and, more importantly, companies that have raised their dividends continuously for the past 25 years. Next time someone tells you that you can’t have it both ways, show them NOBL.

4. VanEck

VanEck is definitely on the smaller side of ETF providers, even though it still makes the top 10 list of most relevant data providers like etf.com and etfbd.com. What sets it apart from all the others is its agility and open-mindedness.

VanEck is a perfect issuer if you want to explore a particular niche or industry. It doesn’t shy away from forming some unorthodox solutions. It also dedicates a certain number of its 58 ETFs to emerging markets.

VankEck Vectors Gold Miners ETF chart

A valuable addition to the funds we have mentioned today is VanEck’s GDX fund. Many make the mistake of thinking this fund invests in gold when it invests in gold-digging companies. In most cases, the two are similar, as the prices of company stocks usually mimic the movements of the commodity itself, but there are still some interesting twists. If you are looking for a chance to express your creativity in investing, definitely give VanEck a look.

5. ARK Invest

While we usually say that it doesn’t matter who stands behind the company as long as the company does well on the market, in this case, we will have to go back on our word. ARK Invest came into the spotlight thanks to only one person, Cathie Wood, with no disrespect to its team. Some question her methods, but there is no doubt that the woman has managed to beat the market on more than one occasion.

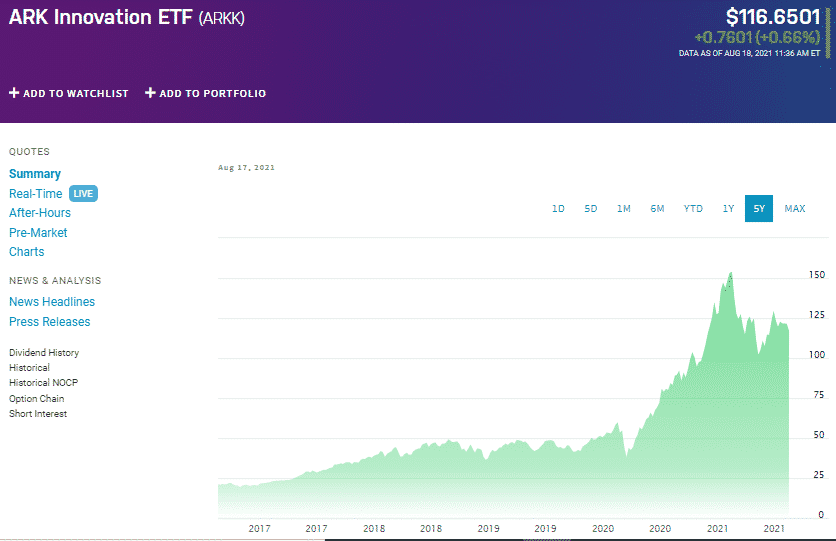

ARK Innovation ETF chart

The company’s flagship ETF is the famous ARKK fund, which looks to benefit from up-and-coming technologies like artificial intelligence, electric vehicles, DNA technologies, and energy innovation. Thanks to its approach, this fund has managed to outperform its rivals multiple times. Based on the latest data provided by the issuer, its annual return amounted to 40.68%.

Final thoughts

Unfortunately, listing all the issuers worth taking a gander at would require much more space than what we have here, and it would take much more time.

The good thing is that you now have the list and knowledge of what constitutes a good ETF issuer. That way, you can find one that best suits your needs, preferences, and investment style.

Be sure to do your research, find as much information as you can, and remember, there is no correct answer for everybody.

Comments