The globe is on the cusp of its next evolution, and the utility sector is in the middle of this phenomenon. It is a segment with a market capitalization of $1.5 trillion in the US alone. With utilities being a mainstay of modern-day life, demand is insatiable as a sector has a history of outperforming the markets.

The three utility ETFs below provide diversified exposure across the utility segment and potential for phenomenal returns in the current volatile markets.

Utility ETFs for profits in 2022: how do they work?

Utility exchange-traded funds comprise equities that provide essential services to both the private and public sectors; electric power, natural gas, sewerage services, water supply, and steam supply. They might also include all ancillary services that support these services.

Top 3 utility ETFs for tasty investment decisions

In most cases, utility ETFs are already well-established blue-chip companies with limitations in growth but with phenomenal dividend yield and stability attractive in volatile markets. So far, the SPY is down -7.91%, showing the market’s volatility due to unchecked inflation, rising interest rates, and the Ukraine-Russia war.

The three utility ETFs below provide a tasty investment decision that ensures investor pockets don’t feel the pinch of all these factors.

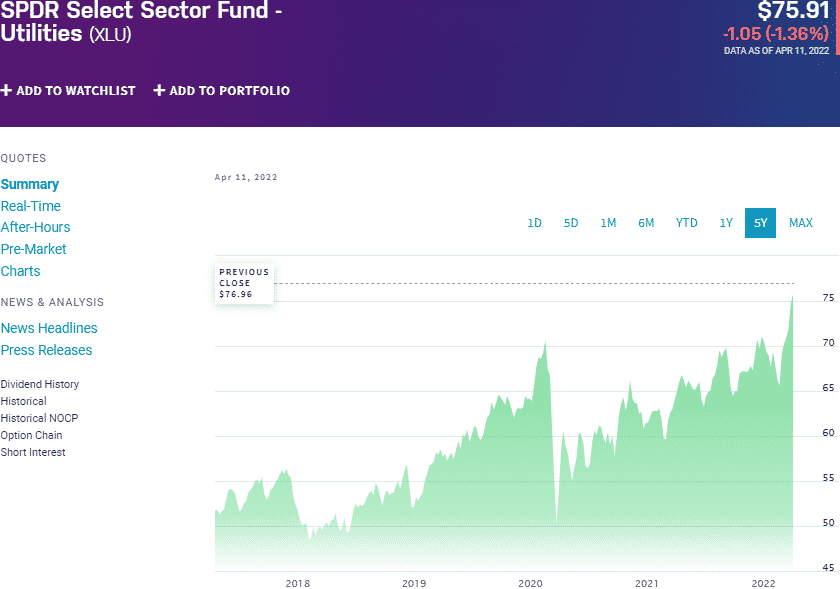

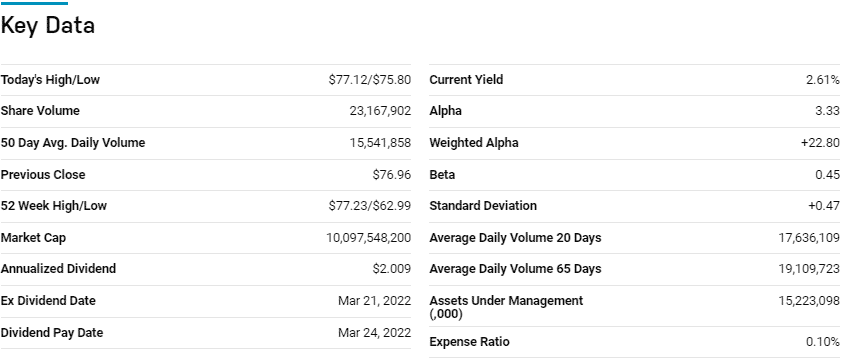

№ 1. Utilities Select Sector SPDR Fund (XLU)

Price: $75.91

Expense ratio: 0.10%

Dividend yield: 2.96%

XLU chart

If you are investing in the utility sector, then you ought to start with the Utility Select Sector SPDR Fund, which tracks the performance of the Utilities Select Sector Index, net of expenses and fees. It invests at least 95% of its total assets in the underlying holdings of the tracked index, offering exposure to the entire utility segment; electric power, natural gas, sewerage services, water supply, steam supply, and the associated ancillary services.

Among 13 utility funds, the XLU is ranked № 4 by USNews.

The top three holdings of this ETF are:

- NextEra Energy, Inc. – 16.78%

- Duke Energy Corporation – 8.16%

- Southern Company – 7.42%

The XLU ETF is the largest utility ETF boasting $15.39 billion in assets under management, with a relatively low expense ratio of 0.10%. This ETF has a concentration bias, with the top three holdings accounting for approximately 32.36% of the total fund weight.

However, a concentration on the best blue-chip companies operating in the US utility niche provides a fund known for consistent returns and more than average dividend yield; 5-year returns of 76.10%, 3-year returns of 45.79%, 1-year returns of 22.18, and a dividend yield of 2.36%. Couple this with high liquidity, deep exposure, and cost efficiency, and this fund is worth considering investing in the utility sector.

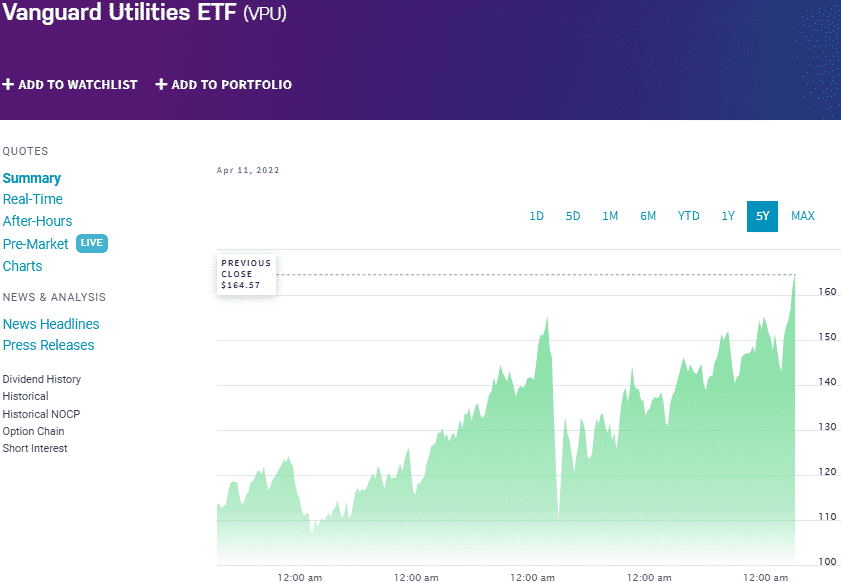

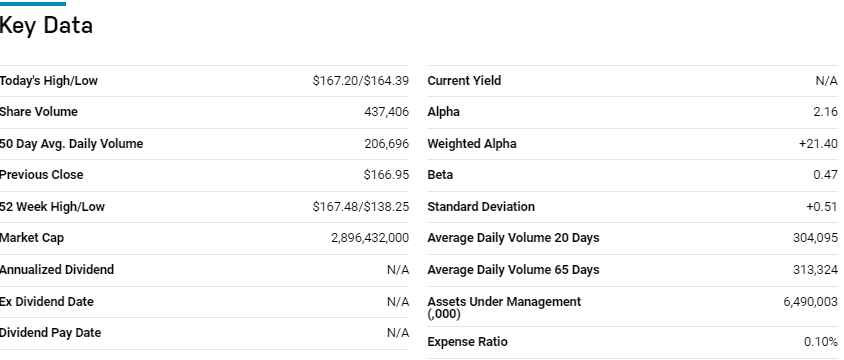

№ 2. Vanguard Utilities ETF (VPU)

Price: $156.73

Expense ratio: 0.10%

Dividend yield: 3.07%

VPU chart

The Vanguard Utilities ETF tracks the performance of the MSCI US Investable Market Index (IMI)/Utilities 25/50, net of fees and expenses. It invests all of its assets in the holdings of its composite index, exposing investors to US large, mid, and small-cap equities operating in the utility sector. It invests all of its assets in the exact weighting as its tracked index.

Among 13 utility funds, the VPU fund is ranked № 2 by USNews.

The top three holdings of this ETF are:

- NextEra Energy, Inc. — 13.99%

- Duke Energy Corporation — 7.04%

- Southern Company — 6.25%

The VPU ETF has $6.51 billion in assets under management, with investors having to part with $10 for every investment worth $10000 annually. Being the most liquid Utility ETF and diversification across the utility sector provides for a pretty resilient fund.

Couple this to holdings spread across the cap divide with no biasness towards mega-caps, and what you get is a fund that provides both value and growth; 5-year returns of 72.56%, 3-year returns of 41.40%, 1-year returns of 21.01%, and consistent above-average return income of 3.07% dividend yield.

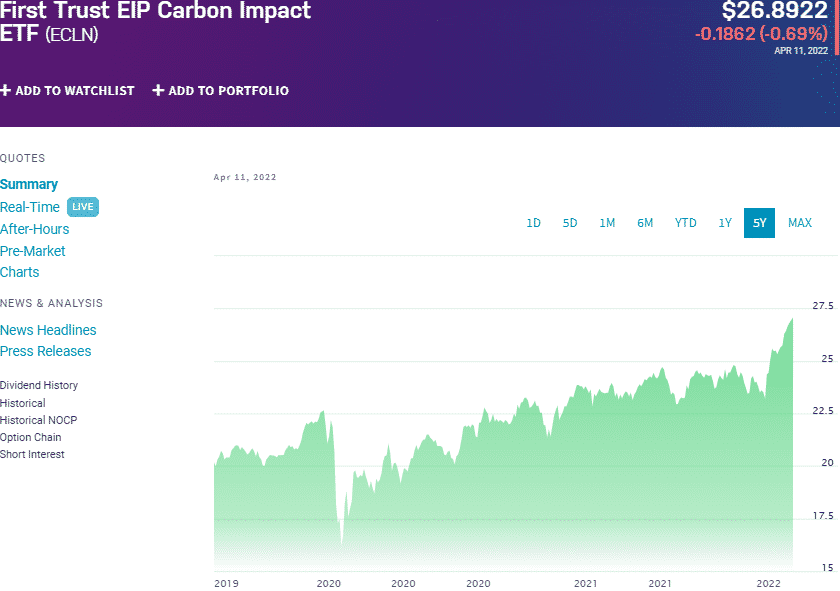

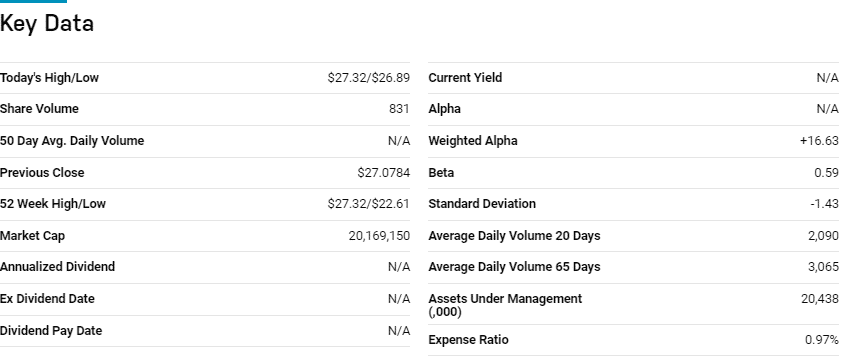

№ 3. First Trust EIP Carbon Impact Fund (ECLN)

Price: $26.89

Expense ratio: 0.97%

Dividend yield: 1.49%

ECLN chart

The utility sector is at the center of the current global revolution toward zero carbon emission. It would be a disservice if one of the ETFs on this list were not in line with conscious investing. The First Trust EIP Carbon Impact Fund is an actively managed fund that seeks both capital appreciation and competitive risk-adjusted returns by tracking the performance of utility equities in a positive carbon footprint.

The top three holdings of this ETF are:

- Morgan Stanley Institutional Liquidity Funds Treasury Portfolio Institutional — 9.53%

- NextEra Energy Partners LP — 5.40%

- Cheniere Energy, Inc. — 5.40%

The ECLN ETF has $20.4 million in assets under management, with investors having to part with $97 for every investment worth $10000 annually. A pretty even weighting coupled with a space that has insatiable demand provides for a fund that can give above-average returns and consistent returns, 12-month returns of 17.39%, and incomes as a result of a 1.49% dividend yield.

Final thoughts

Utility ETFs are a great option to spice up your investment decision to ensure returns despite the economic cycle. Historically, the utility sector has proven to be a defensive investment segment with the ability to hedge against negative returns in bearish markets. This hedge feature is also coupled with stable growth, providing a short-term volatility hedge and long-term growth potential platform.

Comments