The rise of social media has re-invented a well-known strategy employed by beginners to dive into volatile markets without expert skills. Like auto or social trading, the concept leverages the available technology to undermine the risky nature of the asset market.

While it has its unique risks and rewards, the best copy trading platform lets you emulate positions held by experienced investment professionals. It’s a short-term trade strategy borne out of mirror trading, and unique software offers features allowing the sharing and copying of successful trades.

Although copy trading is still in its infancy, the impact of involvement in financial markets is transformational. Novice traders mill around online social networks on auto-trading platforms instead of conducting time-consuming research on market instruments. In this article, we take a look into the risks and rewards involved in copy trading for beginners.

Our recommendations of the best copy trading platforms

TechBerry

TechBerry allows you to trade assets while taking advantage of strategies used by professional and advanced know-how traders. The copy trading platform connects all parties, lets you duplicate actions, and adjust or set the proportions of a copied trade.

Why TechBerry?

TechBerry is a copy trading system that wins on the technical side of things, especially for social connections and automated copy trading software. In addition, the copy trading platform doesn’t charge monthly fees, but the minimum investment is $5,000.

Best overall:

Intuitive interface and solid gains, credibility and regulation.

techberryNaga Trader

Naga Trader has an ultimate priority for transparency in their copy trading system, evidenced by how they keep their monthly leaderboard open even to unregistered traders. Using MT4, the copy trading software offers auto-copy services, plus access to multiple indices, Forex pairs, and stocks, including crypto assets.

Why Naga Trader?

With the Naga Trader copy trading platform, you don’t have to open an account to start tracking your preferred signal provider to emulate their strategy.

Best for:

Transparency and trader strategy profile

naga.comFXTM

A popular copy trading platform, FXTM is an international brokerage active in African and Asian markets. They have various account sizes to suit every trader’s investment portfolio, and their minimum deposit is an affordable $100.

Why FXTM?

You have a wide range of CFD instruments at FXTM, where all your accounts can be in the same place on this copy trading system. The copy trading platform also supports cross-device trading with real-time price updates for commission-free trades.

Best for:

Outstanding customer support

forextime.comeToro

eToro is a leading copy trading platform with a low minimum investment plus a social interaction aspect. You can trade CFDs, crypto, and commodities; plus, as a beginner, you’ll practice copy trading using a demo account before making real money investments.

Why eToro?

To build your portfolio, you can access top assets and ETFs for copy trading software at eToro, including crypto-based instruments. In addition, the copy trading platform has a social function that allows you to interact with the traders you follow or meet other investors.

Best for:

Extensive size of trader network

OctaFX

An award-winning copy trading platform, OctaFX is a prime provider of CFDs and Forex, for which they offer low spreads. Using MetaTrader 5 and cTrader, this copy trading platform provides profitable copy trading software with a demo account for beginner traders.

Why OctaFX?

OctaFX is a copy trading system that doesn’t charge commission on deposits or withdrawals and offers bonuses that create opportunities for all participants.

Best for:

Low spreads

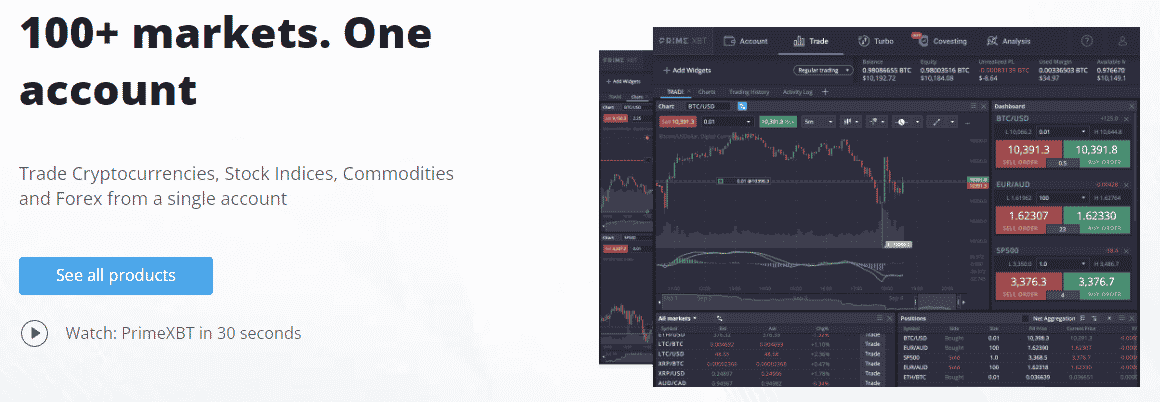

PrimeXBT

Traders of all experience levels, from novices to pros, can monetize their trades at PrimeXBT through copy trading. In addition, the copy trading platform features minimized risk due to the availability of diverse trade instruments and an interface that helps newbies trade effortlessly.

Why PrimeXBT?

PrimeXBT provides access to various asset markets with more than 100 trading instruments on their copy trading system. In addition, you can start copy trading using a demo account, and customer support is available via email and live chat.

Best for:

Diversifying to reduce risk

Pepperstone

Pepperstone is an Australian copy trading platform launched in 2010 and operates out of London, UK. As an independently owned entity, this provider isn’t listed on the stock exchange but offers overall leverage margins of 500:1.

Why Pepperstone?

Pepperstone offers a variety of copy trading accounts that include STP and ECN, with Islamic-friendly investing available on request. Deposits or withdrawals are free, offering negative balance protection and low inactivity fees.

Best for:

Free deposits and withdrawals

AvaTrade

AvaTrade is one of the best copy trading platforms available to Indian traders, and it also features a social section for sharing ideas, comments, or showcasing achievements. The copy trading software is highly regulated, as it’s licensed in six different jurisdictions.

Why AvaTrade?

Due to the efficiency of a vast network, AvaTrade’s copy trading system supports fast and easy account opening with free withdrawal and deposit methods.

Best for:

Variety of copy trading instruments

FBS

FBS operates in over 90 countries and is mainly underrated when the top copy trading software platforms are listed. Initially called Blaze, they’ve been in the trading segment since 2009 and have a proprietary platform for use alongside MT4 and 5.

Why FBS?

FBS has a low minimum deposit, beginning at 10 EUR for EU nationals and $1 for everyone else. That acts as an encouragement for new traders to break into copy trading.

Best for:

The lowest minimum deposit

Comparison table of the best copy trading platforms

| Name | Spreads | Minimum Investment | Fees/Charges | Leveraged | Pros | Cons |

| TechBerry | 1.5 Pips | $5,000 | Free Trial Plan –$19 for Green Plan –$99 for Silver Plan –$199 for Gold Plan –$299 for Platinum Plan –$399 for Diamond Plan –$499 for Infinite Plan |

Yes | 1. High average returns 2. Low subscription fees 3. Real-time monitoring of trades 4. Access to personal manager |

1. High initial deposits 2. You can only integrate with MetaTrader 4/5 |

| Naga Trader | 2.5 pips | $50 | 0% commission 0.2% per lot to copy trade for CFD 0.1% per lot for ETF shares |

Yes | 1. Regulated broker and copy trading system 2. User-friendly interface with useful tools 3. A social network for traders |

1. High spreads 2. Statistics are not very helpful 3. The filter system is unfocused |

| FXTM | 1.5 pips | $50 for an entry-level Micro account | 1. Free Micro Starter account 2. $0.40 – $2 commission for Advantage 3. No fees for Advantage Plus 4. $50 Inactivity fees |

Yes | 1. Low deposit minimums 2. The transparent commission-based trading pricing environment 3. Conversant with MT 4/5 4. Mobile app 5. Quality research content for beginners |

1. Limited choice of assets, especially crypto and commodities 2. Not available to US clients |

| eToro | 2.1 pips for GBP/USD 0.75% for crypto |

$500 | 1. No stock trading fees 2. $10 monthly inactivity fee after one year 3. $5 withdrawal fee 4. FX fee of $5 |

Yes | 1. User-friendly copy trading platform with an extensive network 2. No stock commission and dealing charges 3. Wide variety of asset markets 4. Well-regulated |

1. Technical analysis is lacking 2. High minimum deposits 3. Low retail leverage |

| OctaFX | 1.5 Pips | $100 | 0% commission 0.2% per lot for CFD shares 0.1% per lot for ETFs |

Yes | 1. Unlimited free demo account 2. Account options that suit all levels of traders 3. No commission on deposits and withdrawals |

1. Isn’t available outside Europe 2. Lacks phone options for customer care |

| PrimeXBT | 1 Pip | $250 | 0.075% entry fee 20% commission to signal provider 20% for the platform |

Yes | 1. High-speed network infrastructure for fast trade signals 2. Low Forex and commodity trading commissions 3. Regulated copy trading system |

1. It doesn’t feature a lot of statistics and research tools 2. Intelligent features are only available in upper-tier accounts |

| Pepperstone | 1.59 Pips | $200 | $0.02 per US stock | Yes | 1. Free demo account 2. Integrates with top-rated trading platforms 3. Expansive asset selection |

1. A limited selection of tradable CFD stocks 2. Not accessible to clients from the US |

| AvaTrade | 0.6 Pips | $100 | 1. 5% commission 2. Overnight fees for swing and hold positions 3. Inactivity fees |

Yes | 1. Well regulated 2. It has a favorable pricing structure 3. Features multiple tradable assets |

1. Charges an inactivity fee 2. Their demo account is limited to 21 days |

| FBS | 1.1. Pips | $100 | 1. 5% commission 2. Overnight fees for swing and hold positions 3. Inactivity fees |

Yes | 1. Demo copy trading account 2. Tight spreads 3. Extensive financial instruments 4. MT 4 and 5 integrated |

1. Limited deposit and withdrawal methods 2. Only one account level |

Copy-trading: what is it?

Conventional trading involves actively processing and performing trades backed by knowledge of assets and analysis of open positions. In addition, professional traders benefit from asset price changes using methods like risk spreading, stop-loss, and take-profit.

On the other hand, copy-trading is essentially mimicking investment strategies of more experienced traders, often in the short term.

How to copy trade?

Copy trading software is ideal for beginner investors but also works great when used by experts, as it allows you to make profits without investing in the requisite knowledge and time. New traders employing this strategy are known as copiers assessing the performance of signal providers or experts.

Once you’ve found a professional whose trades you’re comfortable with, you’ll set parameters for the trading platform to copy them in real-time.

How much profit can you earn by using copy trading?

In 2020, traders using the copy trading strategies brought in revenues of over $50 billion, which are impressive numbers. Moreover, it’s projected that by 2025, judging by the amount of interest that the short-term strategy generates and its steady growth, that figure could increase to $80 billion.

Your profits will reflect your signal provider’s successful trades, and one of the benefits of using copy trading software is that you’ll earn while learning.

Where can you practice copy trading?

Copy trading is a social activity with many would-be copiers actively following signal providers on mediums like Discord and Reddit. In addition, there are forums such as Satoshi Street Bets and Wall Street Bets, where trading ideas are shared and capital pooled.

A new breed of entrepreneurs and developers has capitalized on the copy trading software trend to provide platforms that offer support and comfort for nervous newbies.

Copy-trading vs. mirror trading

Mirror trading involves mirroring a signal provider’s trading strategy, which means the style or algorithmic returns. Copy-trading, which emerged from the former, follows the experienced trader without necessarily emulating their transactions.

You’ll track the performance of a signal provider in copy trading, and many platforms enable you to do this automatically with copy trading software. One strategy copiers employ in diversifying to spread risk involves not pooling too much capital on one trader’s transactions.

Copy-trading vs. social trading

It’s often a source of confusion between copy trading and social trading, but the truth is they’re two ideas that work great together. That’s because not all social trades can be termed copy strategies, as you can use social media to find successful investment examples without copying them.

The difference is that with copy trading software, you’re directly aping the moves of a signal provider without expertise, analysis, or research on your part. A copier takes on the risks and benefits of the trader they emulate, but with social trading, you’ll spot investment opportunities and then perform due diligence.

What are the risks associated with copy trading?

While there are plenty of benefits associated with copy trading, a new trader must weigh the risks of following a signal provider’s transaction. That’s because making trades is inherently risky, and even experienced traders get it wrong sometimes.

Risks associated with copy trading software range from higher budgets to a lack of result guarantee, but the most common include;

Improper settings

Copy trading is the perfect solution for traders without time or patience to do due diligence on investment instruments aided by the best platform’s features. For instance, if you set your transactions to mirror too many signal providers, you risk overtrading.

You’re handing over investment control, so examine a signal provider’s trading frequency and see how long bad trades take before they’re closed.

Market risks

The asset investment markets, whether crypto, Forex, or commodities, are often volatile, and there are risks of copying bad trades. Therefore, on your copy trading software before you mirror a signal provider’s account, you must thoroughly scrutinize their performance history.

You can minimize market risks by spreading your investment to more than one experienced trader using the best copy trading system and taking time to look for high drawback trades.

Selection of broker

Broker selection is essential, especially when you’re a beginner trader, as a helpful one recommends traders to follow by examining their performance and stability. If you’re unfortunate in selecting a broker that hasn’t done their homework well, you’ll be following high-risk accounts and losing trades.

Sincere brokers with reputable copy trading software pick out signal providers with a long history of stable profits. However, moderates other than traders with brief high-profit stints.

Liquidity risk

You cannot exit positions at expected levels when trading, mainly if you haven’t managed risk by scrutinizing a trader’s maximum crackdown history. On most copy trading software, that signals providers’ peak-to-trough decline during their transaction strategy’s life or how much they’re comfortable losing.

If a trader has a maximum drawdown of 20%, it means that’s the amount you can expect to lose if you’re copying their strategy.

Lack of diversification

There isn’t much diversification in copy trading software, as you’re not allowed to open multiple positions on the same investment instrument. Other copy trading platforms, especially those compliant with the US Dodd-Frank Act of 2010, enforce first-in, first-out, or FIFO restrictions.

That means you can only liquidate assets in the same order you took them, from the oldest to the newest on the best copy trading platform. For this reason, it’s vital to study the rules of copy trading software that your preferred signal provider complies with.

Technical risks

Emerging markets for digital assets such as currencies are prone to systemic risks, meaning copy trading software can lock up your investment. In the most efficient copy trading system, these scenarios are rare. Technical issues caused by drastic market shifts or political situation in the asset’s home country lead to capital lockdowns.

As a copy trader, your strategy must include copy trading systems where technically risky situations get accommodated, primarily if you’re investing in volatile exchange markets.

Copy-trading: is it legal to use?

Copy trading is a viable investment strategy for traders at all levels, and it’s legal for Indian investors as long as you’ve chosen a regulated broker. Not only does using legit brokerage legitimize your account, but you’ll also minimize the risk of losing your capital or being penalized for illegal trades.

For that matter, it’s essential to be careful with your choice of where your broker or copy trading software is licensed and regulated.

Copy-trading: advantages

- No research, analysis, or instrument study is involved, and you can enter the market as long as you’ve sufficient capital.

- When done on a reputable copy trading platform and regulated broker, copy-trading is profitable.

- Using copy trading software means there’s little time wasted doing preliminary research

- You learn from signal providers and gain insights you can apply to own trades on a copy trading system

- The best copy trading platforms prevent losses as you’re not prone to typical newbie mistakes

- Fully automatable, saving you involvement in every position opening

Copy-trading: disadvantages

- Your investment fate is in the hands of the trader whose transactions you copy

- Lack of diversification on a copy trading system means you’re prone to black swans or market volatility

- Copy trading software has low tolerance for liquidity risks since you can’t pull out of precarious positions

- Often costly as there are commissions paid on the best copy trading platforms, including to trade experts that generate signals

- Using copy trading software keeps your investment portfolio behind the trend as you’re copying others’ trades

Factors to consider when choosing a copy trading platform

One of the popular aspects of the copy trading strategy is the time you save before capitalizing on trades. However, the best copy trading platforms have several standout features to look for to excel with this investment method. These include;

Unique features

The best copy trading platform has user-friendly features that are accommodative for new traders since these are the demographic that benefits most from copying trades. In addition, an automated copy trading system that’s easy to navigate makes the often complex terminology and trading processes effortless for newbies and experts alike.

Other unique features that a copy trading software implements include search filters, investment risk parameters, and flexibility of trade choice and capital allocations.

Asset choice

Your investment instruments should be available to track on the best copy trading platforms, whether it’s stock, Forex, or cryptocurrencies. The signal providers on that best copy trading platform should also major in your asset choice to better establish goals, patterns, and profits.

You must have determined which assets to invest in before proceeding with a trade, as only then can you land on favorable traders to copy.

Fees and commissions

Your copy trading platform is a brokerage that must charge a commission to stay in business, and you’ll probably encounter other trade facilitation fees. For example, some copy trading platforms cut out every trader’s profit, while others offer to pay to signal providers that return winning copy trades.

You must pay attention to a copy trading platform’s fees and commission structure, as it’s easy to miss hidden charges like inactivity fees.

Deposit and withdrawal

When you’re looking to select the best copy trading platform, you must be comfortable with the deposit and withdrawal methods on offer. You’ll be hard-pressed to find brokerages that don’t offer bank transfers and e-wallets, but some also have facilities for cryptocurrencies.

Many copy trading platforms in India offer payment methods resonating with local traders, including mobile payments and Indian digital transaction providers.

Trading tools offered

The number of trading features a copy trading platform offers, order execution quality, and commissions determine the conditions of trade. In addition, some platforms may have high minimum deposits or membership fees, while others charge you extra on the spread.

A copy trading platform’s technological finesse gives you access to better trader selection and more information on risk management.

Customer support

Since you’re using the best copy trading platform as a brokerage, you’ll want to ensure your money is safe, assurances that only excellent customer care can offer. If something goes wrong, you’ll be able to get hold of your platform’s representative if the methods of communication are well laid out.

Look for a copy trading platform with efficient or award-winning customer support and one that offers more than one medium for reaching their agents.

Regulation

A copy trading platform must adhere to regulations depending on the territory they’re licensed to operate. Therefore, you should familiarize yourself with the set rules as they’re set to determine the legitimacy of each aspect of trading, such as tradable instruments and leverage amounts.

Your preferred copy trading software should also offer investment protection and be beyond question regarding a good reputation.

How to choose a safe and reliable copy trading platform?

Copy-trading platforms are innovative systems that enable manual or automated copying of expert trader investment transactions. The best of these allow you to earn money and have features like signal providers’ analytics and flexibility for equity distribution.

Aside from the availability of signals and instruments, the best copy trading platform should also feature investor-friendly payment systems and options to set maximum risk levels.

Summary of the best copy trading platforms

You can bypass the time-consuming research and education necessary to make informed trades by copying a more skilled trader to emulate their profit or loss. Copy-trading software lets you make transactions on assets without analysis, and platforms provide signal provider performance statistics, operating history, and risk scores.

Regarding popularity with traders, eToro is the best copy trading platform, while TechBerry has the user-friendliest interface. Naga Trader openly displays statistics for top performers to help with risk management, and FBS is the copy trading software with the lowest minimum deposit.

Comments