Recently, “The Big Short” investor Michael Burry mused on Twitter, “How do you short a cryptocurrency? Is it possible to squeeze the position and call it in? In such volatile times, I believe it is prudent to avoid shorting, although I am thinking aloud here.”

Shorting Bitcoin may be a suitable alternative for those who feel the currency will crash at some point in the future. The number of methods for shorting BTC has increased with the cryptocurrency’s growing prominence in mainstream finance. Here are various ways.

What is short selling?

The act of selling crypto that the seller does not own is known as “short selling.” That may appear to be a complex topic, but it is pretty simple. The premise is that if you short sell crypto, your broker will lend you the crypto.

The crypto will come from the brokerage’s inventory, a customer’s inventory, or another brokerage firm’s inventory. The cryptocurrencies are sold, and the money is credited to your account. You must eventually “close” the short by purchasing the equivalent number of cryptocurrencies and returning them to your broker. This process is known as “covering.”

If the crypto price falls, you can repurchase it at a lower price and profit from the difference. If the cryptocurrency’s price rises, you’ll have to repurchase it at a higher price, which will cost you money.

There are two basic reasons for shorting:

-

To speculate

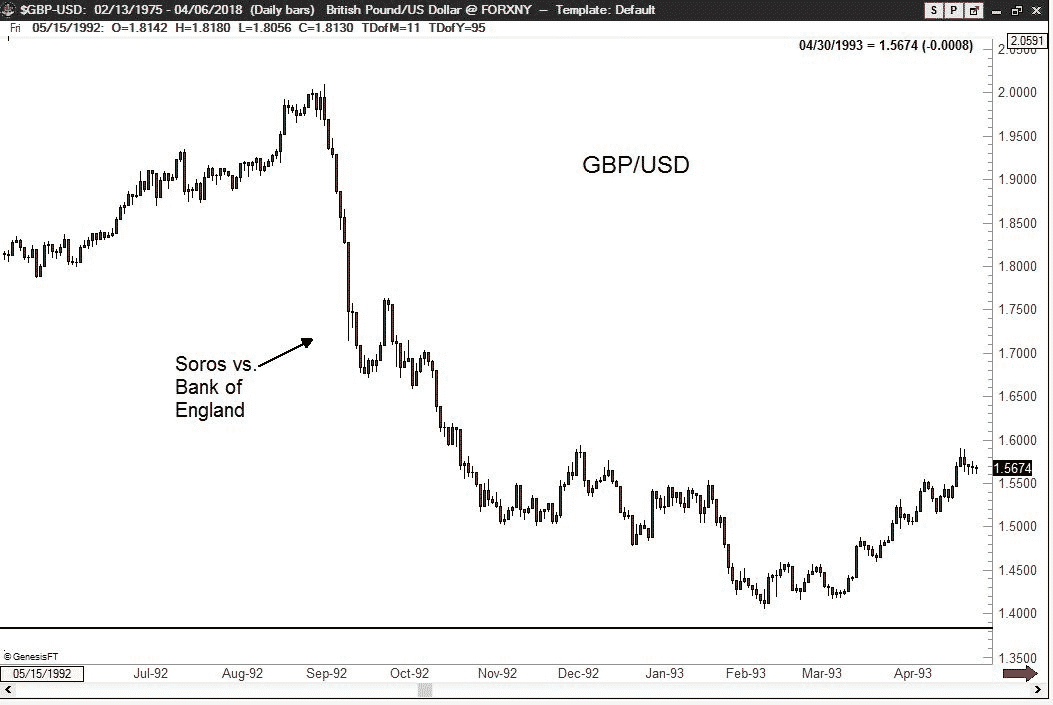

The primary reason for shorting crypto is to profit from an expensive asset. The most famous example of this occurred in 1992 when George Soros “broke the Bank of England.” He bet $10 billion on the British pound falling, and he was correct. Soros made $1 billion from the trade the next night. His earnings eventually amounted to over $2 billion.

Soros vs. Bank of England

-

Risk hedging

Some traders short sell assets to protect their broader portfolio from risk. For example, if you already own Bitcoin but believe it will fall in value soon, you may elect to start a short-selling position. If you’re right, the profit from your short position might offset or even outweigh the loss from your long position.

What is Bitcoin shorting?

The goal of shorting Bitcoin is to sell it at a high price and then repurchase it at a lower price. Unlike most traders, who prefer to purchase low and sell high, short-sellers reverse the order and sell high and buy cheap. If they are correct, and the price falls, the BTC trader earns from the difference in price between when they sold and when they repurchased the asset.

Is it possible to short sell Bitcoin?

Yes, BTC, like other financial products, can be “sold” and “shorted.” On the other hand, short-selling BTC can be a complex process that differs depending on whether you want to use a crypto exchange or a leveraged trading platform.

Are you looking for a place to short Bitcoin?

Shorting BTC can be done in various ways, each with difficulty, risk, and return. Except for the traditional method of shorting via an exchange, all listed below methods are classified as types of derivative trading.

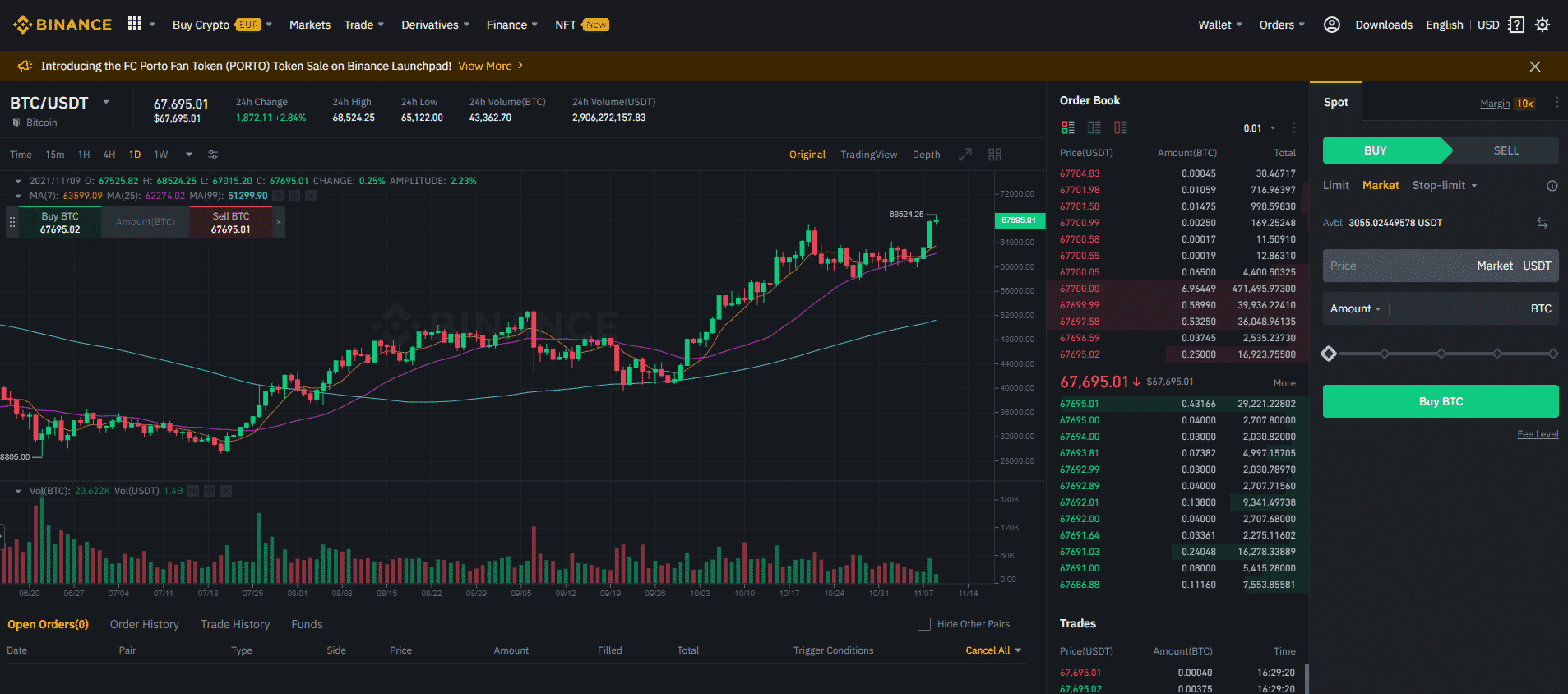

1. Bitcoin exchanges

The most common way to short BTC is to use a market exchange that accepts this crypto shorting. Many exchanges, including Kraken, Binance, and Bitmex, allow you to short it. In contrast to buying and owning the crypto king, exchanges that support the sale of BTC are more complicated.

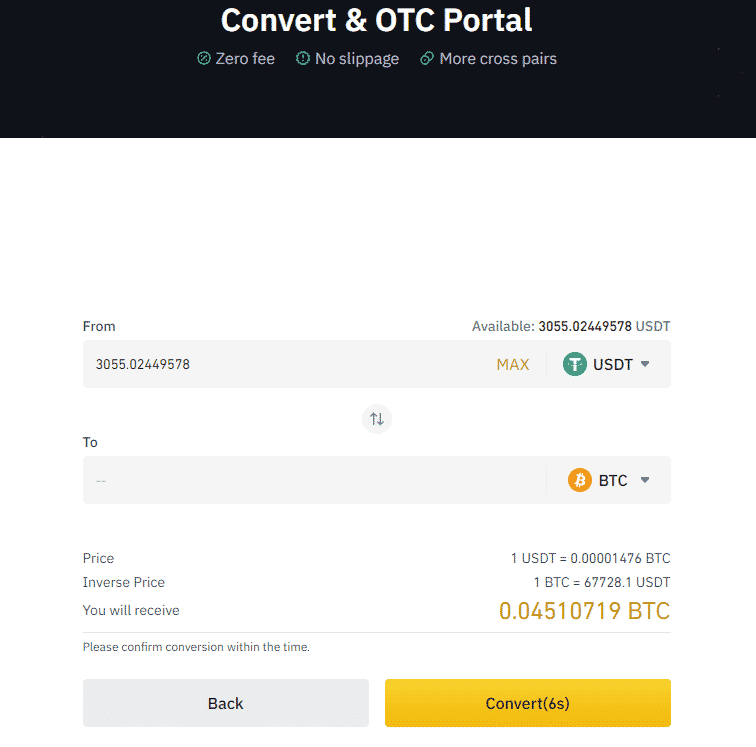

Binance exchange

Short positions can be opened by BTC traders who believe the market will collapse. They must, however, obtain the Bitcoin through a broker or another willing lender. Then, they sell the Bitcoin as soon as they borrow it.

Traders can buy back the amount of BTC they borrowed at a lower price if the price falls. Thus, the trader then pays the borrower back for the cryptocurrencies owed to him, profiting from the price difference. On the other hand, traders face an “infinite loss” scenario if the price continues to rise.

The speculative loss potential is endless because traders must buy back the cryptos they borrowed, and the price of Bitcoin can theoretically keep climbing. Worth remembering that selling on an exchange relies more on liquidity than buying and is subject to borrowing fees, charges, and other penalties. Because shorting BTC on an exchange is difficult, some traders prefer to use a leveraged trading service to open a short position.

2. Leveraged Bitcoin trading provider

Contracts for difference and spread betting are examples of leveraged trading products. You do not own the underlying asset with leveraged trading products, unlike on exchanges where you can borrow it. Instead, you bet on whether the price of Bitcoin will climb or fall, and your profit or loss is dependent on whether you are correct or not.

Spread betting, and CFD trading are both examples of leveraged trading, which means that you only need to put down a modest amount of money to obtain access to the full trade value. Because your exposure is based on your total trade value rather than your deposit, your profits and losses are amplified after the full exposure. The deposit amount varies depending on the asset class.

Bitcoin charge — leveraged trading Binance

Shorting Bitcoin on a leveraged trading platform has various advantages:

- Spread betting, and CFD trading are exempt from stamp duty.

- Spread betting is exempt from capital gains tax.

- Possibility of trading with leverage.

- Retail clients are protected from negative balances.

3. Bitcoin options

Bitcoin is available on some cryptocurrency exchanges. A BTC option contract gives you the option but not the duty to buy or sell it at a defined price over a set of dates. Because of their intricacy and use of leverage, options contracts are best suited for advanced traders. They are, however, an excellent option for shorting this crypto because you only risk the options contract premium at first.

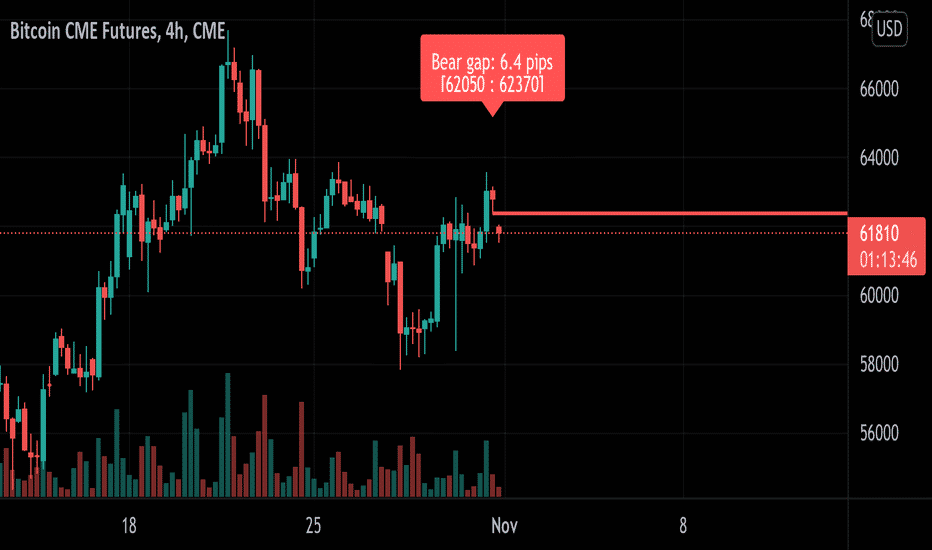

4. Bitcoin futures

Bitcoin futures are a legal contract that allows you to buy or sell BTC at a set price on a specific date. When the futures contract is purchased, the buyer or seller agrees to buy/sell a particular amount of BTC to a specific price on a particular date.

Short selling Bitcoin futures

Futures contracts were originally designed to protect traders against price fluctuations in commodity markets. The availability of a futures contract, on the other hand, quickly expanded beyond commodities. Futures contracts can now be bought with a variety of assets, including cryptocurrencies like Bitcoin. On the other hand, futures are complicated financial transactions that may be better suited to experienced traders.

5. How to short sell Bitcoin

Use our step-by-step guide to learn how to short it using a leveraged trading account. Please remember that learning about short selling, leveraged trading, and the BTC market is critical. You would be likely to make mistakes if you lacked understanding in any of these areas. Before risking any money on a live trading account, new traders should practice on a demo account.

-

Open a trading account online

To get started, open a live spread betting or CFD trading account.

-

Undertake analysis of the Bitcoin market

Performing technical and fundamental analysis is crucial for currency trading. For beginners, fundamental analysis is the study of economic events and news to predict future prices. At the same time, the technical analysis predicts future prices based upon historical price levels.

-

Minimize your risk

It’s essential to stick to your risk management strategy when shorting Bitcoin. Risk management features such as take profit and stop-loss orders can help you maintain an organized and consistent trading procedure.

-

Go short and ‘sell’ Bitcoin

Place your trade once you’ve decided to short BTC and specify the necessary risk management conditions.

Final thoughts

Shorting crypto such as Bitcoin can be profitable. Prices are continually rising and falling due to increased government regulations and the emergence of a slew of new tokens. Experienced market participants can profit from the volatile digital currency market if they use the proper method.

Comments