The fundamentals of the aluminum market have been strong and very positive in recent times. The majority of aluminum stocks in the market appreciated in 2021. One major contributor to this market strength is the limited supply of this metal in China, which has seen demand for it in the long term. Another major catalyst is the burgeoning electric vehicle industry. There is also significant demand for low-carbon aluminum.

Australia, Russia, and China are the biggest providers of aluminum ore in the world. The main applications of aluminum are in packaging, construction, and automotive. The reason aluminum is in great demand in the automobile industry is its lightweight property. Using lightweight material for vehicles would mean better fuel savings than the use of heavyweight metals. See some samples of aluminum products in the image below.

Some aluminum products

Unlike other metals such as platinum, silver, and gold, aluminum is not available as an investment in its physical form. While it is possible to trade aluminum futures contracts, not many investors are familiar with this type of market. In addition, products in the futures markets are highly leveraged, making risk-averse investors uncomfortable. The good thing is that you can gain exposure to the aluminum futures market by engaging in aluminum ETFs. This way, you can trade aluminum without using leverage, similar to trading stocks in an exchange.

Aluminum ETFs to watch and buy

The price of aluminum has been growing steadily due to a combination of fundamental factors. Apart from diversification, investing in aluminum is interesting because of its ability to hedge inflation. You can expect inflation to come anytime soon in the wake of the economic recovery the world has started to enjoy due to the reduction of coronavirus infections.

The increasing demand for aluminum and the accompanying difficulty in its production could mean profits for traders and investors. To jumpstart your engagement, we cover three ETFs in this post for you to get involved with this exciting venture.

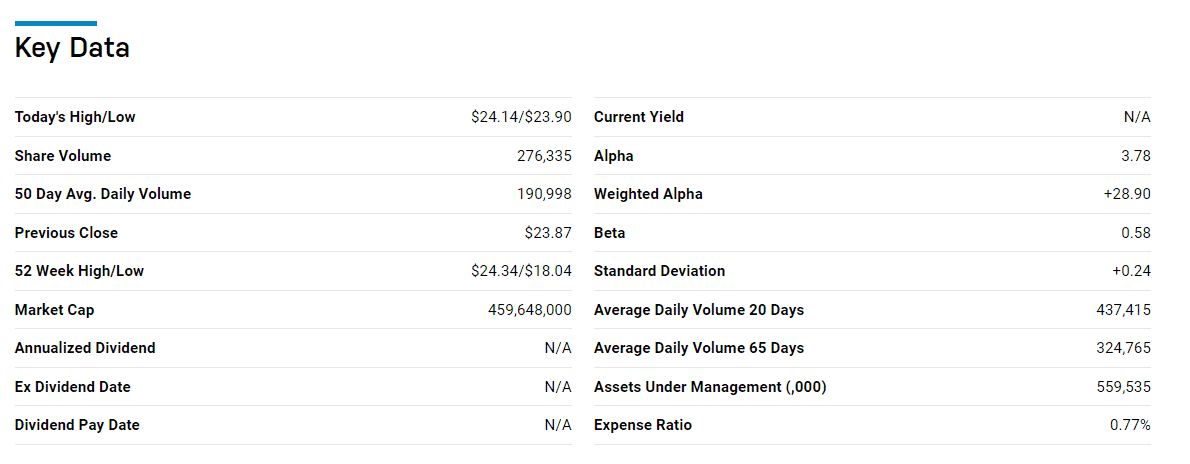

№ 1. Invesco DB Base Metals Fund (DBB)

Price: $23.90

Expense ratio: 0.75%

Dividend yield: 0.00%

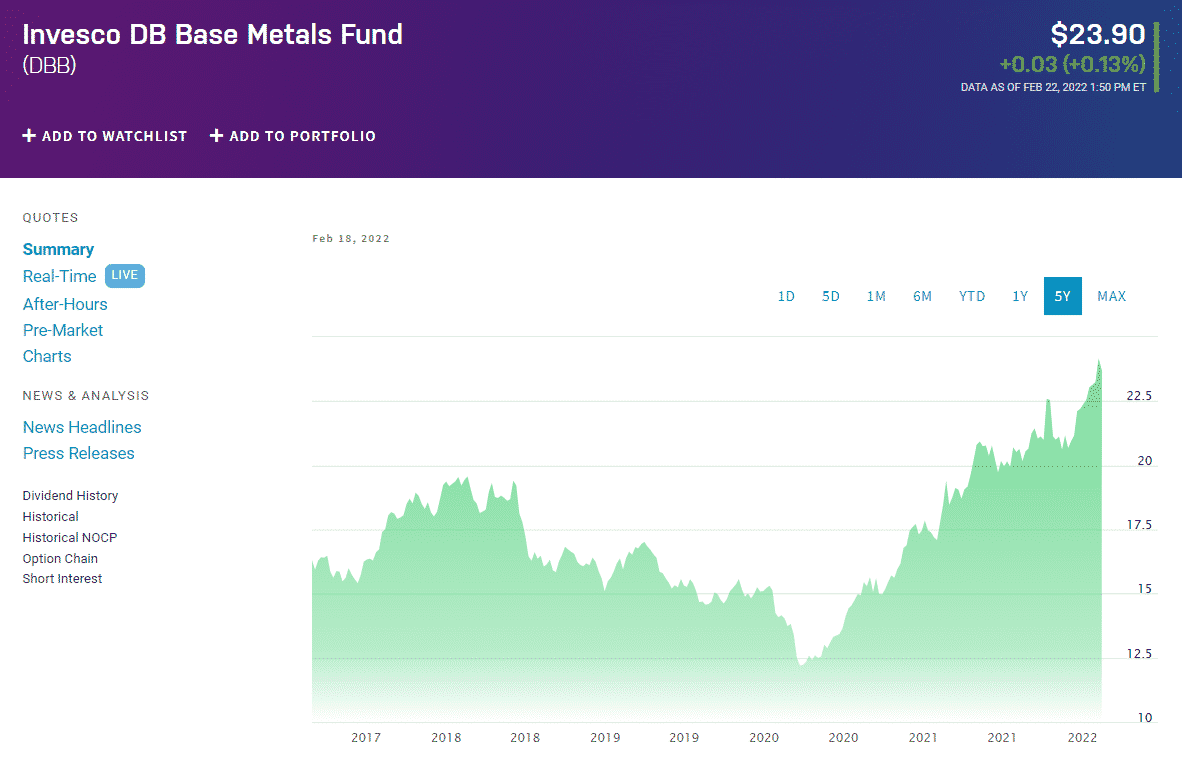

DBB ETF 5Y price chart

The DBB ETF was established in 2007 to engage base metal futures. Unlike precious metals such as silver and gold, base metals are affordable and common metals such as copper and aluminum. DBB puts investment funds in three metals: zinc, copper, and aluminum.

About 46 percent of the fund’s assets are invested in aluminum, with copper and zinc being the second and third holdings. The ETF invests in copper as well as it is another metal with diverse uses and more so in electric cars.

The top three holdings of DBB ETF are:

- Invesco short-term investment government (AGPXX) – 25.31%

- Lme Copper Future May 22 – 21.86%

- Lme Pri Alum Future May 22 – 20.15%

The DBB ETF has been around for a while, established on January 5, 2007. The ETF has a net expense ratio of 0.75%, which is high considering the industry standard is 0.2% maximum. You would be charged $75 yearly for each $10,000 invested in the fund at this ratio.

At present, the ETF shows a zero percent dividend yield. Possibly, it has not given out dividend payments to its investors in the last quarter. If you look at the weekly chart of DBB, you can see that its price has been climbing since the first quarter of 2020. The zero yields should not make you apprehensive of the potential of this investment. You will find that the fund does not make dividend payments yearly at a closer look.

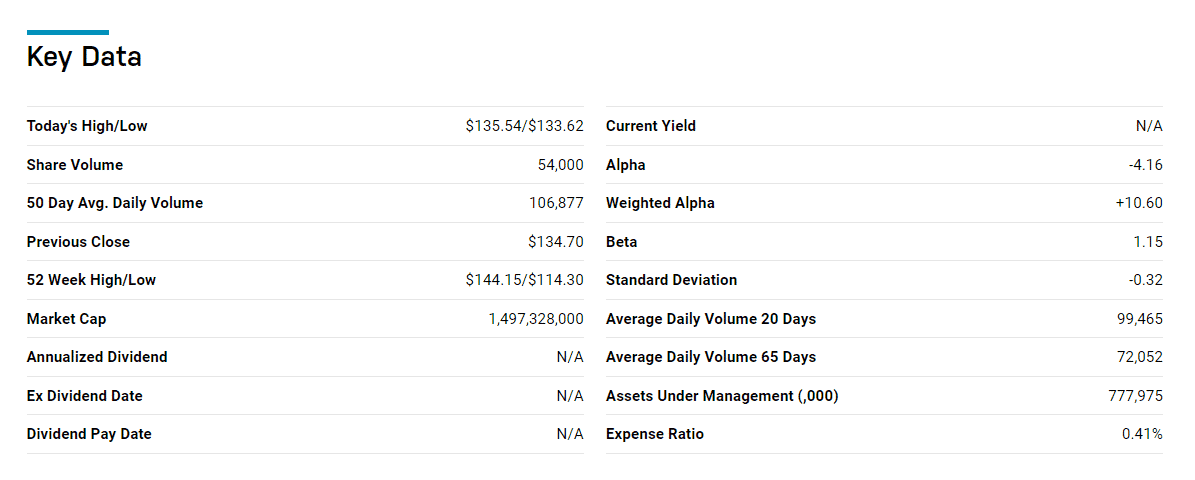

№ 2. iShares U.S. Basic Materials ETF (IYM)

Price: $132.73

Expense ratio: 0.41%

Dividend yield: 1.26%

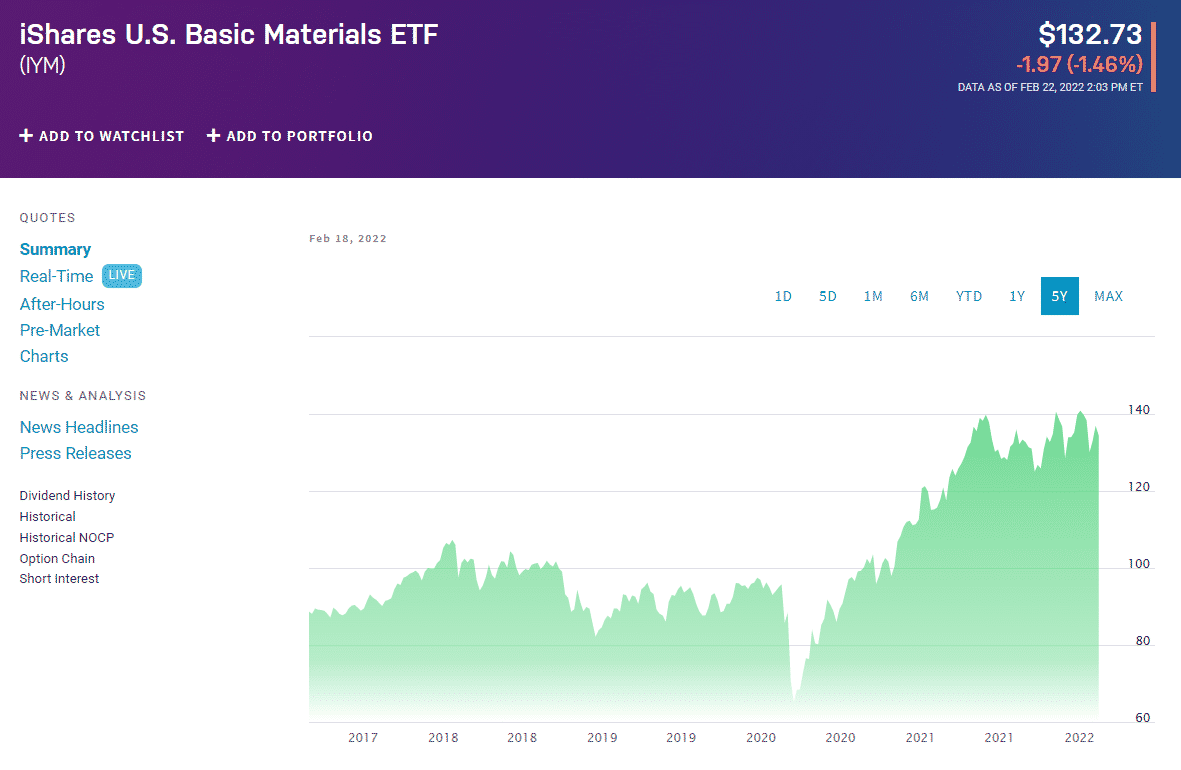

IYM ETF 5Y price chart

The IYM ETF does not invest all of its assets in aluminum, but it ensures that investors have enough exposure to this market. This fund replicates an index containing US companies operating in the basic materials industry. These companies are greatly involved in the production of raw materials, such as chemicals, metals, and forestry products.

The top three holdings of IYM ETF are:

- Freeport-McMoRan, Inc. (FCX) – 9.33%

- Newmont Corporation (NEM) – 8.08%

- Air Products and Chemicals, Inc. (APD) – 7.81%

In a span of 20 years, from 2001 until 2021, IYM encountered losses five times only. However, the returns from the winning years more than compensate for the losing years. The fund gained 25.52 percent in 2021. To date, it has a net expense ratio of 0.41%, which is equivalent to a $41 yearly fee for every $10,000 amount invested. Currently, the ETF gives out a 1.26% dividend yield. This equals a $126 yearly dividend for every $10,000 invested or $31.5 quarterly installment.

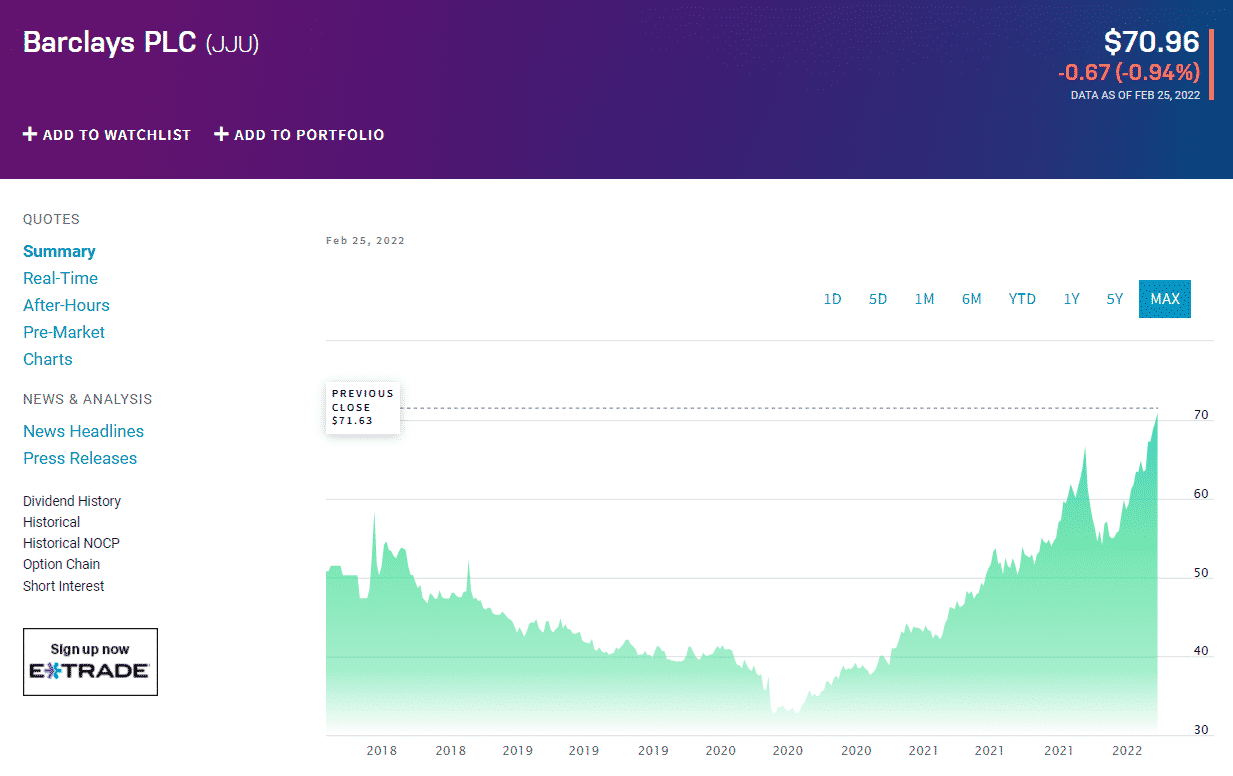

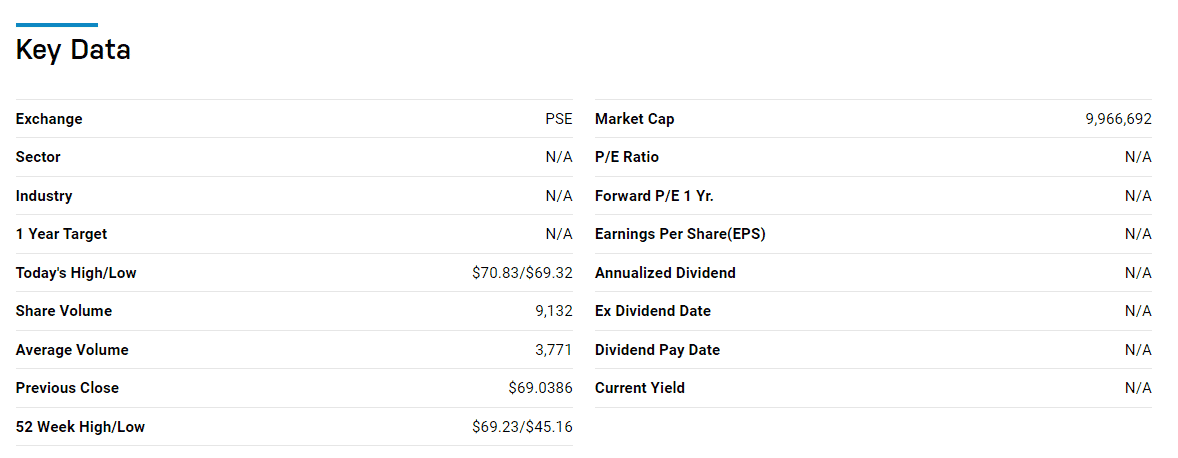

№ 3. iPath Series B Bloomberg Aluminum Subindex Total Return ETN (JJU)

Price: $70.96

Expense ratio: 0.45%

Dividend yield: 0.00%

JJU ETN 5Y price chart

The JJU ETN has a more direct engagement with aluminum without necessarily investing in the physical form of the commodity. It seeks to invest in an index that takes part in aluminum futures contracts without leverage. The benchmark index puts money in one or two contracts continuously reinvested in the nearest trading month.

Established on January 17, 2018, JJU has a net expense ratio of 0.45%, meaning you would pay $45 yearly for every $10,000 investment. As an ETN, the dividend yield is zero percent. This fund is able to generate investor returns year after year, starting from the second quarter of 2020. It generated a 3.42% return in 2020 and 38.37% in 2021. The YTD return is 25.67%, which is a good indication of another possible fruitful year for the ETN.

Final thoughts

There was a time when aluminum was deemed more precious than gold. Although it does not hold that reputation anymore, aluminum is still one of the most in-demand and useful metals. It has found widespread use in transportation, packaging, and construction. The demand for this lightweight metal might grow in new markets as well, such as electric vehicles. At present, no ETF directly invests in physical aluminum, but this might not be the case in the future.

Comments