The world’s wealthiest people achieve financial freedom through investments. At the forefront of these economic movements are exchange-traded funds.

- According to the “Oracle of Omaha,” you can never go long when you put money in the long-term economic outlook — ETFs represent a particular sector of the economy. This is because growth in the long term is inevitable.

- In the words of Suze Orman, “It is insane not to consider ETFs on investments made outside the retirement accounts.” Wealth creation is all about ensuring the cash inflows far outweigh the cash outflows. ETFs provide the perfect balance to the cash inflow-outflow equation.

- According to Jon Stein, “ETF portfolios will be the inevitable default for investors in the years to come because they are lower cost, more transparent and offer greater liquidity and tax advantages than mutual funds.”

When investing in ETFs, we look forward to a long-term perspective due to their value growth over time. But you can also receive additional profit from exchange-traded funds in the form of dividends. What dividend ETFs are, how to invest in them, and what to look for when choosing this article.

What are dividend ETFs?

Exchange-traded funds are a basket of investment assets investing in the underlying holdings of the index they track. Dividend ETFs refer to funds investing in high-dividend equities only. High-dividend stock companies tend to be blue-chip companies-history of year-on-year dividend increase, larger market capitalization, distributes partial earnings to shareholders, and less risky and volatile to trade.

The appeal of dividend ETFs is in their regular income at a low expense ratio compared to investment assets of the exact yield. They are, therefore, for the income-seeking but risk-averse investor-offer portfolio diversification at low risk.

What benefits of dividend ETFs?

- A fast, cost-effective, and straightforward way to access a diverse set of dividends.

- High transparency and low costs.

- One-stop solution to capitalize on a variety of dividend investing strategies, including recurring income and dividend growth.

- A convenient way to reduce the time spent studying individual dividend stocks.

- Benefiting from tax efficiency and the relative ease of trading ETFs compared to mutual funds.

Where to find information about the dividends number?

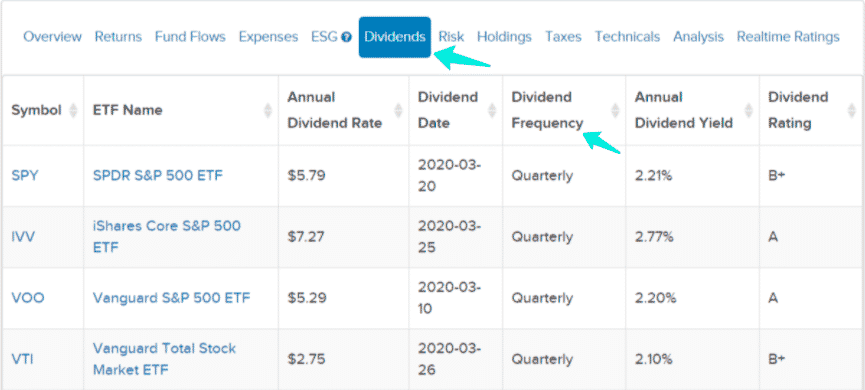

You can study detailed information about options for dividend income on the platform Etfdb.com service:

- Go to the service on the ETF analysis page

- Find the fund you need in the list

- Click the dividends tab

- Notice the frequency of payments in the dividend frequency column

How to buy dividend ETFs?

| Step 1 | Step 2 | Step 3 |

| Find a broadly diversified ETF whose underlying holdings are high-dividend paying assets-use broker platform or screener. | Analyze the ETF and establish its liquidity, risk exposure, returns, and dividend yield. | Buy the ETF. |

Top 4 dividend ETFs worth buying in summer 2021

If you want to invest in assets with additional interest income, you should analyze the entire range and choose the best dividend ETF, which offers investors consistent and regular returns at low costs. So the question is, which are the top four dividend ETFs to buy in summer 2021?

Let’s take a look at the top four dividends ETFs across four different sectors.

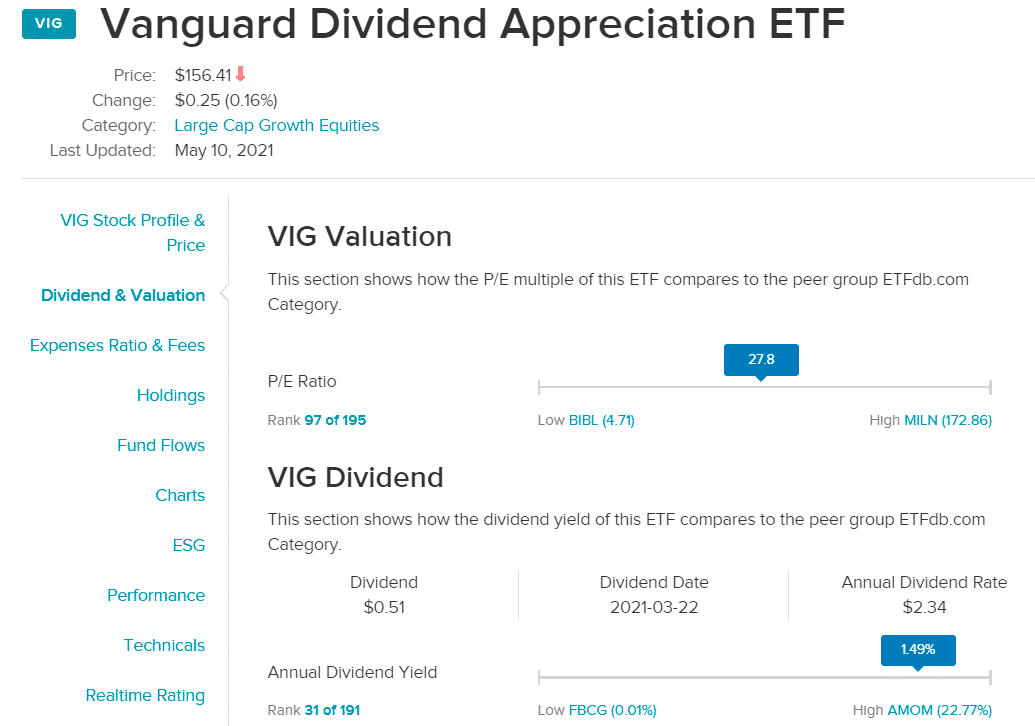

№ 1. Vanguard Dividend Appreciation ETF (VIG)

Price: $156.41

Dividend yield: 1.58%

This dividend exchange-traded fund comprises familiar stock companies with a record of year-on-year dividend payout increase. Experienced investors know the importance of diversifying their investments with dividend stocks.

Therefore, one of the crucial criteria for asset selection is the ability of companies to increase payments. Such stability usually indicates the prospects for growth in the issuer’s profit in the long term. In addition, it utilizes index investing and tracks the performance of the Nasdaq U.S. Dividend Achievers Select Index.

Holdings

Boosting companies such as JPMorgan Chase and Company — 3.92%, Johnson and Johnson — 3.86%, Microsoft Corporation — 3.84%.

As its top three holdings, it is no wonder its performance last year was 42.15% — average annualized returns are 37.12%. The top 10 investments account for 34.7% of net assets.

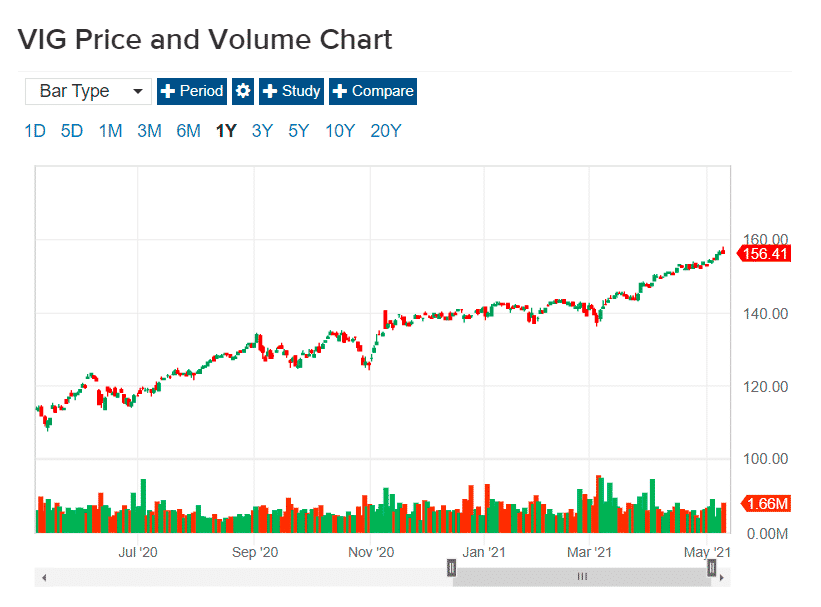

Over the past 12 months, the fund has grown by 46% and has added 2.5% since the beginning of this year. A potential drawdown below $140 will improve the risk/reward ratio.

Since the mid-last year, the fund has been on a bullish rally and shows no signs of slowing down.

This collection of dividend-paying companies has on its arsenal $60.2 billion in assets under management. The current dividend payout is at $0.51 per share every quarter. VIG is 57th among 240 large blended ETFs as rated by U.S. News.

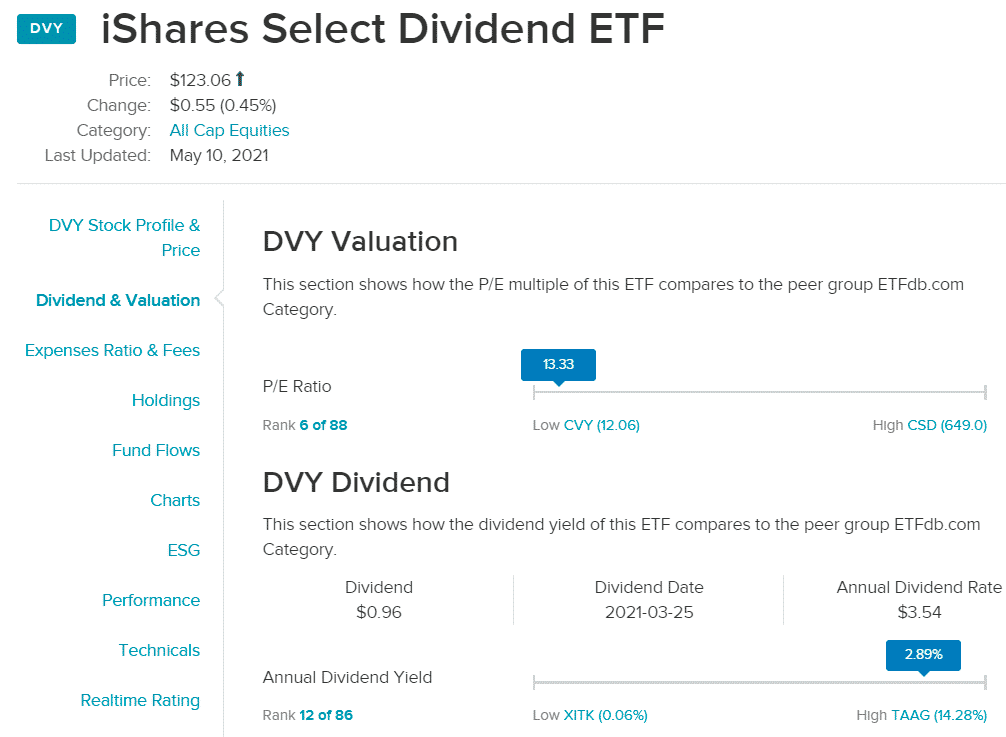

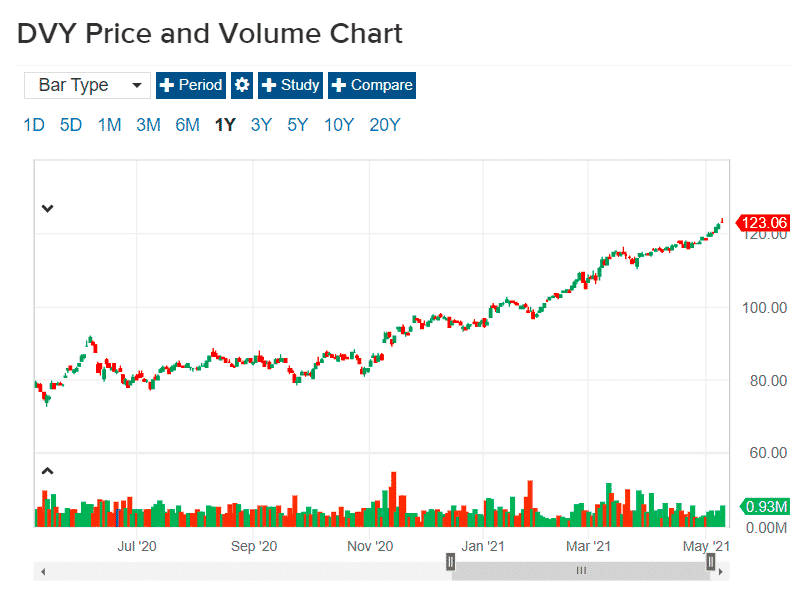

№ 2. iShares Select Dividend ETF (DVY)

Price: $123.06

Dividend yield: 2.89%

The iShares Select Dividend ETF is a diversified fund slightly skewed towards the utility sector; a quarter of the fund is in utility companies with the rest spread across financial, cyclical, industrial, and non-cyclical sectors. It tracks the Dow Jones US select dividend index and is technically the most significant fund tracking a weighted index.

The DVY fund has been on a consistent growth trajectory with no signs of this momentum waning.

Holdings

The top three holdings for the DVY are Oneok Inc. — 2.26%, Altria Group Inc. — 2.25%, and AT&T Inc. — 2.24%.

The ETF has an average annualized return of 19% — last year return, 65.81%. DVY has $19.2 billion in assets under management and an expense ratio of 0.39%. Investors enjoy quarterly dividends currently at $0.96 per share.

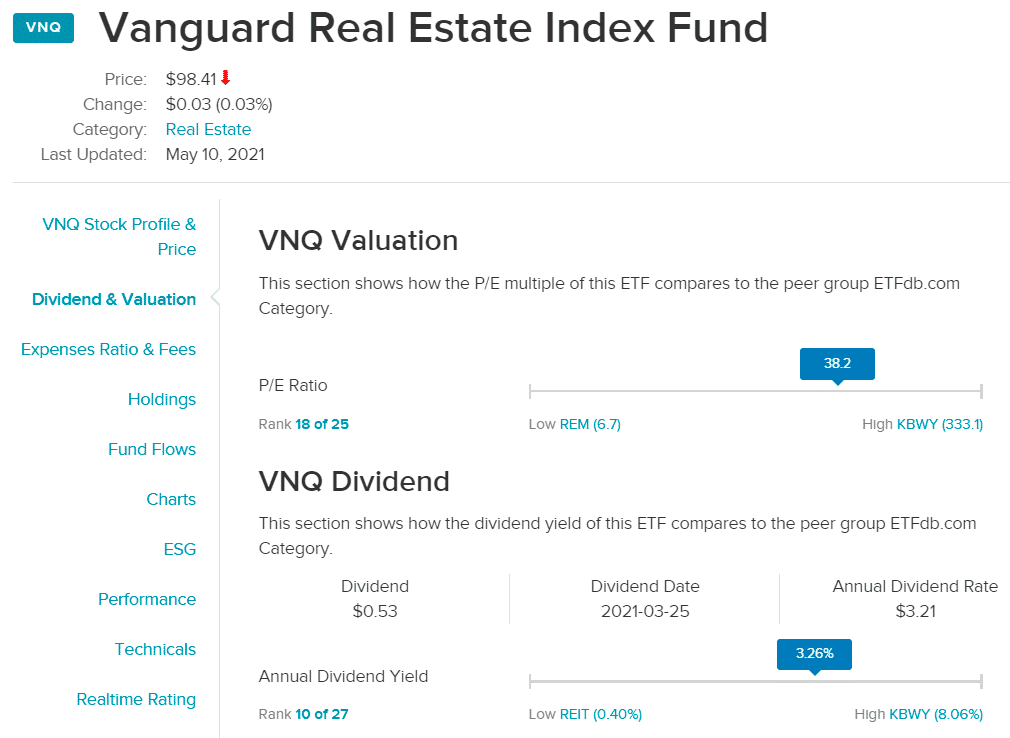

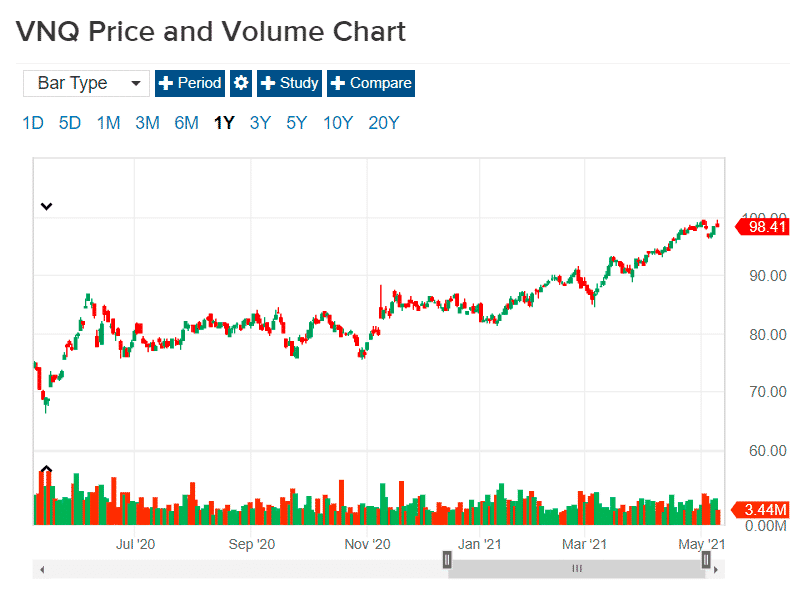

№ 3. Vanguard REIT ETF (VNQ)

Price: $98.41

Dividend yield: 3.07%

The Vanguard REIT ETF is a non-diversified real estate fund whose objective is consistent and regular high income coupled with moderate to high long-term capital appreciation. To achieve its objectives, it tracks the MSCI US Investable Market Real Estate 25/50 Index performance. It, therefore, invests all of its assets in publicly traded REIT equities in addition to other real estate-related ventures.

The VNQ experienced some sideways market in 2020 but has rebounded strongly since November.

Holdings

The top three holdings for the VNQ are Vanguard Real Estate II Index — 11.88%, American Tower Corp. — 7.12%, and Prologis Inc. — 5.52%.

The fund has an average annualized return of 35.34% — last year’s return was 39.61%. In addition, it has $38.68 billion in assets under management and an expense ratio of 0.12%. So, investors enjoy quarterly dividends currently at $0.53 per share.

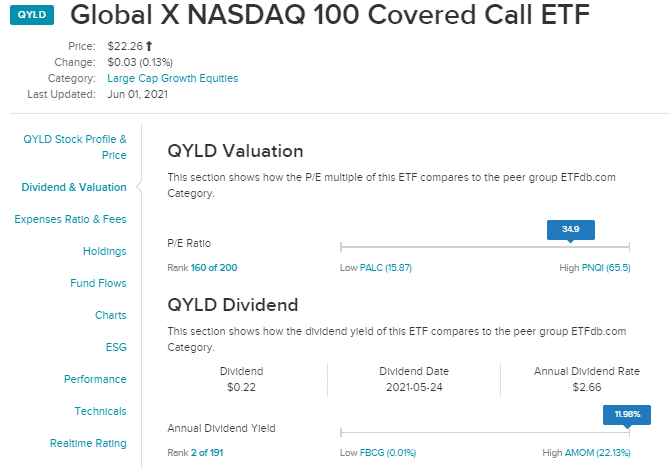

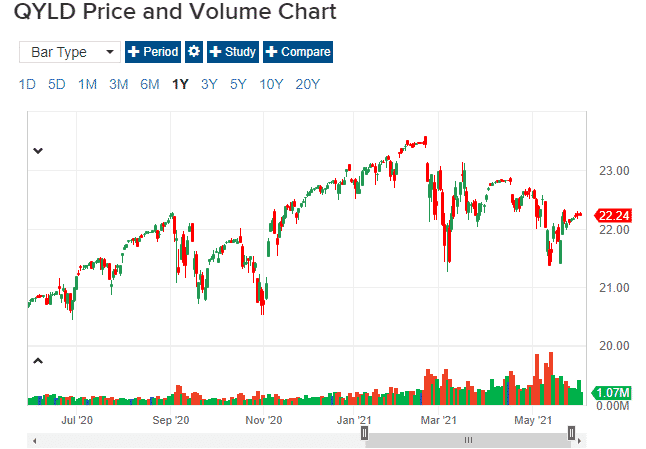

№ 4. Global X NASDAQ 100 Covered Call ETF (QYLD)

Price: $22.26

Dividend yield: 11.98%

The Global X NASDAQ 100 covered call ETF is among an elite group of creative ETFs that ensure income generation and high dividend payout through options trading, specifically covered call selling in the case of the QYLD.

It is a non-diversified blue-chip equity ETF with the underlying companies making up the Nasdaq 100 index. High dividends and return on investments for the QYLD investors guarantee through call short selling of the underlying blue-chip stocks and out-of-the-money expiries on the calls.

Therefore, it employs a replication strategy to ensure that after expenses correspond to those of the CBOE Nasdaq 100 Buy-Write Index.

The QYLD ETF was bullish in 2020 but has experienced choppy markets for the better part of 2021-since February.

Holdings

The top three QYLD holdings are Apple — 11.23%, Microsoft Corp. — 9.58%, and Amazon.com Inc. — 8.46%.

With so many tech companies making the Nasdaq-100 cut as blue-chip equities, it is no wonder that investors of this ETF in the last three years enjoyed 3-year returns of 26.03%. Moreover, as more tech companies mature and start regular dividend payments, investors can expect higher dividend payouts from this ETF-even with the pandemic; the 1-year returns were 20.93%.

The fund is famous for its average distributions of 12.2% since its inception. In addition, it has $2.92 billion in assets under management and an expense ratio of 0.6%.

What are the risks of dividend ETFs?

You should always take into account unforeseen circumstances that may affect the payment of dividends:

- If the company has losses, it may cancel the dividends

- Dividends can be reduced at any time

- A company may decide to direct all profits to development and therefore not pay dividends

Comments