ETF full name: Vanguard Canadian Government Bond ETF (VGV)

Segment: International Government Bond

ETF provider: Blackrock Financial Management

| VGV key details | ||

| Issuer | Blackrock Financial Management | |

| Dividend | 2.44% | |

| Inception date | 31st January 2017 | |

| Expense ratio | 0.20% | |

| Average Daily $ Volume | $3.76K | |

| Investment objective | Replication Strategy | |

| Investment geography | Canadian Bond Market | |

| Benchmark | Bloomberg Barclays Global Aggregate Canadian Government Float Adjusted Bond Index | |

| Weighted Average Market Cap | N/A | |

| Net Assets under Management | $50.2 Million | |

| Number of holdings | 50 | |

| Weighting methodology | Market Capitalization | |

About the VGV ETF

One of the best ways to play the US economy while achieving geographical diversification is setting eyes on Canada. With upwards of 50% exports attributable to the US, the Canadian economy fits as a perfect gauge on the US economy.

However, this is not the only selling point for why investors should look into Canada for investing. It is ranked the 9th best world economy, and as one of the most politically stable global governments, it provides an excellent business environment and a plethora of investment opportunities.

The Canadian investment-grade bond market is one of the best globally, with portfolio diversification and consistent income generation potential. It does not get better than the Vanguard Canadian Government Bond ETF.

VGV Fact-set analytics insight

The Direxion Vanguard Canadian Government Bond Fund tracks the Bloomberg Barclays Global Aggregate Canadian Government Float Adjusted Bond Index, intending to replicate its performance as closely as possible, net of expenses and fees. Therefore, VGV investors gain exposure to the Canadian government investment grade fixed assets. To achieve its objective, this fund employs a passive management index sampling strategy on the entire investment grade Canadian bond market.

The VGV concentrates on government bonds with the highest credit quality ensuring consistent moderate-income for its investors.

VGV performance analysis

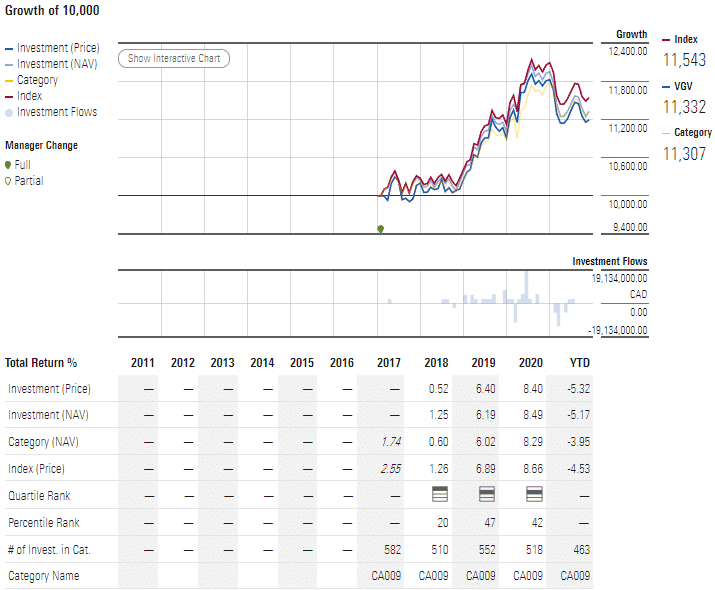

A look at the chart reveals that an initial investment of $10000 on the VGV at inception would now be worth $11248 without accounting for dividend payouts at an annual yield of 2.44%, making it worth a second look if in the market for international government bonds.

VGV ETF performance chart

A look at the chart above reveals that an initial investment of $10000 on the VGV at inception would now be worth $11248 without accounting for dividend payouts at an annual yield of 2.44%, making it worth a second look if in the market for international government bonds.

VGV ETF RATING |

|||||

| Resource | ETF DATABASE | ETF.com | MarketWatch.com | Morningstar.com | Money.usnews.com |

| IPO Rating | N/A | N/A | N/A | *** | N/A |

| IPO ESG Rating | N/A | N/A | N/A | 12.78 out of 50 | N/A |

VGV key holdings

The VGV has one of the most extensive bond holdings among government bond funds, 363, with all of them falling under the following grades:

- AAA-44.96%

- AA-47.97%

- A-6.87%

The top bonds account for only 18% of these funds’ weight and are.

| Holdings | % portfolio weight |

| Canada (Government of) 2% | 2.44 |

| Canada (Government of) 1.25% | 2.35 |

| Canada (Government of) 0.25% | 2.18 |

| Canada (Government of) 1.5% | 1.91 |

| Canada (Government of) 1.5% | 1.72 |

| Canada (Government of) 0.5% | 1.57 |

| Canada (Government of) 1.5% | 1.45 |

| Ontario (Province Of) 3.45% | 1.34 |

| Canada (Government of) 0.25% | 1.33 |

| Canada (Government of) 2% | 1.28 |

Industry outlook

The rampaging US inflation and supply chain bottlenecks are impacting the Canadian economy, given the interdependence of these two giant economies. The Bank of Canada states that in addition to these two factors, the increasing cost of fuel is pushing prices higher and are proving to be more consistent and stronger than expected, as evidenced by increasing CPI inflation numbers.

With the bank of England doubling down on its hawkish outlook and being the second-largest trade partner of Canada, the BoC slack absorptions from the middle quarters of 2022, setting the stage for Canadian bond earnings season in the first quarters of 2022.

Comments