ETF full name: Vanguard FTSE European ETF (VGK)

Segment: European equities

ETF provider: Vanguard

| HYEM key details | |

| Issuer | Vanguard |

| Dividend | $0.74 |

| Inception date | March 04, 2005 |

| Expense ratio | 0.08% |

| Management company | Vanguard |

| Average 3-5 EPS | N/A |

| Average Annualized Return | 14.67% |

| Investment objective | Tracks an all-cap, market-cap-weighted index of developed European securities |

| Investment geography | Developed Europe |

| Benchmark | FTSE Developed Europe All Cap Index |

| Leveraged | N/A |

| Median market capitalization | $84.68 billion |

| ESG rating | 8.16 / 10 (AA) |

| Number of holdings | 1330 |

| Weighting methodology | Market cap |

About the VGK ETF

The Vanguard FTSE European ETF (VGK) fund allows investors exposure to European developed economies. The VGK ETF has been trading on the Nasdaq Stock Exchange Arca since March 04, 2005. The fund uses a weight market cap methodology. Furthermore, it is benchmarked to the FTSE Developed Europe All Cap Index.

VGK Fact-set analytics insight

The VGK fund has a market cap of $84.68 billion and total assets under management of $21.35 million. The fund has a low expense ratio of only 0.08%.

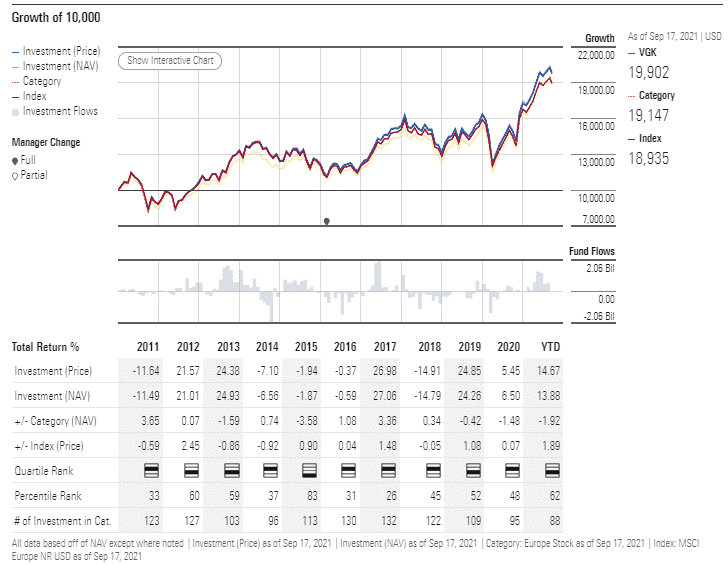

VGK performance analysis

The VGK fund has an annualized return of 14.67%, and the latest dividends are $0.74. The fund’s dividends are higher than peers in its sector, which is currently $0.56. The fund has a price per earnings ratio of 27.5. In terms of ratings, the fund has an AA ESG rating which is a score of 8.16/10

Since its inception, the fund has had a stable performance and has been tracking close to its benchmark, exceeding it occasionally.

VGK ETF RATING |

|||||

| Resource | ETF DATABASE | ETF.com | MarketWatch | Morningstar.com | Money.usnews.com |

| VGK Rating | A+ | A / 98 | Quintile 4 (62nd percentile) | *** | 5 / 10 |

| VGK ESG Rating | 8.16 / 10

(AA) |

8.16 / 10

(AA) |

8.16 / 10

(AA) |

8.16 / 10

(AA) |

8.16 / 10

(AA) |

VGK key holdings

The VGK fund has 1330 holdings. The top ten holdings make up 16.13% of the fund’s assets. Furthermore, 79.69% are large-cap companies. Regarding geography, 24% of its holding firms are in the UK and 15.38% in France. Looking by sector, Financials makes up 17.91%, Industrials 14.15%, and Consumer Cyclicals 13.29%.

| Ticker | Holding name | % of assets |

| NESN | Nestle SA | 3.46% |

| ROG | Roche Holding AG | 2.55% |

| NOV | Novartis AG | 1.96% |

| SAP | SAP SE | 1.83% |

| ALL | ASML Holding NV | 1.55% |

| AZN | AstraZeneca PLC | 1.50% |

| MC | LMVH Moet Hennessy Louis Vuitton SE | 1.24% |

| NOVO.B | Novo Nordisk A/S | 1.18% |

| SAN | Sanofi SA | 1.15% |

| SIE | Siemens AG | 1.02% |

Industry outlook

The VGK fund has a historical increase of 2.5% year on year. Furthermore, the fund’s value has increased every year for the last eight years. In March 2020, the fund was trading around $46 when the pandemic started peaking. The stock has risen by 43.1% since then, as it is currently trading around $66.33.

Therefore, it seems that the fund has performed well under the pandemic. The fund’s dividend yield is also up by 3.17%, which is excellent since an ideal dividend yield is between 2% to 6%.

Comments