ETF full name: Invesco DB US Dollar Index Bearish Fund

Segment: Currencies

ETF provider: Invesco

| UDN key details | |

| Issuer | Invesco |

| Dividend | $0.28 |

| Inception date | February 20, 2007 |

| Expense ratio | 0.77% |

| Management company | Invesco |

| Average 3-5 EPS | N/A |

| Average Annualized Return | 2.82% |

| Investment objective | Replication |

| Investment geography | Currencies |

| Benchmark | Deutsche Bank Short USD Currency Portfolio Index |

| Leveraged | N/A |

| Median market capitalization | N/A |

| ESG rating | N/A |

| Number of holdings | 4 |

| Weighting methodology | Weighted Market capitalization |

About the UDN ETF

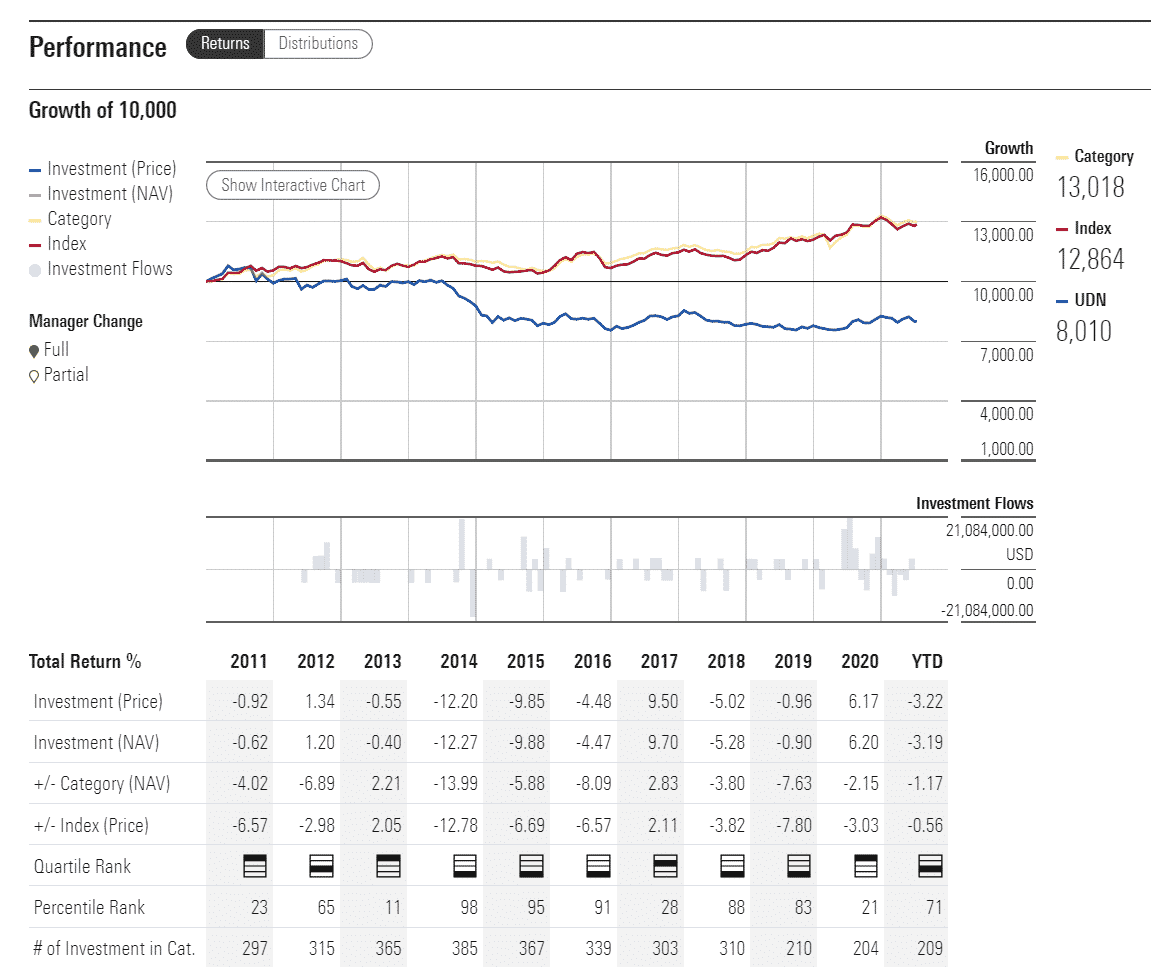

Invesco DB US Dollar Index Bearish Fund UDN came into existence in February 2007, and it tracks the Deutsche Bank Short USD Currency Portfolio Index. It boasts an average yearly return of 2.82%, while its year-to-date return stands at a negative 3.58%.

UDN Fact-set analytics insight

The fund comprises just four holdings, with 42% of the pull being the benchmark’s mutual fund. The other three are the United States Treasury bills and the US dollar.

The ETF uses weighted market capitalization for its methodology.

UDN performance analysis

For the last quarter, the dividend amounted to $0.28 on the share at an expense ratio of 0.77%. On the MarketWatch scale, UDN ETF has a ranking of four and falls within the 75th percentile.

UDN ETF RATING |

|||||

| Resource | ETF DATABASE | ETF.com | MarketWatch | Morningstar.com | Money.usnews.com |

| UDN Rating | N/A | N/A | 4 | * | N/A |

| UDN ESG Rating | N/A | N/A | 75th percentile | N/A | N/A |

UDN key holdings

The UDN ETF mimics the index that allows traders to short the US dollar. Even though it follows six G10 currencies versus the US currency, the fund utilizes the weighting scheme based on exchange rates in 1973.

As a result, you can expect the fund’s movements to follow the relative changes concerning the EUR/USD pair.

Here are the top four holdings making up the UDN ETF.

| Holding name | % of assets |

| Invesco Shrt-Trm Inv Gov&Agcy Instl AGPXX | 42.11% |

| United States Treasury Bills 0% 09/09/21 | 28.91% |

| United States Treasury Bills 0% 08/05/21 | 26.28% |

| United States Treasury Bills 0% 10/07/21 | 2.63% |

Industry outlook

The dollar is not only the currency of the world’s largest economy but also the most widely traded currency around the globe. That’s why the vital governmental data from the United States will impact its standing on the market, but you also have to pay attention to other movers.

Following the bilateral relations between the US and the countries whose currencies UDN seeks to follow, you will gain an insight into how the fund might move in the future. The Swiss franc and the Japanese yen will also play a safe-haven role, so you can expect the fund to fare better during times of crisis when the investors are not confident that the economy will perform optimally.

The most important thing you have to look out for is the relations between Washington and Brussels and how they affect the USD/EUR pair. For the time being, you can get essential hints by following the statements of the European Central Bank and the US Federal Reserve. If you want to go even deeper, our advice is to pay close attention to the coronavirus situation in the US, and the bloc, especially regarding the spread of the Covid-19 Delta variant.

The way that both entities handle the fourth wave of the pandemic could largely determine how soon both central banks will unwind the accommodative measures. The tapering will undoubtedly impact the inflation rate, the markets, and the UDN ETF as well.

Comments