ETF full name: Invesco DB G10 Currency Harvest Fund

Segment: Currencies

ETF provider: Invesco

| DBV key details | |

| Issuer | Invesco |

| Dividend | $0.35 |

| Inception date | September 18, 2006 |

| Expense ratio | 0.78% |

| Management company | Invesco |

| Average 3-5 EPS | N/A |

| Average Annualized Return | 4.11% |

| Investment objective | Replication |

| Investment geography | Currencies |

| Benchmark | DB G10 Currency Harvest (ER) |

| Leveraged | 2:1 |

| Median market capitalization | N/A |

| ESG rating | N/A |

| Number of holdings | 6 |

| Weighting methodology | Weighted Market capitalization |

About the DBV ETF

Invesco DB G10 Currency Harvest Fund launched in September 2006, and it mimics the movements of the DB G10 Currency Harvest (ER) benchmark. Its yearly average return amounted to 4.11%, while its year-to-date gains came in at 2.79%.

DBV Fact-set analytics insight

The fund consists of only six holdings, with 43% of the pull being the index’s mutual fund. The rest are the United States Treasury bills and the US dollar. The ETF uses weighted market capitalization for its methodology.

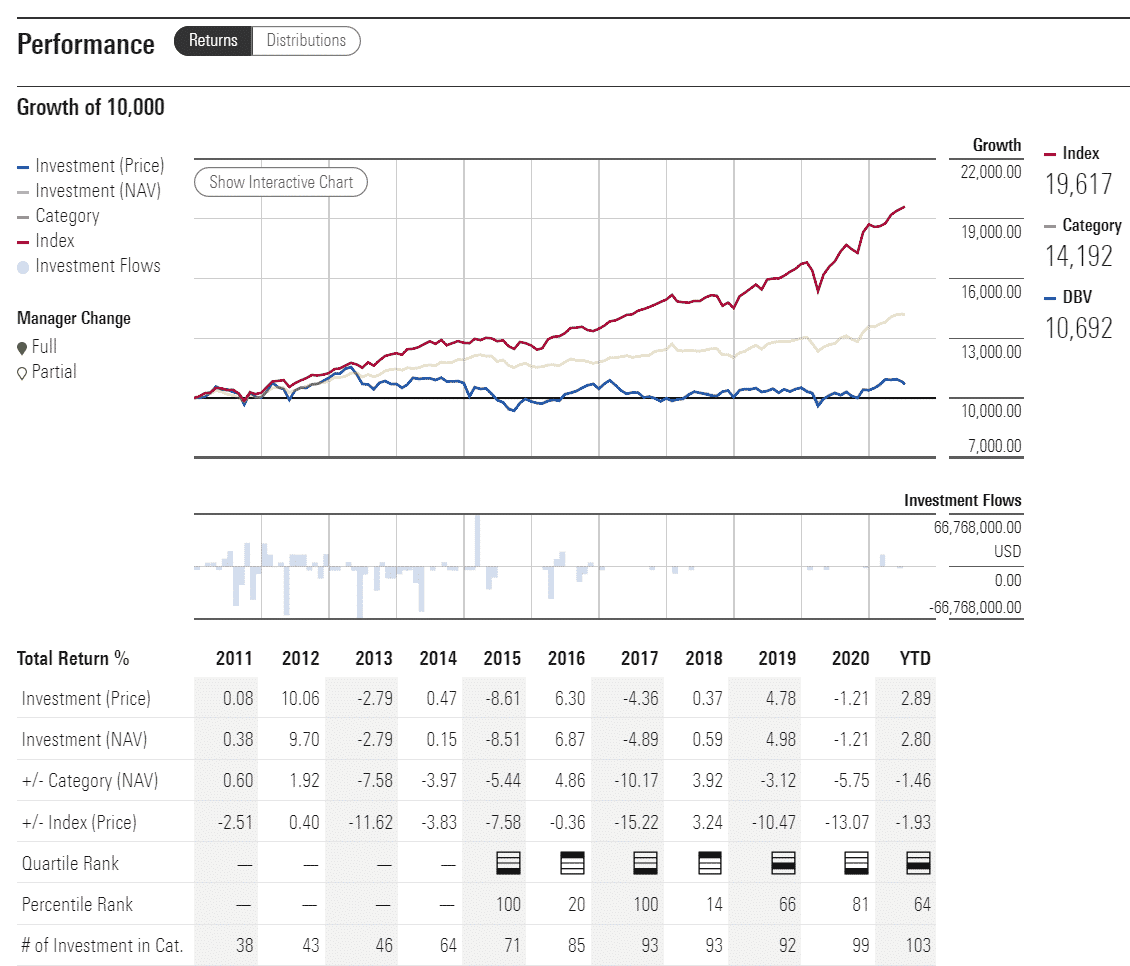

DBV performance analysis

The DBV ETF tracks an index offering exposure to currencies with high interest rates while shorting those where the interest rates are on the lower end via investing in futures contracts.

It looks to borrow in cheap currencies, divert the money into the high-yield accounts, and secure non-correlated returns that tend to be positive, generally speaking. According to the fund’s manager, it aims to give investors a chance to get a “cost-effective and convenient way” to dabble in currency futures.

The last disclosed dividend amounted to $0.35 on the share at an expense ratio of 0.78%. On the MarketWatch scale, DBV ETF has a ranking of 5 and falls within the 87th percentile.

DBV ETF RATING |

|||||

| Resource | ETF DATABASE | ETF.com | MarketWatch | Morningstar.com | Money.usnews.com |

| DBV Rating | N/A | N/A | 5 | ** | N/A |

| DBV ESG Rating | N/A | N/A | 87th percentile | N/A | N/A |

DBV key holdings

The DBV ETF looks to track the movement of the US dollar, the euro, the Japanese yen, the Canadian dollar, the Swiss franc, the British pound sterling, the Australian dollar, the New Zealand dollar, the Norwegian krone, and the Swedish krona.

Its goal is to offer higher returns by utilizing the 2:1 leverage. It is rebalanced once a year, constantly in November.

Here are six holdings making up the DBV ETF.

| Holding name | % of assets |

| Mutual fund | 43.05% |

| United States Treasury Bills 0.0% 16-SEP-2021 | 24.22% |

| United States Treasury Bills 0.0% 05-AUG-2021 | 16.15% |

| United States Treasury Bills 0.0% 04-NOV-2021 | 8.07% |

| United States Treasury Bills 0.0% 09-SEP-2021 | 8.07% |

| US Dollar | 0.06% |

Industry outlook

The DBV fund is most certainly not geared towards beginners, nor is it made to suit the needs of those pursuing a buy-and-hold strategy. Due to the speculative nature of the fund’s trading approach, along with the fact that the ETF carries leverage, the slightest of movements in the market price can have a greater-than-expected impact on the prices of the futures.

Consequently, the underlying futures contracts could bring you a hefty return but can also be tied to significant losses. And that is not just our objective opinion but something that was stated in the disclaimer on the website of the fund’s manager.

As far as the industry outlook goes, the market is too volatile to make a firm prediction at any given point in time. The sheer number of currencies tracked makes it next to impossible to predict if the leveraged nature of the ETF will play out to your advantage in the future or not.

If you decide that the fund is the right choice for you, be sure to analyze the geopolitical situation and pay special attention to the relations between the European Union and the United States and how the fourth wave of Covid-19 infections unfolds.

Comments