Talk about developed economies, and not many will name Taiwan as one. However, at the end of 2021, it was the 6th freest economy globally, with a score of 78.6. It is a country that started its turnaround in the early 1950s by adopting continuous resource shifting from low productivity sectors to high productivity sectors.

Despite efforts by China to alienate Taiwan, it remains the fourth-largest economy in the Asia-pacific region and has an indirect play on the Chinese economy. With this economy set to overtake the Japanese in terms of per capita income by 2028, investors have a chance to make money as new opportunities avail themselves.

What is the composition of Taiwanese ETFs?

By definition, an exchange-traded fund is an investment asset that acts as a basket of like investment assets economically. Therefore, Taiwanese ETFs are made up of companies either solely domiciled in Taiwan, those found in Hong Kong and China but with considerable assets in Taiwan and drawing revenues from Taiwan, and funds that combine assets from the Taiwanese and Chinese regions to trade as regional ETFs with significant Taiwanese exposure.

Top 7 Taiwanese ETFs

Times of economic turmoil call for portfolio diversification. The coronavirus might have ravaged the globe, but Taiwan is one of the countries globally to exhibit the least death rate to the pandemic. In addition, the democratic leadership of the country and enhanced integrity of the regime sow fertile grounds for investments to thrive.

Despite the Taiwan currency lacking globally acceptance, it is ranked as the most stable foreign exchange currency mitigates against currency risk for investments making it ideal for investing in a post-pandemic, investment volatile market environment. These seven ETFs expose investors to this developed economy with emerging market traits for diversification, growth, and value.

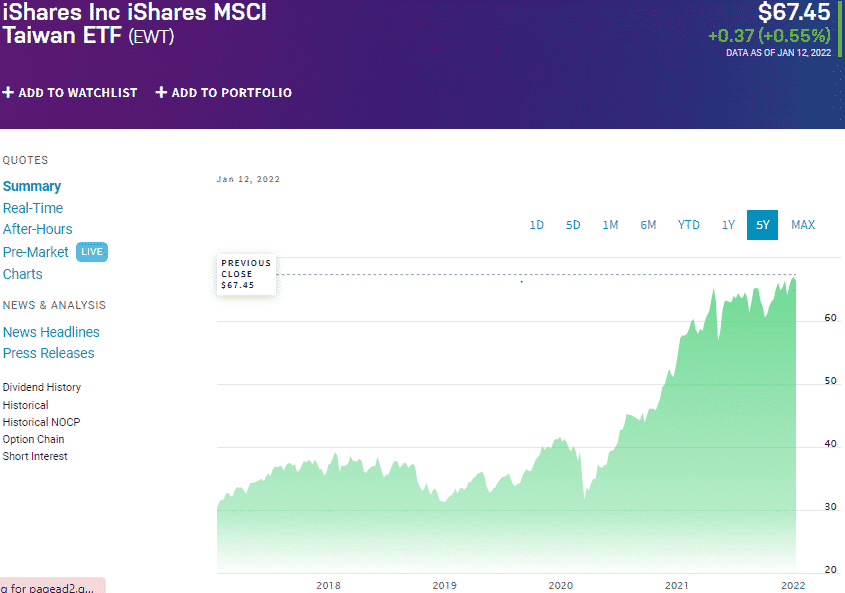

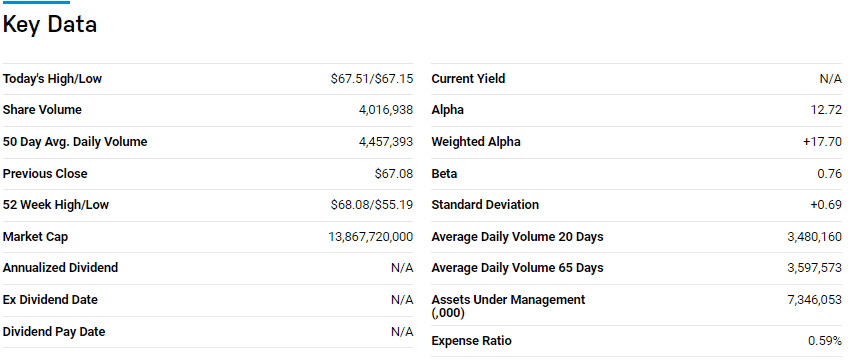

iShares MSCI Taiwan ETF (EWT)

Price: $67.45

Expense ratio: 0.59%

Dividend yield: 1.50%

Taiwan ETFs.

iShares MSCI Taiwan ETF tracks the MSCI Taiwan 25/50 Index, investing at least 80% of its assets in the holdings of its composite index, in combination with other investment assets that have like economic characteristics to those of the tracked-index holdings.

This non-diversified fund exposes investors to the quasi-developed Taiwanese economy by comprising the best large-cap and mid-cap equities domiciled in Taiwan.

EWT ETF is ranked №10 by US News analysts among 48 of the best Chinese region funds for long-term investing.

The top three holdings of this fund are:

- Taiwan Semiconductor Manufacturing Co., Ltd. – 22.96%

- MediaTek Inc. – 5.17%

- Hon Hai Precision Industry Co., Ltd. – 3.99%

EWT ETF boasts $7.35 billion in assets under management, with an expense ratio of 0.59%. In the last half a decade, this ETF has been one of the best performing ETFs in the China region, a testament to the health of the Taiwan economy; 5-year returns of 145.80%, 3-year returns of 122.58%, and 1-year returns of 19.65%. The composition blend of large and mid-cap equities ensures a fund that provides value and growth attributes.

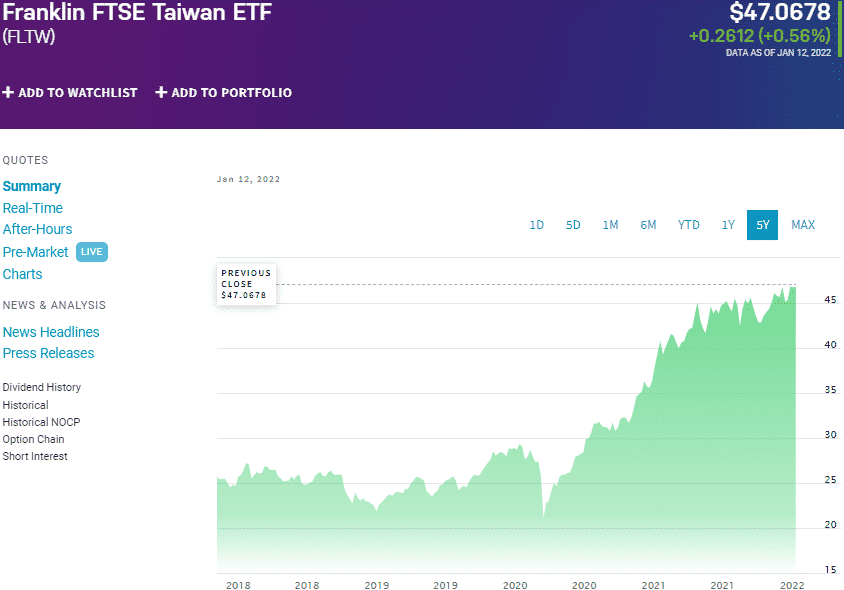

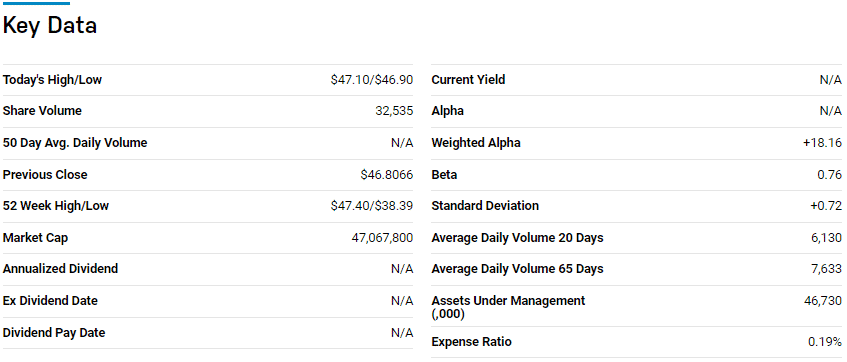

Franklin FTSE Taiwan ETF (FLTW)

Price: $47.07

Expense ratio: 0.19%

Dividend yield: 1.82%

FLTW chart

Franklin FTSE Taiwan ETF tracks the FTSE Taiwan RIC Capped Index, investing at least 80% of its assets in the holdings of its composite index and depository receipts coupled to these holdings. Like the EWT, this non-diversified fund exposes investors to the quasi-developed Taiwanese economy comprised of the best large-cap and mid-cap equities domiciled in Taiwan.

The top three holdings of this fund are:

- Taiwan Semiconductor Manufacturing Co., Ltd. – 20.79%

- MediaTek Inc – 6.36%

- Hon Hai Precision Industry Co., Ltd. – 4.75%

The FLTW has meager assets under management than the EWT at $46.7 million, but it is a way cheaper option to own with an expense ratio of 0.19%. The FLTW ETFs are relatively new compared to the EWT but, since inception, have posted positive returns, putting it in an elite group of ETFs. It is a testament to the potential returns in the Taiwanese economy; 3-year returns of 122.90% and 1-year returns of 22.58%. It diverges from the EWT by having a higher concentration of mid-cap stocks to ensure more upside potential.

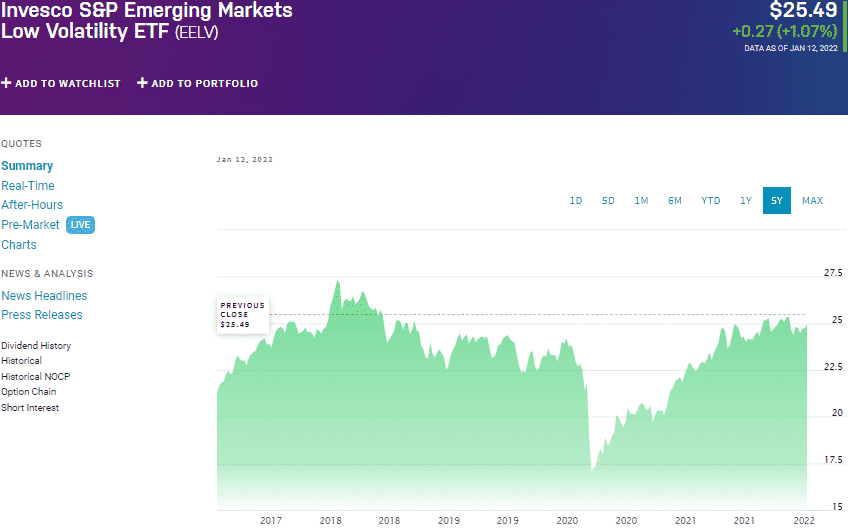

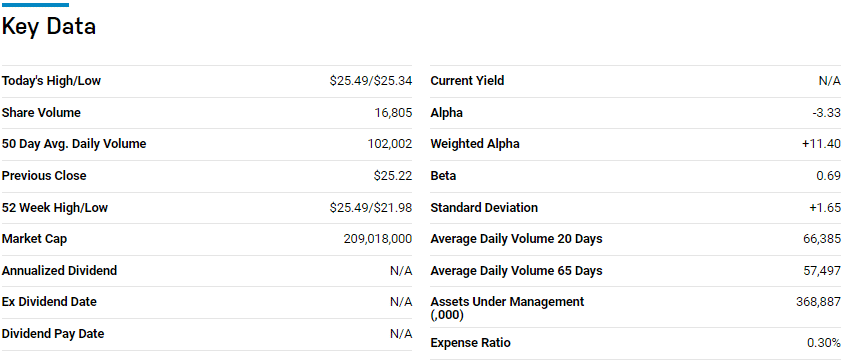

Invesco S&P Emerging Markets Low Volatility ETF (EELV)

Price: $25.49

Expense ratio: 0.30%

Dividend yield: 2.66%

EELV chart

The Invesco S&P Emerging Markets Low Volatility Fund tracks the S&P BMI Emerging Markets Low Volatility IndexTM, investing at least 90% of its total assets in the underlying holdings of the composite index. The EELV exposes investors to 200 Chinese region equities with the lowest volatility compared to their peers across the emerging markets.

EELV ETF is ranked №3 by US News analysts among 82 of the best diversified emerging market funds for long-term investing.

The top three holdings of this non-diversified ETF are:

- Saudi Arabian Oil Company (Saudi Aramco) – 1.05%

- Kuwait Finance House K.S.C. – 1.04%

- Chunghwa Telecom Co., Ltd – 0.98%

The EELV ETF has $369 million in assets under management, with an expense ratio of 0.30%. The special screening of this ETF’s underholding’s, low volatility among emerging market equities, allows investors to enjoy significant upside in times of market downturn; 5-year returns of 45.07%, 3-year returns of 21.35%, and 1-year returns of 16.65%. Despite the low volatility, this fund is an option for significant, consistent income given its dividend yield of 2.66%.

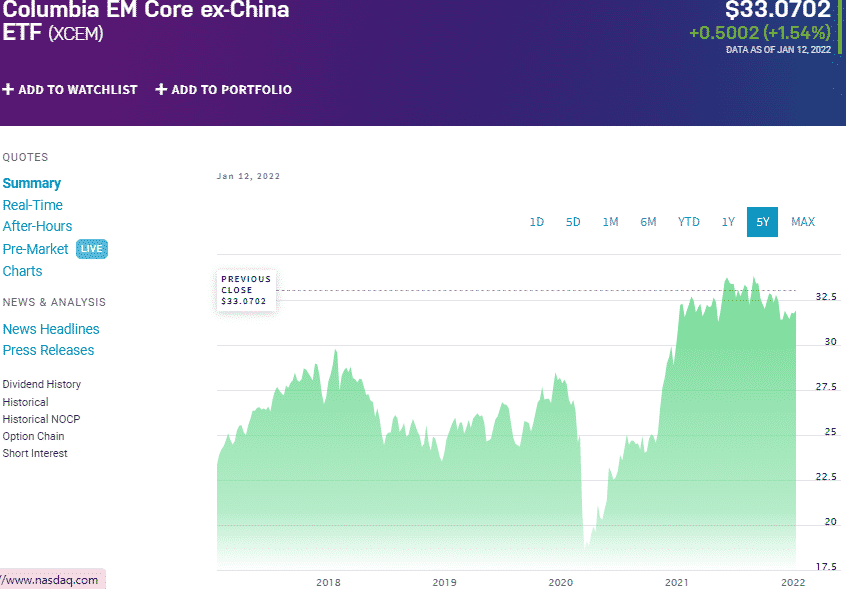

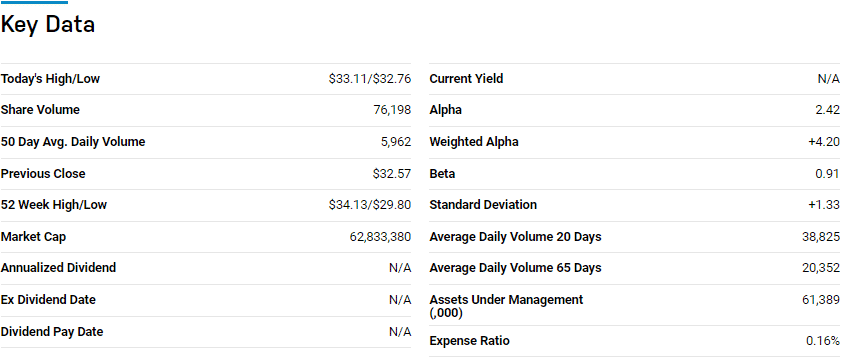

Columbia EM Core ex-China ETF (XCEM)

Price: $33.07

Expense ratio: 0.16%

Dividend yield: 1.50%

XCEM chart

The Columbia EM Core Ex-China ETF tracks the Beta Thematic Emerging Markets ex-China Index, investing at least 95% of its total assets in the underlying holdings of the composite index. The XCEM exposes investors to 700 of the best-emerging markets equities outside China and Hong Kong.

The top three holdings of this non-diversified ETF are:

- Taiwan Semiconductor Manufacturing Co., Ltd. – 11.83%

- Samsung Electronics Co., Ltd. – 6.35%

- EQUITY OTHER – 3.34%

The XCEM has $61.4 million in assets under management, with an expense ratio of 0.16%. Its diversification of over 700 equities ensure it weathers most market storms and provides returns consistently; 5-year returns of 56.21%, 3-year returns of 40.58%, and 1-year returns of 5.37%.

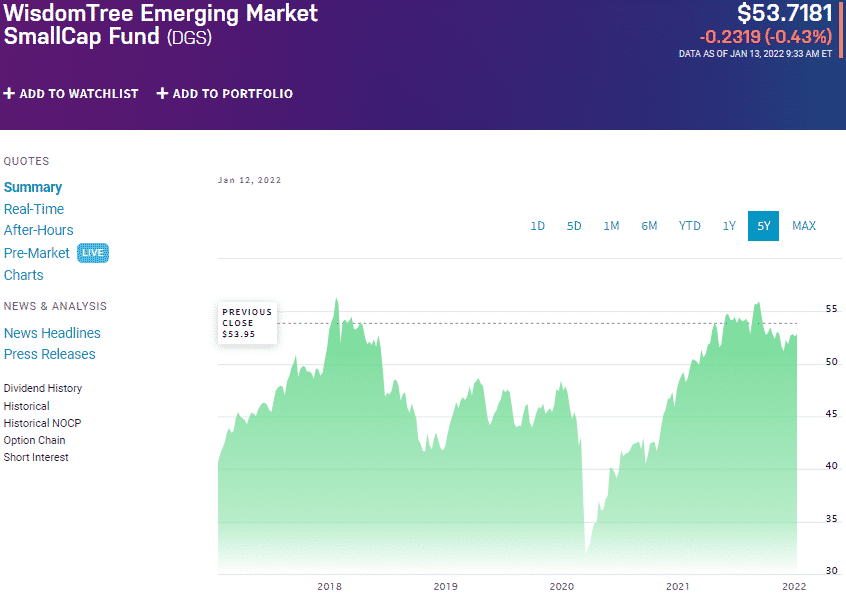

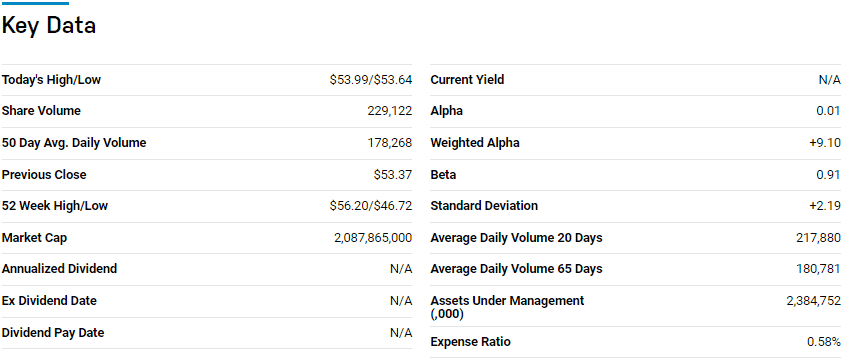

WisdomTree Emerging Markets SmallCap Dividend Fund (DGS)

Price: $53.7181

Expense ratio: 0.58%

Dividend yield: 3.79

DGS chart

The DGS ETF tracks the WisdomTree Emerging Markets SmallCap Dividend Index, investing at least 95% of its total assets in the underlying holdings of the composite index. It exposes investors to the best small-cap common stocks in emerging markets.

DGS ETF is ranked №23 by US News analysts among 82 of the best diversified emerging market funds for long-term investing.

The top three holdings of this non-diversified ETF are:

- Transmissora Alianca De Energia Eletrica S.A. Unit – 1.21%

- Synnex Technology International Corp. – 0.99%

- Royal Bafokeng Platinum Limited – 0.87%

The DGS has $2.38 billion in assets under management, with an expense ratio of 0.58%. Its geographical diversification ensures it weathers most market storms while concentrations on small-cap stocks provide significant room for growth and returns; 5-year returns of 61.25%, 3-year returns of 39.37%, and 1-year returns of 15.18%

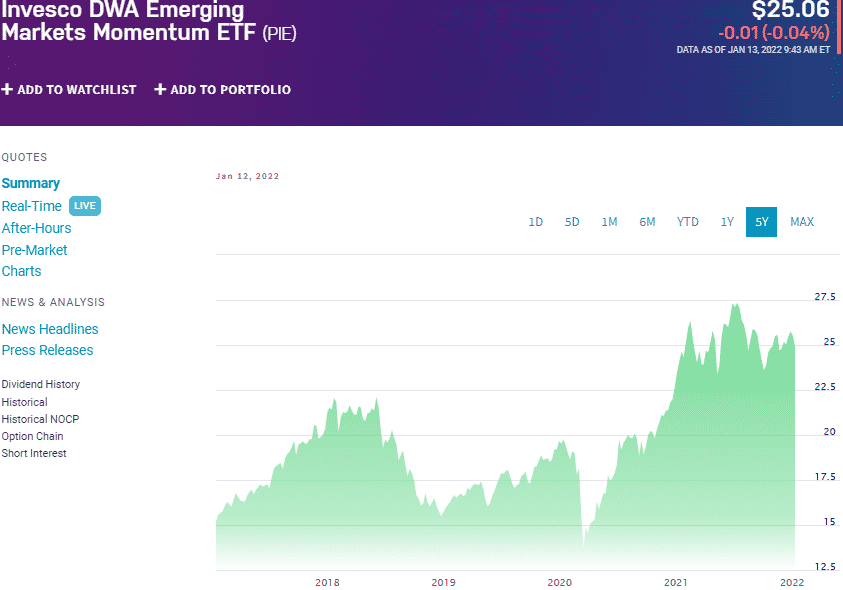

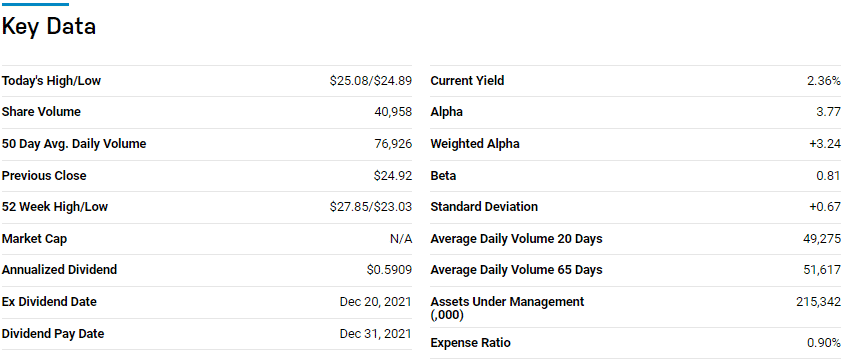

Invesco DWA Emerging Markets Momentum ETF (PIE)

Price: $25.06

Expense ratio: 0.90%

Dividend yield: 1.16

PIE chart

PIE ETF tracks the Dorsey Wright® Emerging Markets Technical Leaders Index, investing at least 90% of its total assets in the underlying holdings of the composite index. It exposes investors to 100 emerging market equities exhibiting the best relative strength factors.

PIE ETF is ranked №32 by US News analysts among 82 of the best diversified emerging market funds for long-term investing.

The top three holdings of this non-diversified ETF are:

- SINBON Electronics Co., Ltd. – 2.72%

- AP Memory Technology Corp. – 2.72%

- Frontken Corp. Bhd. – 2.62%

This diversified fund has $212.8 million in assets under management, with an expense ratio of 0.90%. Despite having just 100 holdings, even distribution of the weighting and the screening methodology has resulted in a pretty return-oriented fund year in year out; 5-year returns of 80.08%, 3-year returns of 61.63%, and 1-year returns of 5.30%.

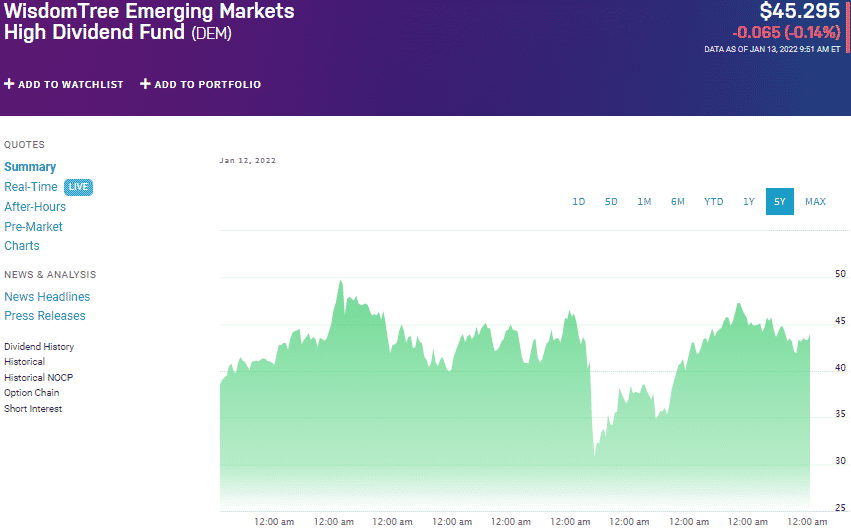

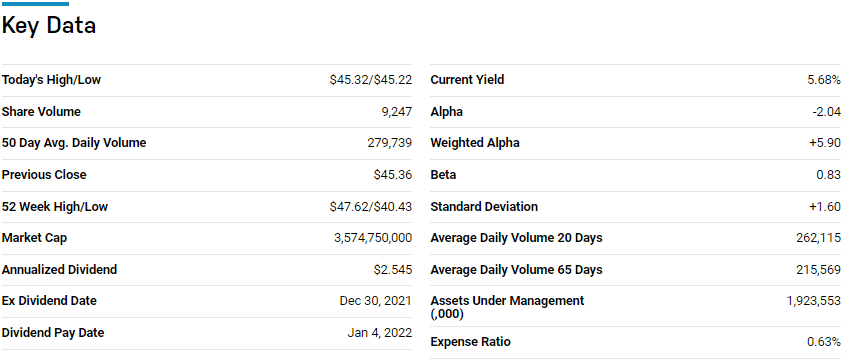

WisdomTree Emerging Markets SmallCap Dividend Fund (DEM)

Price: $45.295

Expense ratio: 0.63%

Dividend yield: 4.77%

DEM chart

The DEM ETF tracks the WisdomTree Emerging Markets High Dividend Index, investing at least 95% of its total assets in the underlying holdings of the composite index. It exposes investors to the best dividend-paying equities to be found in emerging markets.

DEM ETF is ranked № 30 by US News analysts among 82 of the best diversified emerging market funds for long-term investing.

The top three holdings of this non-diversified ETF are:

- Vale S.A. – 7.93%

- China Construction Bank Corporation Class H – 3.25%

- Petroleo Brasileiro SA – 3.04%

The DEM ETF has $1.92 billion in assets under management, with an expense ratio of 0.63%. Concentrating on the best dividend-yielding stocks in emerging markets ensures this ETF has a consistent income, 4.77% dividend yield, while also ensuring investment return; 5-year returns of 48.24%, 3-year returns of 26.25%, and 1-year returns of 11.68%.

Final thoughts

The economic strategy of Taiwan has ensured growth from a struggling economy to a developed economy in half a century. It has also worked tirelessly to ensure that its trade ties are geographically diversified across different economic blocks globally, providing a stable and free economy for investing.

The numerous small, mid, and large-cap equities in the Taiwanese economy provide numerous investment opportunities for growth and value. The ETFs above provide a great starting point for diversified investment in this economy.

Comments