PZ Divergence is software that helps us to know when it’s the right time to open orders and in what direction. The system was demo downloaded many times. We can check it on the terminal, too, if needed.

The indicator has the next list of features:

- The indicator provides us with information when we have to open an order and in what direction.

- It can be used on the MT5 terminal.

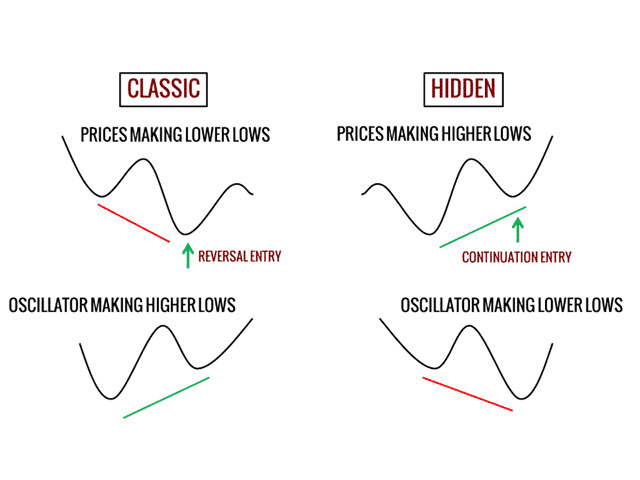

- The system “finds and scans for regular and hidden divergences automatically using your favorite oscillator.”

- We can rely on a user guide if needed.

- The system is easy to use.

- We can work with many oscillators.

- The indicator looks for breakout news.

- It places SL and TP levels for every order.

- We can use configuration oscillator parameters.

- There are trading statistics.

- It uses notifications to inform us about trading opportunities.

- We can set the indicator on one chart to work with all of them at once.

- The list of indicators includes RSI, CCI, MACD, OSMA, Stochastic, Momentum, Awesome Oscillator, Accelerator Oscillator, Williams Percent Range, Relative Vigor Index, Rate of Change.

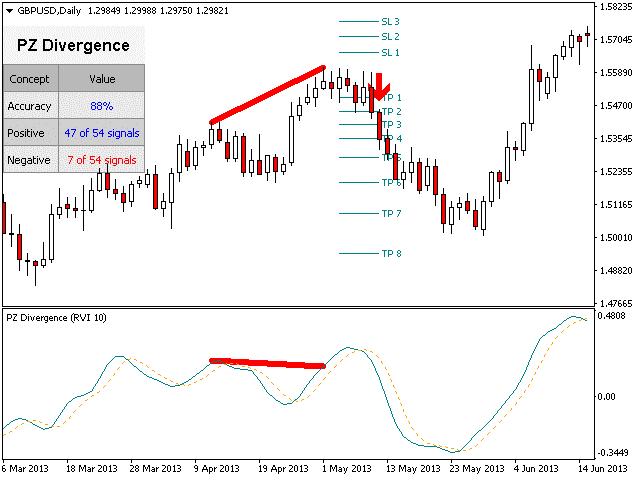

- “Since divergences can expand quite a bit, especially in the Forex market, this indicator implements a twist: it waits for a donchian breakout to confirm the divergence before signaling the trade. The end result is an otherwise repainting indicator with a very reliable trading signal.”

PZ Divergence explanations

- There are many trading cases.

PZ Divergence how the system works

- We may note that the system places SL and TP levels.

Trading strategies and currency pairs

- The system is based on the price action strategy.

- It allows us to work with all time frames and currency pairs.

PZ Divergence trading statistics

We have no backtest reports provided. It’s a significant con because we have no idea if the system was tested on the past tick data.

PZ Divergence trading results

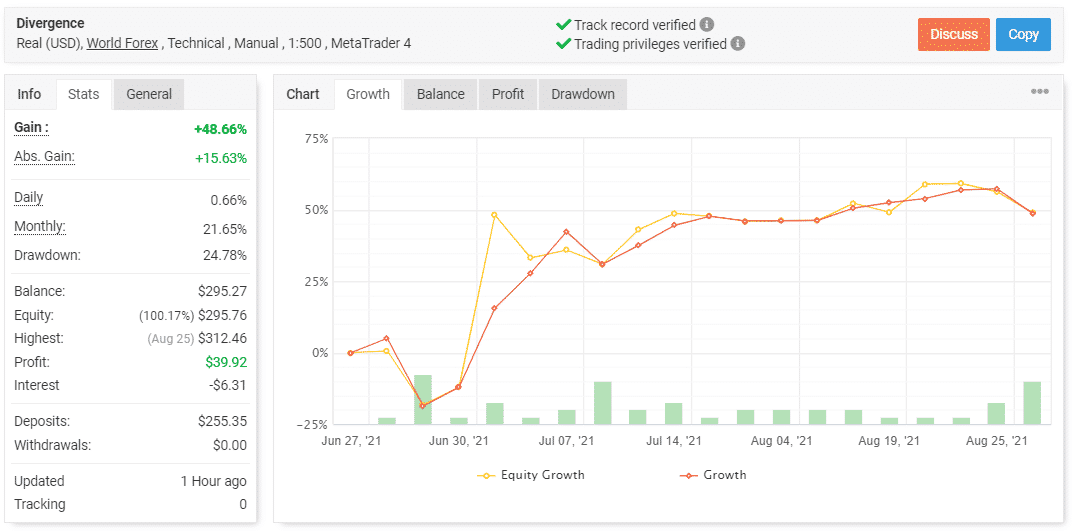

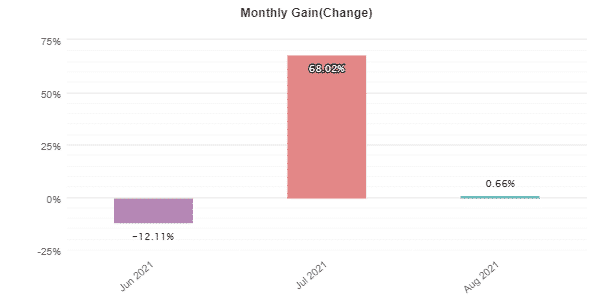

The indicator was set to trade on the real USD account on the World Forex broker. The leverage is 1:500. We haven’t seen this broker before. The account has a verified track record and verified trading privileges as well. It was created on June 27, 2021, and deposited at $255.35. Since then, the absolute gain has amounted to 48.66%. An average monthly gain is 21.65%. The maximum drawdown is 24.78%.

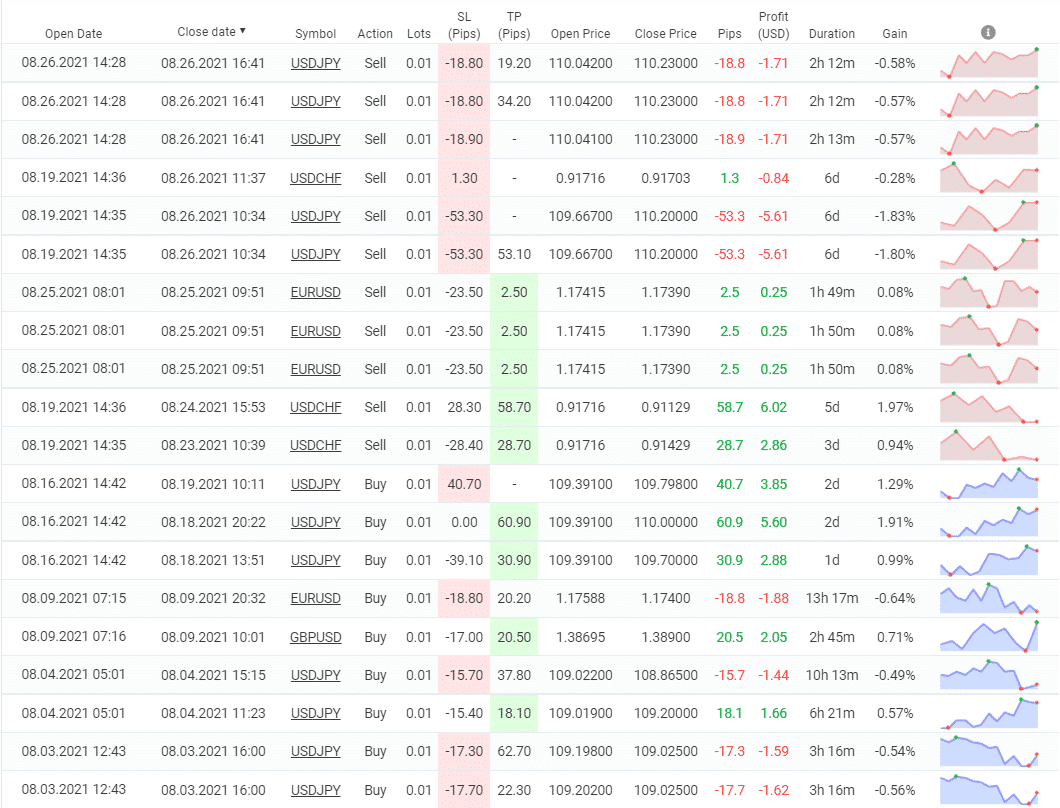

PZ Divergence trading details

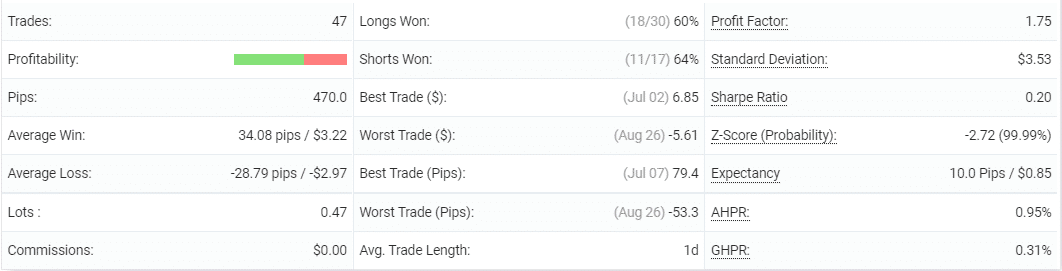

PZ Divergence has executed 47 deals only with 470 pips. An average win is 34.08 pips when an average loss is -28.79 pips. The win rate is 60% for longs and 64% for shorts. An average trade length is a day. The profit factor is 1.75.

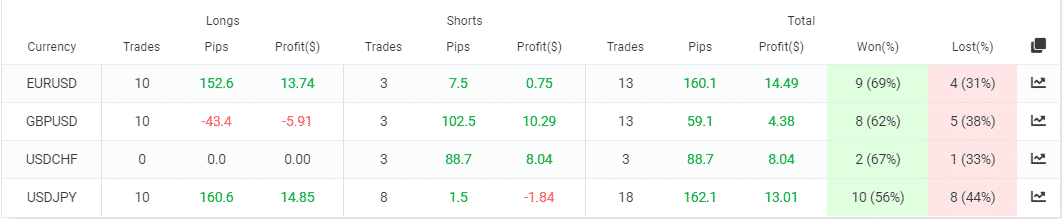

PZ Divergence currency pairs

It opens orders on the four cross pairs. USDJPY is ahead of other symbols with 18 deals. EURUSD is the most profitable, with $14.49.

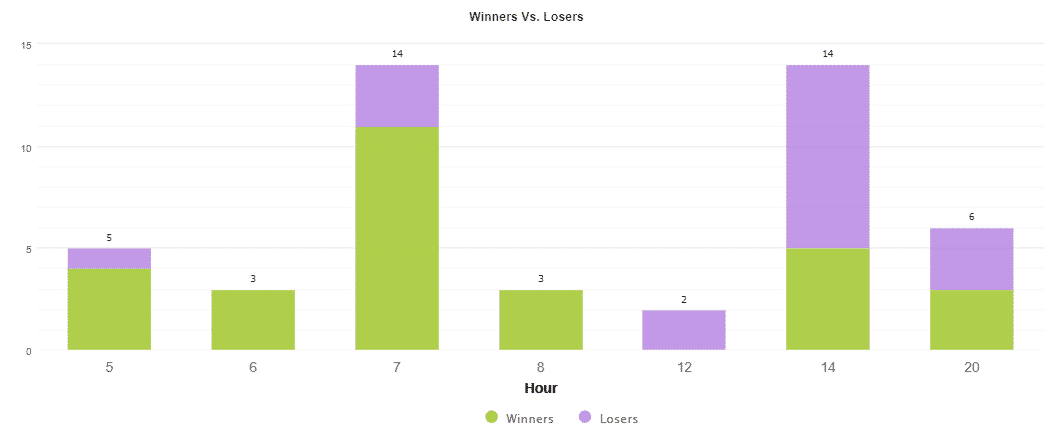

PZ Divergence hourly trading activities

It opens orders twice a day mostly.

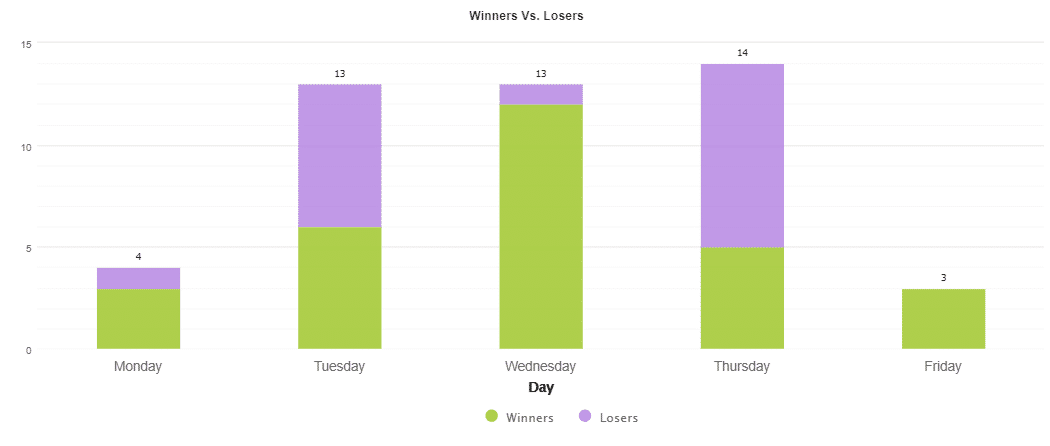

PZ Divergence dailly trading activities

The most-traded days are from Tuesday to Thursday.

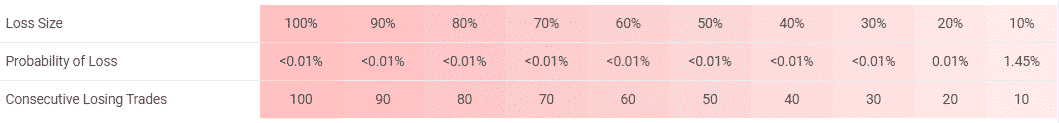

PZ Divergence risks

The risks are medium. It has to lose ten orders in a row to lose ten percent of the account.

PZ Divergence closed orders

The robot closed the last six pairs with losses.

PZ Divergence open orders

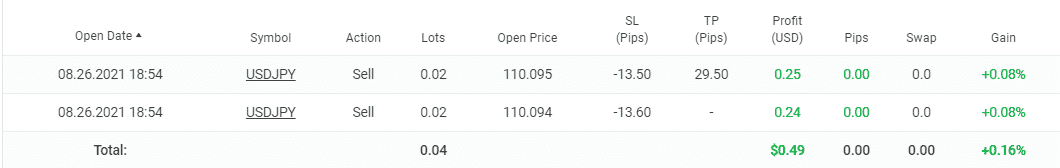

There are open trades shown.

PZ Divergence monthly trading results

The results of August 2021 look horrible.

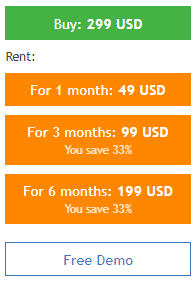

Pricing and refund

PZ Divergence pricing

The system is available for $299. Indicators should cost much less. We can subscribe for the signals. A one-month rent costs $49, three-month rent costs $99, and six-month costs $199. We can download the system for demo usage. We have no money-back guarantee provided.

What else you should know about PZ Divergence

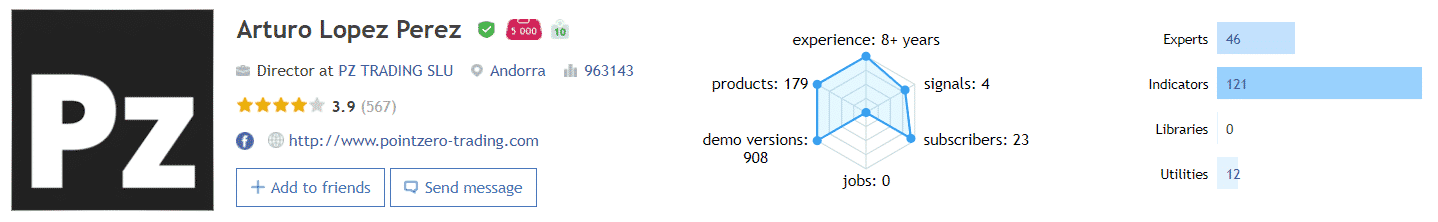

PZ Divergence developer profile

Arturo Lopez is a dev from Andorra with a 963,143 rating. His products have a 3.9 rate based on 567 reviews. He has over 8 years of experience.

People feedback

PZ Divergence feedback

This product has a single positive comment that can’t be relevant.

Comments